Palm Beach County Property Tax Records

Palm Beach County property tax records cover more than 659,000 parcels across one of Florida's largest and most active real estate markets. The Palm Beach County Property Appraiser and Tax Collector maintain these records, which include assessed values, exemption status, ownership history, and tax payment data. This page explains how to search those records, what they contain, how exemptions work, and what to do if you want to appeal your assessment.

Palm Beach County Quick Facts

Palm Beach County Property Appraiser

The Palm Beach County Property Appraiser is Dorothy Jacks, CFA, FIAAO, AAS. The main office sits at 301 North Olive Avenue, 5th Floor, West Palm Beach, FL 33401. You can reach the general line at 561.355.3230 or call 561.355.2866 to speak with staff directly. The appraiser is responsible for valuing all real and personal property in Palm Beach County as of January 1 each year. That value drives the annual tax bill. The appraiser does not collect taxes and does not set millage rates.

Palm Beach County is large, and the appraiser's office runs three service centers to make access easier. The Downtown location is on the first floor of 301 North Olive Avenue. The South service center is at 14925 Cumberland Dr., Delray Beach, reachable at 561.276.1250. The North service center is at 3188 PGA Blvd., 2nd Floor, Palm Beach Gardens, reachable at 561.624.6521. All locations are open Monday through Friday from 8:30 a.m. to 5:00 p.m. Staff at each site can help with exemption questions, assessment reviews, and general parcel lookups.

The appraiser uses mass appraisal methods consistent with Florida Department of Revenue standards. Values are based on comparable sales, property characteristics, and market conditions. Under Chapter 192, Florida Statutes, all property must be assessed at just value each year. The office maintains the official property roll, which lists every parcel with its legal description, ownership, assessed value, and any applied exemptions.

