Search Alachua County Property Tax Records

Alachua County property tax records are public documents maintained by the Property Appraiser and Tax Collector offices in Gainesville. These records cover every parcel in the county and include assessed values, exemption status, ownership data, and tax bill history. Whether you own land here, plan to buy, or just need to check on a parcel, this guide explains how to find and use those records.

Alachua County Quick Facts

Alachua County Property Appraiser

The Alachua County Property Appraiser operates from 5830 NW 34th Blvd. in Gainesville, FL 32653. You can reach the office by phone at (352) 374-5236. The office is responsible for valuing all real and personal property in the county as of January 1 each year. That value forms the base for your annual tax bill. The appraiser does not set tax rates and does not collect taxes, those are separate functions handled by elected bodies and the tax collector.

The appraiser's office maintains the official property roll for Alachua County. This roll lists every parcel with its legal description, owner of record, assessed value, taxable value, and any exemptions applied. Records are updated throughout the year as sales occur, permits are pulled, and ownership changes. The office uses mass appraisal methods that follow Florida Department of Revenue guidelines, so values are based on comparable sales and property characteristics rather than individual inspections each year.

The Alachua County Property Appraiser website gives you online access to parcel data. You can search by owner name, parcel ID, or address. The site shows current assessed values, prior-year values, exemption detail, and sales history. Aerial maps and GIS tools are also available on the site.

The Florida Department of Revenue oversees county property appraisers statewide. You can find guidance on how assessment works at the DOR Property Tax Oversight page. Under Chapter 192, Florida Statutes, "just value" is the standard for property assessment across the state.

The office at 5830 NW 34th Blvd. is open during normal business hours on weekdays. Staff can help with questions about your assessment, exemption applications, and how to read your TRIM notice.

The Alachua County Property Appraiser's online portal lets you look up records at no cost. Printed reports or certified records may carry a fee when requested in person.

The Alachua County Property Appraiser website is the starting point for most property searches in the county.

The search tool on the appraiser site lets you pull up any parcel in Alachua County quickly.

Note: The appraiser's values are not the same as market values. Florida law requires a separate calculation for SOH-capped properties.

Tax Billing and Collection in Alachua County

The Alachua County Tax Collector handles billing, payment, and enforcement of property taxes. The office is located at 5830 NW 34th Blvd., Gainesville, FL 32653, and can be reached at (352) 374-5236. The tax collector's website is where you go to pay a bill, look up a balance due, or get information on tax certificates.

Tax bills go out in November each year. They reflect the taxable value set by the appraiser plus any exemptions, multiplied by the millage rates set by local governments. Alachua County has several taxing authorities, including the county commission, the school board, and special districts, so the total bill on any parcel reflects several separate millage rates added together.

Florida offers a discount schedule for early payment. Pay in November and you get 4% off. December earns 3%, January 2%, and February 1%. After March 31, taxes become delinquent. Once taxes are delinquent, the collector holds a tax certificate sale where investors bid on the right to collect the unpaid taxes plus interest. That process is governed by Chapter 197, Florida Statutes.

You can pay Alachua County property taxes online at the tax collector's payment portal. The site accepts major credit cards and e-checks. In-person payment is available at the main office and at branch locations throughout the county. The collector's office can also answer questions about payment plans for low-income seniors and other hardship situations.

The Alachua County Tax Collector's payment portal handles online tax payments.

The tax collector's online portal shows current amounts due and accepts payment directly.

How to Search Alachua County Property Tax Records

Most people start their search on the Alachua County Property Appraiser's site. The search tool lets you look up any parcel by property address, owner name, or parcel identification number. Once you find a parcel, the record shows the current assessed value, just value, taxable value, land data, building data, and sales history. You can also see which exemptions are on file for that parcel.

If you need tax bill information, how much is owed, whether a bill was paid, or the history of past payments, the tax collector's site has a separate lookup tool. Enter the parcel ID or property address to pull up billing history and current status. These two databases together give a complete view of any property in Alachua County.

For broader research, the Florida Department of Revenue maintains a statewide property tax data portal with downloadable files. This is useful for researchers or investors who want county-level aggregate data rather than individual parcel lookups.

