Search Florida Property Tax Records

Florida property tax records are public documents maintained by county property appraisers and tax collectors across all 67 counties. These records include assessed values, tax bills, exemption history, and payment status for real property and tangible personal property throughout the state. You can search Florida property tax records through county online portals, request copies in person, or access statewide data through the Florida Property Tax Data Portal. This guide explains how the system works and where to find the records you need.

Florida Property Tax Quick Facts

How Florida Property Tax Records Work

Florida does not run a single statewide property tax office. Instead, each county manages its own records through two elected offices: the property appraiser and the tax collector. The property appraiser sets values. The tax collector handles billing and payment. The Florida Department of Revenue provides oversight through its Property Tax Oversight program, but it does not assess or collect taxes directly. This structure means property tax records for any given parcel live at the county level, not at a state agency.

Every year, property is assessed as of January 1. The property appraiser reviews each parcel, applies any exemptions or assessment limitations, and produces the county's assessment roll. Under Chapter 192, Florida Statutes, the assessment roll is the official list of all taxable property in the county. It documents the owner of record, the property's just value, the assessed value after any caps, any exemptions, and the final taxable value used to calculate the tax bill. This roll is public record in Florida.

The DOR summarizes the system this way: "In Florida, local governments are responsible for administering property tax. The Department of Revenue's Property Tax Oversight program provides oversight and assistance to local government officials, including property appraisers, tax collectors, and value adjustment boards." The Florida Constitution and statutes define how each part works together. For most questions about a specific parcel, the right starting point is your county property appraiser's office, not the state.

The Property Tax Oversight Division can be reached at: Florida Department of Revenue, P.O. Box 3000, Tallahassee, FL 32315-3000. Phone: 850-717-6570. Email: DORPTO@floridarevenue.com. For public records requests to the DOR itself, contact taxpublicrecords@floridarevenue.com or call 850-488-6800.

The Florida Department of Revenue Property Tax Oversight homepage is where the DOR publishes guidance, rules, and links to all county officials.

From that page, you can access administrative rules, technical assistance bulletins, and the county official directory for all 67 counties in Florida.

Search Florida Property Tax Records Online

The fastest way to find property tax records in Florida is through your county's online portal. Every county property appraiser maintains a public search tool. Most let you look up parcels by owner name, parcel ID, or property address. Results typically show the assessed value, exemptions, tax history, and ownership details. Many portals also link directly to the county tax collector so you can check payment status. These searches are free in most Florida counties.

