Access Collier County Property Tax Records

Collier County property tax records cover every parcel in one of Florida's wealthiest and most diverse real estate markets, from beachfront condos in Naples to agricultural tracts in Immokalee and rural land along the Everglades fringe. Two elected offices manage these records: the Property Appraiser sets values and processes exemptions, while the Tax Collector handles billing and payment. This page shows you how to search Collier County tax records, understand assessments, and get the information you need on any property in the county.

Collier County Quick Facts

Collier County Property Appraiser

The Collier County Property Appraiser is located at 3291 E. Tamiami Trail, Naples, FL 34112. Phone: (239) 252-8177. Fax: (239) 774-9327. The appraiser's website is at collierappraiser.com. The office is independently elected and operates without direction from the county commission. Its core job is to place a fair market value on every parcel in Collier County as of January 1 each year, then certify that tax roll to the Tax Collector by October 1.

Collier County's real estate landscape is exceptionally varied. The appraiser's office must value luxury waterfront homes worth tens of millions of dollars alongside mobile home parks, commercial strips, citrus groves, and large-scale agricultural operations in the eastern part of the county. Different valuation methods apply to different property types. Residential properties largely depend on comparable sales. Income-producing properties like apartment buildings and office parks use an income approach. Agricultural land uses a separate classified-use valuation system.

The TRIM (Truth in Millage) notice goes out in August each year. It shows the proposed assessed value, the exemptions applied, and the tax rates from each taxing authority. Do not mistake it for a bill. It is a notice. The actual tax bill comes from the Tax Collector in November. Between the TRIM notice and November, you have a window to challenge any value that seems wrong.