All of these records are public under Chapter 119, Florida Statutes. Anyone can access them without showing ID or stating a reason. Some data, like Social Security numbers on exemption applications, is exempt from disclosure, but the core assessment and tax data is fully open.

Note: Parcel IDs in Alachua County follow a standard format. Using the full parcel ID gives the fastest, most accurate search result.

Property Tax Exemptions Available in Alachua County

Florida offers several property tax exemptions, all of which apply to qualifying Alachua County parcels. The most widely used is the homestead exemption, worth up to $50,000 off the assessed value of a primary residence. The first $25,000 applies to all taxing authorities. The second $25,000 applies to the assessed value between $50,000 and $75,000 and covers all authorities except school taxes.

Homestead also triggers the Save Our Homes cap. Once a property is homesteaded, annual increases in assessed value are limited to 3% or the rate of inflation, whichever is lower. This protection is set out in Chapter 193, Florida Statutes. Over time, SOH can create a large gap between a property's just value and its assessed value, which significantly reduces the tax bill.

Other exemptions available in Alachua County include the senior exemption for low-income residents over 65, disability exemptions, veteran exemptions, and widower exemptions. Each has its own eligibility rules. Applications are filed with the Property Appraiser's office. The deadline to apply for homestead, and for most other exemptions, is March 1 of the tax year. Late applications are generally not accepted.

Tangible personal property (TPP) used in a business also has an exemption, the first $25,000 of value is exempt. Business owners who file a TPP return by April 1 claim this automatically. The return is filed with the appraiser, not the tax collector. Details on exemptions are in Chapter 196, Florida Statutes.

