Hernando County Property Tax Records

Hernando County property tax records are maintained by the Property Appraiser and Tax Collector offices in Brooksville, Florida, and cover every parcel in the county, from the dense subdivisions of Spring Hill to rural acreage in the county's northern sections. These records are public, and most can be searched online at no cost.

Hernando County Quick Facts

Hernando County Property Appraiser

The Hernando County Property Appraiser's office is at 201 Howell Ave., Suite 300, Brooksville, FL 34601. Phone: (352) 754-4190. Fax: (352) 754-4189. This office is responsible for setting the assessed value of all real and tangible personal property in Hernando County as of January 1 each year. Their records form the foundation for all property tax calculations in the county.

Hernando County has seen significant residential growth over the past two decades, particularly in the Spring Hill area. The appraiser's office keeps up with a large and active property market, processing thousands of ownership changes, new construction valuations, and exemption applications each year. Their online search tool makes it easy to pull current data on any parcel in the county.

The appraiser's database shows assessed and taxable values, land and building information, exemption status, and tax history for each parcel. You can search by owner name, address, or parcel ID. The data is updated regularly as deeds are recorded at the Clerk of Court and changes are entered into the system.

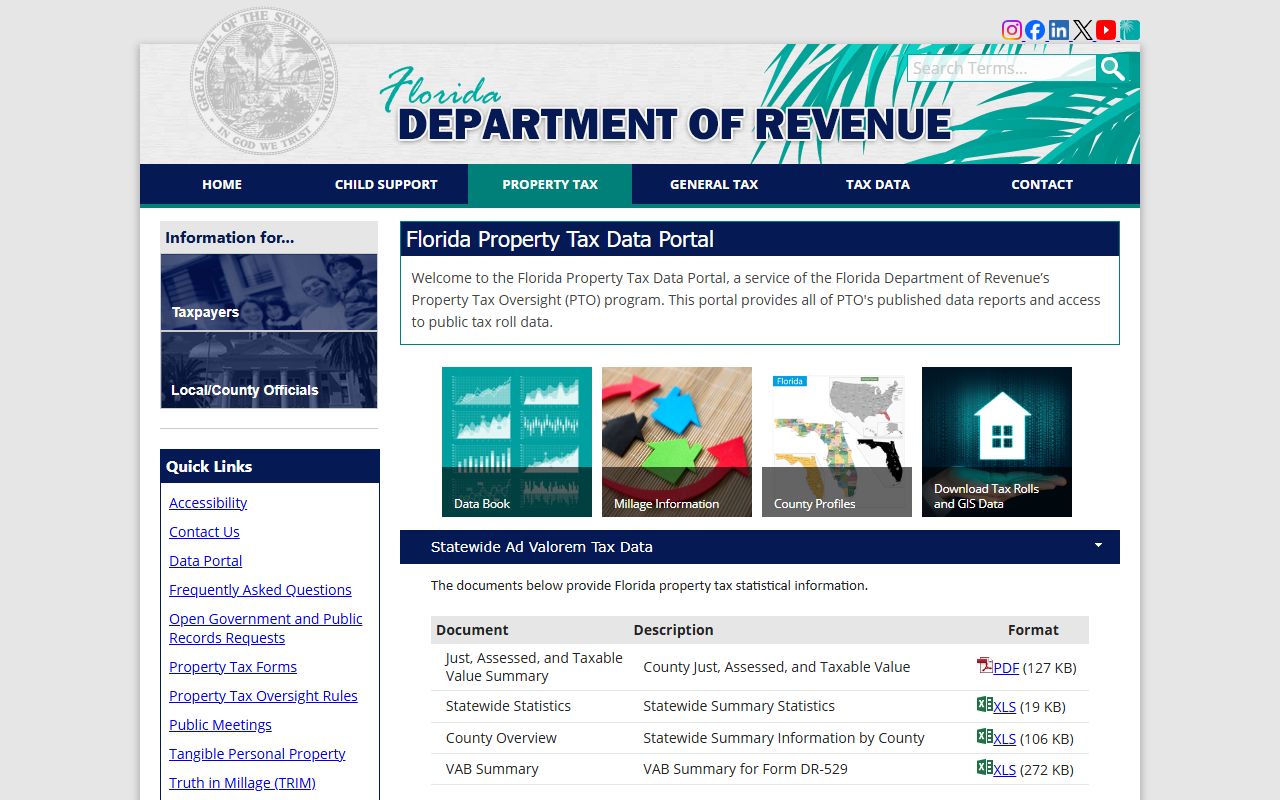

Florida's Department of Revenue sets the rules for how county property appraisers must operate. Their oversight program is described at floridarevenue.com, and they review Hernando County's tax roll each year to make sure assessments meet state standards.

The DOR data portal at floridarevenue.com gives access to Hernando County bulk assessment data, which researchers and professionals can download for analysis.

Hernando County Tax Collector

The Tax Collector's office is at 20 North Main Street, Room 112, Brooksville, FL 34601. Phone: (352) 754-4180. Fax: (352) 754-4189. This is the office you contact for tax bills, payment processing, receipts, and delinquency questions. They work from the certified roll that the Property Appraiser submits each fall.

Tax bills are mailed in November. Pay in November and you save 4%. December saves 3%, January saves 2%, and February saves 1%. All taxes are due by March 31 without penalty. After March 31, taxes become delinquent. Chapter 197 of the Florida Statutes governs what happens after that, interest starts accruing and the Tax Collector is required to move toward a tax certificate sale.