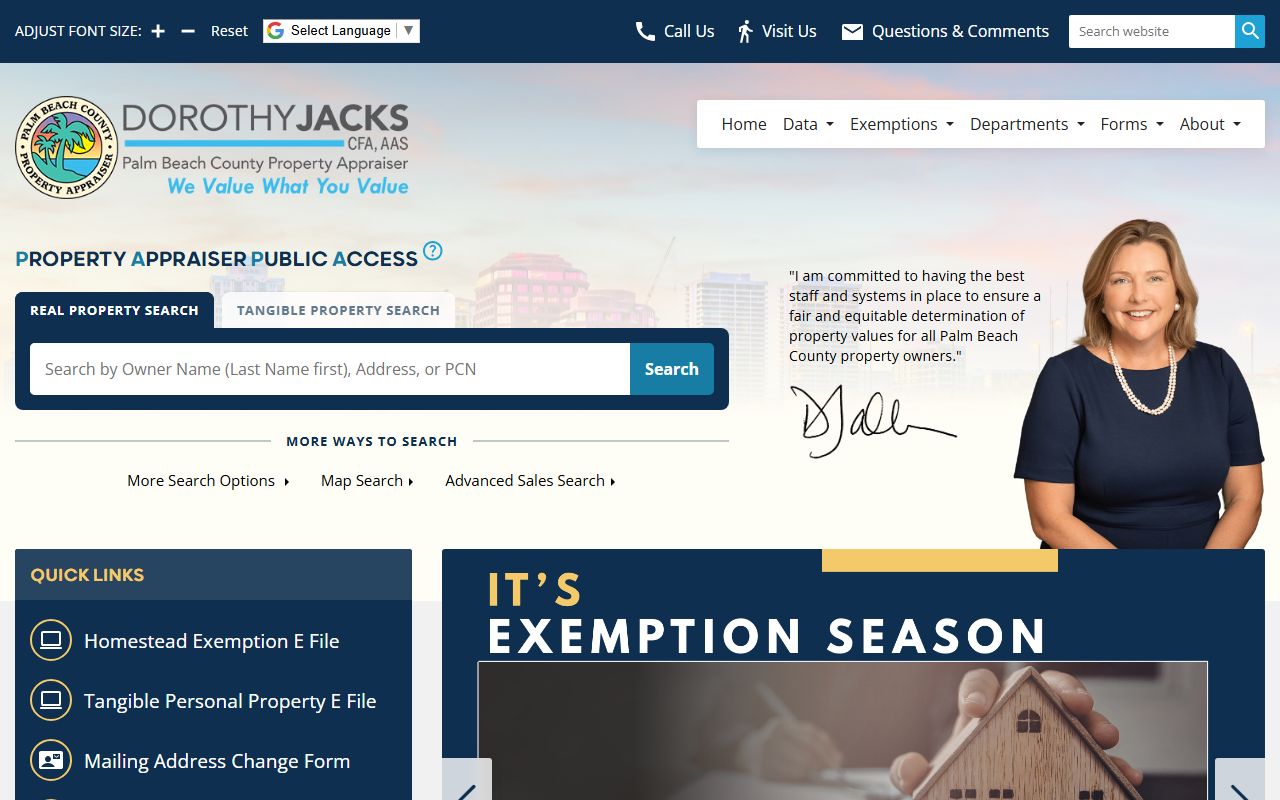

The Palm Beach County Property Appraiser website gives you direct access to parcel data at no cost. You can search by owner name, property address, or parcel ID number. The site returns current values, prior-year comparisons, exemption detail, sales history, and aerial maps through the GIS tool. The system covers all 659,119 parcels in the county.

The Palm Beach County Property Appraiser website provides free public access to the county property roll and search tools.

The appraiser's homepage is your main entry point for searching Palm Beach County property tax records online.

The Palm Beach County Property Appraiser homepage links to all major tools including the advanced parcel search and GIS map.

From the homepage you can reach the search portal, contact information, exemption forms, and the FAQ section.

Tax Collection and Billing in Palm Beach County

The Palm Beach County Tax Collector is Anne M. Gannon. The main office is at 301 N. Olive Ave., 3rd Floor, West Palm Beach, FL 33401. Phone: 561-355-2264. You can also reach the office by email at ClientAdvocate@pbctax.com. The collector runs five locations across the county to serve residents wherever they are. Branch offices are located in Belle Glade at 2976 SR 15, in Greenacres at 4215 S. Military Trail (Central Palm Beach), in Palm Beach Gardens at 3185 PGA Blvd. (North County), in Delray Beach at 501 S. Congress Ave. (South County), and in Westlake at 16440 Town Center Pkwy S.

Tax bills go out in November. They reflect the taxable value set by the appraiser, adjusted for any exemptions, and multiplied by the combined millage rates from the county, school board, and any applicable special districts. Florida's early payment discount schedule applies: 4% off in November, 3% in December, 2% in January, 1% in February. Taxes not paid by March 31 become delinquent. The collection process after that date is governed by Chapter 197, Florida Statutes, which includes tax certificate sales and eventually tax deed proceedings for long-unpaid parcels.