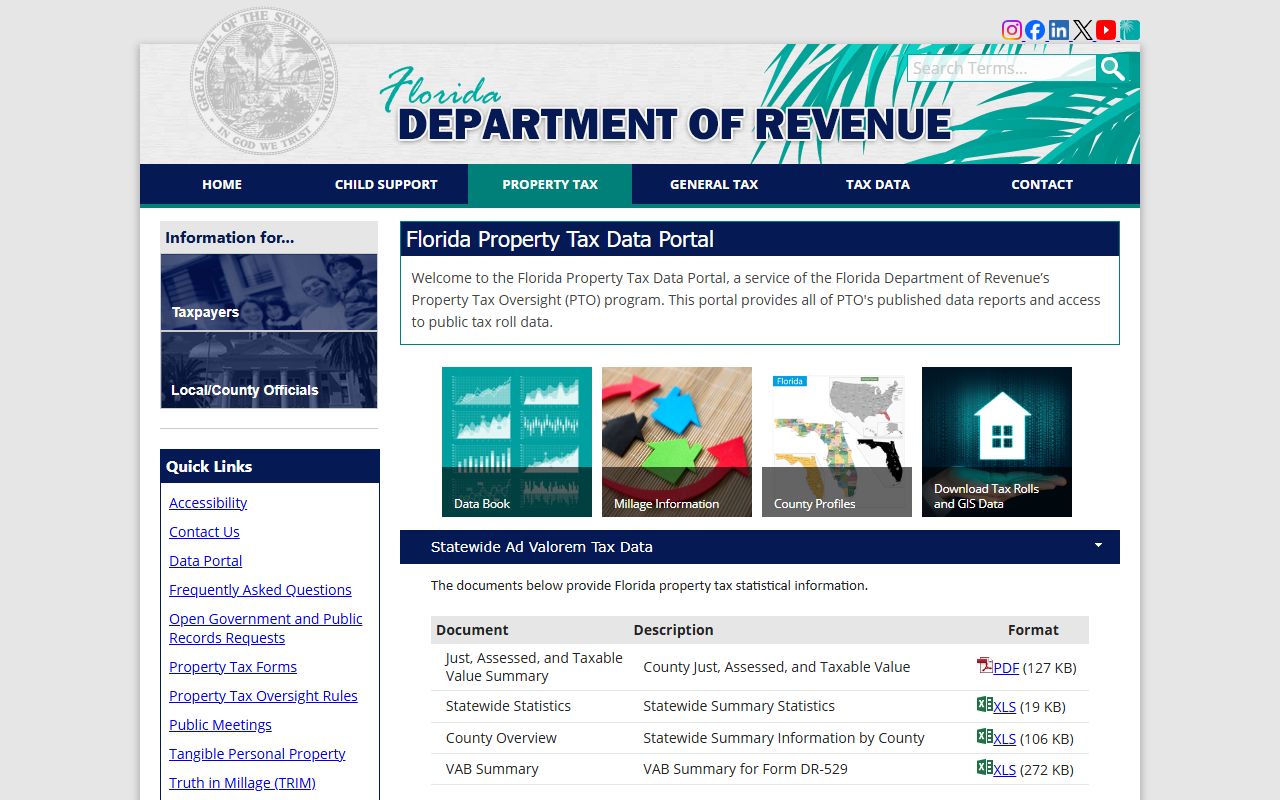

For statewide data, visit the Florida Property Tax Data Portal. This portal, run by the DOR's Property Tax Oversight program, gives access to published data reports and public tax roll data from all 67 counties. As the DOR describes it: "This portal provides all of PTO's published data reports and access to public tax roll data." Available downloads include just, assessed, and taxable value summaries; statewide statistics; county and municipal property tax data files; and assessment roll evaluation results. Under Section 195.052, Florida Statutes, both the DOR and every county property appraiser must publish specified tax information online, which is why so much data is publicly available.

The Florida Property Tax Data Portal is a useful resource for researchers, investors, and property owners who want statewide tax data.

The portal includes historical data across multiple tax years, which can help track trends in assessed values across Florida counties.

To find the right county portal, use the county official directory on the DOR website. It lists property appraisers and tax collectors for all 67 Florida counties with links to their websites. Not every county site works the same way, but most offer basic parcel search for free.

This directory is the best single starting point if you are not sure which county to search or need contact details for a specific local office.

Common questions about property tax in Florida are answered on the DOR's property tax FAQ page. Topics include how to read a TRIM notice, how to calculate your taxes, and what to do if you think your assessed value is wrong.

The FAQ also covers installment payment plans and what happens if property taxes go unpaid in Florida.

Florida Property Appraisers and Tax Collectors

Two separate offices handle property tax in every Florida county. They are independent constitutional officers, both elected by county voters. The property appraiser and the tax collector work in parallel but serve distinct roles. Knowing which one to contact saves time when you are searching for property tax records in Florida.

Property appraisers establish value. They assess each parcel every year as of January 1. They also review and apply exemptions, assessment limitations, and land use classifications that may reduce taxable value. Each August, the property appraiser mails Truth in Millage, or TRIM, notices. These notices show the proposed assessed value, any exemptions applied, the proposed tax rates from each taxing authority, and an estimate of next year's taxes. The TRIM notice is an important property tax record in Florida because it triggers the window to file a Value Adjustment Board petition if you disagree with the assessment.

Tax collectors handle billing and payment. They send out tax bills in November, collect payments, approve tax deferrals, and sell tax certificates on delinquent properties. They also process overpayment refunds and distribute collected taxes to the schools, county, city, and other taxing authorities. Under Chapter 197, Florida Statutes, tax collectors govern the full collection process in their county. If you need to check whether a tax bill has been paid, contact the tax collector, not the property appraiser.

The clerk of court handles a third property tax function: tax deed sales. If a tax certificate goes unredeemed, the holder can apply for a tax deed. The clerk conducts the sale and keeps those records. The Florida Association of Counties and the Florida Court Clerks and Comptrollers both maintain contact directories that help you reach the right local office for property tax records.

