Clearwater Property Tax Records

Clearwater is the county seat of Pinellas County, and both the Property Appraiser and Tax Collector offices are based here. Property tax records for Clearwater parcels are public documents. They cover assessed values, tax bills, ownership history, and exemption status for every parcel in the city and the wider county.

Clearwater Quick Facts

Pinellas County Tax Administration for Clearwater

Clearwater sits inside Pinellas County, and all property tax matters flow through county offices rather than city hall. The city does not assess property or collect tax. Those functions belong to two elected county officials - the Property Appraiser and the Tax Collector. Both offices are located in Clearwater, which is convenient for residents who need in-person help.

Property values are set as of January 1 each year. The appraiser uses mass appraisal methods that follow Florida Department of Revenue guidelines. These methods rely on sales data, property characteristics, and market trends to estimate just value for each parcel. Clearwater has a mix of residential, commercial, and waterfront properties, so the appraiser's office handles a wide range of property types.

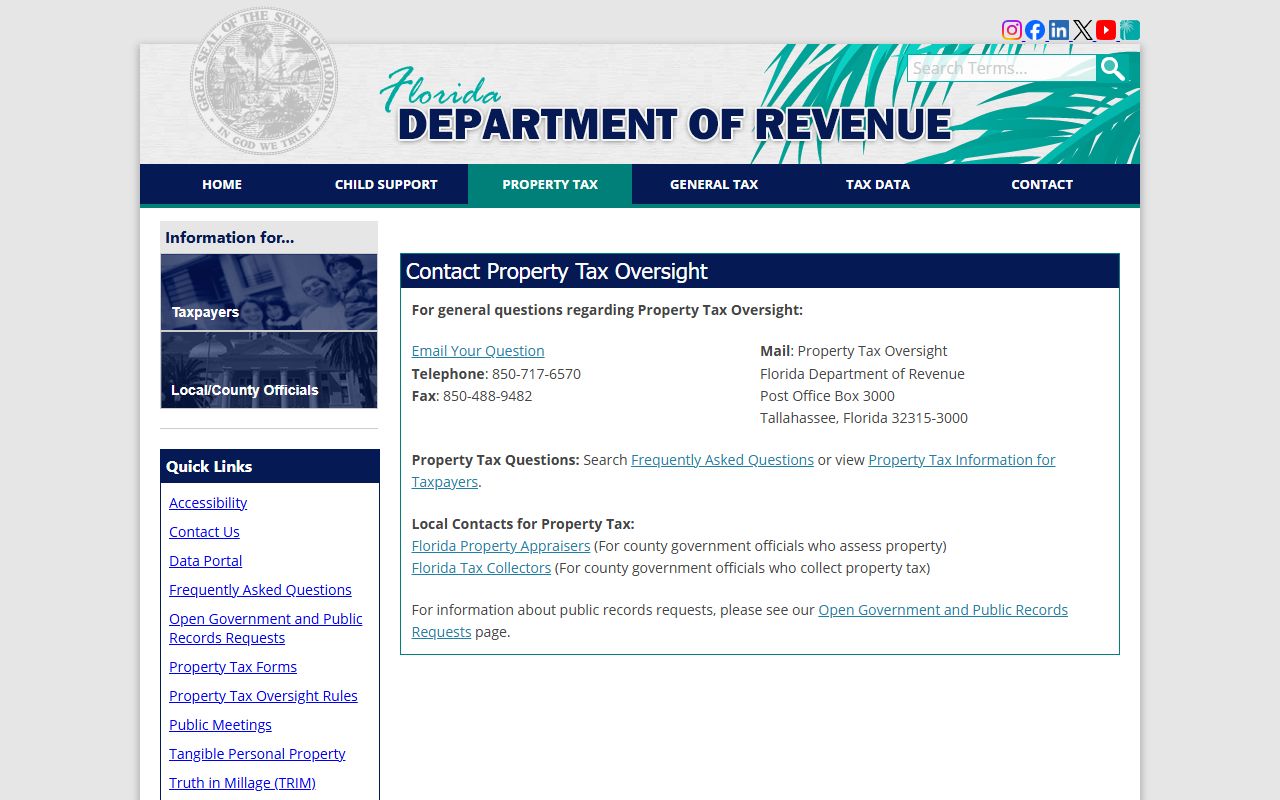

The Florida Department of Revenue oversees all county property appraisers and makes sure they follow state law. You can find general guidance on how property tax works at the DOR Property Tax Oversight page. Pinellas County is one of the most densely populated counties in Florida, and the volume of parcels is significant. The appraiser and collector both maintain robust online systems to handle the workload.

For a full look at county-level policy, fees, and procedures, see the Pinellas County property tax records page.

Pinellas County Property Appraiser

The Pinellas County Property Appraiser is located at 315 Court Street, Clearwater, FL 33756. The phone number is (727) 464-3207. The office is open Monday through Friday during normal business hours. Staff can help with questions about your assessment, TRIM notice, or exemption applications. The appraiser does not set tax rates and does not collect taxes.

The appraiser maintains the official property roll for all of Pinellas County. That roll lists every parcel with its legal description, owner of record, land and building data, assessed value, and any exemptions on file. Records are updated throughout the year as sales close, permits are issued, and ownership transfers. When you look up a Clearwater parcel, you are pulling from this roll.

The Pinellas County Property Appraiser website has a full search tool. You can look up a parcel by address, owner name, or parcel ID. The site shows current and prior-year values, sales history, building data, and exemption detail. GIS maps are also available. Most people find what they need online without calling or visiting in person.

The appraiser's values are based on just value, which Florida law defines as fair market value. For homesteaded properties, the assessed value may be lower than just value because of the Save Our Homes cap. That cap limits annual increases to 3% or the rate of inflation, whichever is less. The difference between just value and assessed value is called the SOH differential.