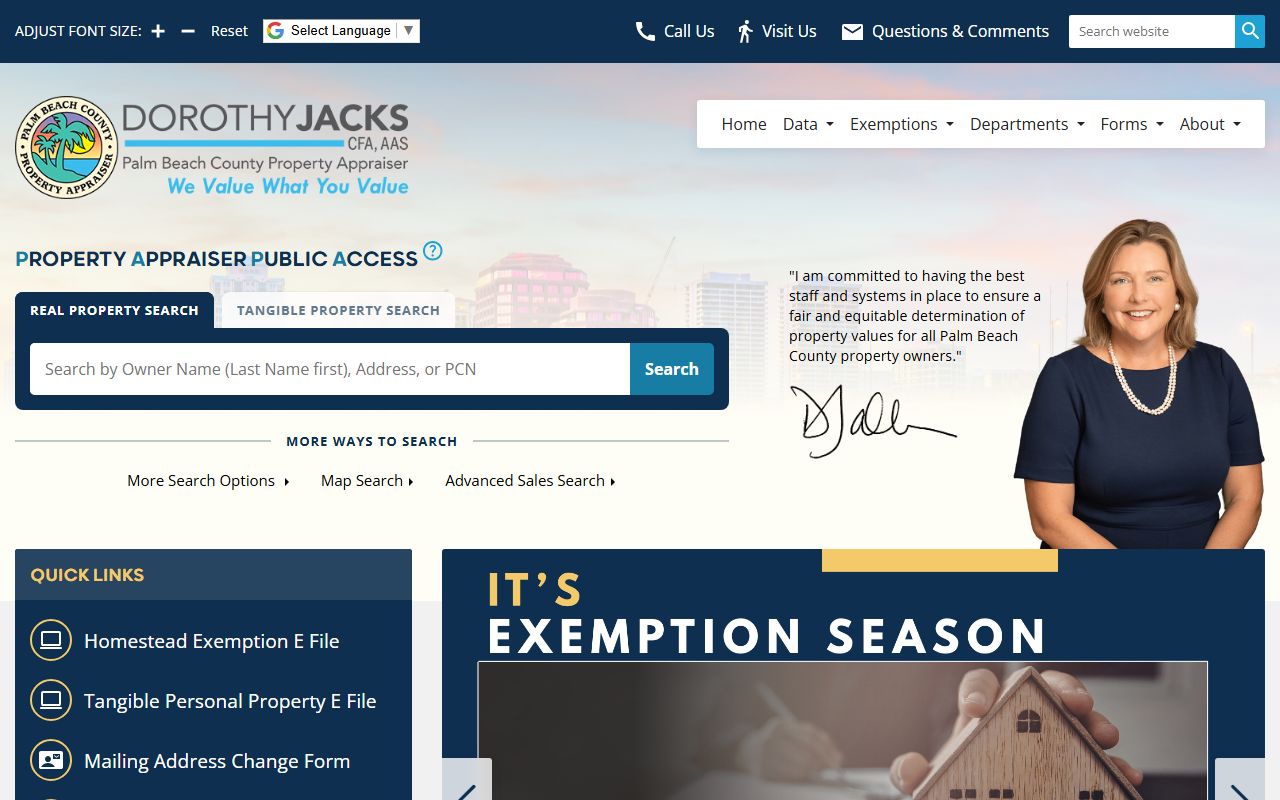

The Palm Beach County Tax Collector website handles online payments, bill lookups, and office location information.

The tax collector's site is where you pay your bill, check what you owe, and find branch office hours.

The Palm Beach County property tax payment portal lets you pay online by credit card or e-check.

The payment portal accepts most major cards and e-checks. Keep the confirmation number after paying.

Note: The tax collector and property appraiser are separate elected offices. A question about your bill amount goes to the collector. A question about your assessed value goes to the appraiser.

