Lehigh Acres Property Tax Records

Lehigh Acres property tax records are administered by the Lee County Property Appraiser and Tax Collector, both operating from Fort Myers. Lehigh Acres is an unincorporated community and census-designated place, so it has no city government of its own. All property tax matters, from assessment to payment, are handled at the Lee County level. Records for every parcel in Lehigh Acres are public and available online.

Lehigh Acres Quick Facts

Lee County Property Appraiser

The Lee County Property Appraiser's main office is at 2480 Thompson Street, Fort Myers, FL 33901. The phone number is (239) 533-6100. This office values all real and tangible personal property in Lee County as of January 1 each year. For Lehigh Acres, that means every residential lot, home, and commercial property in the community is assessed by this office and listed on the Lee County property roll.

Lehigh Acres was originally developed as a planned community with a large number of subdivided lots, many of which were sold as vacant land decades ago. The Lee County Property Appraiser tracks all of them. Some lots are improved with homes or structures; others are still vacant. Both types appear on the property roll with their own parcel identification numbers, ownership records, and assessed values. The roll is the official public record for all of this data.

You can search Lee County parcel records on the Lee County Property Appraiser website. Search by address, owner name, or parcel ID to find a specific lot. The record shows the current assessed value, just value, taxable value, land area, improvement details if any, and recent sales. You can also confirm exemptions on file for any parcel. The site is free and open to anyone.

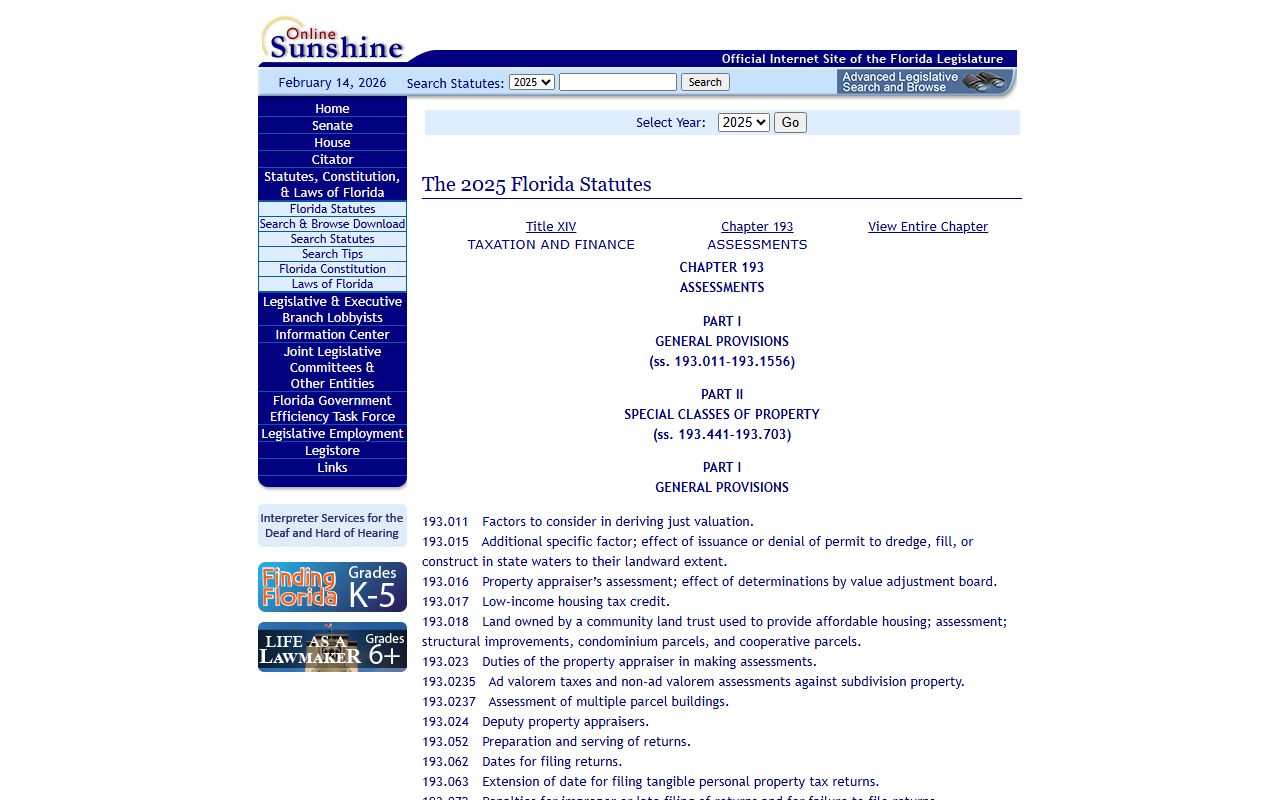

The Florida Department of Revenue sets the rules that guide how Lee County's appraiser conducts valuations. Their guidance and statewide oversight resources are at the DOR Property Tax Oversight page. County appraisers must follow state standards under Chapter 193 of the Florida Statutes.

The Florida DOR directory lists every county property appraiser and tax collector with contact details.

Use the directory to find the Lee County offices or any other county office across Florida.

