Find Pompano Beach Property Tax Records

Pompano Beach property tax records are maintained by the Broward County Property Appraiser and Tax Collector, based in Fort Lauderdale and Plantation. Every residential, commercial, and vacant parcel in Pompano Beach is on the official Broward County property roll. These records are public documents. You can access them online for free through the county's search tools without needing to show ID or state a reason.

Pompano Beach Quick Facts

Broward County Property Appraiser

The Broward County Property Appraiser's office is at 115 S. Andrews Ave., Room 111, Fort Lauderdale, FL 33301. The main phone is (954) 357-6830. This office is responsible for valuing all real and tangible personal property in Broward County, including every parcel within Pompano Beach. The appraiser sets values as of January 1 each year, and those values form the basis for the annual tax bills that go out each November.

Pompano Beach has a wide range of property types. The city has beachfront condominiums, single-family neighborhoods, industrial parcels near the airport, retail corridors, and vacant lots. The appraiser values all of them. The official property roll records each parcel with its legal description, owner of record, land data, building characteristics, assessed value, just value, taxable value, and any exemptions that apply. The roll is updated throughout the year as deeds are recorded, permits are issued, and sales close.

You can search the Broward County Property Appraiser website by address, owner name, or folio number. The folio number is Broward County's parcel identifier. Each parcel in Pompano Beach has one. Search results show current and prior-year assessed values, sales history, building data, and exemption detail. The site is free and requires no login. Most searches return results instantly.

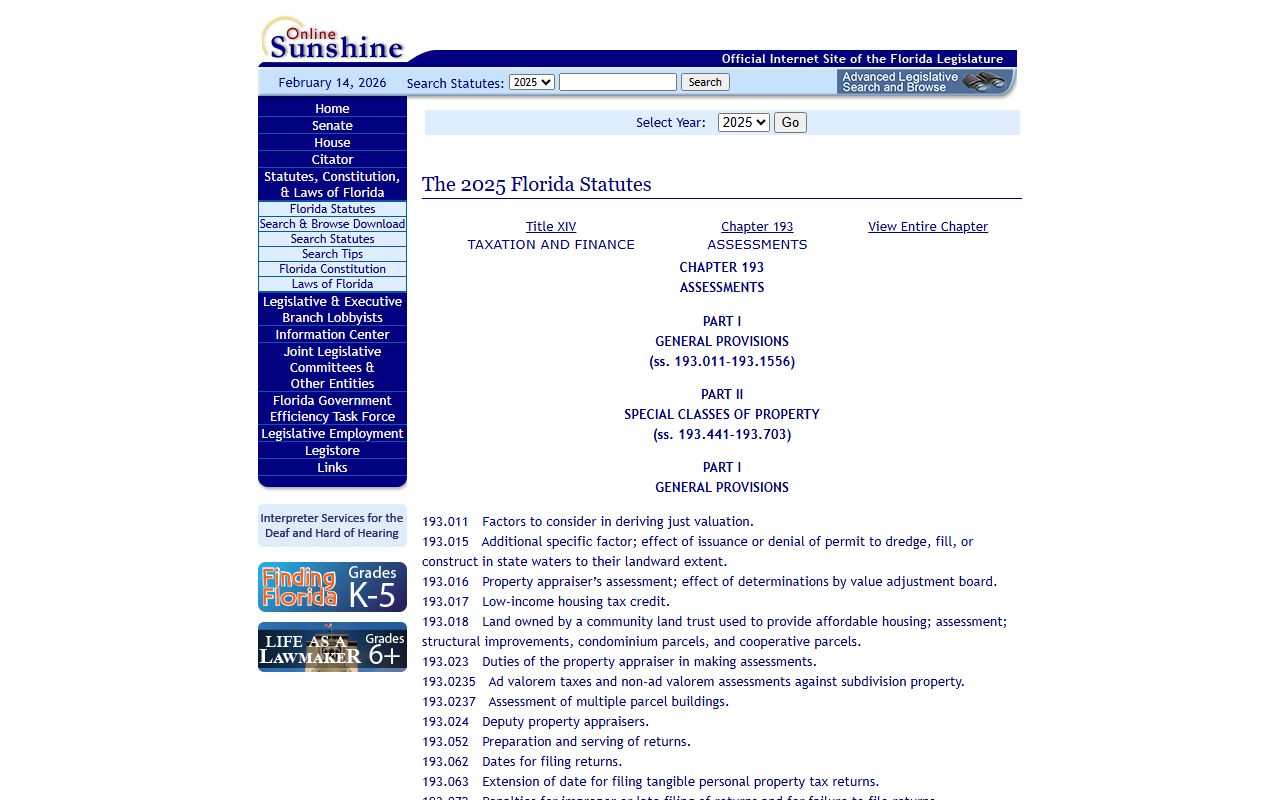

Florida's Department of Revenue oversees all 67 county property appraisers, including Broward's. You can learn more about how assessment works statewide at the DOR Property Tax Oversight page. County appraisers must follow rules established by the DOR under Chapter 193 of the Florida Statutes.

The Florida DOR Property Tax Oversight page explains how assessment, exemptions, and oversight work across the state.

The DOR site is a useful reference for understanding the rules behind the numbers on your Pompano Beach assessment notice.