The Florida Association of Counties site links to every county's official website, which is useful when you need to navigate to a specific county's property tax offices.

If your county's Value Adjustment Board does not have its own website, the Florida Court Clerks site can help you locate the clerk's office that runs the VAB process.

Property Tax Exemptions in Florida

Florida law offers several ways to reduce what you owe on property taxes. The most widely used is the homestead exemption. Under Chapter 196, Florida Statutes, homeowners who live on their property as their primary residence can exempt the first $25,000 of value from all taxes. A second $25,000 exemption applies to assessed value between $50,000 and $75,000 and is exempt from all taxes except school taxes. Together, these two exemptions can reduce the taxable value of a qualifying home by up to $50,000.

Chapter 196 also covers exemptions for veterans with service-connected disabilities, widows and widowers, the blind, and certain nonprofit organizations that own property in Florida.

The Save Our Homes cap protects longtime homeowners from sharp tax increases. Under Section 193.155, Florida Statutes, once a property has the homestead exemption, the assessed value cannot rise more than 3% per year, or the percentage change in the Consumer Price Index, whichever is lower. This cap can create a big gap between a home's market value and its assessed value over time. The cap resets to market value when the property is sold or loses homestead status. You must apply for homestead exemption by March 1 to get the benefit for that tax year.

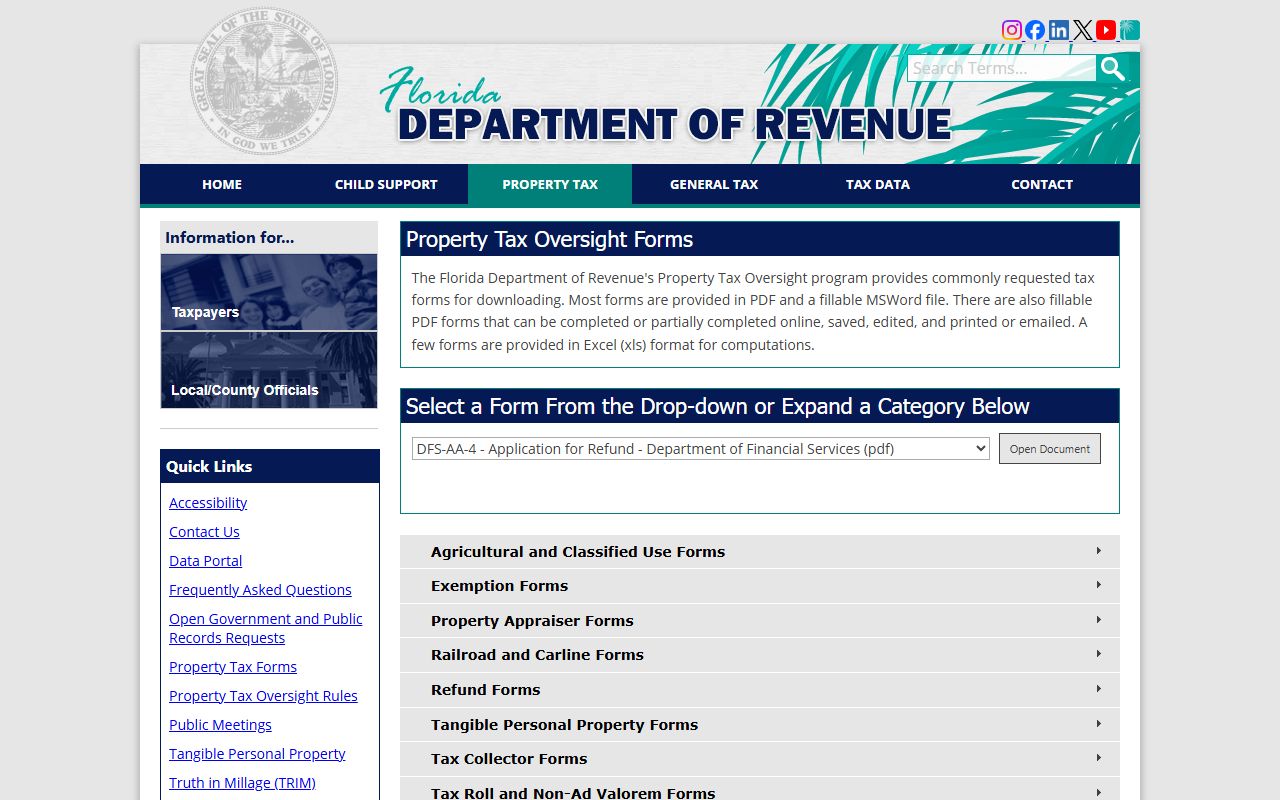

Tangible personal property used in business must be reported to the county property appraiser each year by April 1. All required forms are available through the DOR property tax forms page.

The forms page includes the DR-501 series for exemption applications, forms for agricultural classification, and TPP return forms used by businesses across Florida.

Appealing Your Property Assessment in Florida

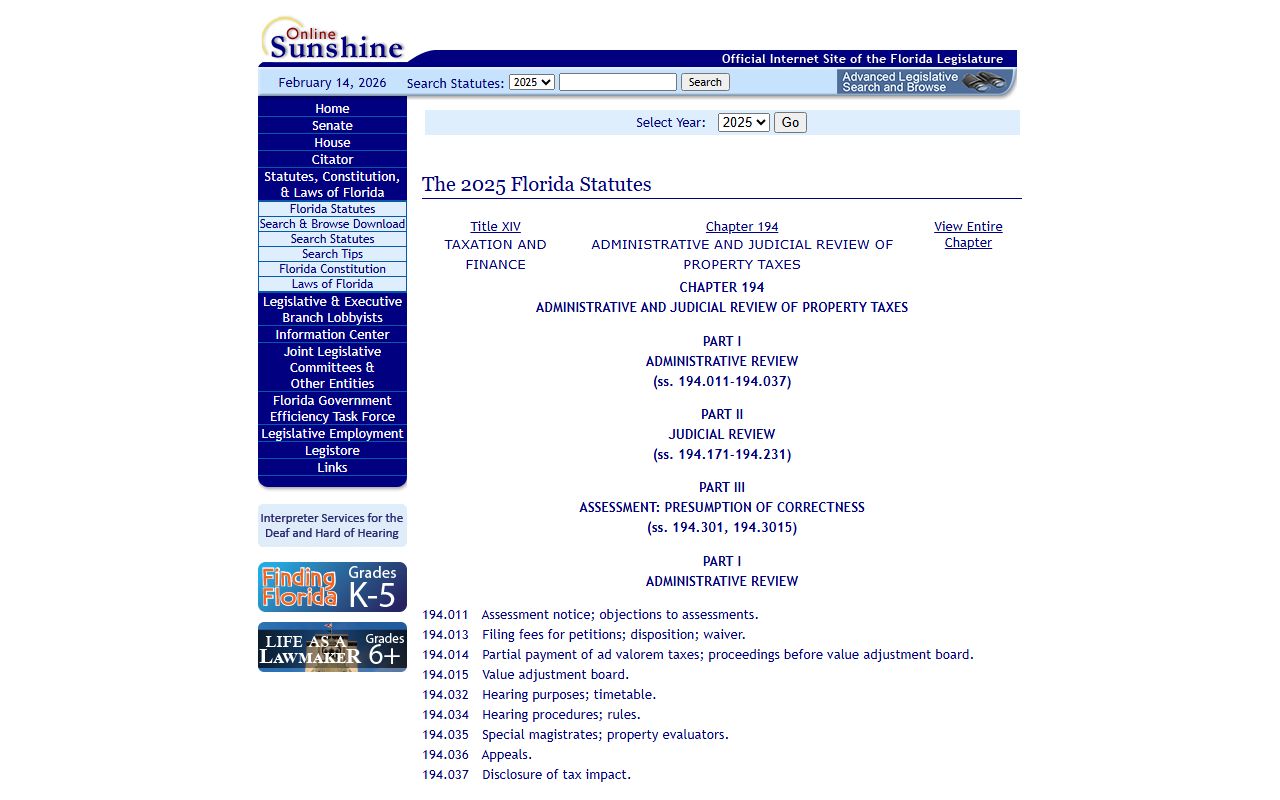

If you believe your property's assessed value is too high, you can challenge it. The Value Adjustment Board, or VAB, hears and rules on challenges to assessments, classifications, and exemption denials. Under Chapter 194, Florida Statutes, you must file a petition within 25 days of the date on your TRIM notice. TRIM notices typically arrive in mid-August, so the deadline usually falls in September. If you miss the window, you lose the right to appeal for that tax year.

