Boca Raton Property Tax Records

Boca Raton property tax records are public documents maintained by Palm Beach County. The Property Appraiser and Tax Collector are county officials who handle assessment, billing, and collection for all Boca Raton parcels. This page covers how to find those records, what they contain, and how to use them - whether you own property here, are researching a purchase, or need to check on a tax bill.

Boca Raton Quick Facts

Palm Beach County Tax Administration for Boca Raton

Boca Raton is an incorporated city in southern Palm Beach County. Property taxes here are administered at the county level. The city sets its own millage rate, but the assessment, billing, and collection are handled by Palm Beach County officials. Your tax bill shows the county rate, school board rate, city of Boca Raton rate, and any applicable special district rates - all managed by the county collector.

Palm Beach County is large and affluent, and Boca Raton reflects that character. The property mix includes high-value residential, significant commercial and office development, beachfront condominiums, and luxury gated communities. The appraiser's office handles all of these property types using methods appropriate for each class. For high-value properties, income and cost approaches play a bigger role alongside sales data.

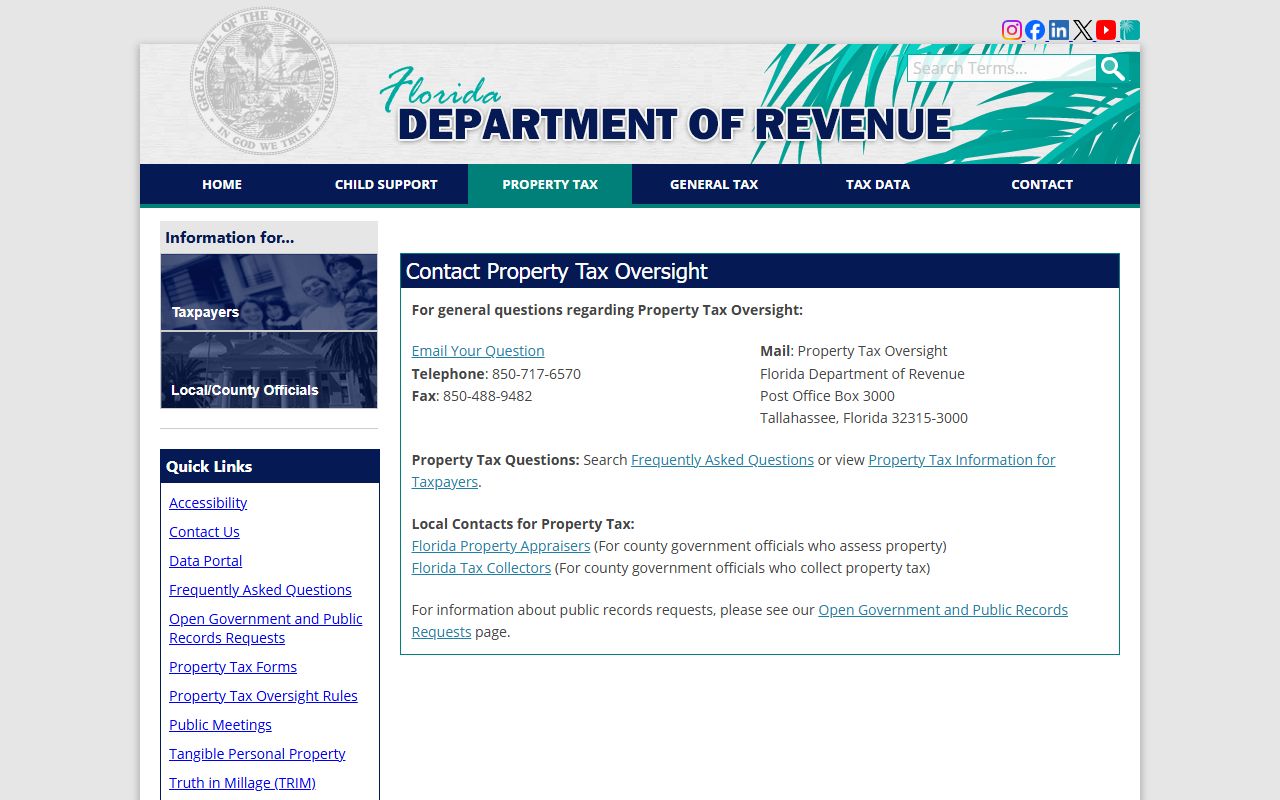

The Florida Department of Revenue oversees all county property appraisers and sets the standards they must meet. Their statewide resources are at the DOR Property Tax Oversight page. State law governs the framework. Palm Beach County applies it to every Boca Raton parcel.

For a full breakdown of Palm Beach County property tax policy, office contacts, and millage history, see the Palm Beach County property tax records page.

Palm Beach County Property Appraiser

The Palm Beach County Property Appraiser (Dorothy Jacks) is located at 301 North Olive Avenue, 5th Floor, West Palm Beach, FL 33401. The phone number is 561.355.2866. The main office is in West Palm Beach, about 45 minutes north of Boca Raton. For Boca Raton residents, the online tools available at the appraiser's website handle most needs without a trip to West Palm Beach.

The appraiser sets values for all Palm Beach County parcels as of January 1 each year. For Boca Raton, that covers everything from modest condominiums to oceanfront estates. Mass appraisal methods use comparable sales, property characteristics, and DOR guidelines. The appraiser does not inspect every property every year. Values are derived statistically from market data, with on-site inspections triggered by new construction, permits, or appeals.

