Spring Hill Property Tax Records

Spring Hill property tax records are administered by the Hernando County Property Appraiser and Tax Collector, both based in Brooksville. Spring Hill is an unincorporated community, so there is no city government handling property taxes here. All assessment, exemption, and billing work is done at the Hernando County level. Records for every Spring Hill parcel are public documents available online at no cost.

Spring Hill Quick Facts

Hernando County Property Appraiser

The Hernando County Property Appraiser's office is at 201 Howell Ave., Suite 300, Brooksville, FL 34601. The phone is (352) 754-4190. This office values all real and personal property in Hernando County as of January 1 each year. Spring Hill is the largest community in the county, and its parcels make up a significant portion of the county property roll. The roll records each parcel's legal description, ownership, assessed value, taxable value, and exemptions.

Spring Hill was developed starting in the 1960s as a planned residential community. It has thousands of single-family homes, along with commercial properties along major corridors. The appraiser tracks every parcel. As values change through sales and market shifts, the rolls are updated. The appraiser uses mass appraisal methods that follow Florida Department of Revenue standards. Individual inspections do not happen every year, but the office does field inspections when properties change hands or when permits are pulled.

You can search Hernando County parcel records on the Hernando County Property Appraiser website. Look up any Spring Hill property by address, owner name, or parcel ID. The result shows current assessed value, just value, taxable value, land data, building data, and sales history. Exemptions on file for the parcel are also listed. The search is free and open to anyone without registration.

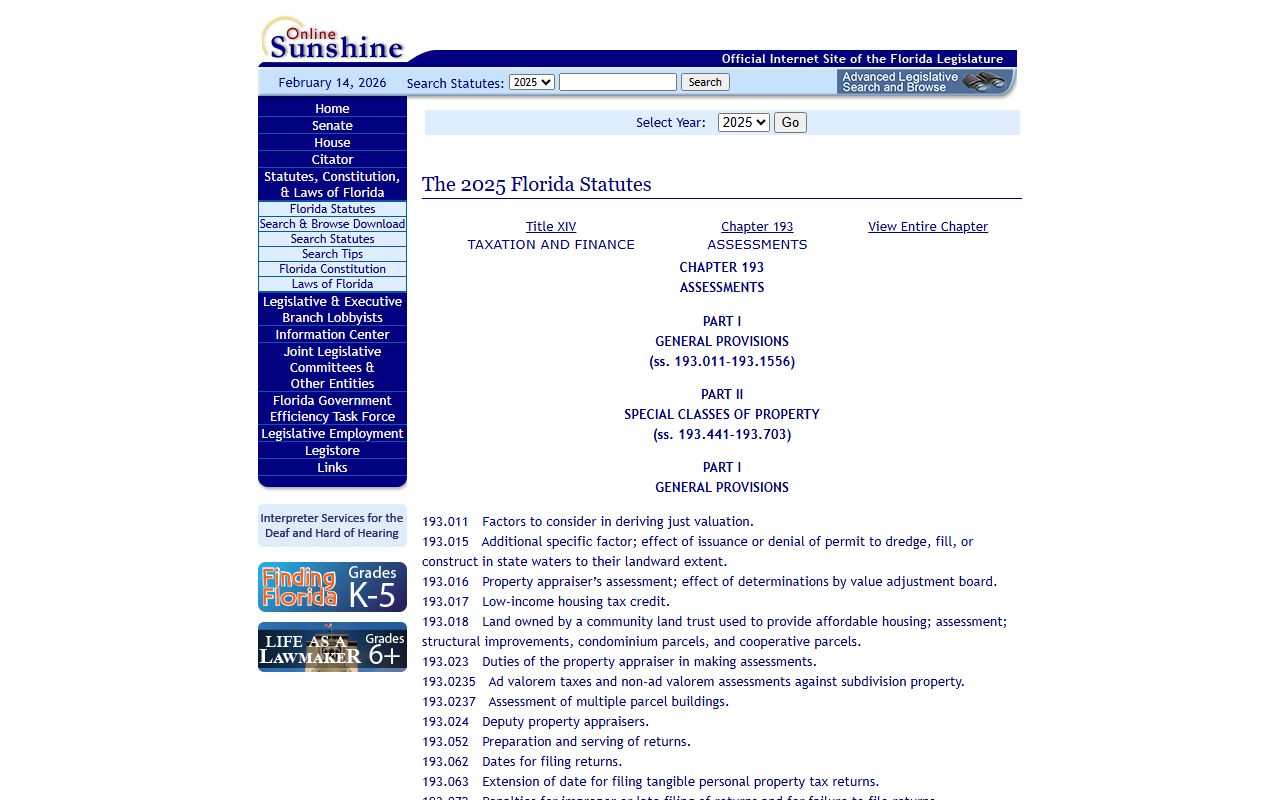

The Florida Department of Revenue oversees county appraisers across the state. For statewide guidance on how assessment works, see the DOR Property Tax Oversight page. Appraisers follow rules set out in Chapter 193 of the Florida Statutes.

The Florida DOR directory gives you direct contact information for every county property appraiser and tax collector.

Find the Hernando County offices here, along with contacts for any other county in the state.

