Access Polk County Property Tax Records

Polk County property tax records are public documents kept by the Property Appraiser in Bartow and the Tax Collector, also based in Bartow. These records cover all parcels in the county, including residential, commercial, agricultural, and industrial property, and contain assessed values, ownership history, exemption status, and tax payment data. This page explains how to search Polk County property tax records, what the records contain, and what options you have as a property owner.

Polk County Quick Facts

Polk County Property Appraiser

The Polk County Property Appraiser's office is at 255 N. Wilson Ave., Bartow, FL 33830. Phone: (863) 534-4777. Fax: (863) 534-4717. The appraiser is an elected official responsible for valuing all real and personal property in Polk County as of January 1 each year. This value is the starting point for the annual tax bill. The appraiser does not collect taxes. That function belongs to the Tax Collector. The appraiser also does not set millage rates, those are decided each year by county commissioners, school board members, and other taxing authorities.

Polk County is geographically large, with a diverse mix of property types. The appraiser's office maintains the official property roll listing every parcel with its legal description, ownership data, assessed value, taxable value, and applied exemptions. The office uses mass appraisal techniques that follow Florida Department of Revenue standards. Values are derived from comparable sales, property condition, and physical characteristics. Under Chapter 192, Florida Statutes, all property must be assessed at just value annually.

The Polk County Property Appraiser's website offers free online access to the property roll. You can search by owner name, parcel ID, or property address. Results show current and prior-year assessed values, just value, taxable value, exemption data, land and building details, and sales history. The site also includes GIS mapping tools for spatial parcel searches.

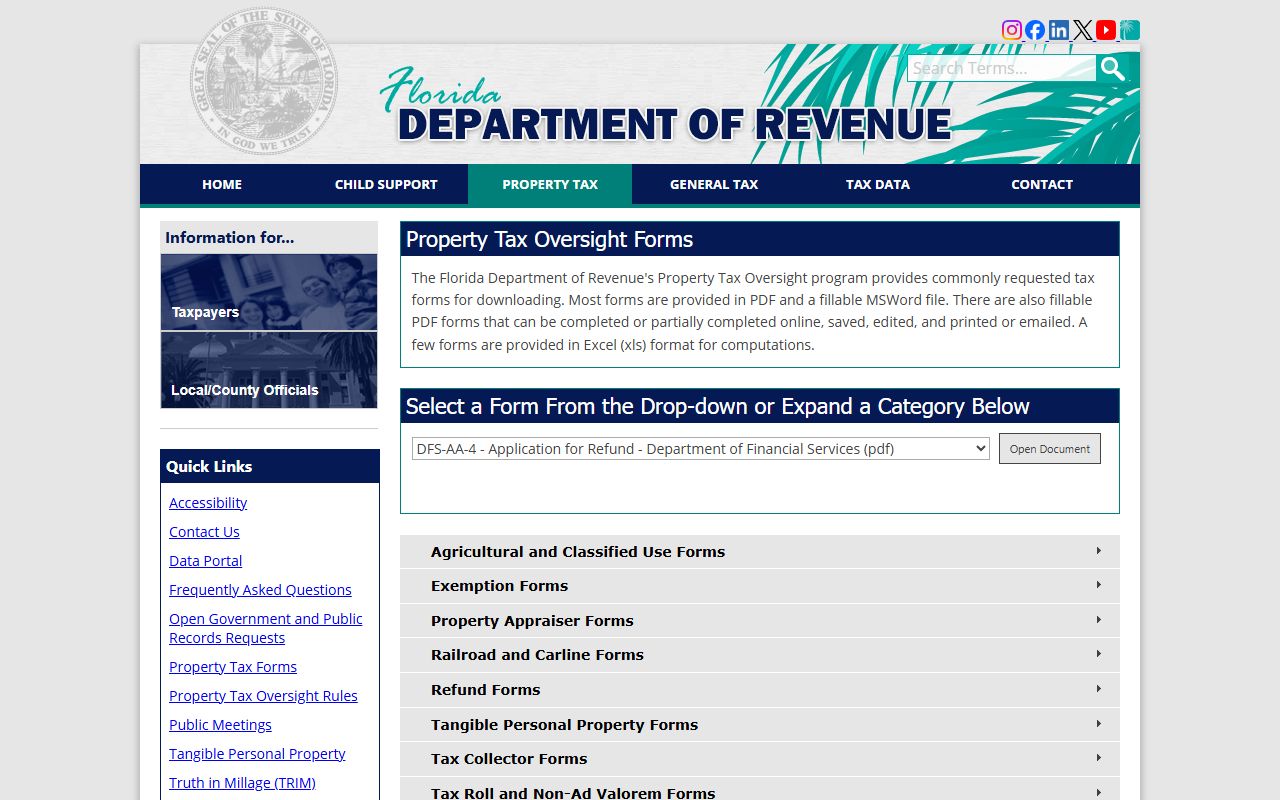

The Florida DOR provides oversight for all county appraisers. Statewide guidance on how property assessment works is available at the DOR Property Tax Oversight page. The same rules that govern Polk County apply to every other Florida county. The department also reviews each county's assessments annually to verify compliance.