How to Search Palm Beach Property Tax Records

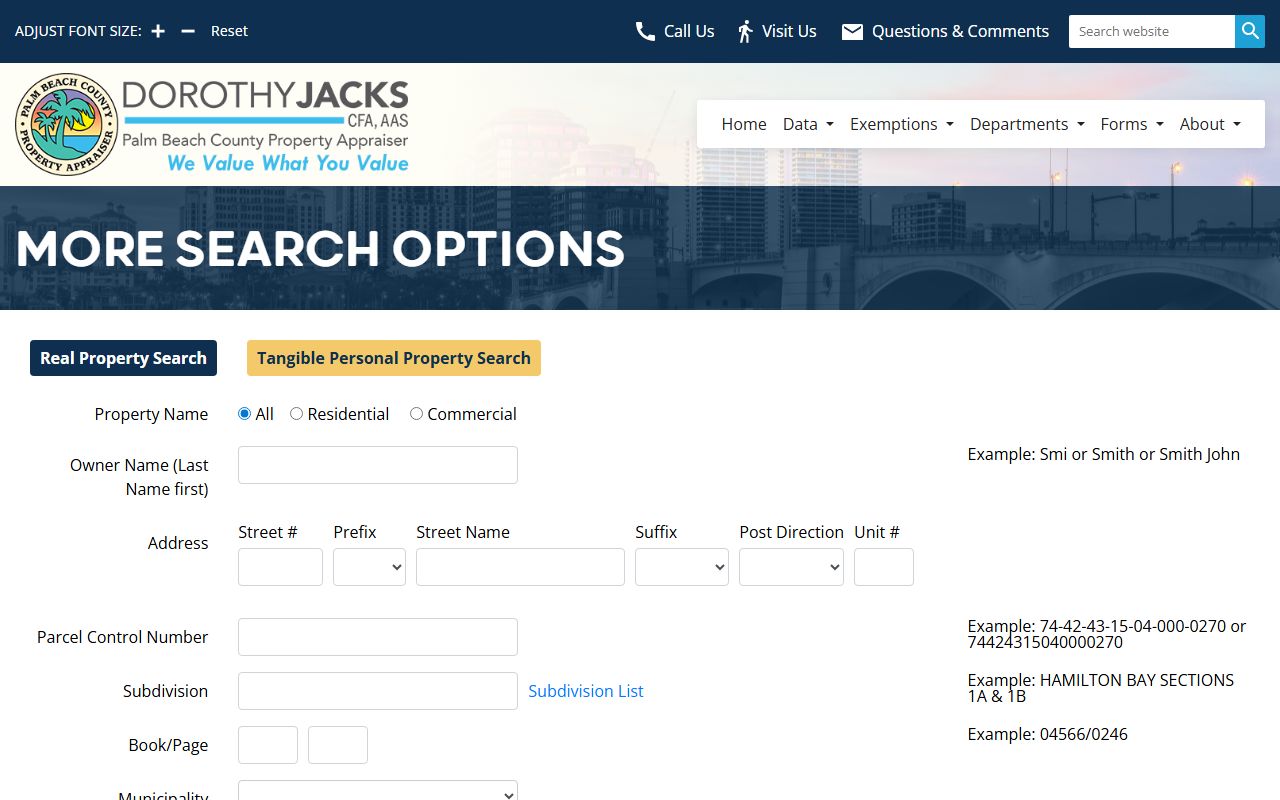

Start with the Palm Beach County Property Appraiser advanced search tool. This tool lets you search by parcel ID, owner name, property address, subdivision name, or legal description. The results page shows the assessed value, just value, taxable value, exemptions, land data, building characteristics, and recent sales. It is free and open to anyone.

The advanced property search on the Palm Beach County Property Appraiser site supports multiple search fields and returns full parcel detail.

The advanced search is the fastest way to pull up any specific parcel in the county by address, owner, or ID.

