Monroe County Property Tax Records

Monroe County property tax records cover parcels spread across the Florida Keys, from Key Largo down to Key West and out to the Dry Tortugas. The Monroe County Property Appraiser and Tax Collector maintain these records for all real property and tangible personal property in the county. This page covers how to find those records, how assessments work in a county with an unusual geography, and what options property owners have when they need to appeal or pay taxes.

Monroe County Quick Facts

Monroe County Property Appraiser

The Monroe County Property Appraiser's office is based in Key West with a mailing address of P.O. Box 1129, Key West, FL 33041. The main phone number is (305) 295-5000, and you can reach the fax at (305) 295-5022. The office handles all property valuation for Monroe County, which stretches along the Keys archipelago. Every parcel, whether a single-family home in Marathon, a commercial building on Stock Island, or a vacant lot in the Lower Keys, is valued as of January 1 each year.

The Monroe County property roll is available through the appraiser's official website at mcpafl.org. The search tool on that site lets you look up parcels by owner name, address, or parcel identification number. Results include the assessed value, just value, taxable value, exemptions, and sales history. Monroe County uses the same mass appraisal methods as every other Florida county, following standards set by the Florida Department of Revenue under Chapter 193, Florida Statutes.

Monroe County properties include a mix of residential, commercial, and waterfront parcels. Waterfront and ocean-access properties make up a large share of the county's tax base. The appraiser's office tracks sales data across the Keys to set values that reflect the local market. If you think your assessed value does not match what comparable properties are selling for, you have options to dispute it.

The Monroe County Property Appraiser's website is the main source for parcel data across the Florida Keys.

The appraiser's site covers all parcel types in Monroe County from Key Largo to Key West.

The appraiser's office does not set tax rates. Those are set by the county commission, school board, and special districts. The appraiser's role is to establish the value that those rates are applied to.

Homestead Exemption in Monroe County

Florida's homestead exemption reduces the assessed value of your primary residence by up to $50,000. The first $25,000 applies to all taxing authorities. The second $25,000 applies only to non-school levies. You must file for the exemption by March 1 with the Monroe County Property Appraiser. You can apply online, by mail to P.O. Box 1129, Key West, FL 33041, or in person at the office. New homeowners who buy a home in Monroe County should file as soon as they take ownership to make sure they do not miss the March 1 cutoff for the next tax year.

The Save Our Homes cap is an important feature for year-round residents in Monroe County. Once you have homestead status, Florida law limits how much your assessed value can rise each year to the lesser of 3% or the change in the Consumer Price Index. In the Keys, where property values have climbed sharply over recent years, this cap can translate to a big difference between your assessed value and the actual market value. That accumulated benefit is called the SOH cap, and it is portable, you can transfer it to a new Florida home when you move.

Other exemptions available in Monroe County include the widow/widower exemption ($500 off assessed value), the disability exemption for persons with total and permanent disability, and full exemptions for certain veterans disabled in combat. Senior residents meeting income limits may also qualify for an additional county-level exemption. All exemption details are governed by Chapter 196, Florida Statutes.

Tax Billing and Delinquency

The Monroe County Tax Collector handles billing and payment for property taxes. The mailing address is P.O. Box 1129, Key West, FL 33041, and the phone number is (305) 295-5000. Tax bills are mailed in November and reflect the taxable value certified by the appraiser plus the millage rates set by local taxing authorities. Monroe County has several taxing authorities that each add a separate rate to your bill, including the county, the school board, and special districts covering fire, mosquito control, and other services.

Florida's early-payment discount applies in Monroe County just as it does everywhere else in the state. Pay in November for a 4% discount, December for 3%, January for 2%, and February for 1%. Taxes not paid by March 31 are delinquent as of April 1. The tax collector can then begin the tax certificate process under Chapter 197, Florida Statutes, which allows investors to bid on the right to collect unpaid taxes plus interest. If the property owner does not redeem the certificate within two years, a tax deed application can follow.

Monroe County property taxes can be paid online, by mail, or in person. The tax collector's office is the place to go for questions about your bill, payment options, or how to set up an installment plan. Installment plans must be set up before April 30 of the prior tax year.

Tangible Personal Property in Monroe County

Businesses in Monroe County, including restaurants, charter boat operations, hotels, and retail shops, must file a Tangible Personal Property return with the Property Appraiser by April 1 each year. TPP covers business assets like furniture, equipment, fixtures, and machinery. The first $25,000 in value is exempt, but you must file a return to claim it. Returns filed after April 1 lose the exemption and may face a penalty.

The Monroe County tourism and hospitality sector means many businesses operate with significant physical assets subject to TPP assessment. Charter boats, diving equipment, restaurant furnishings, and hotel equipment all fall into this category. New businesses must file in their first year of operation. Existing businesses update their returns each year to reflect current assets and depreciation. The appraiser's office can provide forms and filing instructions for new and returning filers.

Appealing Your Assessment

Monroe County property owners who disagree with their assessed value can appeal to the Value Adjustment Board. You must file a petition within 25 days of the mailing date shown on your TRIM notice, which arrives each August. The VAB in Monroe County follows the same process as other Florida counties: a special magistrate hears your case, reviews evidence from you and the appraiser's office, and issues a recommendation. The VAB issues a final decision based on that recommendation. The full VAB process is governed by Chapter 194, Florida Statutes.

