Lee County Property Tax Records Search

Lee County property tax records cover a large and active real estate market on Florida's southwest coast. The Property Appraiser sets assessed values for every parcel in the county each year, and the Tax Collector handles billing, payment processing, and delinquent accounts. This page covers how to find parcel records, look up assessments, claim exemptions, and navigate the tax roll for properties in Cape Coral, Fort Myers, Lehigh Acres, and communities throughout Lee County.

Lee County Quick Facts

Lee County Property Appraiser

The Lee County Property Appraiser is located at 2480 Thompson Street, Fort Myers, FL 33901. The main phone is (239) 533-6100 and fax is (239) 533-6144. The appraiser's online portal is at leepa.org. The Property Appraiser is an elected official who operates independently from the Lee County Board of County Commissioners. The office is responsible for placing a just value on every parcel of real property and tangible personal property in the county as of January 1 each year.

Lee County is one of the largest counties in Southwest Florida. The property base is enormous and varied. Cape Coral, one of the largest cities in the state by land area, is almost entirely residential with a grid of canals running through it. Fort Myers serves as the commercial and government center. Lehigh Acres, an unincorporated community, has one of the largest populations of any unincorporated area in Florida. Bonita Springs sits in the south near the Collier County line. The appraiser's office values all of these through Florida's mass appraisal process, driven heavily by sales data from arm's-length transactions.

TRIM notices go out in August. Every Lee County property owner receives one showing the proposed assessed value and the proposed millage rates from each taxing authority covering their parcel. That might include the county, the school district, municipalities like Cape Coral or Fort Myers, and various special districts. The TRIM notice is not a bill. It is your notification and your opportunity to review the numbers before the tax roll is certified. You have 25 days from the mailing date to file a petition if you disagree.

