Access Indian River County Property Tax Records

Indian River County property tax records cover every parcel along the Treasure Coast, from the barrier island communities near Vero Beach to the rural western reaches of the county. The Property Appraiser sets assessed values each January 1, and the Tax Collector handles billing and payment collection. This guide explains how to search the tax roll, understand your assessment, apply for exemptions, and access public records for any property in Indian River County.

Indian River County Quick Facts

Indian River County Property Appraiser

The Indian River County Property Appraiser's office is at 1801 27th Street, Vero Beach, FL 32960. The main phone number is (772) 567-8000 and fax is (772) 770-5045. The office website at ircpa.org provides the primary online search tool for parcel records, assessment data, and exemption information.

The Property Appraiser is an elected official, separate from county government, responsible for placing a just value on all real property in Indian River County as of January 1 each year. That date is mandated by state law and does not shift based on when a sale or construction project closes. The office handles residential homes, commercial buildings, vacant land, agricultural tracts, and tangible personal property returns filed by businesses.

Each August the appraiser mails TRIM notices to every property owner. TRIM stands for Truth in Millage. The notice shows your proposed assessed value and the tax rates being set by each taxing authority that has jurisdiction over your parcel. It is not a bill. It is your chance to review the numbers and raise a concern if something looks off before the values become final.

Indian River County has a mix of property types. Coastal residential parcels, barrier island homes, agricultural land in the western part of the county, and commercial corridors along US-1 all fall under the same assessment process. The appraiser uses sales data from recent arm's-length transactions to calibrate values across each neighborhood and property class.

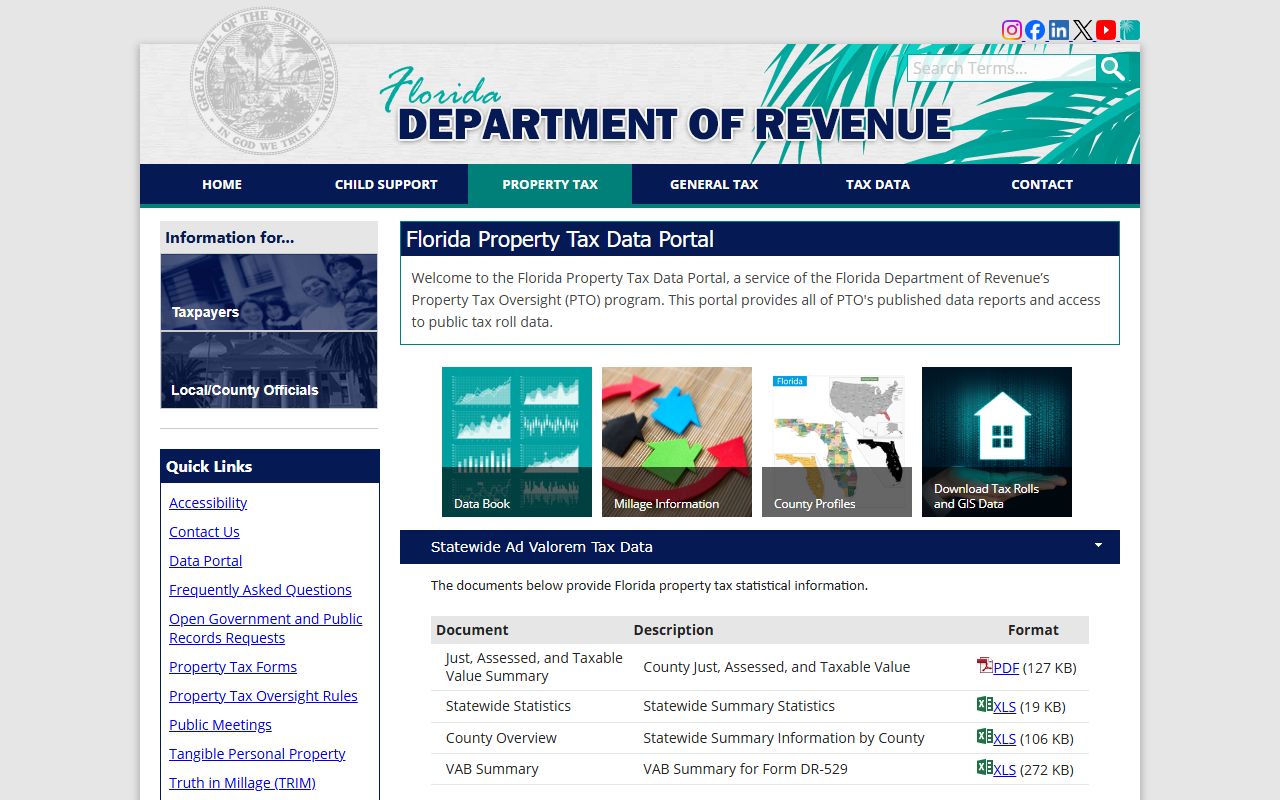

The Florida Department of Revenue provides statewide oversight for county property appraisers through its Property Tax Oversight program.

That page lists contact details for every county appraiser and tax collector in Florida, which is useful if you need to cross-reference offices or find information for a neighboring county.

Indian River County Tax Collector

The Indian River County Tax Collector is also located at 1801 27th Street, Vero Beach, FL 32960, with a direct phone of (772) 770-5000 and fax (772) 770-5045. The Tax Collector is a separate elected official from the Property Appraiser. Once the tax roll is certified in October, the collector takes over: printing bills, accepting payments, and managing delinquent accounts.

Bills go out by November 1. Florida law rewards early payment. Pay in November and save 4%. December is 3%, January is 2%, February is 1%. After March 31, the bill is delinquent and no discount applies. The April 1 delinquency date is firm. On that date, interest and fees begin to accrue, and the account moves toward the certificate sale process.

