Nassau County Property Tax Records

Nassau County property tax records are public documents that cover every parcel in this fast-growing northeast Florida county. The Property Appraiser and Tax Collector each maintain separate records tied to land and buildings in Fernandina Beach, Yulee, Callahan, and the surrounding areas. This page explains how to find those records, how the assessment process works, and what Nassau County property owners need to know about exemptions, appeals, and tax payments.

Nassau County Quick Facts

Nassau County Property Appraiser

The Nassau County Property Appraiser's office is located at 96135 Nassau Place, Suite 4, Yulee, FL 32097. The main phone number is (904) 491-7300, and the fax is (904) 491-7301. The office is responsible for valuing all real property and tangible personal property in Nassau County as of January 1 each year. That value forms the base for your annual tax bill. The appraiser does not set tax rates and does not collect taxes.

Nassau County has been one of Florida's faster-growing counties, driven by its location just north of the Jacksonville metropolitan area. The appraiser's office tracks sales data across the county, from barrier island properties on Amelia Island to inland parcels in Callahan and Hilliard, to set values that reflect the local market. The official property roll includes each parcel's legal description, owner of record, assessed value, taxable value, and any exemptions. Under Chapter 193, Florida Statutes, all county appraisers must assess property at just value using mass appraisal methods consistent with Department of Revenue guidelines.

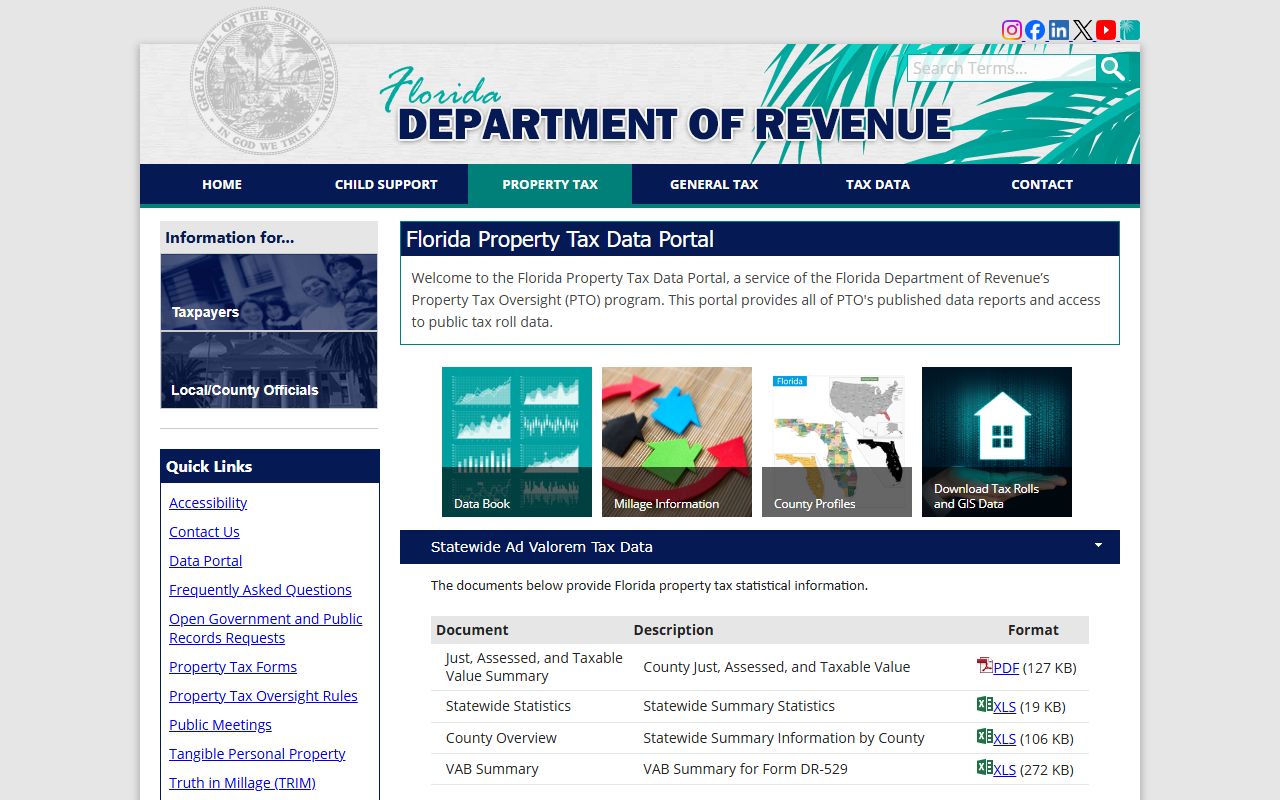

The Florida Department of Revenue's Property Tax Oversight program supervises all county appraisers statewide. You can review the statewide standards on the DOR's website to understand how Nassau County's assessments fit into the broader Florida system.

The Florida DOR property tax oversight page explains assessment standards that apply in Nassau County and across the state.

The DOR site links to statewide forms, FAQ resources, and contact information for every county appraiser in Florida.

Property owners can reach the Nassau County appraiser's office directly at (904) 491-7300 during regular business hours for help with parcel lookups, assessment questions, and exemption applications.

