Okeechobee County Property Tax Records

Okeechobee County property tax records are public documents maintained by the Property Appraiser and Tax Collector for every parcel in this south-central Florida county. The county sits along the northern shore of Lake Okeechobee and includes a mix of agricultural land, residential properties, and commercial parcels in and around the city of Okeechobee. This page explains how to find and use those records and what property owners need to know about assessments, exemptions, and tax payments.

Okeechobee County Quick Facts

Okeechobee County Property Appraiser

The Okeechobee County Property Appraiser's office is at 307 NW Fifth Avenue, Suite B, Okeechobee, FL 34972. The phone number is (863) 763-3421, and the fax is (863) 763-2426. The appraiser values all real property and tangible personal property in Okeechobee County as of January 1 each year. That assessed value is the base for the annual tax bill. The appraiser does not set millage rates and does not collect taxes, those are separate functions handled by local governing bodies and the tax collector.

The property roll for Okeechobee County lists every parcel with its legal description, owner of record, assessed value, taxable value, and exemptions. The county includes a substantial amount of agricultural land, ranches, and citrus operations. Agricultural land classified under Florida's agricultural classification rules may have a lower assessed value than its market value. The appraiser reviews agricultural classifications annually and applies the rules set out in Chapter 193, Florida Statutes.

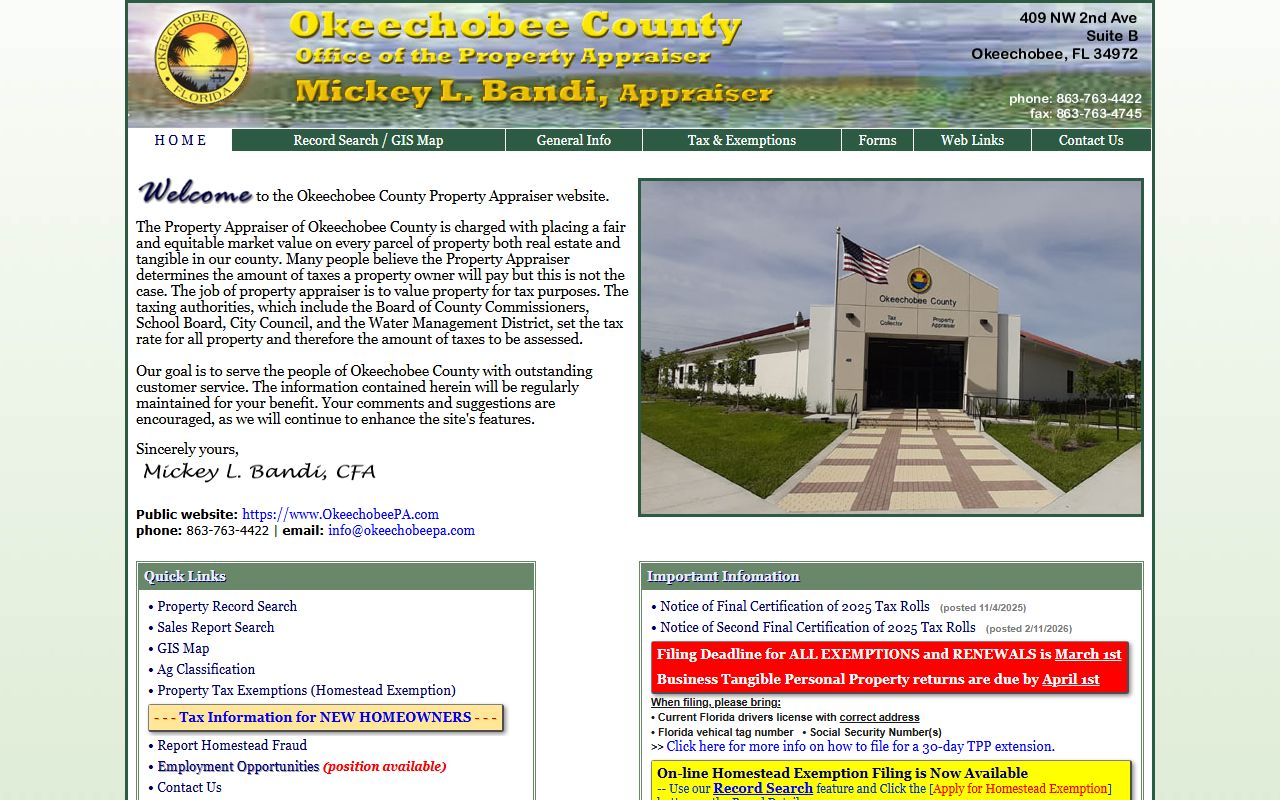

You can search Okeechobee County parcel records online at the Okeechobee County Property Appraiser website. The site lets you search by owner name, parcel ID, or address. Results include assessed values, prior-year values, exemption status, and sales history.

The Okeechobee County Property Appraiser's website is the main source for parcel lookups and assessment data in the county.

The appraiser's online portal covers residential, commercial, and agricultural parcels across Okeechobee County.

The Florida Department of Revenue reviews all county tax rolls each year to ensure they meet statewide standards. Information on how assessments work statewide is available at the DOR Property Tax Oversight page.

