Find Property Tax Records in Largo

Largo property tax records are kept by Pinellas County, which handles assessment and collection for all parcels in the city. These records show who owns each parcel, what it is worth for tax purposes, which exemptions apply, and whether taxes are current. This page explains how to find and use those records.

Largo Quick Facts

Pinellas County Property Appraiser

Largo is the third largest city in Pinellas County. Property assessment for all Largo parcels is handled by the Pinellas County Property Appraiser, whose office is at 315 Court Street, Clearwater, FL 33756. The phone number is (727) 464-3207. The appraiser is an elected county official who sets assessed values for every parcel in the county as of January 1 each year.

The appraiser does not collect taxes and does not set millage rates. Those tasks fall to the Tax Collector and the local governing bodies, the county commission, school board, and city council. The appraiser's role is to determine what each property is worth based on market conditions, physical characteristics, and comparable sales. This value becomes the starting point for your annual tax bill.

The Pinellas County Property Appraiser website has a free online search tool. You can search for any Largo parcel by address, owner name, or parcel ID. The record shows current assessed value, taxable value after exemptions, sales history, building data, and land information. The site also has maps and GIS tools to view parcels visually.

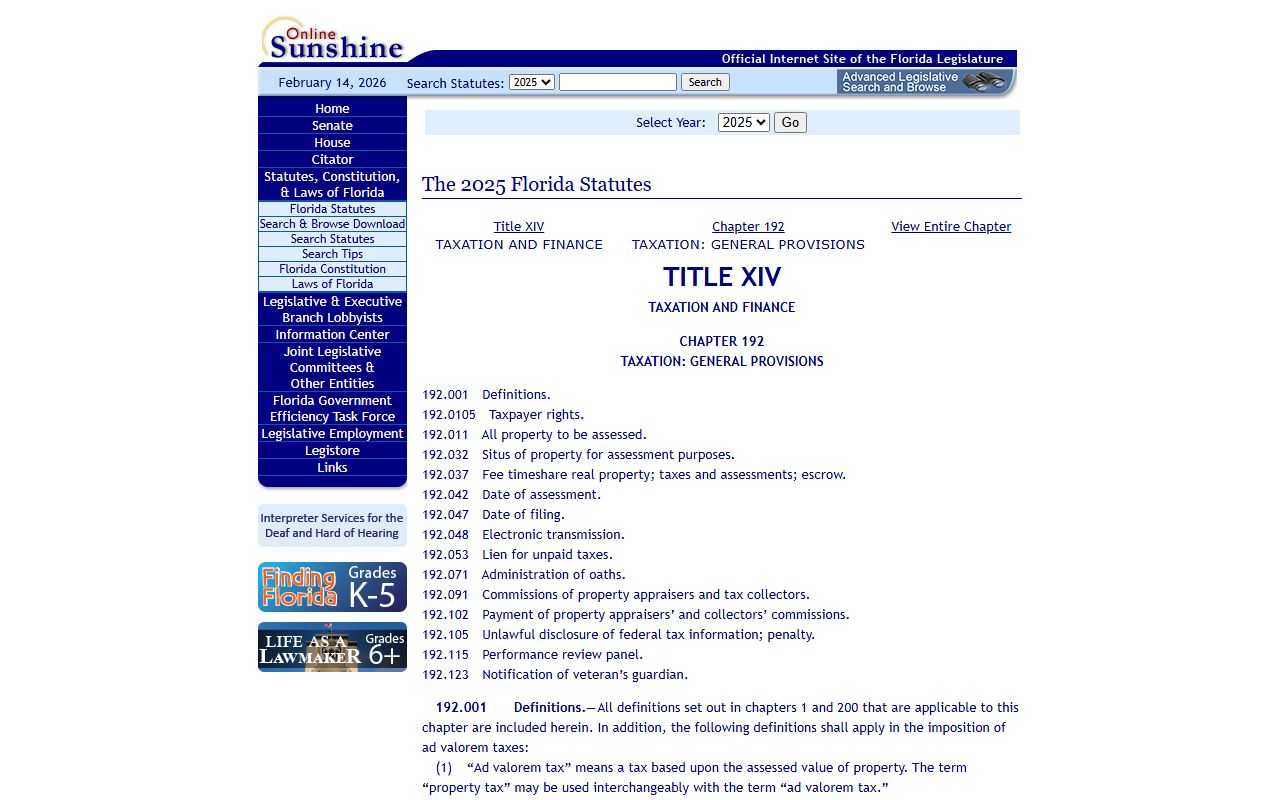

Valuation standards for Pinellas County follow Florida law. The state requires appraisers to value property at just value under Chapter 192, Florida Statutes. The Florida Department of Revenue oversees county appraisers and reviews their work each year. You can find DOR guidance on the Property Tax Oversight page.

For Largo residents, all in-person appraiser services are in Clearwater since that is the county seat. The office is open normal business hours on weekdays. Staff can help with exemption applications, TRIM notice questions, and appeals information.

The Pinellas County Property Appraiser site is where you start any Largo property search.

