Find Baker County Property Tax Records

Baker County property tax records are maintained by the Property Appraiser and Tax Collector offices based in Macclenny, Florida. These records cover every parcel in the county and show assessed values, ownership details, exemption status, and tax bill information. This page explains how to search Baker County property tax records, understand your assessment, and access the public data on file.

Baker County Quick Facts

Baker County Property Appraiser

The Baker County Property Appraiser's office is at 32 North 5th Street, MacClenny, FL 32063. The main phone number is (904) 259-6880, and the fax is (904) 259-2279. This office is responsible for assessing all real property and tangible personal property in Baker County as of January 1 each year. The appraiser does not set tax rates or collect taxes, that responsibility belongs to separate elected officials and governing boards.

The appraiser's office builds and maintains the official tax roll. Every parcel in Baker County has a record that includes the legal description, owner of record, land value, improvement value, total just value, assessed value, and taxable value after exemptions. The office uses comparable sales data and Florida Department of Revenue guidelines when setting values. Mass appraisal methods are standard practice for counties of all sizes in Florida.

Baker County is a smaller, rural county with a modest number of parcels compared to urban counties. That said, the appraiser's office maintains full records on all property types, residential, agricultural, commercial, and vacant land. Agricultural classification is common here and can significantly reduce assessed value on qualifying farm and timberland parcels. You apply for agricultural classification with the Property Appraiser by March 1.

Property owners who want to verify their record or check for errors can visit the office in person or call during business hours. Staff can walk you through your assessment, explain how your value was calculated, and help you determine if you qualify for any exemptions. The Florida Department of Revenue maintains a list of all county property appraisers through its Local Officials directory.

Under Chapter 192, Florida Statutes, all property in Florida must be assessed at just value as of January 1. For Baker County parcels, that assessment sets the foundation for each year's tax bill. The appraiser certifies the tax roll to the tax collector each year after the state reviews it.

The Florida DOR Property Tax Oversight program reviews each county's assessment work and can require corrections if values don't meet state standards. This oversight helps keep assessments fair across all 67 counties.

The Florida Department of Revenue Property Tax Oversight program provides statewide guidance on how county appraisers must assess property.

The DOR site explains assessment rules and offers tools for property owners across Florida, including Baker County residents.

Note: Baker County does not have an online parcel search portal as of this writing. Contact the office directly at (904) 259-6880 for parcel-specific records.

Baker County Tax Collector

The Baker County Tax Collector shares an address with the Property Appraiser at 32 North 5th Street, MacClenny, FL 32063. The phone is (904) 259-6880 and fax is (904) 259-2279. The tax collector is responsible for billing and collecting property taxes after the appraiser certifies the tax roll in the fall. The collector also handles motor vehicle tags, driver licenses, and other state services, but property taxes are the primary focus here.

Tax bills go out in November. They show the assessed value, any exemptions, the net taxable value, and each taxing authority's millage rate. Baker County parcels may be subject to county millage, school board millage, and any applicable special district millages. The total bill is the sum of all these components. You only receive one combined bill, but the tax collector sends portions to each taxing authority after collection.

Discounts run from November through February. Pay in November for 4% off, December for 3%, January for 2%, and February for 1%. After March 31, taxes become delinquent and interest begins to accrue. The tax collector then schedules a tax certificate sale, typically in late May or early June. At that sale, investors bid on delinquent parcels and pay the outstanding taxes in exchange for a certificate. The property owner can redeem that certificate by paying the face amount plus interest, but if they don't act within two years, the certificate holder may apply for a tax deed under Chapter 197, Florida Statutes.

The Florida Tax Collectors Association maintains a statewide directory and general resources for taxpayers. Baker County residents should call the office directly for the most current payment options and branch hours.

Searching Baker County Property Tax Records

Baker County is a small county without a dedicated online parcel search portal at this time. The most reliable way to access Baker County property tax records is to contact the Property Appraiser's office directly. Staff can look up any parcel by address, owner name, or parcel identification number and provide the information over the phone or in person. The office can also provide printed reports for a modest fee if you need certified documentation.

