Columbia County Property Tax Records

Columbia County property tax records cover every parcel in a county centered on Lake City in north-central Florida. The Property Appraiser sets assessed values each year, and the Tax Collector handles billing and payment. Whether you own a home in Lake City, farmland in the county's rural stretches, or commercial property along the I-75 corridor, this page covers how to find parcel data, review your assessed value, understand available exemptions, and manage your tax bill through Columbia County's official offices.

Columbia County Quick Facts

Columbia County Property Appraiser

The Columbia County Property Appraiser's office is at 135 N.E. Hernando Ave., Suite 238, Lake City, FL 32055. Phone: (386) 758-1083. Email: jeff@ccpafl.com. The appraiser is an independently elected official who values all real property and tangible personal property in Columbia County as of January 1 each year. That January 1 assessment date is set by state law and does not shift based on when sales, improvements, or ownership changes happen during the year.

The office uses three main approaches to assess property. Sales comparison is most common for residential parcels, the appraiser reviews recent sales of similar homes in the same area and uses those prices to set the value of comparable properties. For income-producing commercial property, an income approach estimates what the property could earn as a rental. For special-use or unique properties, a cost approach estimates what it would cost to replace the improvements at current prices, adjusted for depreciation.

In August, the appraiser mails TRIM notices to every property owner in Columbia County. The TRIM notice shows your proposed assessed value, any exemptions applied, and the rates proposed by each taxing body, the county commission, the school board, the city (if applicable), and water management. This notice is not a bill. It is a heads-up. Review it closely. If the value looks wrong, August is the time to call the appraiser's office and ask questions.

The Florida Department of Revenue oversees all county property appraisers statewide. Their property tax page is at floridarevenue.com/property.

