Levy County Property Tax Records

Levy County property tax records are public documents maintained by the Property Appraiser and Tax Collector offices in Bronson, Florida. These records cover every parcel in this largely rural north-central Florida county and include assessed values, ownership history, exemption status, and tax bill data. This page explains how to search those records, who maintains them, and what you can find in them.

Levy County Quick Facts

Levy County Property Appraiser

The Levy County Property Appraiser office is at 310 School Street, Bronson, FL 32621. Phone is (352) 486-5212 and fax is (352) 486-5213. This office is responsible for valuing all real and personal property in the county as of January 1 each year. The appraiser does not collect taxes and does not set millage rates. Those functions belong to local taxing authorities and the tax collector.

Levy County covers a large land area with a mix of agricultural land, timberland, forested areas, and Gulf Coast parcels along the Nature Coast. That mix means the appraiser deals with a wide range of property types, from timber tracts and cattle operations to waterfront homes and commercial properties along US-19. Agricultural properties often receive special classification under Florida law, which can significantly reduce the taxable value compared to assessed value.

The Levy County Property Appraiser website provides online parcel search. You can look up any parcel by owner name, parcel ID, or address. The site shows current and prior-year values, exemption status, and sales data. GIS mapping tools show parcel boundaries and aerial imagery for the county.

The Levy County Property Appraiser site is the primary online resource for property data in the county.

The parcel search on the appraiser's site returns ownership, value, and exemption data for any property in Levy County.

Statewide assessment standards are set by the Florida Department of Revenue. The DOR Property Tax Oversight page explains how county appraisers must follow state guidelines when valuing property. Chapter 193, Florida Statutes sets the legal framework for how assessment must be conducted each year.

Agricultural Classification in Levy County

Agricultural classification is one of the most important tax tools in Levy County. A large share of land in the county is used for farming, cattle, timber, or other agricultural purposes. Under Florida law, land that qualifies for agricultural classification is assessed based on its value in agricultural use, not its market value. That difference can be substantial, especially for land near growing areas like Alachua County to the east.

To get ag classification, you must apply with the Property Appraiser by March 1. The appraiser evaluates whether the land is used in good faith for commercial agricultural purposes. A hobby farm or small garden plot typically does not qualify. The appraiser considers the size of the operation, income generated, and how the land is managed. You may be asked to provide records of sales, lease agreements, or other evidence of active agricultural use.

If your application is denied, you have the right to appeal to the Value Adjustment Board under Chapter 194, Florida Statutes. The board is an independent panel that reviews classification denials. File your petition within 25 days of the denial notice. The DOR property tax FAQ has additional guidance on the appeal process.

Once you have ag classification, it stays in place as long as the use continues. If you sell the land or change the use, rollback taxes may apply. Rollback covers the prior three years and represents the difference between what you paid and what you would have paid without the classification.

Tax Collection and Payment Options

The Levy County Tax Collector is also located at 310 School Street, Bronson, FL 32621, and can be reached at the same number: (352) 486-5212. The collector sends out tax bills each November and handles all payment processing. As with all Florida counties, tax bills reflect the taxable value set by the appraiser multiplied by combined millage rates from all local taxing bodies.

Florida's early-payment discounts apply in Levy County. Pay in November for 4% off, December for 3%, January for 2%, and February for 1%. Taxes become delinquent after March 31. At that point, the collector must conduct a tax certificate sale in June. Bidders compete to cover the unpaid amount plus interest. The certificate holder earns interest until the property owner redeems the certificate or the holder applies for a tax deed. All of that is governed by Chapter 197, Florida Statutes.

You can check on your tax bill and pay online through the county's collector portal. The Florida Tax Collectors Association website links to all county collector offices and can help you find current payment options for Levy County. In-person payments are also accepted at the Bronson office during regular business hours.

Homestead and Other Exemptions

Levy County property owners who use their home as a primary residence can apply for the homestead exemption. The exemption is worth up to $50,000 in assessed value reduction, the first $25,000 applies to all taxing authorities, and the second $25,000 applies to non-school levies only. The deadline to file is March 1 of the tax year. Applications go to the Property Appraiser's office in Bronson.

Homestead protection also activates Save Our Homes, which caps annual assessment increases at 3% or the rate of inflation, whichever is lower. For longtime homeowners in areas with rising values, this cap can mean a taxable value well below actual market value. The cap resets when the property is sold or the homestead is removed. Chapter 196, Florida Statutes covers all exemption programs.

Other exemptions available in Levy County include senior exemptions for qualified low-income residents age 65 and older, disability exemptions, and veteran exemptions for those with service-connected disability ratings. Each has its own income or eligibility requirements. The appraiser's office can walk you through which ones apply to your situation. Forms are also available through the DOR forms page.

Accessing Levy County Property Records

Property tax records in Levy County are open to the public under Chapter 119, Florida Statutes. You do not need to give a reason to view assessment data, ownership information, or tax payment history. Records are available online at no charge through the appraiser's website.