Agricultural Land Classification

A significant portion of Okeechobee County is classified as agricultural land, which affects how it is assessed for property tax purposes. Under Florida law, land used primarily for bona fide agricultural purposes, farming, ranching, aquaculture, or similar uses, may qualify for an agricultural classification that sets the assessed value based on the land's capacity to produce income from agriculture rather than its market value. This can result in a substantially lower tax bill for qualifying landowners.

To get or keep an agricultural classification, you must apply with the Okeechobee County Property Appraiser by March 1. The appraiser reviews applications and site conditions to verify the land is being used for bona fide agricultural purposes. Simply owning land or having it zoned agricultural is not enough, active agricultural use must be demonstrated. If you lose the classification and the land is later developed or sold, the difference in taxes between the agricultural value and market value for up to ten years may become due as a rollback tax. This is governed by Florida Statutes and is an important consideration for anyone buying or selling agricultural land in Okeechobee County.

Homestead Exemption and SOH Cap

Florida's homestead exemption reduces the assessed value of a primary residence by up to $50,000. The first $25,000 applies to all taxing authorities, and the second $25,000 applies only to non-school levies. File by March 1 with the Okeechobee County Property Appraiser at 307 NW Fifth Avenue, Suite B. You can apply in person, by mail, or online if that option is available through the appraiser's website. New homeowners should file as soon as they close on their home to avoid missing the next March 1 deadline.

The Save Our Homes cap limits annual assessment increases on homesteaded property to the lesser of 3% or the Consumer Price Index change. This cap protects long-term residents from large tax increases when the local market rises. The benefit is portable, if you sell your Okeechobee County home and buy another Florida home, you can transfer the accumulated benefit to reduce your new assessed value. Apply for portability at the same time as your new homestead application. Portability and homestead exemption rules are in Chapter 196, Florida Statutes.

Other exemptions available include the widow/widower reduction, the disability exemption, and exemptions for qualifying veterans. Contact the appraiser's office at (863) 763-3421 for details on eligibility and how to apply.

Tax Bills and Payment Options

The Okeechobee County Tax Collector's office is at 307 NW Fifth Avenue, Suite B, Okeechobee, FL 34972. Phone: (863) 763-3421. Tax bills go out in November and reflect the taxable value certified by the appraiser, multiplied by millage rates set by the county commission, school board, and special districts. The total bill on any parcel reflects the combined rate from all taxing authorities that apply to that parcel.

Florida's early-payment discounts apply: 4% if you pay in November, 3% in December, 2% in January, 1% in February. Taxes not paid by March 31 are delinquent as of April 1. Delinquent taxes lead to the tax certificate process under Chapter 197, Florida Statutes. Investors bid at a public sale on certificates, and if the owner does not redeem the certificate within two years, a tax deed application can proceed. Losing a property to a tax deed is rare but possible if taxes go unpaid long enough.

You can pay Okeechobee County property taxes in person at the tax collector's office, by mail, or online. The tax collector can also answer questions about installment plans, which split the annual bill into four payments and must be applied for by April 30 of the prior year.

Tangible Personal Property Returns

Businesses in Okeechobee County must file a Tangible Personal Property return with the Property Appraiser by April 1 each year. TPP covers non-real-estate business assets like furniture, fixtures, equipment, and machinery. The first $25,000 in assessed value is exempt, but only if you file a return. File late and you lose that exemption and may face a penalty.

Okeechobee County has agricultural businesses, farm supply operations, and service businesses that all have TPP filing obligations. New businesses must file in their first year. The appraiser's office provides forms and instructions at (863) 763-3421. You can also download TPP forms from the Florida DOR forms page, which has standardized forms used across the state.

Appealing Your Assessment

Okeechobee County property owners who disagree with their assessed value can petition the Value Adjustment Board. File within 25 days of the mailing date shown on your TRIM notice. The TRIM notice arrives in August and shows the proposed value, exemptions, and estimated taxes. It is not a bill, it is a heads-up that gives you time to review the proposed value and decide whether to appeal.

The VAB in Okeechobee County uses special magistrates to hear evidence from property owners and the appraiser's office. Bring comparable sales data, a private appraisal, or documentation of errors in the appraiser's property record to support your case. You can represent yourself or hire a professional. The magistrate issues a recommendation, the VAB board issues a final order, and you can still appeal to circuit court if you disagree. The full appeals process is in Chapter 194, Florida Statutes.

Accessing Property Records

Okeechobee County property records are public under Chapter 119, Florida Statutes. Core parcel data is available online through the appraiser's portal at no cost. For bulk data, the Florida DOR's data portal lets you download full county assessment rolls. The DOR property tax FAQ answers common questions about how the assessment and exemption system works across Florida.

Find contact information for the Okeechobee County Property Appraiser and Tax Collector on the Florida DOR's local officials page.

The DOR local officials directory links to every county appraiser and tax collector in Florida and is kept up to date.

The Florida Tax Collectors Association and the Property Appraisers Association of Florida both provide directories and general information on how county offices operate.

Cities in Okeechobee County

Okeechobee County has no cities above the population threshold for individual city pages. The city of Okeechobee is the county seat and largest municipality, but it falls below the qualifying threshold. Property tax records for all county parcels are accessible through the county appraiser's office at 307 NW Fifth Avenue, Suite B, Okeechobee.