Osceola County Property Tax Records

Osceola County property tax records are public documents maintained by the Property Appraiser and Tax Collector for all parcels in this central Florida county. The county covers a large area that includes Kissimmee, vacation resort communities near Walt Disney World, agricultural land in the south, and fast-growing residential subdivisions throughout. This page explains how to find those records, how assessments are handled in Osceola County, and what property owners need to know about exemptions, tax bills, and appeals.

Osceola County Quick Facts

Osceola County Property Appraiser

The Osceola County Property Appraiser's office is located at 2505 E. Irlo Bronson Memorial Highway, Kissimmee, FL 34744. The phone number is (407) 742-5000, and the fax is (407) 742-3995. The office values all real property and tangible personal property in Osceola County as of January 1 each year. That value is the base for the annual tax bill. The appraiser does not set millage rates and does not collect taxes. Those are separate functions carried out by local governing bodies and the tax collector.

Osceola County has grown rapidly over the past two decades and now includes a diverse range of property types. Residential neighborhoods in Kissimmee and St. Cloud, vacation short-term rental properties in resort communities like Reunion and Championsgate, commercial and hospitality properties along US 192 and US 441, and large ranches and cattle operations in the county's southern reaches all appear on the tax roll. The appraiser tracks sales data across these different segments to set values consistent with Florida law and the guidelines of the Department of Revenue. Assessment standards are set by Chapter 193, Florida Statutes.

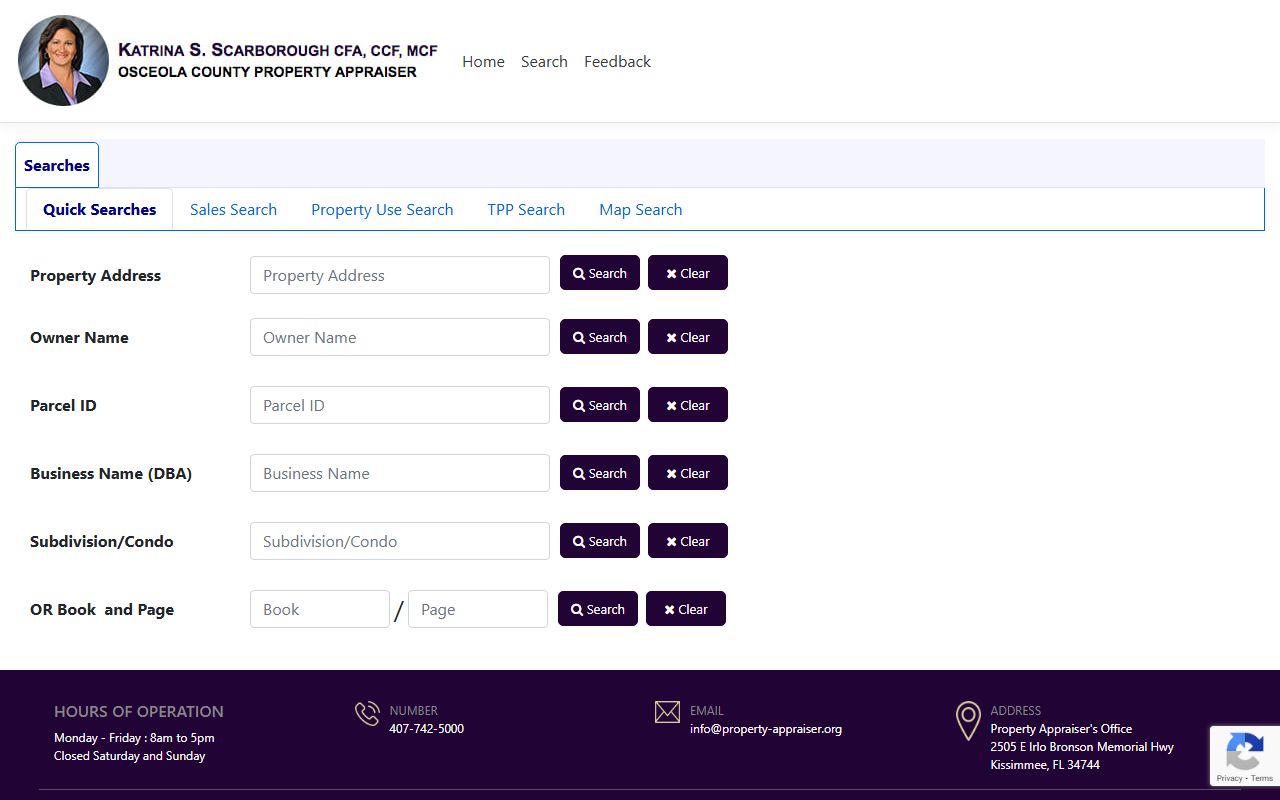

The Osceola County property search portal is available at search.property-appraiser.org. You can look up parcels by owner name, address, or parcel ID. Search results show current and prior-year assessed values, taxable value, exemptions, and sales history.