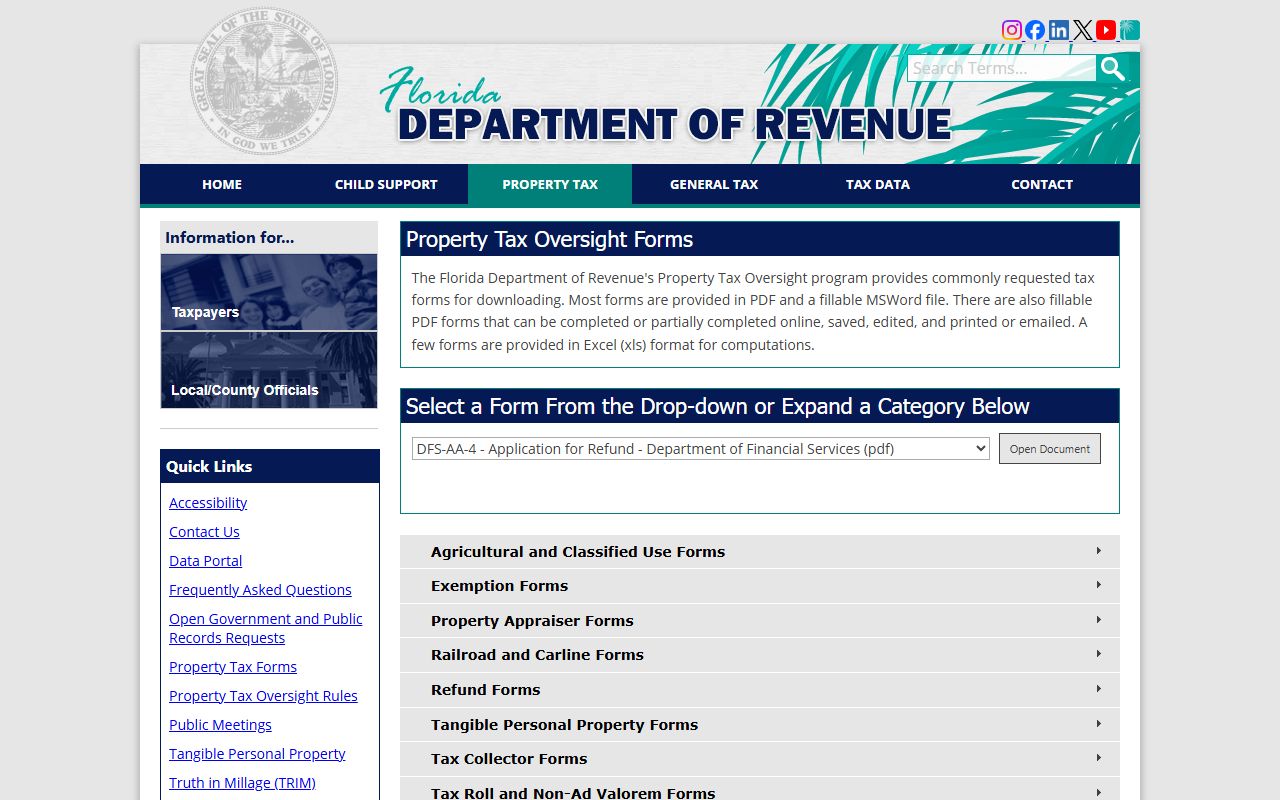

The Florida Department of Revenue's Property Tax Oversight homepage explains the statewide system that guides Columbia County's assessment process.

The DOR site links to county contacts, forms, exemption rules, and guidance on the annual assessment and billing cycle.

Columbia County Tax Collector

The Tax Collector is located at 135 NE Hernando Ave., Suite 125, Lake City, FL 32055. Phone: (386) 758-1077. Fax: (386) 719-7460. The collector is a separate elected official from the appraiser. Once the appraiser certifies the tax roll in October, the collector generates and mails property tax bills by November 1. Payment is due by March 31 each year.

Florida's early-payment discount system applies in Columbia County just as it does statewide. Pay in November for 4% off. Each month after that, the discount drops by one point. By February it is 1%. After March 31, no discount applies and the account is delinquent. Tax certificates are then sold in a late-spring auction for unpaid accounts. Investors pay the overdue amount and earn interest until the owner redeems the certificate.

The Tax Collector also handles vehicle registrations, driver license issuance, hunting and fishing licenses, and business tax receipts. For property tax questions specifically, the collector's office is the right contact for billing, payment confirmation, installment plan details, and delinquency status. Value questions go to the Property Appraiser.

Note: The Tax Collector's records are updated after each payment. If you recently paid online, allow a few business days for the record to reflect the payment before assuming there is an error.

How to Search Columbia County Property Tax Records

For parcel data and assessed values, contact the Columbia County Property Appraiser's office directly or check their online resources. The appraiser can look up any parcel by owner name, property address, or parcel identification number. Providing the parcel ID number is the fastest approach, it eliminates any ambiguity from address formatting or common names. You can find the parcel ID on a deed, a prior tax bill, or a title report.

Each parcel record from the appraiser's office shows the owner of record, mailing address, property use code, land value, building or improvement value, total assessed value, any exemptions, and the legal description. Sales history data is also typically available and shows when the property last transferred and at what price. That data is used to set comparable values for similar nearby properties.

Tax payment records, current bills, and delinquency information come from the Tax Collector's office. Search by parcel number or property address. The collector's records show the current year's bill amount, any prior-year payments, and whether a tax certificate has been issued. All of this is public record under Chapter 119, Florida Statutes. You do not need to own the property or state a reason to access these records.

The Florida Department of Revenue's statewide data portal at floridarevenue.com/property/Pages/DataPortal.aspx allows bulk download of Columbia County and other county assessment rolls for researchers and data users.

Property Tax Exemptions in Columbia County

Homestead exemption is available to any Columbia County resident who owns and occupies their home as a primary residence. Apply with the Property Appraiser by March 1. The exemption removes up to $50,000 from your assessed value. The first $25,000 applies against all taxing authorities. The second $25,000 applies only to non-school taxes, and only if your property is valued between $50,000 and $75,000. The result is a meaningful reduction in the annual tax bill for homestead-eligible owners.

Homestead also triggers the Save Our Homes cap under Chapter 193, Florida Statutes. Once you have homestead, your assessed value can only rise by 3% or the CPI change, whichever is lower. If you have owned a Columbia County home for several years, your assessed value may be significantly below the current market value thanks to the SOH cap. That benefit is portable, if you sell and buy another Florida home, you can transfer the accumulated SOH savings to the new property's assessment.

