Boynton Beach Property Tax Records

Property tax records for Boynton Beach are maintained by Palm Beach County, covering every parcel within city limits. These records show ownership, assessed value, exemptions, and tax payment history. This page explains how to find and use those records, who handles them, and what rights you have under Florida law.

Boynton Beach Quick Facts

Palm Beach County Property Appraiser

Boynton Beach sits in Palm Beach County, so the county Property Appraiser handles all assessment work for parcels inside the city. The appraiser's main office is at 301 North Olive Avenue, 5th Floor, West Palm Beach, FL 33401. You can call them at 561-355-2866. The appraiser for Palm Beach County is Dorothy Jacks, an elected official who oversees valuation of all real and personal property in the county.

The appraiser values every parcel as of January 1 each year. That value drives the tax bill. The office uses mass appraisal methods that Florida law requires, comparing sales data and property features across the county to set fair market values. For Boynton Beach parcels, the appraiser looks at sales of comparable homes and commercial properties in similar neighborhoods to arrive at just value.

The Palm Beach County Property Appraiser website has a full online search tool. You can look up any Boynton Beach parcel by address, owner name, or parcel identification number. The site shows assessed value, taxable value, exemptions on file, building data, land data, and sale history. The tool is free to use and open to anyone.

For Boynton Beach residents, the advanced parcel search lets you narrow results by city, subdivision, or zip code. This is useful when you know the neighborhood but not the exact address. The appraiser's data is updated regularly as sales close and permits are issued.

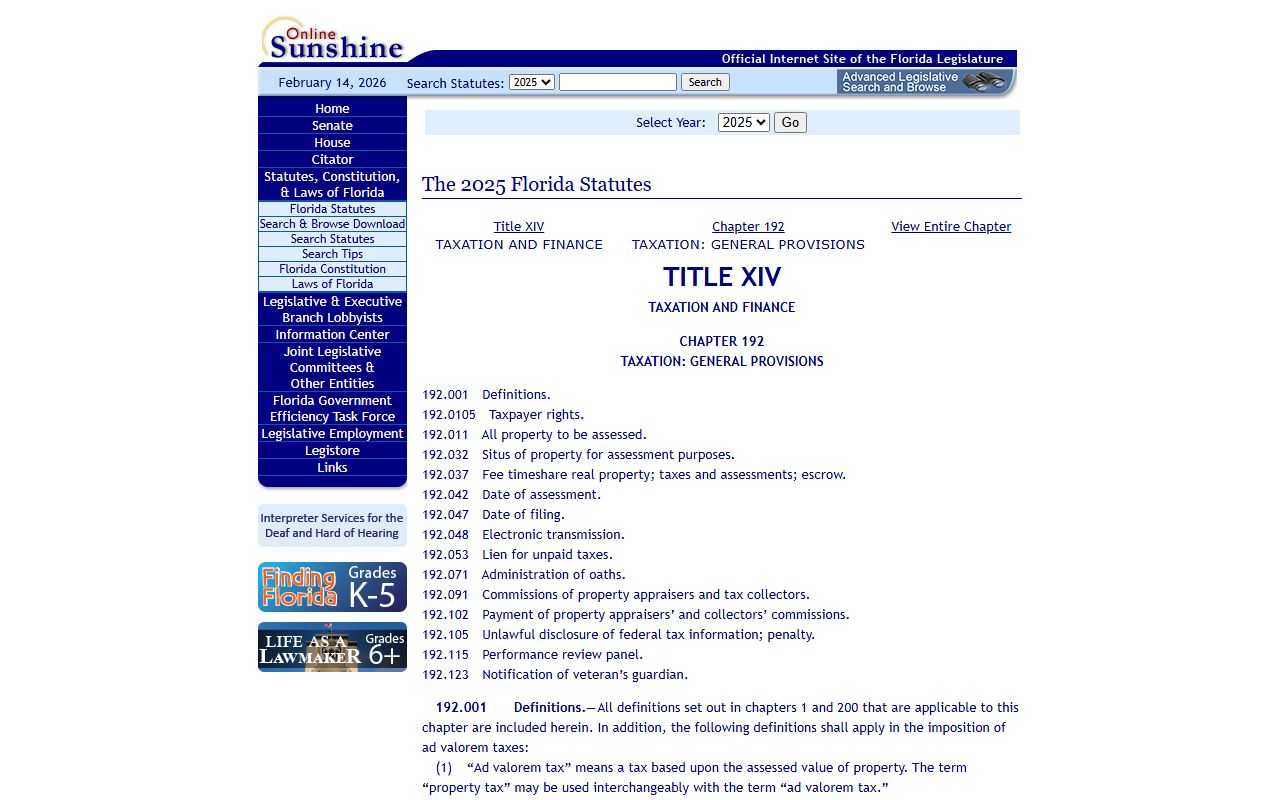

Assessment rules and standards are set at the state level. The Florida Department of Revenue supervises county appraisers and can be reached through their Property Tax Oversight page. State law for assessment is in Chapter 192, Florida Statutes.

The Palm Beach County Property Appraiser website is the main tool for looking up Boynton Beach parcels.

The Florida DOR sets the rules that all county appraisers must follow, including those covering Boynton Beach parcels.

Tax Collection in Boynton Beach

Palm Beach County Tax Collector Anne Gannon handles billing and collection for all Boynton Beach properties. The main office is at 301 North Olive Avenue, 3rd Floor, West Palm Beach, FL 33401. Phone is 561-355-2264. For Boynton Beach residents, the South County service center at 501 S. Congress Avenue, Delray Beach, FL 33445 is much closer and handles the same services.

