Find Hardee County Property Tax Records

Hardee County property tax records are public documents that show assessed values, ownership history, tax bills, and exemption status for every parcel in this central Florida county. The Property Appraiser's office in Wauchula maintains these records, and state law allows anyone to search them free of charge.

Hardee County Quick Facts

Hardee County Property Appraiser

The Hardee County Property Appraiser's office is at 110 W. Oak St., Suite 102, Wauchula, FL 33873. Phone: (863) 773-9144. Fax: (863) 773-9679. The appraiser's core job is to determine the just value, meaning fair market value, of all real property in the county as of January 1 each year. That value, along with any exemptions the owner qualifies for, is what the tax bill is based on.

Hardee County is a largely agricultural county in south-central Florida. Much of the land is used for citrus, cattle, and row crops, and the appraiser's office handles classifications for these uses under Florida's agricultural classification rules. Agricultural land is typically valued at its productivity potential rather than its market value, which can significantly reduce a property's taxable value for qualifying landowners.

The appraiser's database includes every parcel in the county. It tracks ownership (updated from deeds recorded at the Clerk of Court), building characteristics, land size and type, exemptions applied, and assessment history. This data feeds directly into the annual tax roll that the Tax Collector uses to generate bills.

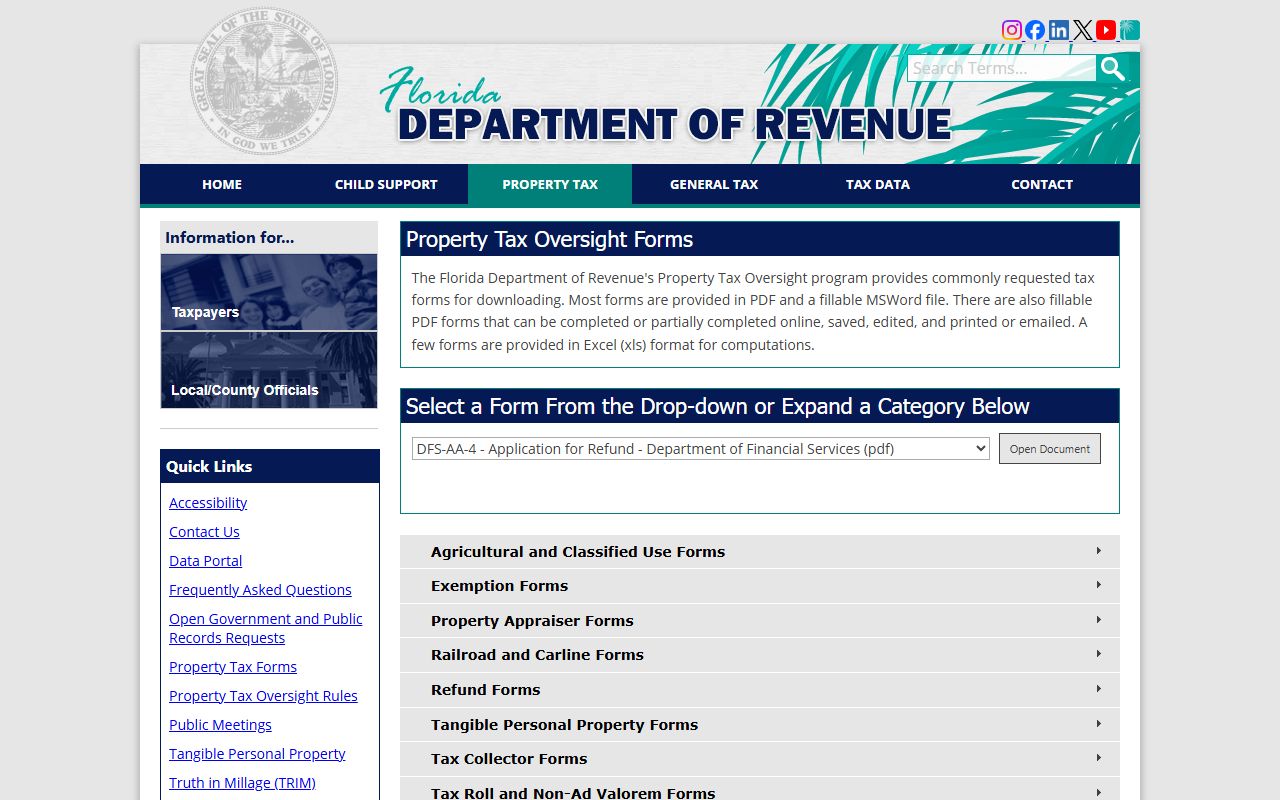

The Florida Department of Revenue's property overview page at floridarevenue.com explains how county property appraisers operate statewide, and what standards they must follow when valuing property.

The Department of Revenue oversees all county property appraisers in Florida, setting assessment standards and reviewing tax rolls each year.

Hardee County Tax Collector

The Hardee County Tax Collector handles billing, collection, and delinquency for all property taxes. Mailing address: P.O. Box 445, Wauchula, FL 33873. Phone: (863) 773-9144. They work from the certified tax roll submitted by the appraiser each year and send notices and bills to property owners starting in November.