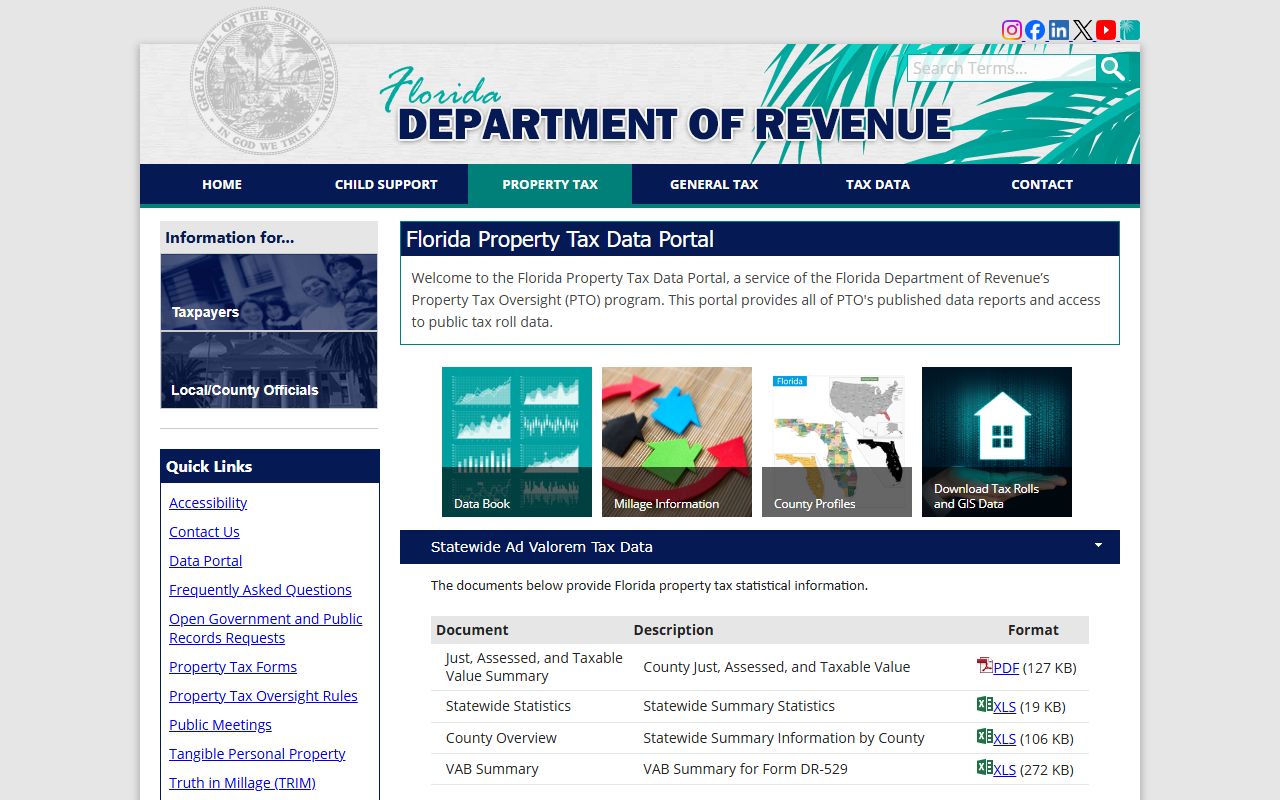

For broader statewide searches and data downloads, the Florida Department of Revenue offers a Property Tax Data Portal. This portal contains county-level data files with assessed values, tax rolls, and exemption summaries. Researchers and investors often use this resource to pull Baker County data in bulk without making individual parcel inquiries.

All Baker County property tax records are public under Chapter 119, Florida Statutes. You do not need to be a Florida resident or state a purpose to access them. The office must respond to written records requests in a reasonable time frame. If the records you need are not available online, a written or in-person request to the Baker County offices at 32 North 5th Street in Macclenny will get you the data.

