Glades County Property Tax Records Search

Glades County property tax records are held by the Property Appraiser and Tax Collector based in Moore Haven, Florida. Glades is one of Florida's smallest and least densely populated counties, sitting along the shores of Lake Okeechobee in South Central Florida. The county's land is mostly agricultural, with sugarcane fields, cattle ranches, and wetlands making up the majority of the property tax roll. This page covers how to access Glades County property tax records, claim exemptions, and handle appeals or payments.

Glades County Quick Facts

Glades County Property Appraiser

The Glades County Property Appraiser's office is at P.O. Drawer 1589, Moore Haven, FL 33471. Call (863) 946-6035 or fax (863) 946-3295. The property appraiser is an elected constitutional officer who operates independently from county government. Their job is to value every parcel in Glades County as of January 1 each year at just value, the price a willing buyer would pay a willing seller in a fair, open transaction.

Glades County's property tax roll is dominated by agricultural land. Large sugarcane operations along the Caloosahatchee River, cattle ranches, and wetland tracts are common. Agricultural classification plays a major role in the county's assessments. Properties actively used for farming, grazing, or other agricultural purposes can be assessed at their agricultural use value rather than market value under Chapter 193, Florida Statutes. That can mean a dramatically lower assessed value and a smaller tax bill. Apply by March 1 each year and demonstrate genuine agricultural use.

Residential properties in Glades County are mostly in and around Moore Haven. The appraiser tracks building permits, new construction, and ownership transfers to keep the rolls current. If you buy property in Glades County, your deed will trigger a review of the property's assessed value. Don't assume the previous owner's low value carries over, especially if there was a significant gap between assessed value and sale price due to exemptions or the SOH cap.