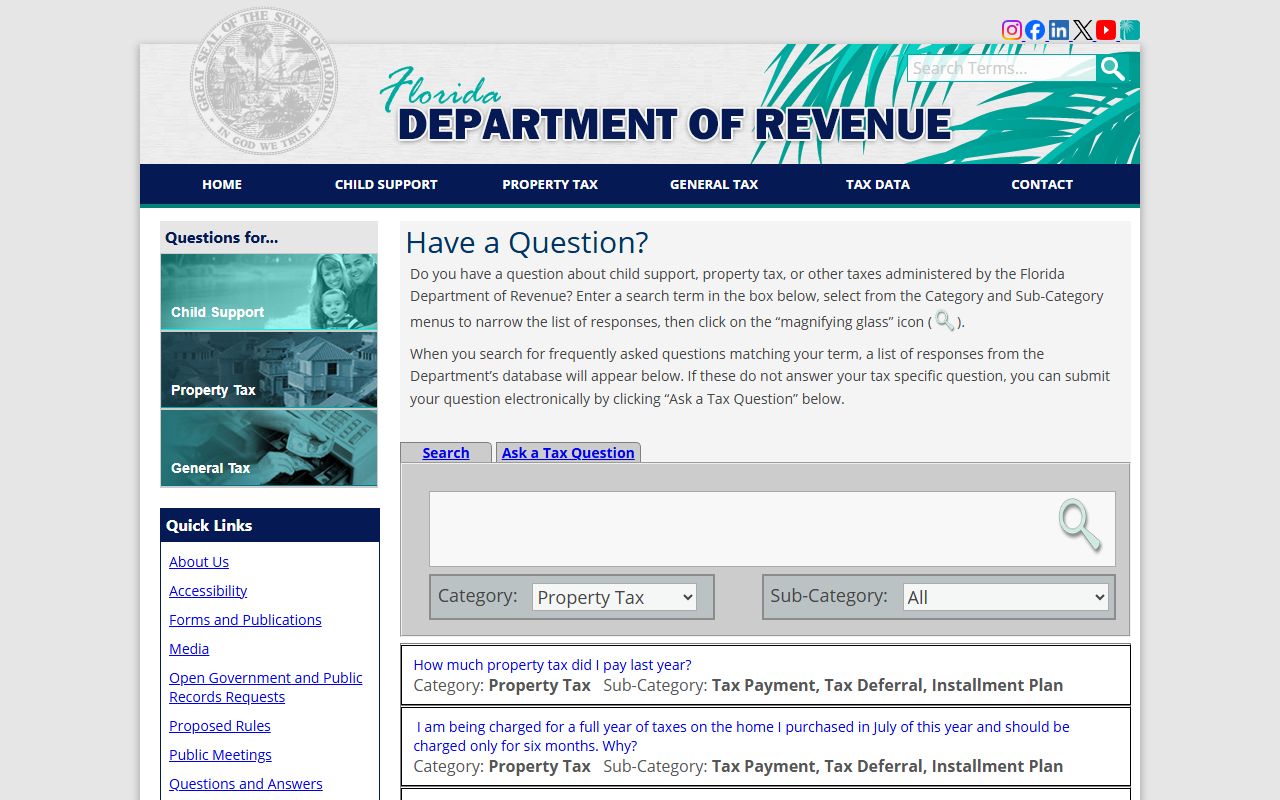

The Florida Department of Revenue's property tax overview and county contacts resource is available at floridarevenue.com/property/Pages/LocalOfficials.aspx, listing the appraiser and collector for every Florida county.

The Collier County Property Appraiser's website allows public parcel searches for any property in the county, including detailed assessment breakdowns and sales histories.

The site includes GIS map tools, parcel data downloads, and exemption information specific to Collier County.

Collier County Tax Collector

The Tax Collector's office is at 3291 E. Tamiami Trail, Naples, FL 34112, with phone (239) 252-8177 and fax (239) 774-9327. Like the appraiser, the collector is an elected official who operates independently. Once the October tax roll certification happens, the collector generates and mails bills by November 1. Payment is due by March 31 to avoid delinquency.

Collier County has branch locations in addition to the main Naples office, serving areas like Marco Island, Immokalee, and the Estates. The collector's website lists current branch hours and locations. Online payment is available for property taxes. You can also pay by mail or in person. The collector also handles motor vehicle services, concealed weapon licenses, and other state-level transactions.

For property-tax-specific matters, the Tax Collector handles payment processing, installment plan enrollment, tax certificate issuance, and tax deed applications on delinquent parcels. Collier County's high property values mean that even a single delinquent parcel can involve large dollar amounts and significant legal consequences for the owner.

The Florida Tax Collectors Association at floridataxcollectors.com provides information about statewide collection practices, payment options, and the certificate and deed processes used in all Florida counties.

How to Search Collier County Property Tax Records

Start at collierappraiser.com for assessed value data, parcel information, and ownership records. The search tool accepts owner name, property address, or folio number. The folio number is Collier County's term for the parcel identification number. It is unique to each property and is the most precise way to pull a specific record. Use the address search if you do not have the folio number. Partial address entries usually work fine.

Each record includes the legal owner, mailing address, property use code, land value, improvement value, assessed value, any exemptions, and the legal description. Sales history shows prior transactions. The appraiser's site often includes a building sketch, an aerial photo, and a list of comparable sales that influenced the assessment. That last piece is particularly useful if you are considering a challenge to the assessed value.

For tax payment records, the Tax Collector's system uses the same folio number. You can see the current year's bill, prior-year payments, and any outstanding balances. If a tax certificate has been issued on a delinquent account, that information may appear as well. All of this data is public under Chapter 119, Florida Statutes.

The Florida Department of Revenue's data portal at floridarevenue.com/property/Pages/DataPortal.aspx provides statewide and county-level bulk downloads of property assessment data, useful for analysts and researchers working across large datasets.

Property Tax Exemptions in Collier County

Homestead exemption in Collier County works the same way it does statewide. The first $25,000 of assessed value is exempt for all taxing authorities. The next $25,000 (applying to the value between $50,000 and $75,000) is exempt for non-school taxes only. The result: up to $50,000 off your assessed value, depending on how your property is valued. Apply with the Property Appraiser by March 1 and you must be a Florida resident with the property as your primary home.

Collier County homeowners with homestead exemption benefit from the Save Our Homes cap. That cap limits assessed value increases to 3% or the Consumer Price Index change, whichever is lower. In Naples and other high-demand markets, home values have often risen well above 3% per year, meaning the SOH cap delivers real tax savings. The gap between assessed value and market value can become substantial over time. Portability lets you take that built-up benefit to a new Florida homestead if you move. Chapter 193, Florida Statutes governs both the SOH cap and portability.

Agricultural classification is significant in the eastern portions of Collier County. Qualified agricultural land is assessed at its agricultural use value rather than market value. That can represent a very large difference in taxable value for working farms and ranches. The appraiser's office reviews agricultural classification applications each year.