Appealing Your Alachua County Property Assessment

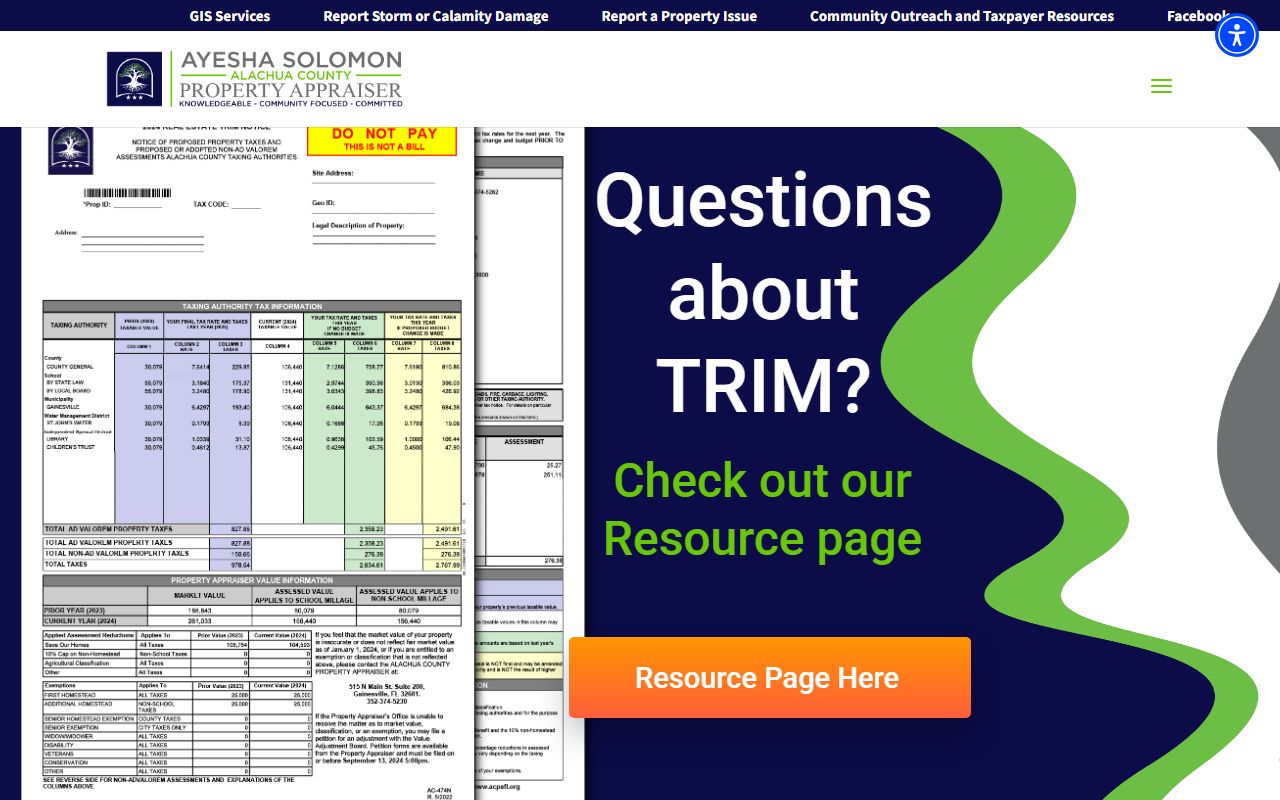

If you think your property is assessed too high, Florida gives you a formal appeal path. Each summer, the Property Appraiser sends a TRIM (Truth in Millage) notice. This notice shows your proposed assessed value and what your taxes will be at that value. You have 25 days from the mailing of the TRIM notice to file a petition with the Value Adjustment Board (VAB).

The Alachua County VAB is an independent board made up of county commission members, school board members, and citizen appointees. When you file a petition, you get a hearing before a special magistrate. The magistrate reviews the appraiser's evidence and your evidence, then makes a recommendation. The board votes to accept or reject that recommendation.

To build a strong case, gather comparable sales from the same area, photos showing any condition issues, and an independent appraisal if you have one. The burden shifts to you to show the appraiser's value is wrong, so good evidence matters. VAB appeals are governed by Chapter 194, Florida Statutes.

If the VAB ruling doesn't go your way, you can still file a lawsuit in circuit court. Most disputes are settled before that point. The filing fee for a VAB petition is modest, it varies by parcel type, and you do not need an attorney, though many commercial property owners use one.

Note: You must pay at least the non-disputed portion of your tax bill while an appeal is pending or risk additional penalties.

Property Tax Payment Options in Alachua County

Alachua County tax bills are mailed in November. The bill covers the prior calendar year's assessment and the current year's millage rates. The face amount on the bill is the full tax before any discount. Pay early and the savings add up, 4% in November, 3% in December, 2% in January, and 1% in February.

Online payment is available through the Alachua County Tax Collector's portal. You can also mail a check to the collector's office or pay in person at any branch location. Partial payments are not generally accepted unless you are on an approved installment plan. The collector offers a quarterly installment plan for those who prefer to spread payments throughout the year, sign-up is in the spring before the bill year begins.

If taxes go unpaid after March 31, they become delinquent. The collector then holds a tax certificate sale in June. Investors pay the delinquent taxes and receive a certificate that earns interest. If the property owner does not redeem the certificate within two years, the certificate holder can apply for a tax deed, which could lead to the sale of the property. This is a serious consequence of non-payment and affects the property record going forward.

The Florida Tax Collectors Association provides general information on the tax collection process statewide, including contacts for county offices.

Accessing Alachua County Property Tax Records Under Public Records Law

Florida's public records law is one of the broadest in the nation. Under Chapter 119, almost all government records are available to anyone who asks. Property tax records, including assessment rolls, tax rolls, exemption records, and payment history, are public. You do not need to be a Florida resident. You do not need to provide a reason for your request.

The most common way to access Alachua County property tax records is through the online portals maintained by the Property Appraiser and Tax Collector. These sites are free to use and updated regularly. For records not available online, older records, bulk data, or certified copies, you can submit a written request directly to the office. The office must respond in a reasonable time. They may charge a fee for copies or staff time spent on large requests, but the records themselves are public.

Some data is protected. Social Security numbers, bank account information, and certain personal details on exemption applications are confidential under Florida law. But the core property data, owner name, address, value, tax amounts, and sales history, is fully open. The Florida DOR directory of county property appraisers and tax collectors lists all county offices with contact information if you need to reach the Alachua County office directly.

Cities in Alachua County

Gainesville is the county seat and the largest city in Alachua County, home to the University of Florida and the main hub for county government. Gainesville property tax records follow the same process as all other Alachua County parcels, assessed by the Property Appraiser at the county level. You can find more detail on Gainesville property tax records on the city page. Smaller communities in the county include Newberry, Archer, Waldo, and Hawthorne, all served by the same county offices.