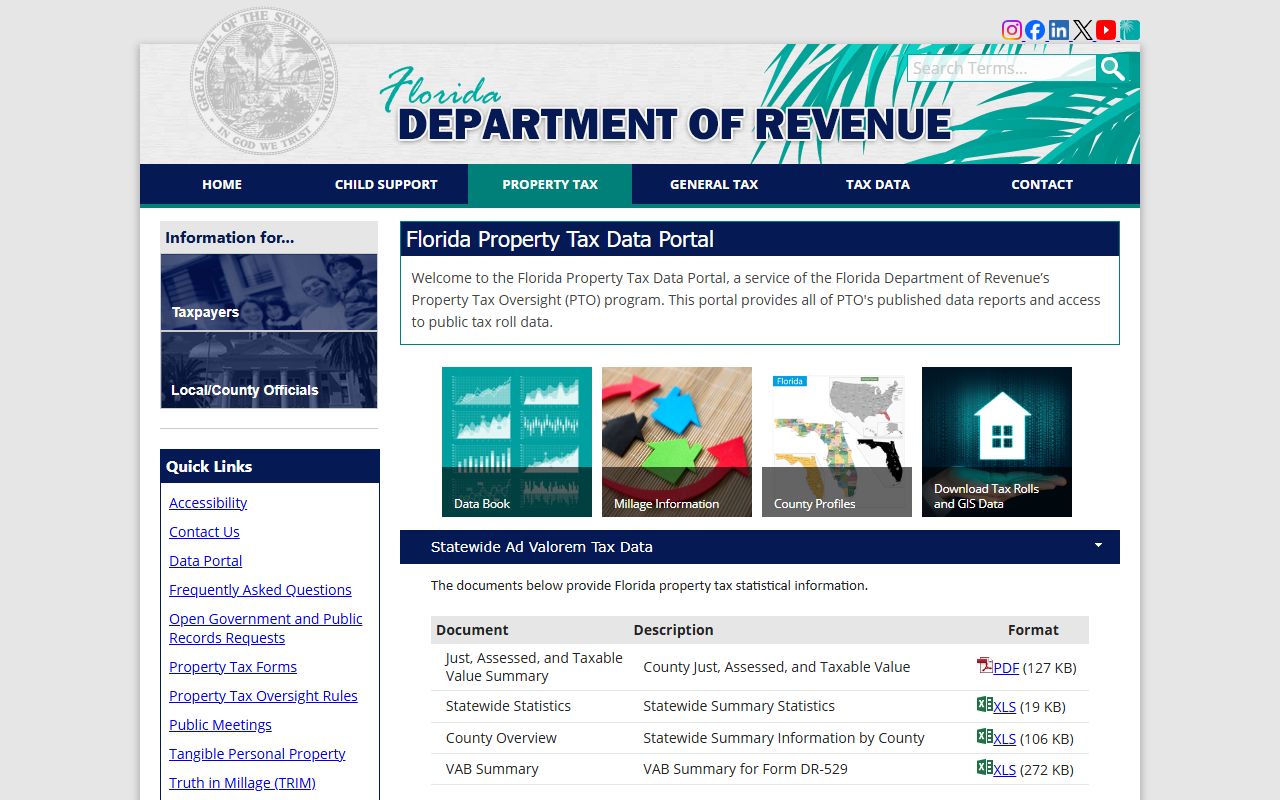

Because no county-specific screenshots are available for Glades County, the images below come from the Florida Department of Revenue, which provides statewide oversight of all county property appraisers.

The Florida DOR Property Tax Oversight page provides the regulatory framework for property assessment across all Florida counties, including Glades.

The DOR sets statewide rules for property tax assessment that the Glades County Property Appraiser must follow each assessment cycle.

Glades County Tax Collector

The Glades County Tax Collector is at P.O. Drawer 1589, Moore Haven, FL 33471, same address as the Property Appraiser. Phone is (863) 946-6035, fax (863) 946-3295. The Tax Collector is a separate elected constitutional officer. Once the Property Appraiser certifies the tax rolls in October or November, the Tax Collector takes over billing and collection.

Glades County tax bills go out each November. You have until March 31 to pay. Florida law under Chapter 197, Florida Statutes provides discounts for early payment. November saves you 4%, December 3%, January 2%, February 1%. On April 1, taxes become delinquent. Interest and penalties begin immediately. Take the discounts when you can, they're worth it on larger rural land holdings common in Glades County.

Delinquent taxes in Glades County are sold as tax certificates at the annual sale. Investors pay the overdue taxes and earn interest. Property owners can redeem their property by paying all taxes plus accrued interest. If a certificate remains unpaid too long, the certificate holder can apply for a tax deed, triggering a public auction of the property. Agricultural landowners who use escrow or seasonal income to pay taxes should plan ahead to make sure bills are paid on time.

The Florida Tax Collectors Association provides statewide resources and information on how Florida's property tax collection system works, including for rural counties like Glades.

Search Glades County Property Tax Records Online

Glades County property tax records are searchable through the Property Appraiser's online portal. Look up parcels by owner name, address, or parcel ID to see assessed values, taxable values, exemptions, land data, and sales history. The search is free and publicly accessible under Florida's open records law.

Florida's public records statute at Chapter 119, Florida Statutes makes property tax records open to everyone. There's no requirement to explain why you want access, prove property ownership, or pay a fee for basic lookups. Ownership records, assessed values, exemption status, and payment history are all public. Only certain personal identifiers, like Social Security numbers, on exemption applications are protected.

Bulk Glades County parcel data is available for download through the Florida DOR data portal at floridarevenue.com/property/Pages/DataPortal.aspx. This is useful for real estate researchers, appraisers, and analysts who need the full county dataset. Files are updated after each assessment cycle and cover all parcel types including agricultural tracts.

For records not available online, older assessments, historical ownership data, or specific exemption documents, contact the Property Appraiser's office by phone or in person. Staff in Glades County's small office can usually respond quickly to specific parcel requests. Have your parcel number ready when you call.

The screenshot below shows the Florida DOR data portal, which includes Glades County parcel data available for download.

Download bulk Glades County property data from the Florida DOR Data Portal.

The DOR data portal provides Glades County parcel-level data in downloadable format, updated after each assessment year.

Property Tax Exemptions in Glades County

Glades County homeowners can file for the homestead exemption by March 1. This exemption reduces the assessed value of your primary residence by up to $50,000. The first $25,000 applies against all tax levies. The second $25,000 applies only to non-school taxes for assessed value between $50,000 and $75,000. File at the Property Appraiser's office or online if the portal allows. Once granted, the exemption renews automatically as long as you remain eligible.