Tax Billing for Spring Hill Properties

The Hernando County Tax Collector's office in Brooksville handles billing and payment for all Spring Hill parcels. The phone is (352) 754-4224. Tax bills go out each November. The amount you owe is based on your taxable value multiplied by the combined millage rates of all taxing authorities that cover your property. For Spring Hill, those typically include Hernando County, the school board, and relevant special districts. Because Spring Hill is unincorporated, there is no city millage rate on the bill.

Early payment earns a discount. Pay in November and you get 4% off the face amount. December earns 3%, January 2%, and February 1%. After March 31, taxes are delinquent under Chapter 197, Florida Statutes. The collector then holds a certificate sale in June. Investors pay the delinquent taxes and receive a tax certificate that earns interest. If not redeemed, the certificate can eventually lead to a tax deed and forced sale of the property.

You can pay online at the Hernando County Tax Collector's website, mail a check to the Brooksville office, or pay in person at any county office location. The collector may maintain additional service centers in Spring Hill or elsewhere in the county for convenience. An installment plan allows qualified property owners to pay in four quarterly installments. Enrollment opens in the spring before the new tax year.

The absence of a city government in Spring Hill means there is no separate city tax office to contact. All billing questions go to the county collector in Brooksville. This can actually simplify things, since you deal with one office rather than two.

Searching Spring Hill Parcel Records Online

The Hernando County Property Appraiser's website is the starting point for most parcel searches. Type in a Spring Hill address or parcel ID and you get the full property record. This includes the current and prior-year assessed values, just value, taxable value, land size, building details, year built, and all recorded sales. You can also see the exemptions that are currently on file for the parcel.

For billing and payment status, use the Hernando County Tax Collector site. Enter the parcel ID to see what is owed, when the last payment was made, and whether any delinquency exists on the account. Between these two county websites, you can get a complete picture of any Spring Hill property at no cost.

The Florida DOR's statewide property tax data portal has downloadable data files for each county. This is a useful tool for researchers, analysts, or investors who want aggregate county-level data rather than individual parcel lookups.

All of these records are public under Chapter 119, Florida Statutes. You do not need to state a reason or show identification. The only protected data is personal identifiers like Social Security numbers on exemption applications. Everything else is open to the public.

Property Tax Exemptions in Spring Hill

Spring Hill has a large number of owner-occupied homes, and the homestead exemption is widely claimed. It reduces the assessed value of a primary residence by up to $50,000. The first $25,000 applies against all taxing authorities. The second $25,000 covers value between $50,000 and $75,000 but does not count against school taxes. You apply at the Hernando County Property Appraiser's office, and the deadline is March 1 each year.

Homestead triggers the Save Our Homes cap. Under Chapter 193, Florida Statutes, a homesteaded property's assessed value can increase by no more than 3% per year or the rate of inflation. In a growing community like Spring Hill, this cap can produce a large difference between the assessed value used for taxes and the actual market value. When the property sells, the cap resets for the new buyer.

Additional exemptions exist for veterans with disabilities, senior low-income residents, surviving spouses, and people with qualifying disabilities. Each requires a separate application to the Hernando County Property Appraiser. The general deadline for most exemptions is March 1. Exemption law is in Chapter 196, Florida Statutes.

Businesses in Spring Hill that own tangible personal property used in their operations can claim a $25,000 TPP exemption by filing a return with the appraiser by April 1 each year. This applies to equipment, furniture, fixtures, and similar items. Missing the April 1 deadline means losing the exemption for that year.

Chapter 193 of the Florida Statutes covers the Save Our Homes cap and how it protects homesteaded property owners.

Read the full statute to understand exactly how the cap is calculated and what happens when a homesteaded property changes ownership.

Appealing a Spring Hill Assessment

If your TRIM notice shows a value you think is wrong, you have 25 days from the mailing date to file a petition with the Hernando County Value Adjustment Board. The TRIM notice goes out each summer and includes the proposed assessed value and an estimated tax. The VAB is the formal path to challenge that value. The filing fee is modest.

After filing, you are scheduled for a hearing before a special magistrate. You present evidence; the appraiser's office may respond. The magistrate makes a recommendation, and the VAB board votes on it. VAB appeals are governed by Chapter 194, Florida Statutes. You do not need an attorney to file or appear at the hearing.

Put together real evidence before you go. Comparable sales from similar Spring Hill properties sold around the same time as the January 1 assessment date are the most persuasive argument. If your home has condition problems the appraiser did not account for, document them with photos. The burden is on you to show the county's value is off. A feeling that the number is too high is not enough on its own.

Keep paying the undisputed portion of your tax bill during the appeal process. Stopping payment entirely can result in additional penalties. If the VAB rules against you, circuit court is still available as a final option, though most owners do not pursue that route.

Unincorporated Status and County Records

Spring Hill's unincorporated status affects more than just tax rates. It means there is no city hall, no city clerk, and no city court handling property records locally. All county functions are handled in Brooksville. If you need to visit an office in person, plan to make the trip to the county seat. Some offices may have outreach locations or drop boxes in Spring Hill, but the primary offices are in Brooksville.

For complete details on the Hernando County Property Appraiser and Tax Collector, including hours, branch locations, and services offered, see the Hernando County property tax records page. That page covers all the county-level information that applies to Spring Hill parcels along with every other property in Hernando County.