Tax Billing and Collection in Pompano Beach

The Broward County Tax Collector manages billing and payment for all Pompano Beach properties. The office is at 1800 NW 66th Ave., Suite 100, Plantation, FL 33313. The phone is (954) 765-4697. Online payments, balance lookups, and payment history searches are available at the Broward County Tax Collector website. The site is available around the clock and does not require a login to check a balance.

Tax bills go out in November each year. The amount owed is the taxable value times the combined millage rates from all local taxing authorities. For Pompano Beach parcels, those typically include Broward County, the school board, the City of Pompano Beach, and any applicable special assessment districts. Each authority appears as a separate line item on your bill, so you can see exactly where each dollar goes.

Pay early and save money. Florida's discount schedule gives you 4% off the face amount in November. December earns 3%, January 2%, and February 1%. After March 31, taxes are delinquent. The late-payment rules are in Chapter 197, Florida Statutes. The collector holds a tax certificate sale in June. Investors pay delinquent amounts and receive certificates with interest rights. Certificates not redeemed within two years can lead to tax deed proceedings.

Payment options include online, mail, and in person at the Plantation office or any Broward County Tax Collector branch. An installment plan lets you spread the annual bill over four quarterly payments. You must enroll in the spring of the year before you want to use the plan. The collector's site has enrollment details and deadlines.

How to Look Up Pompano Beach Property Records

Go to the Broward County Property Appraiser site and enter a Pompano Beach address or folio number. The parcel record shows the current assessed value, just value, taxable value, land area, building square footage, year built, condition notes, and sales history. You can also see what exemptions are currently on file. The search is free and open to anyone without registration.

For billing data, use the Broward County Tax Collector's search tool. Enter the folio number to pull up the current balance, payment history, and any delinquency status. These two searches together cover the full picture of any Pompano Beach property from an assessment and tax standpoint.

The Florida DOR maintains a statewide property tax data portal with county-level downloadable data files. This is useful for bulk research, trend analysis, or comparing Broward County data against other counties in the state.

All records are public under Chapter 119, Florida Statutes. No ID required. No reason needed. Social Security numbers and personal identifiers on exemption applications are shielded, but all core property and tax data is fully open.

Exemptions for Pompano Beach Property Owners

Florida's homestead exemption is the biggest tax break for Pompano Beach homeowners who live in their property full time. It reduces assessed value by up to $50,000. The first $25,000 applies against all taxing authorities. The second $25,000 applies to value between $50,000 and $75,000 but does not reduce school taxes. Applications go to the Broward County Property Appraiser. The March 1 deadline is firm.

Homestead also activates the Save Our Homes cap. Under Chapter 193, Florida Statutes, a homesteaded property's assessed value can rise by no more than 3% per year or the rate of inflation, whichever is lower. In Pompano Beach, where market values have climbed sharply in recent years, the cap can create a significant gap between a property's market value and its taxable value. That benefit disappears when the property sells, and the new buyer starts fresh at full market value.

Additional exemptions available in Broward County include the senior low-income exemption, veteran and surviving spouse exemptions, and exemptions for certain disabilities. Each requires a separate application and has its own eligibility criteria. Exemption law is in Chapter 196, Florida Statutes.

Business owners in Pompano Beach with tangible personal property can claim the $25,000 TPP exemption by filing a return with the appraiser by April 1. This applies to equipment, furniture, and other business property. File late and you lose the exemption for that year.

Chapter 193 covers how properties are assessed in Florida and explains the Save Our Homes cap in detail.

The statute page includes the full text on how the cap is calculated and applied for homesteaded properties across Florida.

Appealing a Pompano Beach Property Assessment

Each summer, Broward County property owners receive a TRIM notice. It shows the proposed assessed value and an estimated tax at that value. If you think the value is too high, you have 25 days from the mailing date to file a petition with the Broward County Value Adjustment Board. Filing starts the formal appeal process. The fee is modest and varies by parcel type.

After you file, you are scheduled for a hearing with a special magistrate. You present your evidence. The appraiser's staff may also appear. The magistrate makes a recommendation, and the VAB board votes to accept or reject it. The process is governed by Chapter 194, Florida Statutes. You can attend and argue your own case without a lawyer, though commercial property owners often use one.

Evidence is what wins VAB cases. Bring comparable sales from similar Pompano Beach properties sold close to January 1. For condominiums, look for sales of comparable units in the same building or nearby buildings. For single-family homes, find similar homes in the same neighborhood. Document condition issues with photos. The burden is on you to show the county's number is off. A strong evidence package matters far more than just disputing the value in general terms.

Pay the undisputed portion of your bill while the appeal is open. Skipping payment entirely adds penalties. If the VAB rules against you, you can pursue circuit court, though that involves more cost and time. Most residential appeals settle at the VAB level without going further.

Public Records Access and County Resources

All Pompano Beach property tax records are managed at the Broward County level. The city does not maintain its own property assessment or tax billing office. All questions about values, exemptions, and payments go to the Broward County offices in Fort Lauderdale and Plantation. See the Broward County property tax records page for full details on office locations, hours, branch offices, and how to submit public records requests.

Florida's public records law, Chapter 119, makes all property tax records available to anyone without restriction. You can view records online for free, request certified copies by mail or in person, or ask for bulk data extracts. The office may charge a fee for copies or staff time on large requests, but the underlying data is public. The Florida DOR directory has contact information for all county offices if you need to reach Broward County directly.