Homestead Exemption and SOH Cap

Nassau County property owners who use their home as a primary residence can apply for Florida's homestead exemption. The exemption removes up to $50,000 from the assessed value used to calculate taxes. The first $25,000 applies to all taxing authorities, and the second $25,000 applies only to non-school millage. You must file with the Nassau County Property Appraiser by March 1 of the tax year. Applications can be submitted in person at the Yulee office, by mail, or online if the appraiser's office has that option available. Check the office's current filing options when you are ready to apply.

The Save Our Homes cap is a key protection for Nassau County homeowners with homestead status. Florida law limits the annual increase in assessed value to the lesser of 3% or the Consumer Price Index change. In a county where property values have risen quickly, this cap can mean your taxable value is well below market value. That gap is your SOH benefit. When you sell and buy a new Florida home, you can transfer that benefit to the new property through a process called portability. You apply for portability at the same time as your new homestead application.

Additional exemptions are available for widows, widowers, persons with disabilities, and qualifying veterans. Senior citizens who meet income requirements may also qualify for an extra reduction on county and city levies. These exemptions are set out in Chapter 196, Florida Statutes. Call the appraiser's office at (904) 491-7300 to find out which exemptions you may qualify for.

Tax Bills and Payment

The Nassau County Tax Collector handles billing and payment for property taxes. The office is located at 86130 License Road, Suite 5, Fernandina Beach, FL 32034. The phone number is (904) 491-7400, and the fax is (904) 432-0220. Tax bills are mailed in November and reflect the taxable value set by the appraiser multiplied by the millage rates set by local governing bodies, including the county commission, school board, and special districts.

Florida's early-payment discount schedule applies in Nassau County. Pay in November for a 4% discount, December for 3%, January for 2%, or February for 1%. Taxes not paid by March 31 are delinquent as of April 1. Delinquent taxes trigger the tax certificate process under Chapter 197, Florida Statutes. Investors can bid on certificates, and if they are not redeemed within two years, a tax deed application can proceed.

Nassau County taxes can be paid online, by mail, or in person at the Fernandina Beach office. The tax collector's office can provide current payment options and answer questions about your bill. An installment plan is available for qualifying taxpayers who apply before April 30 of the prior year. The plan splits your annual tax into four payments.

Tangible Personal Property Returns

Businesses in Nassau County must file a Tangible Personal Property return with the Property Appraiser by April 1 each year. TPP covers non-real-estate business assets: furniture, fixtures, equipment, machinery, and similar items. The first $25,000 in value is exempt, but you must file a return to claim it. Returns filed after April 1 lose the exemption and face a penalty based on the percentage of value discovered after the deadline.

New businesses in Nassau County must file a TPP return even in their first year of operation. The appraiser's office assigns a TPP account number and tracks the assets reported each year. Existing businesses update their returns annually to reflect current assets and depreciation schedules. The forms are available from the Nassau County Property Appraiser's office at (904) 491-7300 or from the Florida DOR forms page.

Appealing Your Property Assessment

Nassau County property owners who disagree with their assessed value can appeal to the Value Adjustment Board. You must file a petition within 25 days of the mailing date shown on your TRIM notice. The TRIM notice arrives each August and shows the proposed assessed value, applicable exemptions, and estimated taxes. Check the mailing date on the notice and count from there, missing the 25-day window means you cannot appeal for that tax year.

The VAB process in Nassau County follows the same structure as other Florida counties. A special magistrate reviews evidence from the property owner and the appraiser's office and issues a recommendation. The VAB board then issues a final decision. You can represent yourself or hire an attorney or licensed appraiser. The best evidence to bring includes comparable sales data for similar Nassau County properties, a private appraisal, or records documenting errors in the appraiser's property record. The full appeals process is set out in Chapter 194, Florida Statutes.

Accessing Nassau County Property Data

Nassau County property records are public under Chapter 119, Florida Statutes. You can look up parcel data through the appraiser's office in person or by phone. For bulk data needs or research, the Florida Department of Revenue's data portal offers full county assessment rolls for download. These rolls include assessed values, exemptions, parcel details, and ownership data for every county in Florida, including Nassau.

The Florida DOR data portal makes bulk Nassau County assessment data available for download at no cost.

The DOR data portal is especially useful for real estate professionals and researchers who need data on multiple Nassau County parcels at once.

The Property Appraisers Association of Florida lists contact information for all county appraisers, including Nassau. The Florida Tax Collectors Association does the same for tax collector offices. Both organizations provide resources on how the property tax system works in Florida.

More Resources for Nassau County Property Owners

The Florida DOR property tax FAQ answers common questions about assessment, exemptions, and appeals. It is a good starting point if you are new to Florida property taxes or are trying to understand a specific issue. The DOR also publishes guides and fact sheets on topics like portability, the Save Our Homes cap, and TPP filing requirements.

For locally specific questions, like how to request a parcel review, where to file exemption paperwork, or how to get a copy of your property record card, contact the Nassau County Property Appraiser's office directly at (904) 491-7300. Staff can help you understand your assessment, point you toward the right forms, and explain what to expect if you decide to appeal.

The Florida DOR local officials directory links to all county appraisers, including Nassau County.

The DOR directory is updated regularly and links directly to each county office's website.

Cities in Nassau County

Nassau County has no cities above the population threshold for individual city pages. Fernandina Beach is the county seat and largest city, but it falls below the qualifying threshold. Property tax records for all Nassau County parcels are maintained by the county appraiser's office in Yulee.