The Osceola County property search portal lets you look up any parcel in the county by name, address, or ID number.

The search portal is the fastest way to pull up assessed values, exemption data, and sales history for any Osceola County parcel.

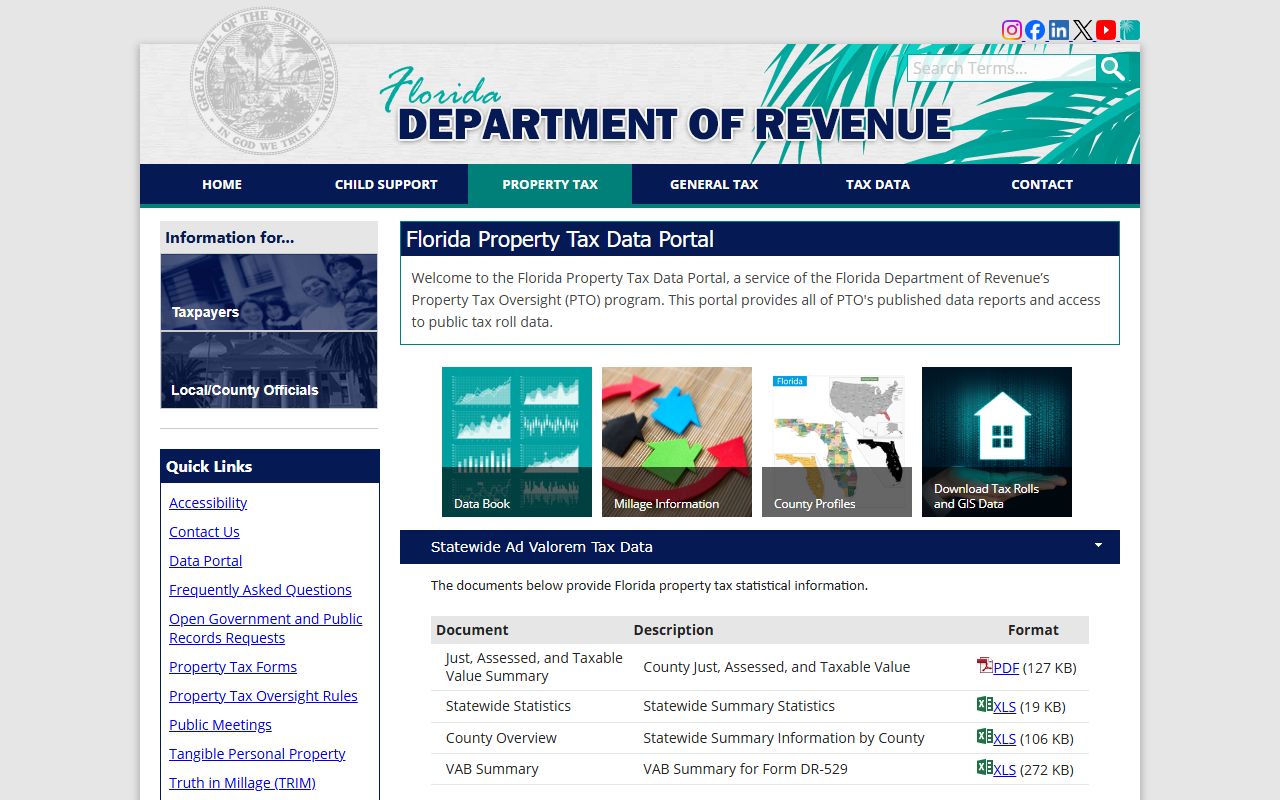

The Florida DOR's Property Tax Oversight program supervises all county appraisers and publishes guidance on how assessments should be conducted statewide.

Short-Term Rentals and Vacation Properties

Osceola County has a significant short-term vacation rental market, particularly in communities near the Walt Disney World area. These properties require careful attention when it comes to property taxes. Properties used as vacation rentals are generally assessed at market value and do not qualify for the homestead exemption, since the homestead requires the property to be the owner's primary residence. If you own a vacation rental and also claim homestead on it, you may face back taxes, penalties, and interest if the exemption is found to be improperly claimed.

Owners of vacation rental properties in Osceola County should review the assessed value on their rental each year through the appraiser's search portal. Comparable sales in the vacation rental market, including properties in the same resort community with similar bedrooms and amenities, are the most relevant evidence for a VAB appeal if you think the value is too high. The appraiser's office can answer questions about how vacation rentals are classified and assessed at (407) 742-5000.