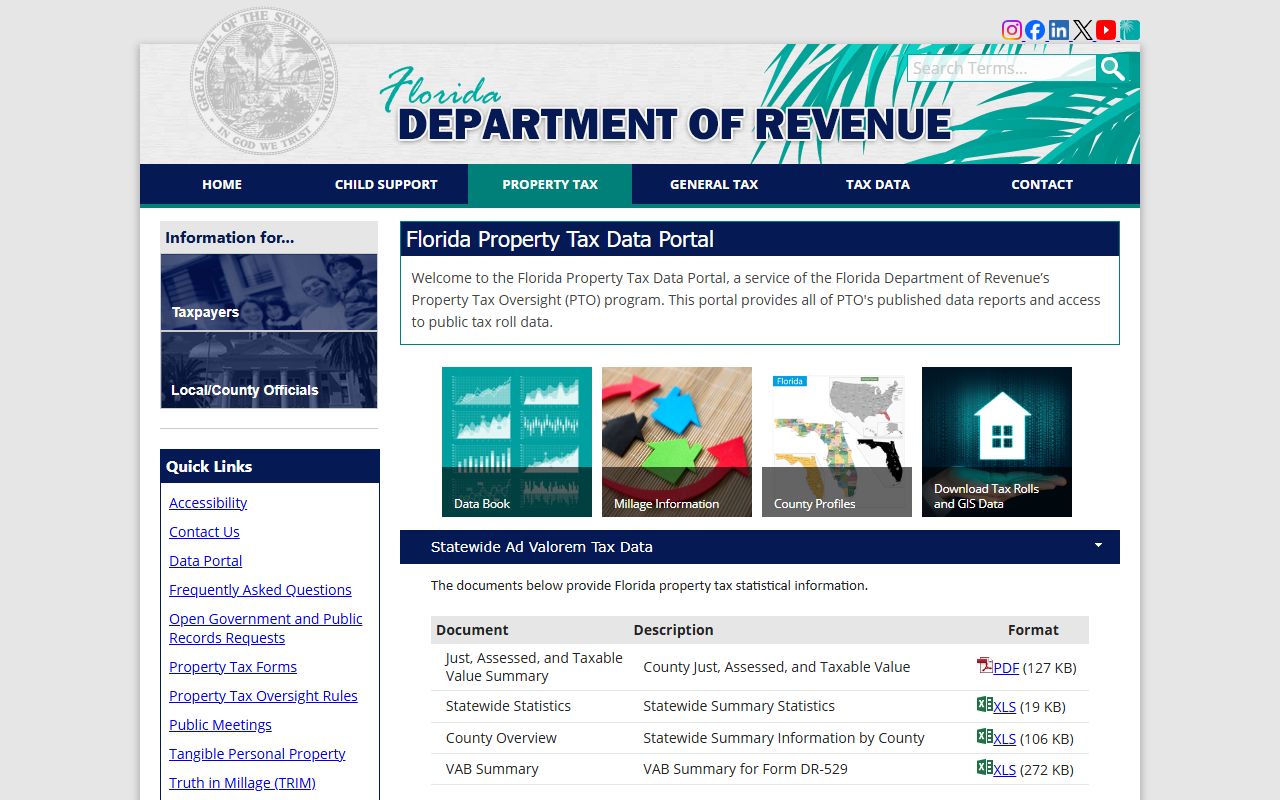

The Florida Department of Revenue's statewide data portal provides downloadable assessment data for Lee County and all 67 Florida counties.

That portal is useful for bulk research on assessment trends and parcel-level data across Lee County.

Lee County Tax Collector

The Lee County Tax Collector's main office is at 2480 Thompson Street, Fort Myers, FL 33901, with a main phone of (239) 533-6000 and fax (239) 533-6144. The Tax Collector is a separate elected official. After the appraiser certifies the tax roll in October, the collector sends bills by November 1 and accepts payments through March 31. The collector also maintains service centers at multiple locations around Lee County to reduce travel time for residents in Cape Coral, Lehigh Acres, Bonita Springs, and other communities.

Florida's early payment discount schedule applies in Lee County. Pay your bill in November and save 4% of the total amount. December is 3%, January is 2%, and February is 1%. After March 31, the discount disappears and the bill becomes delinquent. On April 1, interest and advertising fees begin accruing. The certificate sale follows in May or June. For a county with hundreds of thousands of parcels, the certificate sale process is very active each year.

Lee County residents can pay online through the Tax Collector's website, by mail, or in person at any service center location. An installment payment plan is available for owners who prefer quarterly payments. Apply by April 30 to enroll for the upcoming year. Visit floridataxcollectors.com for statewide guidance on payment procedures and options.

How to Look Up Lee County Parcel Records

Start at leepa.org. No account is needed. You can search by parcel ID number, owner name, or street address. With over 400,000 parcels in Lee County, a precise search input saves time. Use the parcel ID when you have it. If searching by address in Cape Coral or Lehigh Acres, be as specific as possible since both areas have large numbers of similar addresses.

Each parcel record shows the current assessed value, the split between land and improvements, the legal description, recent sales data, and any exemptions on file. For waterfront properties in Lee County, the land value component is often substantial and reflects proximity to canals, the Caloosahatchee River, or the Gulf. Building sketches and square footage breakdowns are included in many records and can be useful for comparing your assessment to similar homes in your neighborhood.

For payment history, current bills, and delinquent account status, use the Tax Collector's online portal or call the Fort Myers office. If you are buying a property in Lee County, verify tax status before closing. Outstanding tax certificates represent liens that need to be cleared. Your title company or attorney should catch these during the title search, but a direct check with the collector adds certainty.

All Lee County property tax records are public under Chapter 119, Florida Statutes. Assessed values, ownership data, sales history, exemption types, and payment records are all accessible to anyone at no cost. Confidential items include Social Security numbers and income information submitted with exemption applications.

Homestead Exemption and the SOH Cap

The homestead exemption is the most important tax benefit for Lee County homeowners who use their property as a primary residence. It removes up to $50,000 from the taxable assessed value. The first $25,000 applies to all taxing authorities. The second $25,000 applies only to non-school levies on the assessed value between $50,000 and $75,000. File the application with the Lee County Property Appraiser by March 1. You must own the property, live there as your primary residence, and be a Florida resident as of January 1 to qualify.