Hernando County offers multiple ways to pay. You can pay in person at the Main Street office or at branch locations if the county operates them. Online payment is available through the Tax Collector's website. Mail-in payments should be postmarked before the discount deadline if you want to claim the discount. The Florida Tax Collectors Association site links to Hernando County's tax collector online services.

How to Search Hernando County Property Tax Records

The fastest way to search Hernando County property tax records is through the Property Appraiser's online portal. The search is free and open to anyone. Enter a parcel ID, owner name, or street address to pull up assessment data, ownership history, land and building details, and exemption information. Tax history going back several years is often included.

The Florida Department of Revenue also offers Hernando County data through its statewide portal at floridarevenue.com. Bulk files can be downloaded, good for comparing multiple properties or analyzing county-wide assessment trends. The files are updated after the annual roll is certified.

If you need documents beyond what's online, older assessment records, exemption applications, VAB petition files, contact the appraiser at (352) 754-4190. Florida's public records law gives you access to all of it. More on that in the records access section below.

Exemptions in Hernando County

Florida homeowners who live in their Hernando County home full-time on January 1 can apply for the homestead exemption. The standard benefit is up to $50,000 in reduced taxable value: the first $25,000 applies to all millage rates, and a second $25,000 applies to the value between $50,000 and $75,000 for non-school levies. The deadline to apply is March 1. The application goes to the Property Appraiser's office, and you'll need to show proof of ownership and Florida residency.

Once homestead is established, the Save Our Homes cap applies. Under the SOH cap, the assessed value of your homestead property cannot increase by more than 3% per year or the Consumer Price Index rate, whichever is lower. For Hernando County homeowners who have stayed in place over the years, this cap often creates a large gap between assessed and market value. That gap can be moved to a new Florida homestead through the portability process, another application through the appraiser's office when you buy and homestead a new home.

Additional exemptions under Chapter 196 include veteran disability exemptions (up to full exemption for 100% service-connected disabled vets), senior citizen exemptions for those over 65 with limited income, surviving spouse exemptions, and exemptions for people with total permanent disability. Ask the Property Appraiser's office about eligibility. Tangible personal property businesses must file their TPP returns by April 1 to keep the $25,000 exemption and avoid late-filing penalties.

Appealing Your Assessment in Hernando County

The Property Appraiser mails TRIM notices every August. TRIM, Truth in Millage, shows the proposed assessment for the upcoming year plus a breakdown of projected taxes from each taxing district. It also tells you the deadline and instructions for filing a challenge. Read yours carefully as soon as it arrives.

If you believe your Hernando County property is over-assessed, file a petition with the Value Adjustment Board within 25 days of the TRIM mailing date. The VAB schedules a hearing before a special magistrate who reviews your evidence and the appraiser's data. You don't need a lawyer. What helps is preparation: recent sales of similar properties in your area, an independent appraisal if you have one, and documentation of anything that reduces your property's value relative to comparable homes. The magistrate can recommend a value reduction if your case is persuasive.

The VAB process is governed by Chapter 194. Assessment rules are in Chapter 193. If the VAB result still doesn't satisfy you, circuit court is the next step, though that is a more involved process.

Paying Property Taxes in Hernando County

Hernando County property tax bills arrive in November. Payment options include in person at the Tax Collector's office on North Main Street in Brooksville, online through the Tax Collector's website, or by mail to the Tax Collector's office. Online credit card payments often carry a processing fee; e-check payments may not. When mailing a payment, make sure it arrives, or is postmarked, before the end of the discount period you want.

After March 31, unpaid taxes are delinquent. The Tax Collector holds a tax certificate sale, usually in June. Investors buy certificates on delinquent parcels. The certificate earns interest while the property owner has up to two years to redeem it by paying back the investor. If the certificate goes unredeemed, the holder can apply for a tax deed, a process that can eventually lead to a forced property sale at public auction. All of this is governed by Chapter 197.

The installment payment plan lets owners spread the bill across four payments (June, September, December, March) with a built-in discount. Enroll by April 30 with the Tax Collector's office. It's a good option for owners who find the lump-sum November bill hard to manage.

Accessing Hernando County Tax Records Under Public Records Law

Under Chapter 119 of the Florida Statutes, all property tax records in Hernando County, including the assessment roll, tax bills, exemption files, TPP returns, and VAB filings, are public. Any person can request access. You do not need to be a county resident, and you do not need to say why you want the records.

Current parcel data is available free online through the Property Appraiser's portal. For older records, documents not posted online, or bulk data outside the DOR portal, contact the appraiser at (352) 754-4190 or visit the office at 201 Howell Ave., Suite 300, Brooksville. The office can reproduce records for a fee based on actual copying costs. They cannot charge for search or retrieval time under Florida law.

The Professional Association of Florida Appraisers (PAAF) offers guidance on how Florida's appraisal system works and what accountability standards local appraisers are held to. The DOR forms page at floridarevenue.com has statewide forms for exemptions, appeals, and tangible personal property returns used throughout Hernando County.

Cities in Hernando County

Spring Hill is the largest community in Hernando County with a population of approximately 118,814, though it is an unincorporated area rather than an incorporated city. Property tax records for Spring Hill parcels are handled by the Hernando County Property Appraiser.

- Spring Hill, Unincorporated community, Hernando County's largest