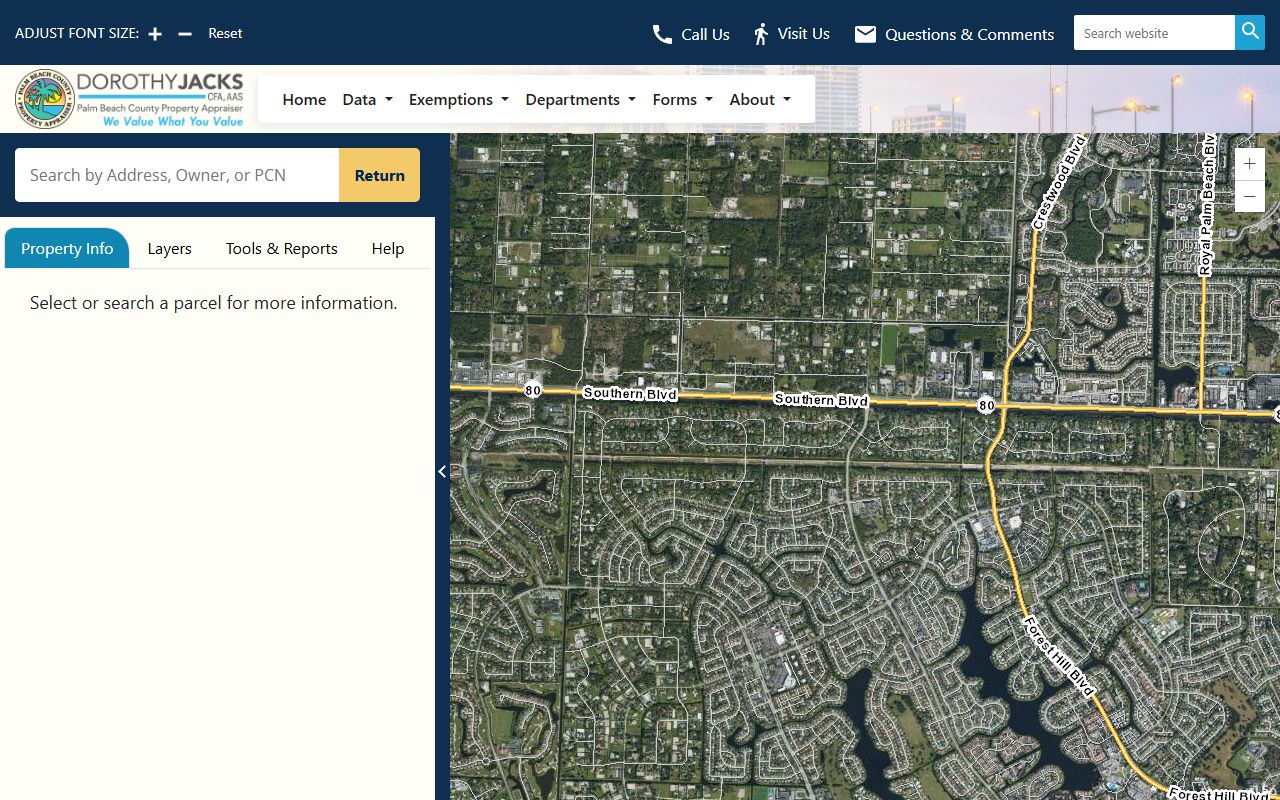

For GIS mapping and spatial searches, the Palm Beach County GIS map search overlays parcel boundaries on aerial photography. You can click any parcel on the map and get the same assessment data shown in the text search tool. This is especially useful when you need to identify parcels by location rather than address.

The Palm Beach County GIS map search lets you find parcels by location using an interactive aerial map.

The GIS tool is useful when you know where a property is but not the exact address or parcel number.

All Palm Beach County property tax records are public under Chapter 119, Florida Statutes. No ID required. No reason needed. The core data, ownership, value, tax amounts, and sales history, is fully open to anyone.

Exemptions for Palm Beach County Property Owners

Florida exemptions apply to all qualifying Palm Beach County parcels. The homestead exemption is the most common. It reduces the assessed value of a primary residence by up to $50,000. The first $25,000 applies to all taxing authorities. The second $25,000 reduces the value between $50,000 and $75,000 for all authorities except schools. This can lower a tax bill by several hundred dollars a year depending on the millage rate.

Homestead also triggers Save Our Homes protection. Once granted, annual increases in the assessed value of your homestead property are capped at 3% or the rate of inflation, whichever is lower. That cap is established in Chapter 193, Florida Statutes. Over years, the gap between just value and assessed value can grow large, making the tax bill substantially lower than it would otherwise be. When a property sells, the cap resets to full just value for the new owner.

Other exemptions available to Palm Beach County residents include the senior low-income exemption, disability exemptions, veteran and surviving spouse exemptions, and the widow/widower exemption. Full details on all exemptions are in Chapter 196, Florida Statutes. Applications go to the Property Appraiser's office. Most have a March 1 deadline.