Tax Collection for Lehigh Acres Properties

The Lee County Tax Collector's office in Fort Myers handles billing and payment for all Lehigh Acres properties. As an unincorporated community, Lehigh Acres does not have a separate city tax. Property owners pay county taxes, school taxes, and any applicable special district assessments. The Lee County Tax Collector's website has online payment tools and lets you look up current balances and past payment records.

Tax bills are mailed each November. They reflect the taxable value on the property roll, which is the assessed value minus any exemptions, multiplied by the combined millage rates of all taxing authorities. Lee County, the school board, and relevant special districts each set a separate millage rate that appears as a line item on your bill.

Pay early and save. Florida law gives a 4% discount for November payment, 3% in December, 2% in January, and 1% in February. After March 31, taxes are delinquent under Chapter 197, Florida Statutes. The collector then runs a tax certificate sale in June. Investors pay the delinquent amounts and receive a certificate with interest. If you don't redeem the certificate within two years, the holder can apply for a tax deed, potentially leading to a forced sale of the property.

You can pay Lee County property taxes online through the tax collector's site, by mail, or in person at county offices. The collector may have branch locations in Lehigh Acres or nearby areas. An installment plan option lets you divide the annual bill into four quarterly payments. Enrollment opens in the spring of each year.

Searching Lehigh Acres Parcel Data

The Lee County Property Appraiser's website is your best starting point. Enter any Lehigh Acres street address or parcel ID to pull up the full property record. You get assessed value, just value, taxable value, land size, improvement details, and sales history. The site also shows exemptions currently in place on the parcel. These records are updated throughout the year as changes occur.

For billing information, use the Lee County Tax Collector's site. Check current amounts owed, confirm prior-year payments, and see whether any delinquencies are on record. These two databases together cover the full scope of property tax records for any Lehigh Acres parcel.

The Florida DOR's statewide property tax data portal offers downloadable data files by county. This is useful for bulk research or comparisons across multiple counties.

All property tax records are public under Chapter 119, Florida Statutes. You do not need to show ID or state a purpose. Personal data like Social Security numbers on exemption applications is protected, but owner names, values, and tax histories are fully open to anyone.

Property Tax Exemptions in Lehigh Acres

Lehigh Acres has a large owner-occupied residential base, so the homestead exemption is widely claimed. It removes up to $50,000 from the assessed value of a primary residence. The first $25,000 applies against all taxing authorities. The second $25,000 covers assessed value between $50,000 and $75,000 but does not reduce school taxes. For a typical Lehigh Acres home, this exemption provides meaningful savings each year.

Homestead also activates the Save Our Homes cap. Under Chapter 193, Florida Statutes, once a property carries homestead, the annual increase in assessed value is capped at 3% or the rate of inflation, whichever is less. This has been especially valuable in Lee County, where home values rose sharply after the pandemic. Long-term homesteaded owners have seen their taxable values stay much lower than their market values.

Veterans, senior low-income residents, people with disabilities, and surviving spouses may qualify for additional exemptions beyond homestead. Each exemption has its own rules and application process through the Lee County Property Appraiser. The deadline for homestead and most other exemptions is March 1. Exemption rules are in Chapter 196, Florida Statutes.

Lehigh Acres has many vacant lots still in private hands. Vacant land is generally not eligible for homestead exemption. The appraiser values vacant lots based on comparable sales of similar vacant parcels in the area. If you own a vacant lot and believe the value is too high, you can appeal through the standard VAB process.

Chapter 193 covers property assessment rules, including how the Save Our Homes cap protects homesteaded owners.

The statute explains the mechanics of the annual cap and what triggers a reset when property changes hands.

Appealing Your Lehigh Acres Assessment

Each summer, Lee County property owners receive a TRIM notice. This is the Truth in Millage notice, and it shows the proposed assessed value along with an estimated tax bill at that value. If you think the value is too high, you have 25 days from the mailing date to file a petition with the Lee County Value Adjustment Board.

The VAB is an independent body that hears disputes between owners and the appraiser. After you file, you get a hearing before a special magistrate. Present your evidence, and the magistrate makes a recommendation. The VAB board votes to accept or reject it. This process is set out in Chapter 194, Florida Statutes.

Bring concrete evidence to your hearing. Comparable sales from nearby properties sold close to the assessment date are the strongest evidence you can offer. For vacant lots, that means sales of similar vacant parcels in Lehigh Acres. For improved properties, look at sales of homes with similar size, age, and condition. Document any condition issues with photos. The burden is on you to show the appraiser's value is wrong.

Pay the undisputed part of your tax bill during the appeal. This avoids extra penalties. If the VAB rules against you, you still have the option of filing a lawsuit in circuit court, though that is less common. Most appeals are resolved at the VAB stage without going to court.

Lee County Records and Unincorporated Status

Because Lehigh Acres is unincorporated, there is no separate city government to contact about property taxes. Everything goes through Lee County. The county appraiser handles values and exemptions. The county tax collector handles billing, payment, and delinquency. For a full breakdown of offices, hours, and services, visit the Lee County property tax records page.

The absence of a city layer also means Lehigh Acres property owners do not pay a separate city millage rate. The taxing authorities for a typical Lehigh Acres parcel include Lee County, the school board, and any applicable special districts or community development districts. The lack of a city government can make total tax bills lower than comparable properties in incorporated cities nearby.