Bring strong evidence to your hearing. Comparable sales data for similar Keys properties is the most effective tool, since the appraiser's value is meant to reflect market conditions. A private appraisal, photos documenting property condition, or records showing errors in the appraiser's data can also help your case. You can represent yourself or hire an attorney or licensed appraiser to argue on your behalf.

If the VAB rules against you and you still believe your value is wrong, you can file an appeal in circuit court. That step involves additional costs and time, so most property owners weigh the potential savings before pursuing it.

Public Records and Data Access

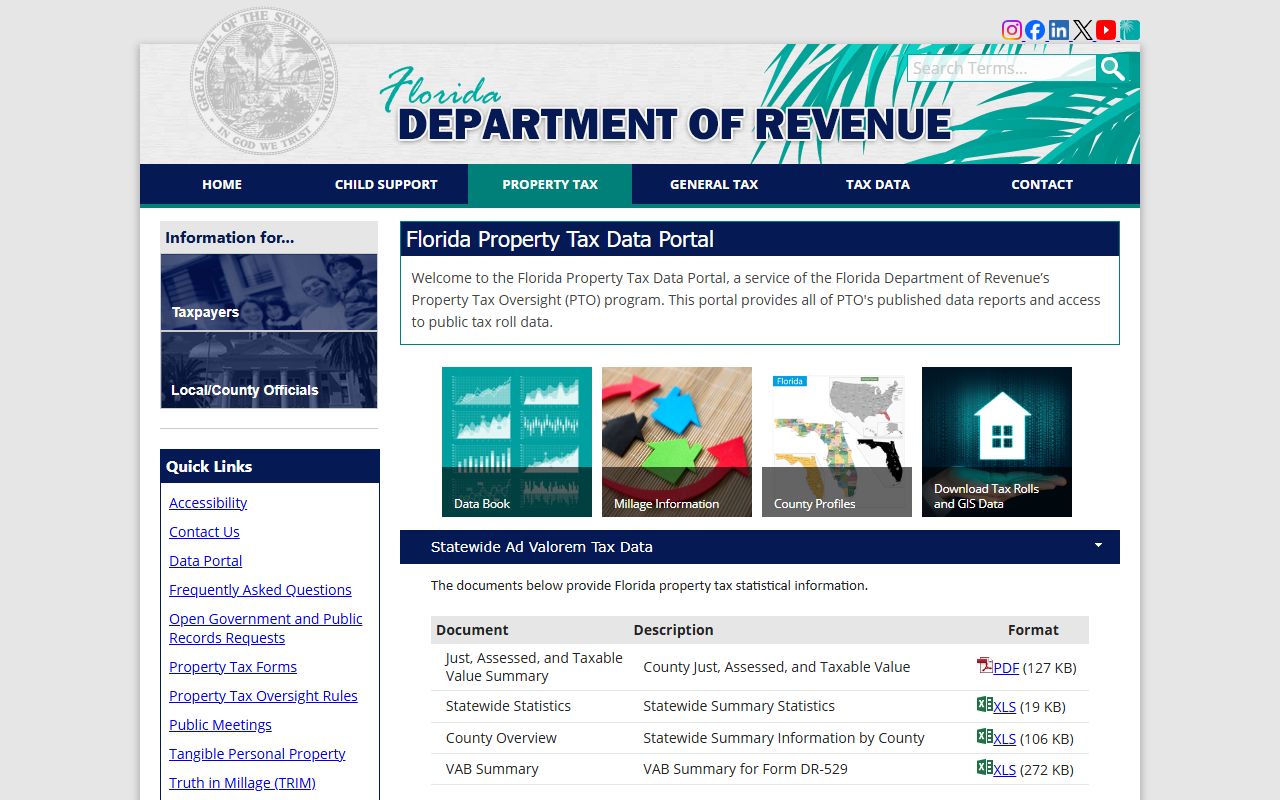

Monroe County property records are public under Chapter 119, Florida Statutes, Florida's public records law. The appraiser's website gives free online access to core parcel data, including ownership, assessed values, exemptions, and sales history. For bulk data or research purposes, the Florida Department of Revenue's data portal makes full county assessment rolls available for download. That tool is useful for anyone who needs data on multiple parcels at once.

The Florida DOR Property Tax Oversight page is a good resource for understanding how the statewide system works. It explains how counties set assessments, what exemptions are available, and how the appeals process functions. The DOR also reviews county tax rolls each year to make sure they meet state standards.

The Florida DOR data portal lets you download full Monroe County assessment data by tax year.

Bulk data downloads from the DOR are free and cover assessed values, exemptions, and parcel details for every county in Florida.

Additional Property Tax Resources

The Florida DOR forms page has downloadable forms for exemptions, TPP filings, and appeals. Most of these forms apply statewide, though some counties have their own versions. The Monroe County Property Appraiser's website links to locally relevant forms as well. The Florida Tax Collectors Association has a directory of all county collector offices in case you need to contact another county's office.

The Property Appraisers Association of Florida also provides information on how county appraisers operate and what standards they follow. For Monroe County specifically, the appraiser's office can answer questions about assessment methodology, exemption eligibility, and how to read your TRIM notice. Call (305) 295-5000 during business hours for help with any of these topics.

The Florida DOR's property tax oversight page explains statewide assessment standards that apply in Monroe County.

The DOR oversight page is updated regularly with guidance, forms, and news about Florida property tax law.

Cities in Monroe County

Monroe County has no cities above the population threshold for individual city pages. Key West is the county seat and largest city, but it falls below the qualifying threshold. Property tax records for all Monroe County parcels are accessible through the county appraiser's office.