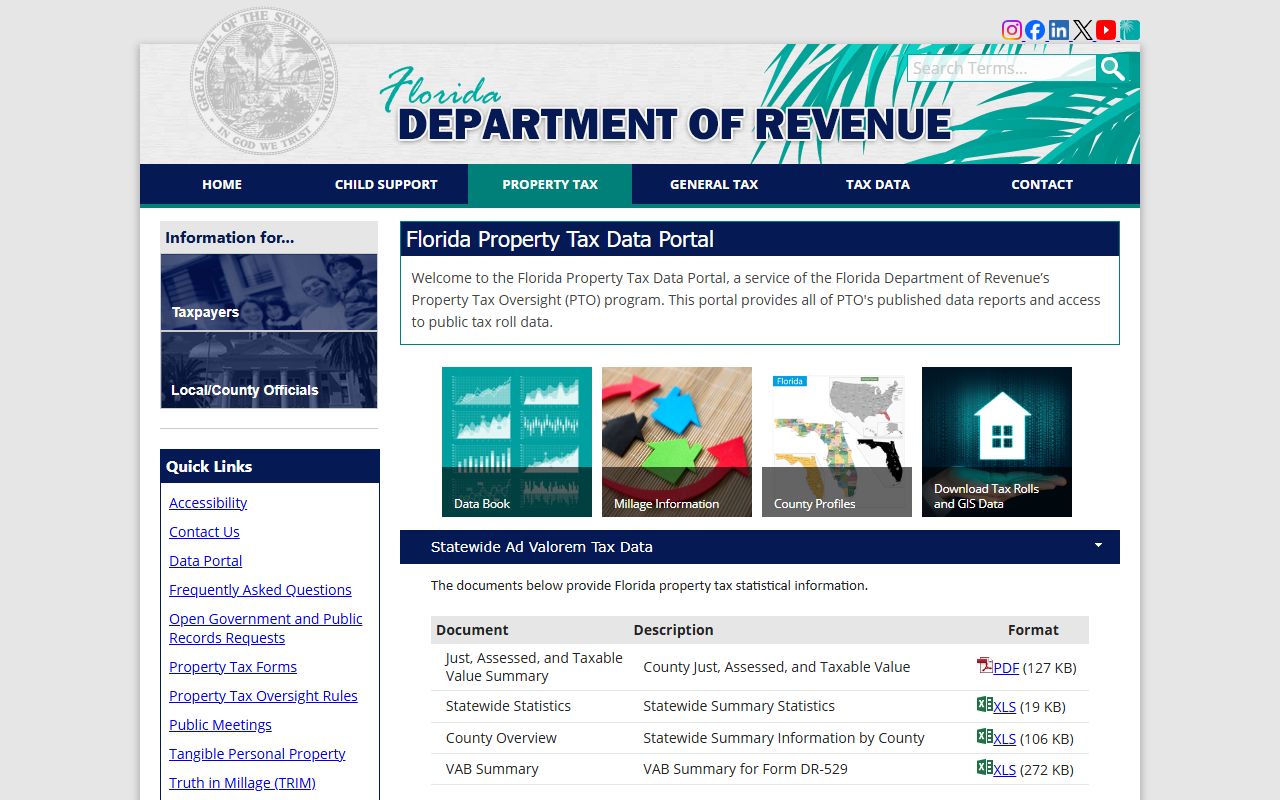

The Florida Department of Revenue also maintains a statewide data portal at floridarevenue.com/property/Pages/DataPortal.aspx. From there, you can download bulk property data for Levy County or any other Florida county. This is particularly useful for researchers, real estate professionals, or anyone who needs more than one parcel's data at a time.

The Florida DOR data portal provides bulk downloads of Levy County property records.

Bulk data from the DOR portal is available for free and is updated regularly for all Florida counties including Levy.

In-person records requests are accepted at the Bronson office. For formal public records requests, contact the appraiser's office in writing. Staff can help identify which records are available and how to get them.

TRIM Notices and Appeals

Levy County property owners receive Truth in Millage (TRIM) notices each August. These show your proposed assessed value, exemptions, and the tax rates proposed by each local taxing authority. The TRIM notice also lists public hearing dates where you can comment on proposed millage rates before they are set.

If you disagree with your assessed value, you have 25 days from the date of the TRIM notice to file a petition with the Value Adjustment Board. The Levy County VAB handles disputes over assessments, exemption denials, and classification decisions. You can also contact the appraiser's office directly to request an informal review before filing a formal petition. Many disputes are resolved at the informal stage.

The filing fee for a VAB petition is $15 per parcel in most cases. Petitions go to the Clerk of Circuit Court, not the appraiser. Once filed, you will receive a hearing date. You can present evidence, and the appraiser must also present the basis for their value. The board's decision can be appealed to circuit court if needed under Chapter 194.

Statewide Property Tax Resources

The Property Appraisers Association of Florida represents all county appraisers and tracks changes in state law that affect assessment. Their site has a directory of all 67 county appraiser offices. The Florida Tax Collectors Association does the same for collector offices. Both are useful if you need to cross-reference Levy County with nearby counties.

Levy County borders several counties with different property markets. Alachua County to the east includes Gainesville, a university city with a strong real estate market. Marion County to the southeast includes Ocala. Citrus County lies to the south, with significant waterfront and retirement residential development. Each county's appraiser operates independently but follows the same state laws.

The Florida DOR oversees all county property appraisers and publishes guidance on assessment standards.

State oversight ensures Levy County's assessment process follows the same standards used across all Florida counties.

Nearby Counties

Levy County shares borders with several North and Central Florida counties. Each maintains its own property tax records.