The Florida DOR Property Tax Oversight page provides statewide guidance on how county property assessments work.

The DOR site links to forms, rules, and data covering Florida property taxes at the state level.

Note: Polk County's large agricultural land base means the appraiser also handles agricultural classification under the Greenbelt Law. Qualified agricultural land is assessed at a lower agricultural value rather than market value, which can significantly reduce a farm owner's tax bill.

Tax Billing and Collection in Polk County

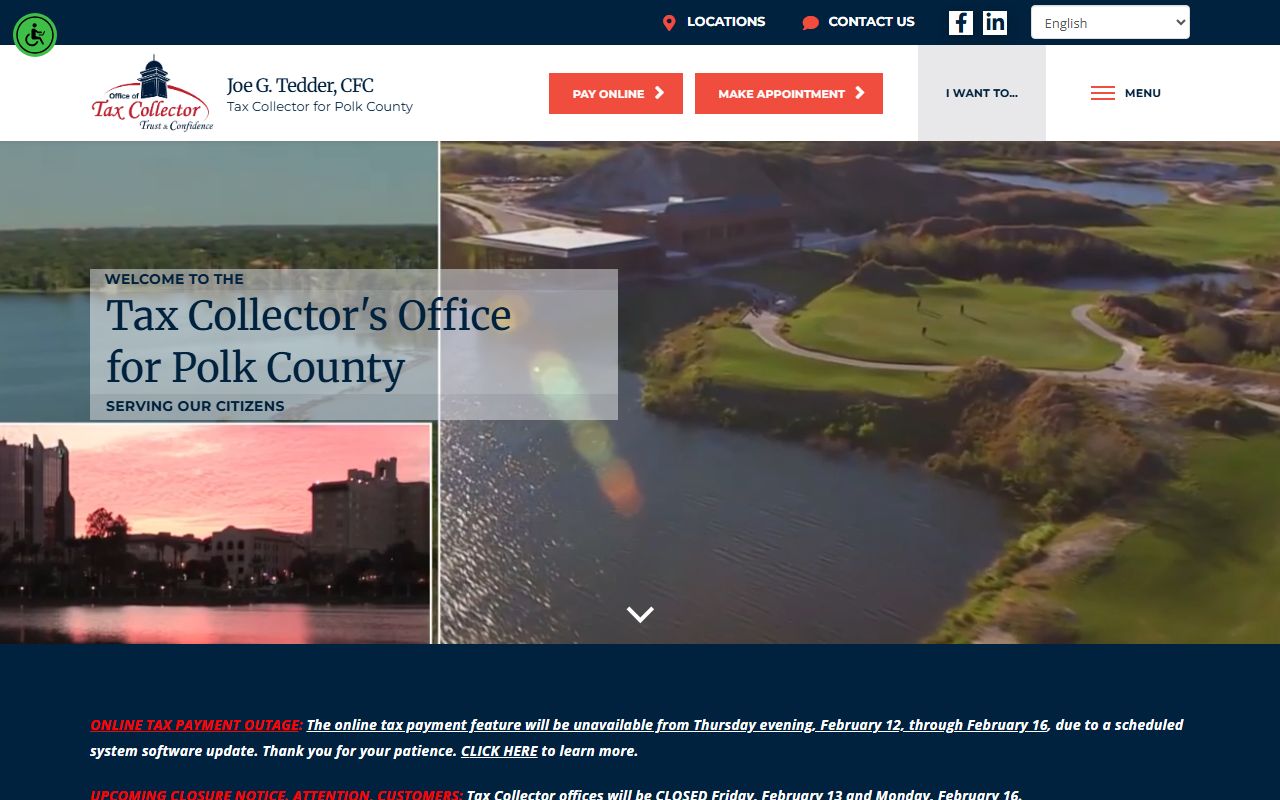

The Polk County Tax Collector handles all billing and payment for property taxes. The mailing address is P.O. Box 1189, Bartow, FL 33831. Phone: (863) 534-4700. Fax: (863) 534-4717. The Polk County Tax Collector website allows you to pay your bill online, check your balance, and find office locations across the county.

The Polk County Tax Collector website is where you pay property taxes, check balances, and find office locations.

The collector's site also lists branch office hours and accepts multiple payment methods including e-check and credit card.

Tax bills go out in November each year. The bill amount reflects the taxable value set by the appraiser, minus any exemptions, multiplied by the total millage rate for that parcel. The millage rate includes contributions from Polk County government, the school board, and any applicable special districts. Every parcel can have a slightly different total millage depending on its location within the county.

Early payment discounts apply statewide. Paying in November earns 4% off the face amount. December earns 3%, January earns 2%, and February earns 1%. After March 31, taxes are delinquent and interest begins to accrue. The tax certificate sale process, governed by Chapter 197, Florida Statutes, begins with a June sale in which investors can purchase certificates on delinquent parcels.

