Search Coral Springs Property Tax Records

Coral Springs property tax records are managed by the Broward County Property Appraiser and Tax Collector offices, based in Fort Lauderdale and Plantation. Every parcel in Coral Springs has a public record showing its assessed value, owner information, exemption status, and tax bill history. These records are free to access online and are updated regularly throughout the year.

Coral Springs Quick Facts

Broward County Property Appraiser

The Broward County Property Appraiser is at 115 S. Andrews Ave., Room 111, Fort Lauderdale, FL 33301. The main phone number is (954) 357-6830. This office is responsible for valuing every parcel in Broward County, including all residential and commercial properties in Coral Springs. Assessments are made as of January 1 each year, and the resulting values are the basis for the tax bills that go out each November.

Coral Springs is a large planned community. It has thousands of single-family homes, condominiums, and commercial parcels. The appraiser tracks each one on the county property roll. That roll records the owner of record, the legal description, land data, building characteristics, assessed value, taxable value, and any exemptions that apply. The roll is updated when sales close, when permits are pulled, and when ownership documents are recorded with the county clerk.

You can search the Broward County Property Appraiser website to look up any Coral Springs parcel. The site lets you search by address, owner name, or folio number. A folio number is Broward County's version of a parcel ID. The search results show current and prior-year assessed values, sales history, building data, and exemption detail. The site is free and open to anyone.

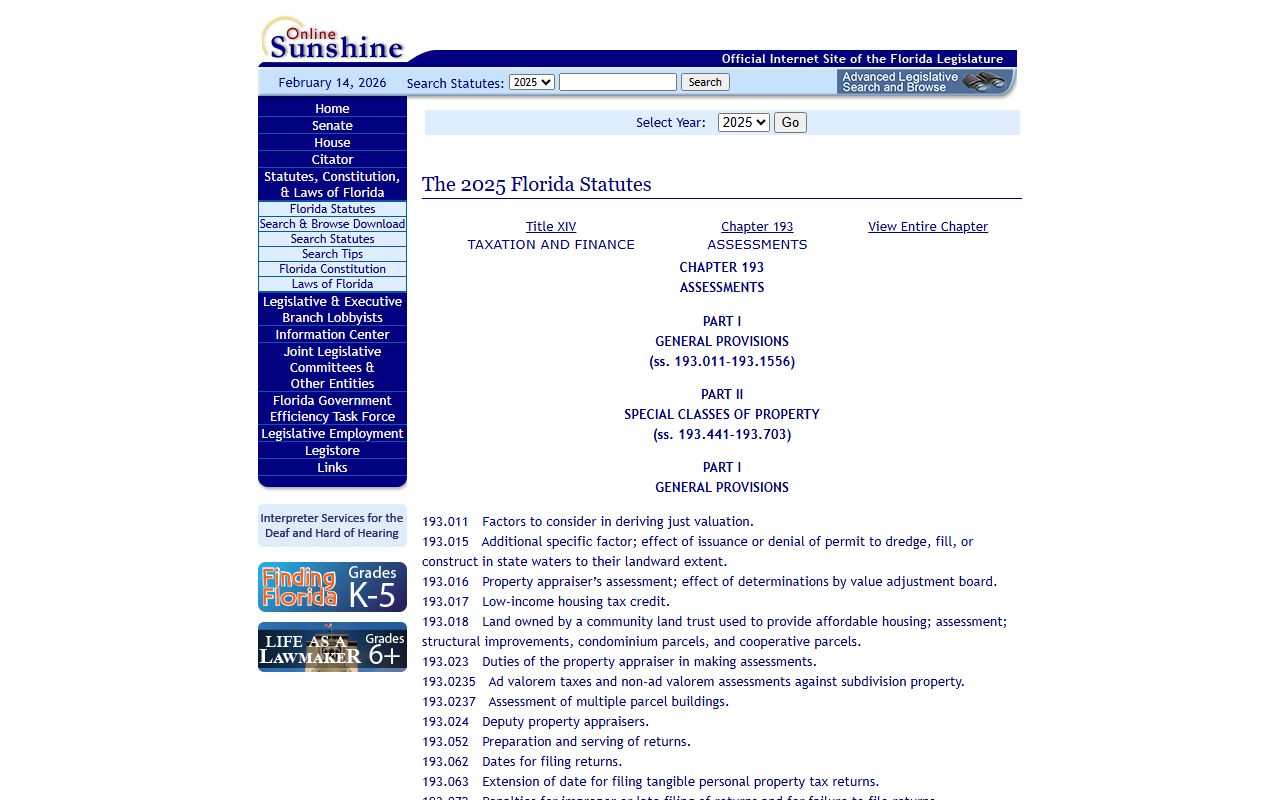

The Florida Department of Revenue provides guidance on how county appraisers conduct their work. See the DOR Property Tax Oversight page for statewide rules and resources. The appraiser's valuation work must follow standards set by the DOR under Chapter 193 of the Florida Statutes.

Chapter 193 of the Florida Statutes covers how property is assessed, including the Save Our Homes cap.