Other exemptions available in Columbia County include the widow and widower exemption, the veteran disability exemption, the total and permanent disability exemption, the deployed military exemption, and the senior citizen low-income exemption. Documentation is required for each. Contact the Property Appraiser's office to confirm which documents are needed before applying.

Business owners must file a tangible personal property return by April 1 each year to keep the $25,000 TPP exemption. Failing to file results in a penalty and may cause the exemption to lapse. Chapter 196, Florida Statutes lists all available property tax exemptions and their eligibility requirements.

Appealing Your Columbia County Assessment

When your TRIM notice arrives in August and the number looks too high, start by calling the Columbia County Property Appraiser at (386) 758-1083. Many problems are simple data errors, wrong square footage, incorrect property class, or a feature listed that does not exist on the property. Those corrections can be made quickly and informally without any formal filing. If the value itself is in dispute, bring comparable sales data, a private appraisal, or other market evidence.

If the informal review does not produce a fair result, file a petition with the Value Adjustment Board. The 25-day filing window opens after the TRIM mailing date in August. Missing that window means waiting until the following year. The VAB is an independent body that hears property tax disputes. A special magistrate reviews your evidence and the appraiser's position and makes a recommendation.

To succeed at the VAB, you need evidence that the appraiser's value exceeds what the property would sell for in the open market as of January 1 of the tax year. Comparable sales from that time period are your best evidence. Chapter 194, Florida Statutes covers VAB petition requirements, hearing procedures, and what happens if you want to take your appeal to circuit court after a VAB decision.

Always pay your taxes on time even if a VAB petition is pending. Delinquency and the appeal process are separate. Winning the VAB gets you a refund. Skipping payment while you appeal gets you a delinquency problem on top of the value dispute.

Paying Columbia County Property Taxes

Tax bills go out November 1 and are due March 31. Pay in November for the full 4% discount. December is 3%. January is 2%. February is 1%. After March 31, the discount is gone and the account becomes delinquent. The discounts are automatic, you do not need to request them. Just pay earlier in the cycle.

The Tax Collector accepts in-person payments at 135 NE Hernando Ave., Suite 125, Lake City. Online and mail payments are also accepted. Check the collector's website for current hours and any online payment fees. Credit card payments may carry a convenience charge. Bank transfers are typically processed without added fees. The Florida Tax Collectors Association at floridataxcollectors.com provides information about payment methods and the installment plan available to eligible property owners.

Delinquent accounts enter the tax certificate sale process each spring. Certificates are auctioned to investors who pay the overdue taxes and earn interest. Property owners must then pay the investor to redeem the certificate and clear the lien. If a certificate goes unredeemed for two years, the holder can apply for a tax deed. That process can result in the forced sale of the property to recover the overdue amount. Chapter 197, Florida Statutes covers the full delinquency, certificate, and tax deed process for all Florida counties.

Columbia County Property Records and Public Access

Columbia County property tax records are public under Chapter 119, Florida Statutes. Anyone can access assessed values, owner names and mailing addresses, sales history, parcel descriptions, exemption types, and tax payment data. No stated reason is required. The records belong to the public.

Some information is protected. Social Security numbers, personal income data, financial documents submitted with exemption applications, and bank or payment account information are confidential. The records will confirm that a homestead or other exemption is on file, but the supporting documentation used to qualify is not accessible to the public.

Most records are accessible through the Property Appraiser and Tax Collector offices in Lake City, by phone, by email, or in person. The Florida Department of Revenue provides statewide property tax forms at floridarevenue.com/property/Pages/Forms.aspx. The Florida DOR also maintains a public records request process for state-level records at floridarevenue.com.

The Florida Department of Revenue's property tax forms page provides downloadable forms used in the assessment, exemption, and appeals processes across all Florida counties.

Forms available there include exemption applications, TPP return forms, and VAB petition templates that apply in Columbia County as in all other Florida counties.

Cities in Columbia County

Columbia County's main communities include Lake City, Fort White, and Jasper. Lake City is the county seat and the center of county government, housing both the Property Appraiser and Tax Collector offices. Fort White is a smaller incorporated town in the western part of the county. None of Columbia County's communities exceed 75,000 residents, so no dedicated city pages exist at this time. All property tax records for the county, including Lake City properties, are managed through the county-level offices described above.