Florida's early payment discount program rewards owners who pay before the end of the calendar year. Paying in November earns a 4% discount off the total tax bill. Each month after that the discount drops by one point. February is the last month with a discount, 1%. Pay in full by March 31 and you avoid delinquency, even without a discount. After April 1, penalties and interest begin under Chapter 197 of the Florida Statutes.

In addition to property taxes, the Tax Collector handles motor vehicles, driver licenses, and various state licenses. For property tax questions, bills, payment history, delinquency, contact the office directly. The Florida Tax Collectors Association also provides a directory of all county tax collector offices across Florida.

How to Search Hardee County Property Tax Records

Hardee County property tax records are available through the Property Appraiser's online search system. You can look up a parcel by owner name, street address, or parcel identification number. Results include assessed and taxable values, land and building details, the current year's exemptions, and prior year tax data. This is the fastest way to pull property information without going to the office.

The Florida Department of Revenue also has a statewide data portal at floridarevenue.com. This portal lets you download Hardee County's full assessment data in bulk, useful for researchers, appraisers, or anyone comparing properties across the county. The data is updated after the certified roll is submitted each year.

If you need documents beyond the basic search, such as exemption application files, agricultural classification records, or appeal filings, contact the Property Appraiser's office directly. Florida's public records law covers all these files, and you can request them in person, by phone, or in writing.

Property Tax Exemptions in Hardee County

Florida law provides several exemptions that cut the taxable value of property. Homestead is the biggest one. If you live in your Hardee County home full-time and own it as of January 1, you likely qualify for up to $50,000 in exemptions: a $25,000 reduction on the first $50,000 of assessed value, plus another $25,000 (for non-school taxes) on value between $50,000 and $75,000. This can save hundreds of dollars each year depending on the millage rate.

The homestead application deadline is March 1. You file with the Property Appraiser's office and must provide documents showing Florida residency and ownership. Once approved, the Save Our Homes cap kicks in. SOH limits how much the assessed value on your homestead can increase each year, no more than 3% or the rate of inflation, whichever is lower. For property owners who stay in the same home for years, this cap can keep their tax bill well below what it would otherwise be. Chapter 196 of the Florida Statutes covers all exemption types and eligibility rules.

Beyond homestead, Hardee County property owners may qualify for senior exemptions (income-based), veterans' disability exemptions, surviving spouse exemptions, or total disability exemptions. Agricultural landowners have a separate classification process. Filing a tangible personal property (TPP) return by April 1 gets businesses a $25,000 TPP exemption on their equipment and furniture.

Challenging Your Property Assessment

Every August, the Property Appraiser mails a TRIM notice, short for Truth in Millage, to all property owners in Hardee County. This document shows the proposed assessment for the coming year, the millage rates from each taxing authority, and the projected tax amount. Read it as soon as it arrives. It is also an instruction sheet on how to challenge the assessment if you think it's wrong.

If you want to appeal, you must file a petition with the Value Adjustment Board within 25 days of the TRIM notice mailing date. The VAB is a local board, in small counties like Hardee, it usually has two county commissioners and one school board member, and hearings are conducted by a state-certified special magistrate. You do not need an attorney, but you do need evidence. Comparable recent sales, an independent appraisal, or documentation of property issues all help your case.

The VAB process is governed by Chapter 194. Assessment methodology standards, including what the appraiser must consider, are in Chapter 193. If the VAB does not resolve things to your satisfaction, you can take the matter to circuit court, though that route is more formal and time-consuming.

Property Tax Payment in Hardee County

Tax bills arrive in November each year. Hardee County property owners can pay by mail (P.O. Box 445, Wauchula, FL 33873), in person at the Tax Collector's office, or online if the county's payment system is available digitally. If paying online, check whether a convenience fee applies to card payments, ACH or e-check payments often have lower or no fees.

Taxes not paid by March 31 become delinquent on April 1. When that happens, the Tax Collector must hold a tax certificate sale. Certificates are auctioned to investors, who pay the delinquent balance and earn interest. The property owner can redeem the certificate at any point within two years by paying the investor back plus interest and fees. After two years, the certificate holder can apply for a tax deed. That begins a process that can end with the property being sold at public auction if the owner still has not paid. The full delinquency procedure is laid out in Chapter 197.

An installment plan is available to qualifying owners. You must enroll with the Tax Collector by April 30. Installment payments are split across four quarters starting in June. There is a small built-in discount for this plan as well.

Accessing Hardee County Property Records

Under Chapter 119 of the Florida Statutes, all Hardee County property tax records, including the assessment roll, tax bills, exemption files, and TPP returns, are public. Anyone can ask to see them. You do not need to be a resident or give a reason for your request.

The Property Appraiser's online search system provides access to current parcel data without any formal request. For historical documents, appeal records, or items not available online, contact the appraiser's office at (863) 773-9144 or visit in person at 110 W. Oak St., Suite 102, Wauchula. The office can reproduce records for you, though they may charge copying costs at a rate set by state law.

The Florida Department of Revenue's forms page at floridarevenue.com has statewide forms for exemptions, appeals, and TPP returns used throughout Hardee County.

Cities in Hardee County

Hardee County's largest city is Wauchula, the county seat, along with Bowling Green and Zolfo Springs. No city in Hardee County meets the population threshold for a dedicated records page.