The Florida DOR Data Portal offers downloadable property tax data for all 67 counties, including Baker County.

The data portal is useful for pulling Baker County assessment summaries, tax roll totals, and countywide exemption data.

Property Tax Exemptions in Baker County

Baker County property owners can apply for the same exemptions available to all Florida property owners. The homestead exemption is the most valuable. It removes up to $50,000 from the assessed value of a primary residence. The first $25,000 reduces value for all taxing authorities. The second $25,000, applied to the portion of value between $50,000 and $75,000, reduces value for all taxing authorities except schools.

Once you receive homestead, the Save Our Homes cap limits how much your assessed value can rise each year. The cap is 3% or the change in the Consumer Price Index, whichever is lower. For long-term homeowners in Baker County, this protection can keep assessed values well below just value, sometimes by tens of thousands of dollars. The cap and its rules are found in Chapter 193, Florida Statutes.

Other exemptions available in Baker County include exemptions for veterans with service-connected disabilities, surviving spouses of veterans or first responders, widows and widowers, and seniors with low income. Agricultural land classification is a common tool in Baker County due to the rural nature of the county, it reduces the assessed value of qualifying farmland significantly below its market value. All exemption applications go to the Property Appraiser at 32 North 5th Street, Macclenny. The deadline for homestead and most other exemptions is March 1. Details on what exemptions are available under Florida law appear in Chapter 196, Florida Statutes.

Note: Agricultural classification is not an exemption, it's a use-based reduction in assessed value. Missing the March 1 deadline means waiting until the following year to apply.

Challenging a Baker County Property Assessment

If you believe the Baker County Property Appraiser has set your value too high, you can challenge it through the Value Adjustment Board (VAB). The VAB in Baker County operates as required under Florida law and follows the same general process used statewide. You must file your petition within 25 days of the mailing of the TRIM notice, which typically arrives in August or early September.

The TRIM notice shows your proposed value, any exemptions already on file, and an estimate of what your taxes will be. If you disagree with the value shown, gather evidence before your hearing. Good evidence includes recent sales of similar properties nearby, a licensed appraisal of your property, or photos documenting conditions that hurt value. The hearing is conducted by a special magistrate, not by the appraiser. You present your case, the appraiser presents theirs, and the magistrate recommends a decision to the VAB.

Appeals are governed by Chapter 194, Florida Statutes. If the VAB decides against you, you can still pursue the matter in circuit court. Most disputes settle at the VAB level. You should pay at least the undisputed portion of your tax bill during the appeal to avoid penalties.

Baker County Property Tax Payments and Delinquency

Baker County tax bills are mailed in November each year. Early payment earns a discount, 4% off in November, 3% in December, 2% in January, and 1% in February. After March 31, the bill is delinquent. At that point, the Tax Collector adds interest and eventually proceeds with a tax certificate sale to recover the unpaid amount.

Payments can be made in person at the Baker County offices at 32 North 5th Street in Macclenny. Call the office at (904) 259-6880 to confirm current payment methods and hours. Mail-in payments by check are typically accepted when accompanied by the payment stub from your tax bill. Always keep a receipt or confirmation of payment for your records.

If a tax certificate is sold on your parcel, the investor who purchased it earns interest on the amount they paid. You can still pay off the certificate, called redeeming it, by paying the original amount plus accrued interest. If you do not redeem it within two years, the certificate holder can file for a tax deed. That process can ultimately result in the forced sale of your property at public auction. Avoiding delinquency is strongly in the interest of every Baker County property owner.

The Florida Tax Collectors Association has general resources on the tax collection and tax certificate process for all Florida counties.

Cities in Baker County

Macclenny is the county seat and the largest community in Baker County. Glen St. Mary and Sanderson are smaller communities within the county. None of these communities meet the population threshold for a dedicated city page, but all property within Baker County, regardless of which community it is in, is assessed and taxed by the same Baker County offices. Residents of Macclenny, Glen St. Mary, and other Baker County communities use the same Property Appraiser and Tax Collector contacts listed above.