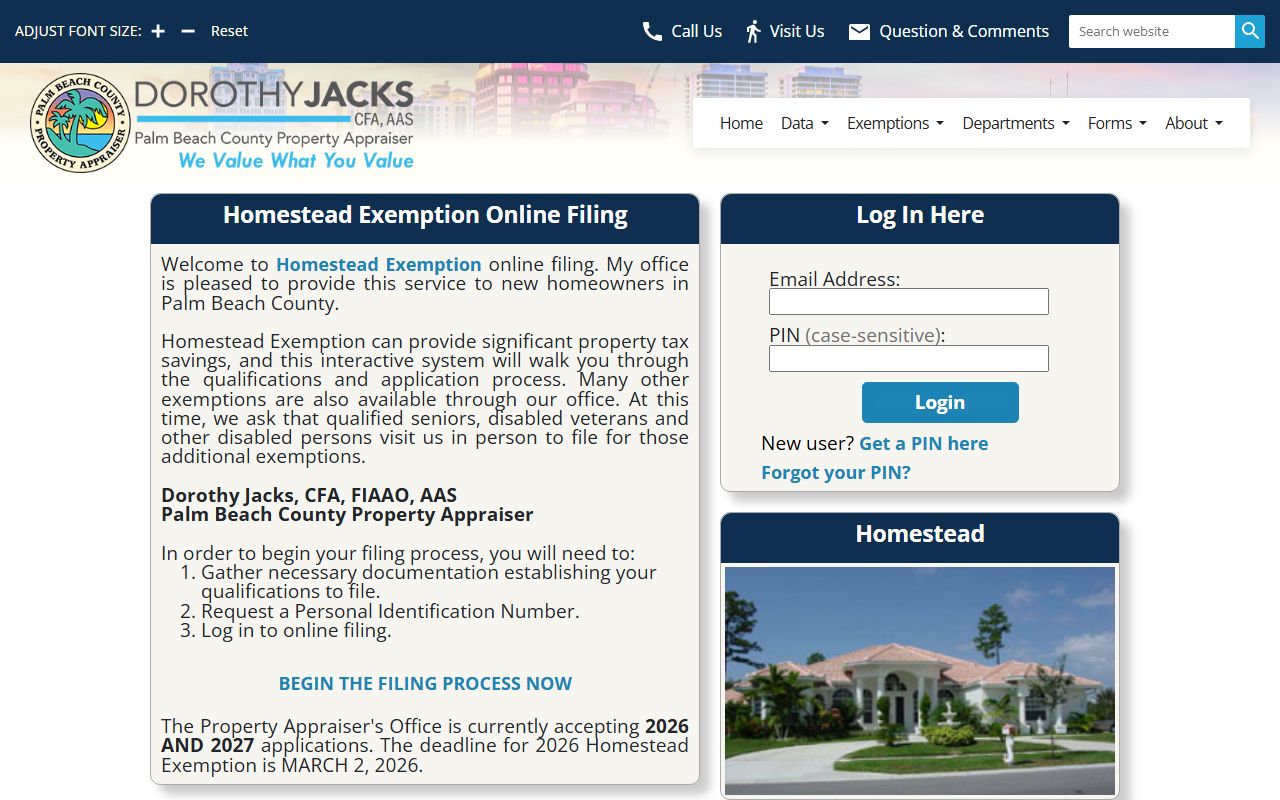

You can file for homestead online. The Palm Beach County homestead e-file portal lets you submit your application digitally without visiting an office.

The Palm Beach County homestead exemption e-file system accepts online applications directly.

Filing online is faster than mailing a paper form. The system confirms receipt once you submit.