The statute page lays out the rules for annual valuation, caps on increases, and the January 1 assessment date.

Tax Billing and Payment in Coral Springs

The Broward County Tax Collector handles billing and collection for all Coral Springs properties. The main office is at 1800 NW 66th Ave., Suite 100, Plantation, FL 33313. The phone number is (954) 765-4697. The Broward County Tax Collector website is where you go to pay online, check your balance, or review past payments.

Tax notices go out in November. The amount due is based on the taxable value assigned by the appraiser, multiplied by the combined millage rates of all taxing authorities that serve your parcel. In Coral Springs, that includes Broward County, the school board, the City of Coral Springs, and any applicable special districts or assessment districts. Each one adds a separate line to your bill.

Florida offers a discount for paying early. You get 4% off if you pay in November. December earns 3%, January 2%, and February 1%. After March 31, taxes are delinquent under Chapter 197, Florida Statutes. Delinquent taxes lead to a certificate sale in June, where investors pay the back taxes in exchange for a lien. If not redeemed within two years, that lien can lead to a tax deed sale.

Online payment is available at the Broward Tax Collector's site. You can also mail a check or pay in person at the Plantation office or other branch locations. An installment plan is available for those who want to spread payments over four quarters. Enrollment for the installment plan opens each spring before the next tax year begins.

How to Search Coral Springs Parcel Records

The Broward County Property Appraiser site is the main tool for parcel lookups. Search by address or folio number for any Coral Springs property. The record pulls up current assessed value, just value, taxable value, land area, building square footage, year built, and any exemptions on file. You also get a full sales history showing every arm's-length transaction the appraiser has recorded for that parcel.

For billing data, the Broward Tax Collector site has a separate search. Enter the folio number to see current amounts owed and a history of past payments. These two databases cover all the essential property tax information for any Coral Springs parcel.

The Florida DOR also maintains a statewide property tax data portal where you can download aggregated county-level data. This is helpful for researchers, analysts, and anyone who needs more than just a single parcel lookup.

All records are public under Chapter 119, Florida Statutes. No ID is required. No reason needs to be given. Social Security numbers and other personal identifiers on exemption applications are shielded from disclosure, but the core property data is fully open.

Property Tax Exemptions for Coral Springs Residents

The homestead exemption is the most common tax break in Coral Springs. It removes up to $50,000 from the assessed value of a primary residence. The first $25,000 applies against all taxing authorities. The second $25,000 reduces assessed value between $50,000 and $75,000 but does not apply to school taxes. For a homeowner with a modest property, this exemption can cut the bill substantially.

Homestead status also triggers the Save Our Homes cap. Once a property carries a homestead exemption, the assessed value can go up by no more than 3% per year or the rate of inflation, whichever is less. This is important in Broward County, where market values have risen fast in recent years. The cap keeps your tax base from jumping along with the market. Details on the cap are in Chapter 193.

Additional exemptions are available to seniors with limited income, veterans with disabilities, widows, widowers, and people with qualifying disabilities. Each exemption has its own eligibility rules and requires a separate application to the Broward County Property Appraiser. The deadline for homestead and most other exemptions is March 1 of the tax year. Exemption law is in Chapter 196, Florida Statutes.

Businesses in Coral Springs that own tangible personal property used in their operations may also qualify for the $25,000 TPP exemption. File the TPP return with the appraiser by April 1 to claim it.

Challenging a Coral Springs Property Assessment

If your TRIM notice shows a value you think is wrong, you have 25 days from the mailing date to file a petition with the Broward County Value Adjustment Board. The TRIM notice goes out each summer and includes the proposed assessed value and estimated tax based on current millage rates. Filing with the VAB starts the formal appeal process.

After you file, you get a hearing before a special magistrate. You present your evidence. The appraiser's staff may also appear to defend their value. The magistrate reviews the case and makes a recommendation to the VAB board. The board votes to accept or reject the recommendation. The whole process is governed by Chapter 194, Florida Statutes.

Strong evidence makes a difference. Bring comparable sales from nearby properties sold around the same time as the assessment date. Point out any condition issues the appraiser may not have accounted for. An independent appraisal helps, especially for commercial or higher-value properties. The burden is on you to show the county's value is incorrect, so come prepared.

You must pay the undisputed portion of your tax bill while an appeal is pending. Don't skip payment entirely or you risk additional penalties. If the VAB does not rule in your favor, circuit court is still an option, though most disputes end at the VAB level.

County Office and Public Records Access

All Coral Springs property tax records are maintained at the Broward County level. The city does not have its own assessment office. Questions about values, exemptions, or tax bills go to the county offices. Visit the Broward County property tax records page for full details on office hours, branch locations, and how to submit records requests.

Florida's public records law makes all of this data available without restriction. Chapter 119 does not require you to be a Florida resident or state a purpose. You can request bulk data, certified copies, or access records in person at the county office. The office may charge for copies or staff time on large requests, but the information itself is public.

The Florida DOR directory lists direct contact information for every county property appraiser and tax collector.

Use the directory to find phone numbers, addresses, and website links for the Broward County offices.