The Tax Collector also runs an installment payment plan for owners who want to spread their annual tax obligation over four payments. You must apply by April 30 to participate in the plan for the coming tax year. The Florida Tax Collectors Association at floridataxcollectors.com provides additional guidance on payment options available across all Florida counties.

Searching the Indian River County Tax Roll

The Property Appraiser's website at ircpa.org is the main access point. No account is needed. Search by owner name, street address, or parcel identification number. The parcel ID is the most precise search method. It is a unique number assigned to every parcel of land in Indian River County and does not change even when ownership changes.

Each parcel record shows the current assessed value, the breakdown between land and building values, the legal description, sales history going back several years, exemptions on file, and in many cases a sketch of the structure. That level of detail is useful when you are buying a property, appealing a value, or comparing your assessment to similar homes nearby.

For current tax bills and payment history, check with the Tax Collector's office. They maintain records of what has been paid, what is outstanding, and whether a certificate has been issued on any delinquent account. That information is critical when reviewing the title history of a property you are considering purchasing.

All Indian River County property tax records are public records under Chapter 119, Florida Statutes. Assessed values, ownership information, sales history, and payment records are open without restriction. Social Security numbers, income data on exemption applications, and federal tax return information are confidential and not disclosed.

Homestead and Other Exemptions

The homestead exemption reduces the taxable value of your primary residence by up to $50,000. The first $25,000 applies to all taxing authorities. The second $25,000 applies to non-school levies on the assessed value between $50,000 and $75,000. You must own and occupy the property as your primary residence on January 1 and file an application with the Property Appraiser by March 1 of the first year you want the exemption to apply.

Once you have homestead, the Save Our Homes cap limits annual increases in your assessed value. The cap is set at 3% or the change in the Consumer Price Index, whichever is lower. Over time that protection adds up. If you have owned your home for many years, your assessed value may be well below current market price. When the property sells, the new owner loses the cap and the value resets to market. Chapter 193, Florida Statutes governs how the cap is calculated and applied each year.

Indian River County also processes additional exemptions through the Property Appraiser's office. These include widow and widower exemptions, disability exemptions, veterans exemptions including the combat-related disability exemption, and the senior citizen low-income exemption. Each has its own application and documentation requirements. Businesses must file a tangible personal property return by April 1 each year to claim the $25,000 TPP exemption. Chapter 196, Florida Statutes covers all exemption types and eligibility standards.

Appealing Your Assessment

Not happy with your assessed value? Start with the Property Appraiser's office. Call or go in person. Bring comparable sales data, a private appraisal if you have one, or documentation of any condition issues affecting your property's value. The appraiser's staff can review the record with you and correct errors before any formal process is needed. Most people who raise concerns get some kind of response at this stage.

If informal review does not resolve the issue, file a petition with the Value Adjustment Board. The deadline is 25 days after the TRIM notice is mailed each August. That deadline does not move. The VAB is a local board that includes county commissioners, school board members, and citizen appointees. A special magistrate reviews the evidence and issues a recommendation. You present your case and the appraiser presents theirs.

Chapter 194, Florida Statutes outlines the full VAB process, petition rules, hearing procedures, and standards of review. Filing a VAB petition does not pause your tax obligation. You still owe the tax by March 31. If you win, you get a refund. If you remain unsatisfied after the VAB, you can file in circuit court, though that step typically involves an attorney and a more involved proceeding.

Delinquent Taxes and the Certificate Sale

Unpaid Indian River County property taxes become delinquent on April 1. Interest and costs begin to add up immediately. The Tax Collector moves toward a tax certificate sale, typically held in late May or early June. Investors bid on the right to pay the delinquent amount and collect interest from the property owner later. The winning bid sets the interest rate the owner will pay to redeem the certificate.

To clear the certificate, the property owner must pay the face value plus the accrued interest. If the certificate sits unredeemed for two years, the holder can apply for a tax deed sale. That process can result in the forced transfer of the property. It is a real risk. If you have unpaid taxes from prior years, address them as soon as possible to avoid certificate accumulation.

Chapter 197, Florida Statutes covers the certificate sale process, redemption rights, interest calculations, and the tax deed application process. Understanding that law is important if you are buying property with a troubled tax history or if you have fallen behind on your own taxes.

The Florida Department of Revenue's data portal offers downloadable property tax data that researchers and buyers can use to review assessment trends in Indian River County.

That portal provides bulk data useful for comparing values across the county or reviewing year-over-year assessment changes.

Public Records and Data Access

Indian River County property tax records are public under Florida's broad open records law. Chapter 119, Florida Statutes presumes all government records are open unless a specific exemption says otherwise. For property tax purposes, that means assessed values, ownership names and mailing addresses, sales data, exemption types, and payment records are all accessible to anyone at no cost through the online systems.

If you need certified copies or bulk data beyond what the online portal offers, contact the Property Appraiser's office directly. Some large data requests involve a nominal reproduction fee. The Florida Department of Revenue's Property Tax Oversight office at floridarevenue.com/property provides statewide resources and oversight documentation that supplements what individual county offices provide.

The Professional Association of Appraisers of Florida at paaf.us is another reference point for understanding how the appraisal profession works in Florida, what standards apply, and how the mass appraisal process is conducted at the county level.

Cities in Indian River County

Indian River County's largest city is Vero Beach, which serves as the county seat and commercial center. Other communities include Sebastian, Fellsmere, Indian River Shores, and Orchid. Vero Beach has a population of roughly 16,000, well below the 75,000 threshold for a dedicated city page. No city-level property tax pages are available for Indian River County at this time.