Florida DOR oversight sets the standards that Pinellas County must follow when assessing Largo properties.

Tax Collection for Largo Properties

The Pinellas County Tax Collector bills and collects property taxes for all Largo parcels. The mailing address is P.O. Box 6288, Clearwater, FL 33758, and the phone is (727) 464-7777. Bills go out in November each year and reflect the taxable value from the appraiser multiplied by millage rates set by each local government that has authority over your parcel.

Largo parcels carry millage from Pinellas County, the Pinellas County School Board, the City of Largo, and possibly special districts. Each of these bodies sets its own rate each fall. Your bill shows the breakdown, so you can see exactly what portion goes to each authority. The combined total is what you owe.

Florida's early payment discount applies to all Pinellas County bills. Pay in November and you save 4%. December is 3%, January is 2%, and February is 1%. Taxes are due by March 31. After that, they are delinquent. The rules for delinquent taxes, including certificate sales, are in Chapter 197, Florida Statutes.

You can pay Pinellas County property taxes online, by mail, or in person at collector offices. Branch locations throughout the county reduce the need to drive all the way to Clearwater for routine transactions. Check the collector's website for the branch nearest to you.

How to Search Largo Property Tax Records

The easiest way is to go straight to the Pinellas County Property Appraiser website and use the parcel search tool. Enter your street address or the property owner's name. The results list matching parcels. Click on the one you want and you get the full record, values, exemptions, sale history, and building details.

If you want billing or payment information, use the tax collector's system separately. Enter the parcel ID from the appraiser's record into the tax collector's lookup tool to see bill history and current balance. Both sites are free and open to the public.

All Largo property tax records are public under Chapter 119, Florida Statutes. You do not need to state a reason for your search. You do not need to be a Florida resident. Anyone can access these records online without cost. For certified copies or bulk data, contact the county offices directly.

Note: Pinellas County parcel IDs have a specific format. When using both sites, copy the full parcel ID carefully to make sure you are viewing the same property on both systems.

Exemptions for Largo Homeowners

Florida homestead gives Largo residents up to $50,000 off the assessed value of their primary home. The first $25,000 reduces value across all taxing authorities. The second $25,000 cuts value between $50,000 and $75,000 but does not affect school taxes. On a home assessed at $200,000, this exemption alone saves hundreds of dollars per year. Exemptions are set out in Chapter 196, Florida Statutes.

Homestead also triggers the Save Our Homes cap. Each year after you get homestead, your assessed value can only rise by the lesser of 3% or the rate of inflation. In years when the real estate market jumps sharply, this cap can save homeowners a lot. The cap is set in Chapter 193, Florida Statutes.

Other exemptions available in Pinellas County include additional exemptions for seniors with limited income, veterans, disabled residents, and widows or widowers. The March 1 deadline is firm for all of these. File your application with the Pinellas County Property Appraiser at 315 Court Street in Clearwater. The office can walk you through which ones you qualify for.

If you already own a homesteaded property in Florida and plan to move, portability lets you bring your SOH savings to the new home. This benefit must be applied for within a set time after the move. The appraiser handles portability applications.

Chapter 196 of Florida Statutes covers every exemption Largo property owners can apply for.

The statute page shows exact rules for homestead, senior, veteran, and other exemptions that apply to Largo parcels.

Appealing a Largo Property Assessment

You have the right to challenge your assessed value if you think it is too high. The process starts with the TRIM notice the appraiser sends in August. That notice shows your proposed value and estimated taxes. You have 25 days from the mailing date to file a petition with the Pinellas County Value Adjustment Board (VAB).

The VAB hears appeals from property owners who dispute their assessments. At the hearing, a special magistrate listens to both sides, your evidence and the appraiser's case. Bring recent comparable sales, photos of any problems with the property, and any independent appraisal you have. The magistrate recommends a value. The board then votes. Appeals are governed by Chapter 194, Florida Statutes.

Most residential appeals do not require a lawyer. Commercial appeals are more complex, and many property owners in that category hire a tax professional or attorney. You must pay the non-disputed portion of your tax bill while the appeal is pending to avoid penalties.

If the VAB result still is not right, you can file a lawsuit in circuit court. Most disputes end before that point. A successful appeal refunds any overpayment you made.

Florida Law and Largo Property Taxes

The same Florida statutes that govern every county in the state apply to Largo. Assessment is under Chapter 192. The Save Our Homes cap and assessment roll are in Chapter 193. Appeals are under Chapter 194. Exemptions are in Chapter 196. Collection and delinquency fall under Chapter 197.

Public access to all these records is secured by Chapter 119, Florida's Government-in-the-Sunshine law. It is one of the strongest open records laws in the country. Property tax records are entirely public, with narrow exceptions for certain personal information on exemption forms.

Pinellas County follows all DOR guidelines. The Florida DOR property tax page has reference material, forms, and contact information for those who want more detail on how state law is applied locally.

County Resources

For a full overview of how property taxes work across Pinellas County, see the Pinellas County property tax records page. That page covers office locations, hours, all service centers, and additional detail on the assessment and collection process that applies to Largo and every other city in the county.