The VAB operates differently in each county. Some have online portals for filing petitions. Others require you to visit the clerk's office in person. Either way, the evidence you bring matters, and you may want to review recent sales of comparable properties before your hearing in Florida.

The Florida Tax Law Library on the DOR site has rules, administrative decisions, and technical assistance bulletins related to assessments and appeals.

If the VAB does not rule in your favor, you can still file a lawsuit in circuit court to contest the assessed value under Florida law.

Requesting Florida Property Tax Records

Property tax records in Florida are public records under Section 119.07(1), Florida Statutes. The law states it is state policy that all government records are open for inspection and copying by any person. Assessment rolls, tax bills, payment records, and exemption data are all accessible. You do not need to be the property owner. You do not need to give a reason for the request. Anyone can ask for these records in Florida.

Some information is not public. Under Section 193.074, Florida Statutes, ad valorem tax returns filed by property owners are confidential. Income statements, federal tax returns, Social Security numbers, and other financial records submitted by taxpayers are also exempt from public disclosure. What you can access is the parcel-level data: values, taxes, exemptions, and payment history tied to a specific property address or parcel ID.

To request records from the Florida Department of Revenue, contact: taxpublicrecords@floridarevenue.com, call 850-488-6800, or mail your request to Records Management Room 1-4364, 5050 W. Tennessee St., Tallahassee, FL 32399-0158. For records on a specific parcel, go directly to the county property appraiser or tax collector. They hold the most complete records for individual properties in Florida. The DOR notes that public records requests "do not have to be made in writing, unless a specific statute requires otherwise," and that all requests must be "acknowledged promptly and in good faith."

The DOR public records page also explains what types of records are exempt from disclosure and how fees for copies are calculated under Florida law.

The DOR contact page provides direct lines to the Property Tax Oversight division and the Open Government Officer for records-related questions.