Other Collier County exemptions include veteran disability, total and permanent disability, widow and widower, deployed military, and the senior citizen low-income exemption. See Chapter 196, Florida Statutes for eligibility rules on each. Tangible personal property returns are due April 1 for business owners who want to preserve the $25,000 TPP exemption.

Appealing Your Collier County Property Assessment

If your TRIM notice shows a value that does not reflect the actual market, contact the Collier County Property Appraiser's office first. Informal review is the fastest path to resolution. Bring recent comparable sales, a private appraisal, photos of condition problems, or documentation of any factual error in your property record, wrong square footage, missing depreciation, incorrect use code. The appraiser's staff can correct data errors and review value methodology.

If informal review does not get you to a fair value, file a VAB petition. The deadline is 25 days after the TRIM notice mailing date. You file with the Value Adjustment Board, which is a separate body from the appraiser's office. The VAB assigns a special magistrate to hear your case. Hearings are scheduled months after filing, so be patient. The magistrate reviews evidence from you and from the appraiser and makes a recommendation to the full board.

Collier County's high property values mean that even a small percentage difference in assessed value can translate to thousands of dollars in tax liability. That makes it worth taking the time to review your TRIM notice carefully and to file a VAB petition if the numbers do not look right. Chapter 194, Florida Statutes covers VAB procedures, petition requirements, and your rights as a property owner during the appeal process.

You must still pay your taxes by March 31 even if a VAB petition is pending. Winning your petition means a refund of the overpaid amount. Losing means you were paid up on time with no penalty. Either way, do not skip the payment while waiting on the VAB outcome.

Paying Collier County Property Taxes

Tax bills mail November 1. Payment is due March 31. Florida's discount system rewards early payers: 4% off in November, 3% in December, 2% in January, 1% in February. After March 31, the account goes delinquent. The discount amounts can be significant on Collier County properties, where annual tax bills often run into the thousands or even tens of thousands of dollars.

The Tax Collector accepts online payments, mail payments, and in-person payments at multiple office locations. Some payment types may carry a convenience fee. Bank account transfers are typically fee-free. The quarterly installment plan lets eligible property owners split the annual bill into four payments with enrollment by April 30.

When taxes go unpaid past April 1, a tax certificate sale follows. Investors bid on the overdue amount. The certificate earns interest at the bid rate. To clear the lien, the property owner must pay back the certificate amount plus interest. After two years without redemption, the certificate holder can apply for a tax deed and begin the process toward a forced sale. Chapter 197, Florida Statutes governs the full delinquency and collection process.

Note: If your mortgage servicer pays taxes from an escrow account, confirm payment each November. The Tax Collector's online system will show whether the bill for your folio number has been paid.

Collier County Property Records and Public Access

Property tax records in Collier County are public under Chapter 119, Florida Statutes. Assessed values, ownership data, parcel descriptions, sales histories, exemption types, and payment records are all available to the public. You do not need a reason to access these records, and you do not need to own or have an interest in the property.

Confidential items include Social Security numbers, federal income tax data, personal financial records submitted with exemption applications, and payment account details. The appraiser's and collector's records will confirm that a homestead or other exemption exists but will not disclose the supporting income documentation that was submitted to qualify.

Most Collier County property tax records are available online through the appraiser's and collector's websites at no cost. For certified copies, bulk data requests, or documents not available online, contact the offices directly. The Florida Department of Revenue provides statewide property tax forms at floridarevenue.com/property/Pages/Forms.aspx. The Professional Association of Florida Appraisers at paaf.us is another resource for understanding how Florida's appraisal system is structured and regulated.

The Florida Department of Revenue's FAQ resource answers common questions about property tax access, exemptions, and how Florida's assessment system works.

This resource covers questions that apply across all Florida counties, including Collier, on topics like homestead eligibility, payment deadlines, and how to request records.

Cities in Collier County

Collier County includes the City of Naples, Marco Island, Everglades City, and the unincorporated community of Immokalee. Naples serves as the county seat area and is the largest incorporated city. Marco Island sits on the Gulf Coast south of Naples. None of Collier County's incorporated communities currently exceed 75,000 residents, so no individual city pages are available at this time. Property tax records for all communities, Naples, Marco Island, Immokalee, Golden Gate, and the Estates, are managed through the county-level offices in Naples.