Tangible Personal Property returns are also required for vacation rental businesses that furnish the property and operate it as a business. If you hire a property management company to run your rental, confirm who is filing the TPP return so the deadline is not missed. The April 1 filing deadline and the $25,000 exemption apply to vacation rental TPP just as they do for other businesses.

Homestead Exemption and Save Our Homes

Osceola County homeowners who use their property as their primary residence can apply for Florida's homestead exemption. The exemption removes up to $50,000 from the assessed value used for taxes. The first $25,000 applies to all taxing authorities; the second $25,000 applies only to non-school levies. File with the Osceola County Property Appraiser by March 1. Applications can be submitted online through the appraiser's portal, in person at 2505 E. Irlo Bronson Memorial Highway, Kissimmee, or by mail.

Once homestead is established, the Save Our Homes cap limits annual assessment increases to the lesser of 3% or the CPI change. Osceola County has experienced rapid value growth, so the SOH cap has been a significant benefit for long-term homeowners. The gap between your assessed value and market value is your SOH benefit. It is transferable, when you sell and buy another Florida home, you can take up to $500,000 of that benefit with you through the portability process. Apply for portability when you file for homestead on your new home. All of this is governed by Chapter 196, Florida Statutes.

Tax Bills and Payment

The Osceola County Tax Collector handles billing and payment for property taxes. The mailing address is P.O. Box 422105, Kissimmee, FL 34742. The phone number is (407) 742-4000, and the fax is (407) 742-3995. Tax bills are sent in November and reflect the taxable value certified by the appraiser plus the millage rates set by local governing bodies. Multiple taxing authorities cover Osceola County parcels, including the county government, school board, and special districts for fire, water, and other services.

Florida's early-payment discounts apply in Osceola County: 4% in November, 3% in December, 2% in January, 1% in February. Taxes not paid by March 31 become delinquent on April 1. Delinquent taxes trigger the tax certificate process under Chapter 197, Florida Statutes. Tax certificates are sold at a public auction, and if not redeemed within two years, the certificate holder can apply for a tax deed. Pay on time to avoid this outcome.

Osceola County taxes can be paid online through the tax collector's website, by mail, or in person at collector service centers. Installment payment plans are available for qualifying taxpayers who apply before April 30 of the prior year. The plan breaks the annual bill into four quarterly payments.

Tangible Personal Property Returns

Businesses in Osceola County must file a Tangible Personal Property return with the Property Appraiser by April 1 each year. TPP includes business furniture, fixtures, equipment, and machinery. The first $25,000 in assessed value is exempt if you file on time. File late and you lose the exemption and may face a penalty. Osceola County's large hospitality and resort sector means many businesses have substantial TPP assets on the tax roll. New businesses must file in their first year of operation.

The Osceola County Property Appraiser's website and the Florida DOR forms page both have TPP forms and instructions. The appraiser's office at (407) 742-5000 can also answer questions about how to file and what assets need to be reported.

Assessment Appeals in Osceola County

If you disagree with your Osceola County assessed value, you can appeal to the Value Adjustment Board. File your petition within 25 days of the mailing date shown on your TRIM notice. The TRIM notice arrives each August. Missing the 25-day deadline means you lose the right to appeal for that tax year, so act quickly once you receive the notice.

The Osceola County VAB uses special magistrates to hear appeals. Bring evidence that supports your position, comparable sales data for similar properties in the county is the most effective argument. A licensed private appraisal, photos showing property condition, or records documenting errors in the appraiser's property description all help your case. You can represent yourself or hire a professional. The magistrate issues a recommendation; the VAB issues a final order. Further appeal to circuit court is possible but involves additional cost. The VAB process is governed by Chapter 194, Florida Statutes.

Public Records Access and Data

Osceola County property records are public under Chapter 119, Florida Statutes. Core parcel data is available free online through the property search portal. For bulk data needs, the Florida DOR's data portal lets you download full county assessment rolls for Osceola and every other Florida county. This is useful for researchers, investors, and real estate professionals who need data on many parcels at once.

The Florida DOR data portal offers free downloads of the Osceola County assessment roll by tax year.

Bulk data from the DOR portal includes assessed values, exemptions, and parcel details for every property in Osceola County.

The Florida Tax Collectors Association and the Property Appraisers Association of Florida both maintain directories and resources for property owners across the state. The DOR property tax FAQ answers common questions about how the Florida property tax system works.

Cities in Osceola County

Osceola County includes one large city with its own property tax profile.

St. Cloud is the county's second-largest city but falls below the qualifying population threshold. Property records for all Osceola County parcels, including those in St. Cloud, are maintained by the county appraiser at 2505 E. Irlo Bronson Memorial Highway, Kissimmee.