Property Tax Rules and Oversight in Florida

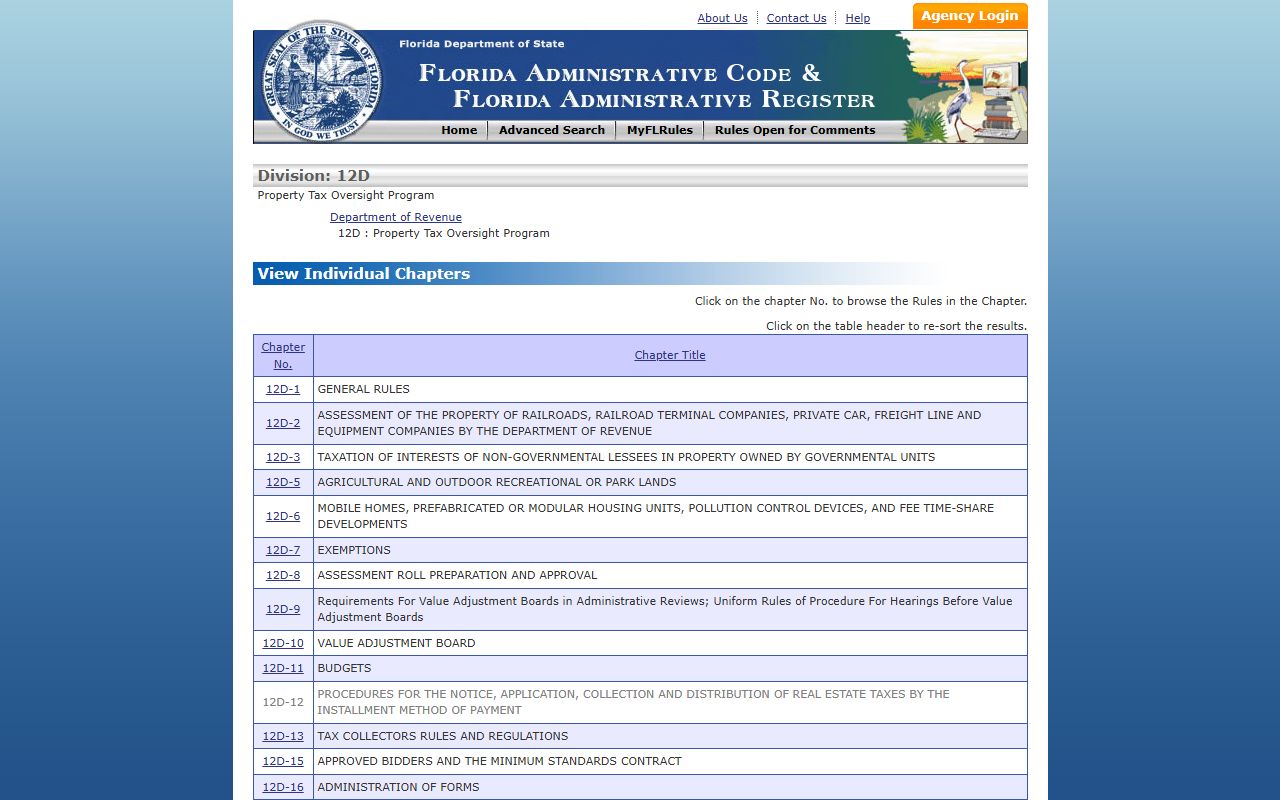

The Department of Revenue sets administrative rules that all 67 county property appraisers must follow. These rules cover how property is valued, what documentation supports exemption claims, how assessment roll evaluation works, and what data counties must report to the state. The full set of current rules is published at floridarevenue.com.

DOR rules are also codified in the Florida Administrative Code and are searchable at flrules.org.

The administrative code rules fill in procedural details that the statutes do not specify. They explain, for example, how property appraisers must document value determinations and what forms must be used for various types of exemption applications across Florida.

Under Chapter 195, Florida Statutes, the DOR evaluates each county's assessment roll every year. This review checks whether assessed values meet required equity and accuracy standards. If a county's roll fails to meet the standard, the DOR can require corrections. This oversight process is one reason Florida property tax records tend to be consistent and well-maintained across counties.

The DOR's review results are published through the data portal, giving the public visibility into how well each county's assessment roll performs against state standards.

Florida Property Tax Collection and Payment

Tax bills go out in November of each year. They cover the period from January 1 through December 31. Payment is due by March 31 to avoid delinquency under Chapter 197, Florida Statutes. Early payment earns a discount: 4% in November, 3% in December, 2% in January, and 1% in February. Taxes become delinquent on April 1. After that, interest and fees begin to accrue.

When taxes go unpaid, the county sells a tax certificate at public auction. The buyer pays the outstanding tax and earns interest on the amount. The property owner can redeem the certificate by repaying the buyer. If no redemption occurs within two years, the certificate holder can apply for a tax deed. Tax deed proceedings are handled by the clerk of court and become part of the public record. All Florida counties handle this process the same way under state law, though the specifics of each auction and redemption vary by county.

The Florida Tax Collectors Association represents all 67 elected tax collectors and provides links to each county's tax payment portal. The Property Appraisers Association of Florida represents county property appraisers and publishes resources for property owners across the state.

Most county tax collectors now accept online payments, which can be found through the Florida Tax Collectors Association directory or through the individual county websites.

The PAAF also connects property owners with their county appraiser's office when they have questions about how values were set or which exemptions they may qualify for in Florida.

Florida statutes are the core legal framework for all of this. The statutes covering property tax span Chapters 192 through 197 and are accessible online at the Florida Legislature's statute database.

Chapters 192 through 197 together create the complete legal framework for how property is assessed, exempted, appealed, and collected in Florida's 67 counties.

Note: Installment payment plans are available for annual property tax bills over $100. Contact your county tax collector by April 30 to enroll for the coming year.

Search Florida Property Tax Records by County

Each Florida county has its own property appraiser and tax collector. Select a county below to find contact information, online search portals, local fees, and property tax resources for that area.

Florida Property Tax Records by City

Property tax records for Florida cities are filed with the county property appraiser for that area. Select a city below to find property tax resources and contact information for that location.