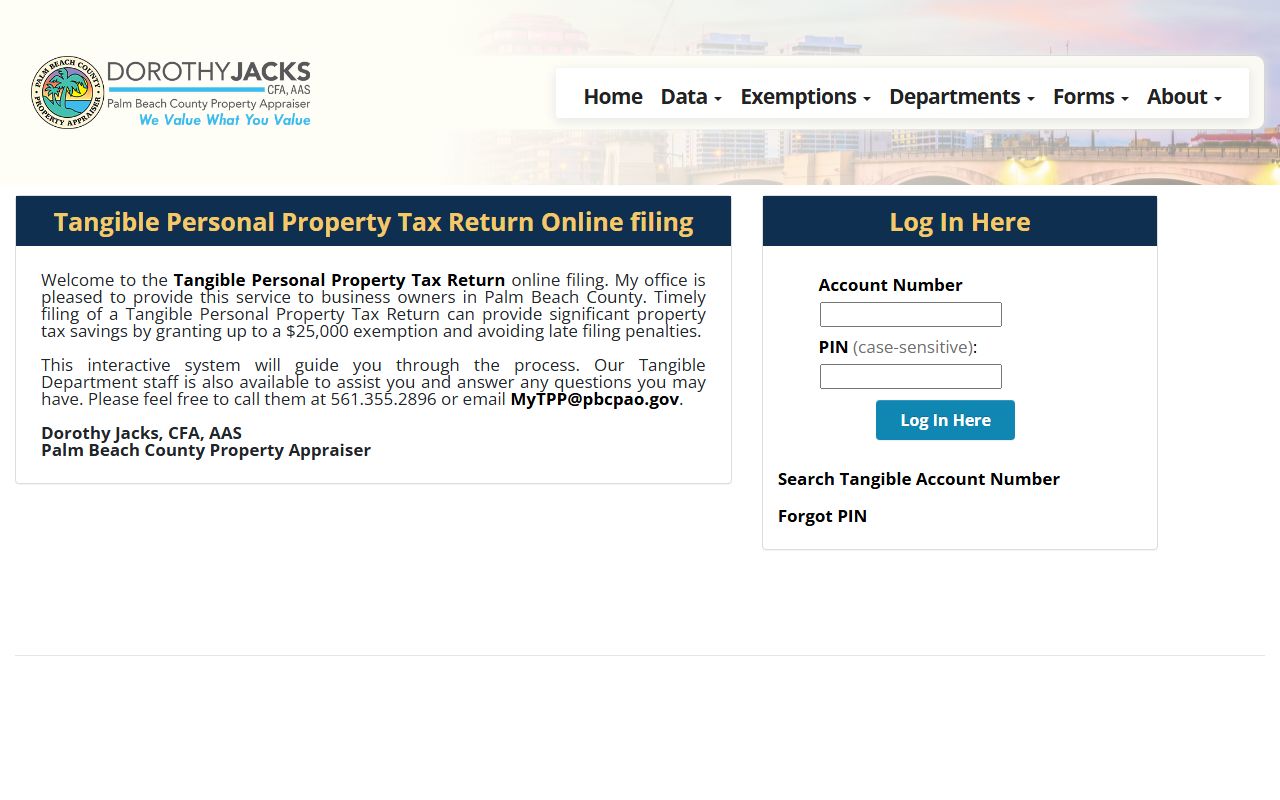

Business owners with tangible personal property can also file online. The TPP e-file portal handles tangible personal property returns, which are due by April 1. Filing on time preserves the $25,000 TPP exemption for qualifying accounts.

The Palm Beach County tangible personal property e-file system handles annual business property returns.

The TPP e-file system is separate from the homestead portal. File by April 1 to avoid penalties.

Appealing Your Palm Beach County Assessment

If your assessed value seems too high, you have a formal appeal path in Palm Beach County. Each summer, the Property Appraiser sends a TRIM notice, Truth in Millage. This document shows your proposed assessed value and what your taxes will look like at that rate. You have 25 days from the mailing date to file a petition with the Palm Beach County Value Adjustment Board.

You can also talk to the appraiser's office first. The contact and FAQ pages are good starting points. The appraiser's contact page lists staff and department contacts for assessment questions.

The Palm Beach County Property Appraiser contact page lists department phone numbers and email contacts for assessment questions.

Contacting the appraiser's office directly is often the fastest way to resolve a value question before filing a formal appeal.

If you still disagree after talking with the appraiser, file a VAB petition. The appeal process is governed by Chapter 194, Florida Statutes. You will get a hearing before a special magistrate. Bring comparable sales, photos of any property condition issues, and any independent appraisal you have. The magistrate makes a recommendation; the board votes on it. If you lose, you can still go to circuit court, though most cases resolve at the VAB level.

The Palm Beach County Property Appraiser FAQ page answers common questions about assessments, exemptions, and the TRIM notice process.

The Palm Beach County Property Appraiser FAQ page covers assessment questions, exemption rules, and TRIM notice guidance.

The FAQ section is worth reading before calling the office. Many common questions about assessments and exemptions are answered there.

Note: Pay at least the portion of your tax bill that is not under dispute while the appeal is pending. Unpaid taxes can lead to interest and penalties that accumulate regardless of the appeal outcome.

Payment Options for Palm Beach County Taxes

The Palm Beach County Tax Collector offers several ways to pay your property tax bill. Online payment is available through the collector's website using a credit card or e-check. In-person payment is accepted at all five branch locations. You can also mail a check to the main office at 301 N. Olive Ave., 3rd Floor, West Palm Beach, FL 33401.

The installment plan is available for those who prefer to spread payments. You sign up in the spring before the bill year. Payments come due in June, September, December, and March. Each installment includes a small discount. The plan is a good option for fixed-income owners who find the lump-sum November bill difficult to manage. Ask the collector's office about eligibility and deadlines.

After March 31, taxes are delinquent. Interest starts to accrue. In June, the collector holds a tax certificate sale. Investors bid on unpaid tax certificates and pay the delinquent amount. The rate they bid becomes the interest rate charged to the property owner if they later redeem. After two years, an unredeemed certificate holder can apply for a tax deed, which puts the property on a path to public sale. That is a serious outcome. Staying current on payments avoids the entire process.

Palm Beach County Property Records Under Public Records Law

Florida's public records law is strong and broad. Under Chapter 119, Florida Statutes, government records are open by default. Palm Beach County property tax records, assessment rolls, tax bills, ownership records, payment history, exemption data, are all public. You do not need to be a Florida resident. You do not need a lawyer. You do not need to explain why you want the data.

Online access through the appraiser and collector sites covers most common needs at no charge. For bulk data, certified copies, or records not available through the web portals, you can submit a public records request directly to the appropriate office. Staff must respond in a reasonable time. Fees may apply for large requests or copies that require staff time, but the underlying records are public. The Florida DOR data portal also has aggregate statewide data useful for county-level research.

Cities in Palm Beach County

Palm Beach County includes several major cities, each served by the same county property appraiser and tax collector. Property tax records for all cities in the county are part of the same county roll. You can find city-specific information on the pages below.