Searching Polk County Property Tax Records

The Polk County Property Appraiser's site is the main tool for parcel data searches. You can look up any parcel by address, owner name, or parcel ID. Once you find the parcel, the record shows assessed value, just value, taxable value, exemption detail, land and building data, and a full sales history. All of this is free and accessible to anyone.

For tax bill information, what is owed, whether a payment was made, or the history of bills, use the Polk County Tax Collector's search tool. Enter a parcel ID or address to pull up billing records. The appraiser database covers assessment data; the collector database covers billing and payment data. Both are public and free to use.

Aggregate data at the county level is available through the Florida DOR data portal. This is useful for bulk research involving multiple parcels or county-level trends. All individual parcel records in Polk County are public under Chapter 119, Florida Statutes. No ID or explanation is required to access them.

Property Tax Exemptions in Polk County

Florida exemptions apply to qualifying Polk County parcels. Homestead is the most widely claimed. A primary residence can qualify for up to $50,000 off the assessed value. The first $25,000 applies to all taxing authorities. The second $25,000 reduces value between $50,000 and $75,000 for all authorities except the school board. The deadline to apply is March 1 each year.

Once homestead is granted, the Save Our Homes cap applies. Each year, the assessed value of a homesteaded property can increase by no more than 3% or the prior year's inflation rate, whichever is lower. The cap is established by Chapter 193, Florida Statutes. In a rapidly appreciating market, the SOH cap can create a substantial difference between just value and assessed value, substantially reducing the taxable value and the tax bill. The cap resets when a property is sold.

Polk County property owners may also qualify for other exemptions. These include the senior low-income exemption for residents over 65 who meet income limits, veteran exemptions, disability exemptions, and the widow/widower exemption. Each requires a separate application and documentation. Applications go to the Property Appraiser's office. All Florida exemptions are governed by Chapter 196, Florida Statutes.

Agricultural classification under the Greenbelt Law is also available for qualifying farm and agricultural land in Polk County. This is a separate process from homestead and is based on the use of the land, not the owner's residency. Classified agricultural land is assessed at a use-value rather than market value.

Note: If you move to a new primary residence in Florida, you can transfer up to $500,000 of your existing SOH benefit to the new property. This is called portability. You must apply at the same time as homestead on the new property.

Appealing a Polk County Property Assessment

Florida gives every property owner in Polk County the right to challenge an assessed value they believe is wrong. The process starts with the TRIM notice mailed by the Property Appraiser each summer. The notice shows your proposed assessed value and the estimated tax impact. You have 25 days from the mailing date to file a petition with the Value Adjustment Board.

Before filing, call or visit the appraiser's office. Bring any evidence you have that the value is wrong. If the appraiser used incorrect data, wrong building size, wrong condition, or sales that don't match your property type, the office may correct the value without a formal hearing. This is often the fastest resolution.

If the informal step doesn't work, file the VAB petition. You will get a hearing date. A special magistrate reviews the evidence from both sides and makes a recommendation. The VAB votes on it. The full appeal process is governed by Chapter 194, Florida Statutes. If the board rules against you, you can still go to circuit court. Most commercial property owners hire an attorney for court-level appeals; residential owners often represent themselves.

Payment Options for Polk County Property Taxes

The Polk County Tax Collector offers online payment by credit card or e-check, in-person payment at multiple office locations, and payment by mail. Mail a check to P.O. Box 1189, Bartow, FL 33831. Online card payments may carry a convenience fee. E-check payments are typically lower cost.

The installment plan lets you pay quarterly instead of all at once. Sign up in the spring. Payments come due in June, September, December, and March. Each installment earns a small discount. The plan is available to all property owners in Polk County regardless of property type.

After March 31, taxes are delinquent. Interest accrues on the unpaid amount. The tax certificate sale in June allows investors to pay the overdue taxes and earn interest on the certificate. If the owner does not redeem within two years, a tax deed application can follow. This leads to a public sale of the property to recover the unpaid taxes. Keeping payments current, or using the installment plan, prevents this outcome.

Polk County Property Records and Public Access

Florida's public records law makes Polk County property tax records open to everyone. Under Chapter 119, Florida Statutes, you can search or request these records without being a Florida resident and without providing an explanation. Assessment rolls, tax rolls, exemption data, and payment records are all public. Some personal details on exemption applications, Social Security numbers, for example, are exempt from disclosure, but the core property and tax data is fully open. Online access is free through the appraiser and collector websites. For records not available online, submit a written request to the office. Response times are regulated and fees may apply for large requests.

Cities in Polk County

Polk County includes several cities and communities. Lakeland is the largest and the only city in the county above the population threshold for a dedicated page. Smaller cities like Bartow, Winter Haven, and Haines City are served by the same county property offices but do not have individual pages here. All Polk County property tax records, regardless of city, are managed by the County Property Appraiser and Tax Collector.