Homestead activates the Save Our Homes assessment cap. The cap limits annual increases in your assessed value to either 3% or the change in the Consumer Price Index, whichever is less. Lee County has seen significant real estate price appreciation in recent years, particularly in Cape Coral and along waterfront areas. For long-time homeowners, the SOH cap can mean a very wide gap between assessed value and market value. When the property sells, the cap resets for the new buyer. Chapter 193, Florida Statutes governs how the cap is calculated and how accumulated SOH benefits can be ported to a new homestead within Florida.

Lee County also processes exemptions for widows, widowers, veterans, people with permanent disabilities, and low-income seniors. Businesses with tangible personal property must file annual returns by April 1 to maintain the $25,000 TPP exemption. Missing the April 1 deadline results in a penalty. See Chapter 196, Florida Statutes for the full list of exemptions and their eligibility requirements. All applications go through the Property Appraiser's office in Fort Myers.

Assessment Appeals in Lee County

If you think your Lee County assessment is too high, start by contacting the Property Appraiser's office. Request an informal review before filing a petition. Bring comparable sales data, a private appraisal, or documented evidence of condition issues that affect your property's value. Many property owners resolve their disputes at this stage without a formal VAB petition. Lee County's large parcel volume means the VAB process can involve wait times, so informal resolution is worth pursuing first.

If you need to go to the VAB, file your petition within 25 days of the TRIM notice mailing date. That deadline is firm. The Value Adjustment Board uses special magistrates to hear cases and issue recommendations. At the hearing, you present your evidence. The appraiser presents theirs. You need to show that the assessed value is not justified by the market data for your property type and location.

Chapter 194, Florida Statutes sets out the full appeals process, petition requirements, hearing rules, and the standards used to evaluate both informal and formal challenges. Filing a VAB petition does not pause your tax due date. Pay by March 31 to avoid delinquency. If you win the appeal, the difference is refunded. Circuit court is an option after the VAB, but that step typically requires an attorney and a longer timeline.

Property Tax Payments and Delinquency

Lee County property tax bills are mailed by November 1. Early payment discounts run through February. Pay in November for 4% off, December for 3%, January for 2%, and February for 1%. After March 31, no discount and the bill is delinquent. April 1 is the hard cutoff.

Tax certificate sales in Lee County run in May or June. Investors buy certificates by paying the delinquent amount. The interest rate is set by competitive bid. The property owner then owes the redemption amount plus that interest to clear the lien. If the certificate sits unredeemed for two years, the holder can apply for a tax deed, which can eventually lead to a forced public sale of the property. Chapter 197, Florida Statutes governs the certificate sale, redemption, and tax deed process from start to finish.

If you have a mortgage, your lender likely pays taxes from escrow. But verify each year that the payment was made and received on time. Escrow errors happen. The legal obligation is yours regardless of who was responsible for making the payment.

The Florida Department of Revenue's Property Tax Oversight homepage provides statewide guidance on assessment rules, exemptions, and payment procedures that apply in Lee County.

That page explains how state oversight connects to county-level offices like Lee County's Property Appraiser and Tax Collector.

Public Access to Lee County Property Records

Florida's public records law is broad and applies fully to Lee County property tax records. Under Chapter 119, Florida Statutes, assessed values, owner names and mailing addresses, sales history, legal descriptions, exemption types, and payment status are all public and available without restriction. You do not need to state a reason or prove residency to access them.

The Property Appraiser's online portal at leepa.org provides free access to individual parcel records. For bulk data, the Florida Department of Revenue's data portal at floridarevenue.com/property/Pages/DataPortal.aspx offers downloadable assessment rolls including all Lee County parcels. That resource is used by real estate professionals, researchers, and investors who need county-level or parcel-level data in volume.

If you need certified copies or records not yet digitized, contact the Property Appraiser's office directly. Some large bulk requests involve a modest production cost. The Professional Association of Appraisers of Florida at paaf.us provides additional resources on how appraisal works in Florida and what standards county offices must follow.

Cities in Lee County

Lee County has three communities that qualify for individual property tax pages based on population.

- Cape Coral - population approximately 233,000

- Lehigh Acres - unincorporated community, population approximately 127,000

- Fort Myers - county seat, population approximately 100,000

Other Lee County communities including Bonita Springs, Sanibel, Captiva, Estero, and North Fort Myers do not reach the 75,000-resident threshold and do not have separate pages at this time.