Tax bills go out each November. The bill shows your property's taxable value, the millage rates set by each local government, and the total due. Boynton Beach parcels may carry millage from Palm Beach County, the School Board, the City of Boynton Beach, and any special districts in your area. Each adds to the total bill. You can see the breakdown on your notice and on the Palm Beach County Tax Collector website.

Florida gives you a discount for paying early. November brings 4% off. December gets 3%, January 2%, and February 1%. Pay by March 31 to stay current. After that date, taxes become delinquent and additional charges apply. The process for delinquent taxes, including tax certificate sales, is governed by Chapter 197, Florida Statutes.

You can pay online, by mail, or in person at any Palm Beach County service center. The Delray Beach office is the most convenient for most Boynton Beach residents since it is just a few miles south on Congress Avenue.

How to Search Boynton Beach Property Tax Records

Start at the Palm Beach County Property Appraiser advanced search. Enter the property address, parcel ID, or owner name to pull up the record. For a Boynton Beach address, just type the street address and the city. The results show every parcel that matches. Click on any parcel to see the full record including values, exemptions, and sale history.

If you want tax bill data rather than appraisal data, use the Palm Beach County Tax Collector site. Enter the parcel ID or address there to see billing history, amounts due, and payment records. These two sites together cover all public data on any Boynton Beach parcel.

All these records are public under Chapter 119, Florida Statutes. You do not need to give a reason or show ID. You can access them from anywhere with an internet connection at no cost. Certified copies or bulk data requests may carry fees when handled by county staff in person.

Note: The parcel ID format in Palm Beach County uses a long numeric string. Copy it carefully when moving between the appraiser and tax collector sites to make sure you are looking at the same parcel.

Homestead and Other Exemptions

Florida's homestead exemption saves Boynton Beach homeowners up to $50,000 off assessed value for their primary residence. The first $25,000 applies to all taxing authorities. The second $25,000 applies to value between $50,000 and $75,000 but does not reduce school taxes. This is one of the most valuable tax breaks available to Florida property owners.

Once you get homestead, the Save Our Homes cap limits annual increases in assessed value to 3% or the inflation rate, whichever is lower. In a hot real estate market, this can create a big gap between just value and assessed value over time, which keeps your bill lower than it would otherwise be. Exemptions are covered under Chapter 196, Florida Statutes.

Other exemptions apply to seniors with low income, disabled residents, veterans, and widows or widowers. Each has its own rules. Apply by March 1 with the Palm Beach County Property Appraiser. Late applications are not accepted for the current year, so do not miss the deadline if you are newly eligible.

If you move from one Florida home to another, you can carry some of your SOH savings with you. This portability benefit is available for a limited time after moving. The appraiser's office handles portability applications along with the initial homestead filing.

Florida Statutes Chapter 196 covers all property tax exemptions, including homestead rules for Boynton Beach residents.

Chapter 196 sets the rules for every exemption available to Florida property owners, including residents of Boynton Beach.

Appealing Your Assessment in Boynton Beach

If you think your assessment is too high, Florida gives you a formal way to challenge it. Each year in August, the appraiser sends a TRIM (Truth in Millage) notice. It shows your proposed value and estimated taxes. You have 25 days from that mailing to file a petition with the Palm Beach County Value Adjustment Board (VAB).

The VAB process is governed by Chapter 194, Florida Statutes. You file a petition, pay a small fee, and get a hearing before a special magistrate. At the hearing, you present your evidence, comparable sales, photos, an appraisal if you have one, and the appraiser presents their case. The magistrate recommends a value; the VAB votes to accept or reject it.

Most homeowners who appeal use recent sales of similar homes nearby as their main evidence. If you can show that comparable properties sold for less than your assessed value implies, that often moves the needle. You do not need a lawyer for a residential appeal, though commercial property owners often hire one.

While an appeal is pending, pay at least the non-disputed part of your tax bill. Missing the payment deadline causes penalties that apply regardless of the appeal outcome. A successful appeal results in a refund for any overpayment.

Florida Property Tax Laws That Apply in Boynton Beach

Several chapters of Florida law govern how property taxes work in Boynton Beach. Chapter 192 defines assessment standards. Chapter 193 covers the Save Our Homes cap and the assessment roll process. Chapter 196 sets out all exemptions. Chapter 197 handles collection and delinquency. Appeals fall under Chapter 194.

Public access to these records is guaranteed by Chapter 119, Florida's public records law. This law is broad. It covers government records statewide and requires agencies to provide access promptly. Property tax records are among the most commonly accessed public records in the state.

The Florida DOR provides guidance documents, training, and oversight for county appraisers across the state. Their Property Tax Oversight division is a useful resource if you want to understand how assessment works at a technical level.

County Resources for Boynton Beach

All Boynton Beach property tax matters flow through Palm Beach County. The Palm Beach County property tax records page covers the full county system in detail, including office locations, hours, and how to use the appraiser's and tax collector's tools. That page is the best reference if you need information beyond what's covered here.

Palm Beach County is large, with over 700,000 parcels. The county offices in West Palm Beach handle the full workload, but service centers across the county make it easier to get help locally. The South County center in Delray Beach, about 5 miles from Boynton Beach, is the closest full-service location for most city residents.