The Florida DOR Property Tax Oversight page explains how property appraiser offices operate statewide.

The DOR site covers statewide rules that apply to Clearwater and all Pinellas County properties.

Pinellas County Tax Collector

The Pinellas County Tax Collector mailing address is P.O. Box 6288, Clearwater, FL 33758. The phone number is (727) 464-7777. This office handles billing, payment, and enforcement once the appraiser certifies the tax roll each year. The collector sends bills in November and processes payments through March 31 at the non-delinquent rate.

Tax bills reflect the taxable value set by the appraiser plus whatever millage rates the county commission, school board, and special districts set each year. Clearwater parcels may carry several layers of millage - county, school, city, and any applicable special districts. The total rate is applied to the taxable value to get the annual bill.

Florida law gives a discount for early payment. Pay in November and you get 4% off the face amount. December earns 3%, January earns 2%, and February earns 1%. Taxes paid after March 31 are delinquent and subject to additional charges. Delinquent taxes lead to a tax certificate sale in May or June, governed by Chapter 197, Florida Statutes.

The collector's office has branch locations throughout Pinellas County. You can also pay online, by mail, or in person at any branch. The installment payment plan is available if you prefer quarterly payments. Sign up in the spring before the tax year begins.

How to Search Clearwater Property Tax Records

Start at the Pinellas County Property Appraiser's website. The search tool at pcpao.gov lets you look up any parcel by address, owner name, or parcel number. The results show current and historical assessed values, ownership data, sales history, and building characteristics. This is the best tool for checking assessed value, looking at comparable sales, or researching a property before you buy.

For tax bill data, use the Tax Collector's portal. Enter a parcel number or address to see current amounts due, payment history, and whether any delinquent amounts are outstanding. The two databases work together - the appraiser sets the value and the collector bills and collects based on that value.

All of these records are public under Chapter 119, Florida Statutes. Anyone can access them. You do not need an account, and you do not need to give a reason for your search. Some fields on exemption applications are confidential - things like Social Security numbers - but the core property data is fully open.

If you need certified copies or bulk data, contact the appraiser's office directly at 315 Court Street. Staff can tell you what formats are available and what fees apply. Large data requests may take time to fulfill, but the office must respond in a reasonable period under state law.

Property Tax Exemptions in Clearwater

Florida's exemptions apply to all qualifying Clearwater properties. The main one is the homestead exemption. It takes up to $50,000 off the assessed value of your primary residence. The first $25,000 applies against all taxing authorities. The second $25,000 covers the value between $50,000 and $75,000 and applies to all but school taxes. You must apply with the Pinellas County Property Appraiser. The deadline is March 1.

Homestead also triggers the Save Our Homes cap. Once a property is homesteaded, annual increases in assessed value cannot exceed 3% or the inflation rate, whichever is lower. This is set in Chapter 193, Florida Statutes. Over time, the gap between just value and assessed value can be significant, especially in a market like Pinellas where values have risen sharply.

Other exemptions include: senior exemption for low-income residents over 65, disability exemptions, veteran exemptions, and widower exemptions. Each has separate eligibility rules. All applications go to the Property Appraiser at 315 Court Street in Clearwater. Details on all exemptions are in Chapter 196, Florida Statutes.

Businesses in Clearwater also need to file a tangible personal property return each year by April 1. The first $25,000 of TPP value is exempt. File with the appraiser to claim this. Missing the deadline means you lose the exemption and may face a penalty on the assessment.

Value Adjustment Board Appeals

If you think the Pinellas County Property Appraiser set your value too high, you can appeal. The process starts with your TRIM notice, which arrives in late summer. It shows your proposed assessed value and projected tax amounts. You have 25 days from the mailing date to file a petition with the Pinellas County Value Adjustment Board.

The VAB is independent of the appraiser. It has members from the county commission, the school board, and citizen appointees. When you file, you get a hearing before a special magistrate. You present your evidence. The appraiser presents theirs. The magistrate makes a recommendation, and the board votes on it. Appeals are governed by Chapter 194, Florida Statutes.

Bring comparable sales, photos of any condition issues, and any independent appraisal you have. The burden is on you to show the appraiser's value is wrong. If the VAB rules against you, circuit court is the next option. Most disputes settle before that. Pay at least the undisputed portion of your tax while the appeal is pending - non-payment can result in penalties even if you win.

Property Tax Payments

Bills go out in November. Pay by March 31 to avoid delinquency. The discount schedule is 4% in November, 3% in December, 2% in January, 1% in February. After March 31, taxes are delinquent and the collector adds interest and fees.

Payment options include the online portal, mail, and in-person at any Pinellas County Tax Collector branch. The main office is in Clearwater. Branch locations serve other parts of the county. Online payment takes credit cards and e-checks. The installment plan is another option - you sign up in the spring and make four quarterly payments instead of one annual payment.

Delinquent taxes go to a tax certificate sale. Investors pay the unpaid amounts and earn interest. If the owner does not redeem within two years, the certificate holder can apply for a tax deed. This is a real risk for properties with long-standing delinquencies. Check any property you are buying for outstanding tax certificates before closing.

The Florida DOR contact page lists resources for property tax questions at the state level.

The DOR contact page can point you to the right state office if county-level help is not enough.

Public Records Access

Florida's public records law gives broad access to government records. Under Chapter 119, property tax records are public. That includes the assessment roll, tax roll, exemption records, and payment history. You do not need to be a Florida resident or give a reason for your request.

Most records are available online at no cost. For records not on the web - older data, bulk exports, or certified copies - submit a written request to the Pinellas County Property Appraiser or Tax Collector office. The office may charge for copies or staff time on large requests, but the records themselves are open to all.