The Palm Beach County Property Appraiser website at pbcpao.gov has a robust parcel search. The advanced search tool at pbcpao.gov/AdvSearch/AdvanceSearch lets you look up Boca Raton parcels by address, owner name, or parcel control number. The results page shows assessed value, just value, taxable value, exemptions, and sales history. Aerial maps and building details are also available. The site is free and does not require an account.

Palm Beach County uses the term "parcel control number" (PCN) rather than parcel ID. If you know your PCN - it is on your tax bill or deed - that is the fastest way to pull up your record. If you do not know your PCN, start with a street address search and then note the PCN from the results page for future reference.

Boca Raton has a significant number of condominium units. The appraiser values these separately from the underlying land, which is owned by the condominium association. If you own a condo, your taxable interest is your unit and your proportionate share of the common elements. Look up your unit number through the address search on the appraiser's site to find the right record.

The appraiser's office cannot change your millage rate or fix errors on your tax bill. For billing issues, contact the Tax Collector. For value disputes, use the formal appeal process. The appraiser's staff can answer questions about how your value was determined and what comparable sales were used.

The Florida DOR Property Tax Oversight page explains how Palm Beach County appraisals are done under state law.

The DOR site covers the assessment standards that apply to all Boca Raton parcels in Palm Beach County.

Palm Beach County Tax Collector

The Palm Beach County Tax Collector (Anne Gannon) is located at 301 North Olive Avenue, 3rd Floor, West Palm Beach, FL 33401. The phone number is 561-355-2264. For Boca Raton residents who want to pay in person without driving to West Palm Beach, the South County service center is at 501 S. Congress Avenue, Delray Beach, FL 33445. Delray Beach is just north of Boca Raton and is a much more convenient option.

The Tax Collector's website is at pbctax.gov. Online payment is available through the portal. You can pay by credit card or e-check. The site also has a property tax lookup function so you can check current balances and payment history for any Boca Raton parcel before or after you pay.

Bills go out in November. The discount schedule gives 4% off for November payment, 3% for December, 2% for January, 1% for February. After March 31, taxes are delinquent under Chapter 197, Florida Statutes. The collector adds fees and interest. A tax certificate sale follows. Investors pay the delinquent amounts and earn interest at a rate set at auction. The property owner has two years to redeem the certificate. After that, the certificate holder can apply for a tax deed, which puts the property at risk of forced sale.

The installment plan option lets Boca Raton property owners split the annual bill into four payments. Sign up by April 30. The first payment is due in June. This is worth considering for residents who own high-value property with a significant tax bill and prefer not to pay it all at once in November.

How to Search Boca Raton Property Tax Records

Go to pbcpao.gov and use the parcel search. Enter a Boca Raton address or parcel control number. The record shows current assessed value, just value, taxable value, exemptions, and sales history. For condominiums, search by unit address and be specific - include the unit number to find the right record among many units at the same building address.

For billing and payment data, use pbctax.gov. Enter the parcel control number to check the current bill, payment status, and any history. These two portals together give a full picture of any Boca Raton property's assessment and tax status.

All records are public under Chapter 119, Florida Statutes. No ID needed. No reason required. Exemption application data like Social Security numbers is protected, but ownership, value, and tax history are fully open. For bulk data or certified copies, contact the Palm Beach County Property Appraiser in West Palm Beach directly.

Property Tax Exemptions in Boca Raton

Florida's exemptions apply to all qualifying Boca Raton properties. The homestead exemption removes up to $50,000 from assessed value for a primary residence. The first $25,000 applies to all taxing authorities. The second $25,000 applies to value between $50,000 and $75,000, covering all but the school board levy. Apply with the Palm Beach County Property Appraiser by March 1.

Homestead triggers the Save Our Homes cap, which limits annual increases in assessed value to 3% or the inflation rate, whichever is less. This is in Chapter 193, Florida Statutes. In Boca Raton, where high property values and recent market appreciation are common, the SOH cap can create a very large gap between just value and assessed value for long-time homeowners. That gap means a lower taxable base and a lower annual bill.

Other available exemptions include: senior low-income exemption for residents 65 and older, total disability exemptions, veteran and combat-related disability exemptions (including a total exemption for qualifying veterans), and widower exemptions. All require applications filed with the Palm Beach County Property Appraiser. Full statutory details are in Chapter 196, Florida Statutes.

Businesses in Boca Raton with tangible personal property should file a TPP return with the appraiser by April 1. The first $25,000 of TPP value is exempt. File on time to claim it. Late filers lose the exemption and may face a penalty assessment on the full value of their personal property.

Value Adjustment Board Appeals

If your assessed value seems wrong, file a petition with the Palm Beach County Value Adjustment Board. The window is 25 days from the TRIM notice mailing date. The VAB is independent of the appraiser and is made up of county commission members, school board members, and citizen appointees. Petitions go to special magistrates who hold hearings. The process is governed by Chapter 194, Florida Statutes.

Boca Raton has many high-value properties where an assessment dispute can involve significant money. Commercial property owners in particular often hire attorneys or appraisers to represent them at VAB hearings. For residential owners, comparable sales from the same neighborhood are the most useful evidence. Bring photos of condition issues, any independent appraisal, and comparable sales data. You carry the burden of proof. Pay the undisputed portion of your tax bill while the appeal is open to avoid penalties.

Public Records Access

Florida's public records law applies fully to Boca Raton property tax records. Under Chapter 119, assessment and tax records are open to anyone. No ID, no account, no explanation needed. The online portals handle most requests at no cost. For records not available online, contact the Palm Beach County Property Appraiser or Tax Collector directly. The office must respond to public records requests within a reasonable time. Fees may apply for large data extractions or certified documents.

The Florida DOR contact page lists state-level resources for property tax questions across all counties.

The DOR contact page connects you to state-level resources when county offices need additional support.