The Save Our Homes cap limits annual increases to the assessed value of homestead property. The limit is 3% per year or the Consumer Price Index, whichever is lower. Over several years this can build up a sizable benefit. If you move to a new home in Florida, that accumulated benefit is transferable through the portability application. File portability when you apply for homestead at your new address. The legal framework is in Chapter 196, Florida Statutes.

Agricultural classification is critical for many Glades County landowners. If your property is used for bona fide agricultural purposes, cattle, sugarcane, citrus, vegetables, or other crops, you may qualify for assessment at agricultural use value rather than market value. This can mean an enormous reduction in assessed value for large rural tracts. You must apply by March 1 and provide evidence of active agricultural use. The appraiser's office will review your application and may inspect the property.

Additional exemptions available in Glades County include veterans' exemptions for service-connected disability, widow and widower exemptions, blind persons exemptions, and total disability exemptions. Each requires documentation. Contact the Property Appraiser's office to find out which ones you may qualify for and what paperwork you need to bring.

Glades County Property Assessment Appeals

Your August TRIM notice shows the proposed assessed value for your Glades County property. You have 25 days from that date to file a petition with the Value Adjustment Board. The clock starts on the date printed on the notice. Miss the 25-day window and the VAB option for that year is closed.

The Glades County VAB process follows Chapter 194, Florida Statutes. After filing a petition and paying the fee, you get a hearing date before a special magistrate, a licensed appraiser or attorney. The magistrate reviews evidence from both you and the Property Appraiser, then issues a recommendation. The full VAB votes on the outcome. If you still disagree, circuit court is the next step.

Agricultural classification denials can also be appealed through the VAB. If the appraiser denies your agricultural classification application, you can file a petition to contest that decision. The evidence you bring should show the land is in active agricultural use, receipts, leases, harvesting records, photos of crops or livestock, and testimony about the farming operation all help make the case.

Before filing, call the appraiser's office. Many issues, data errors, a missed agricultural classification, or incorrect measurements, can be resolved informally. The Glades County office is small and staff are usually accessible. A quick call can save you the filing fee and the time of a formal hearing.

Property Tax Payment in Glades County

Glades County tax bills are mailed in November. The payment deadline is March 31. Pay early to save money. November gives you 4% off. December 3%, January 2%, February 1%. On April 1, the account becomes delinquent and you start paying interest.

Pay by mail to P.O. Drawer 1589, Moore Haven, FL 33471, in person at the Tax Collector's office, or online if the portal is available. For large agricultural land holdings common in Glades County, property tax bills can be substantial. If you rely on seasonal income from crops or cattle sales, plan your payment schedule around the discount calendar. November payment saves more money on a large bill than it does on a small one.

Delinquent Glades County taxes go to the annual tax certificate sale. Investors bid on certificates and pay your overdue taxes. You can redeem the certificate and retain your property by paying all amounts owed plus interest. Let it go too long and the certificate holder can apply for a tax deed, putting your land at risk of public sale. Don't let agricultural or investment land sit unpaid, the consequences can be severe.

Accessing Glades County Property Tax Records

Property tax records in Glades County are public under Florida law. The Property Appraiser's online search provides free access to assessed values, ownership, exemptions, and sales data. The Tax Collector handles billing and payment records. Both are open to anyone under Chapter 119.

For records not available online, contact the Property Appraiser's office in Moore Haven. Under Florida's public records law, they must respond promptly. Simple requests are usually handled quickly at no cost. Large or complex data requests may involve fees for copying or staff time.

The Florida DOR at floridarevenue.com/property provides statewide oversight of the property tax system and publishes forms, guides, and data. Their county officials directory at floridarevenue.com/property/Pages/LocalOfficials.aspx has current contact info for Glades County's Property Appraiser and Tax Collector. State-level property tax forms are at floridarevenue.com/property/Pages/Forms.aspx.

The Professional Association of Property Appraisers at paaf.us represents Florida's county property appraisers, including Glades County's appraiser, and publishes resources on appraisal standards and best practices.

Cities in Glades County

Glades County has no cities meeting the population threshold for a dedicated page. Moore Haven is the county seat and the largest community in the county, but its population is far below the qualifying minimum.

Nearby Counties

Glades County borders Hendry, Highlands, Martin, Okeechobee, and Palm Beach counties. Each maintains its own property tax records through a separate Property Appraiser and Tax Collector.