Find Property Tax Records in Miami Gardens

Miami Gardens property tax records are maintained by Miami-Dade County. The city does not run its own assessment or collection operation. Every parcel in Miami Gardens goes through the Miami-Dade Property Appraiser and Tax Collector - the same offices that serve the rest of the county. Here is how to find and use those records.

Miami Gardens Quick Facts

Miami-Dade County Tax Administration for Miami Gardens

Miami Gardens is a city within Miami-Dade County. Property taxes here are handled at the county level. The city collects its own municipal taxes through a city millage rate, but the actual assessment, billing, and collection all run through Miami-Dade County offices. That means your tax bill will show the county rate, school board rate, city of Miami Gardens rate, and any applicable special district rates - all on one document generated by the county.

Miami-Dade is one of the most populous counties in the United States, and its property tax operation reflects that size. The Property Appraiser's office handles hundreds of thousands of parcels. The online systems are well-developed and allow most searches without any in-person visit. The county has invested in digital access, which makes it easier for Miami Gardens property owners to check their records from home.

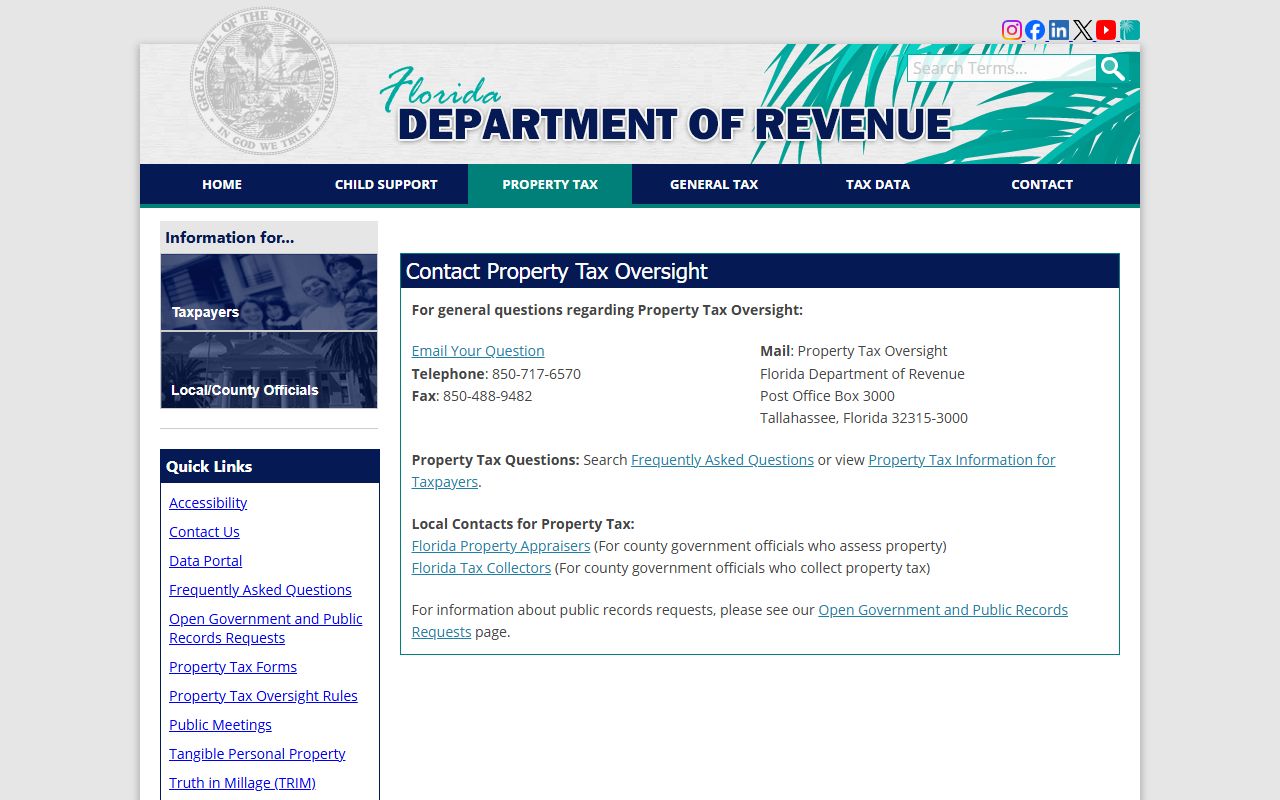

The Florida Department of Revenue oversees county property appraisers and ensures they follow state standards. Their resources on how assessment and taxation work are at the DOR Property Tax Oversight page. State law sets the framework - local offices carry it out.

For the full picture on Miami-Dade County policy, millage rates, and office contacts, see the Miami-Dade County property tax records page.

Miami-Dade Property Appraiser

The Miami-Dade Property Appraiser is located at 111 NW 1st Street, Suite 710, Miami, FL 33128. The phone number is 305-375-4712. The office is open on weekdays during standard business hours. For Miami Gardens parcels, all assessment records and exemption files are held here. The appraiser sets values as of January 1 each year using mass appraisal methods that follow Florida Department of Revenue guidelines.

The official property search tool is at miamidade.gov/pa/property-search.asp. You can search by property address, owner name, or folio number - Miami-Dade uses the term "folio" for what other counties call a parcel ID. The search shows current assessed value, just value, taxable value, land data, building data, exemptions on file, and sales history. It is free to use and does not require an account.

Miami Gardens includes a wide range of residential property types - single-family homes, condominiums, and multi-family buildings. The appraiser's office values each type using methods appropriate for that class of property. Sales in Miami Gardens and comparable neighborhoods drive the residential values. Commercial parcels use income and cost approaches in addition to sales data.

The appraiser's website at miamidadepa.gov also provides GIS maps, aerial views, and tools to compare your value against recent sales. These tools are helpful if you are thinking about filing an appeal. The site is updated as sales close and records change, so data is reasonably current at any given time.

Miami-Dade uses a folio number system that encodes the property's location within the county grid. If you know your folio number, that is the fastest way to pull up your record. You can find your folio number on a tax bill, a deed, or through an address search on the appraiser's site.

The Florida DOR Property Tax Oversight page explains how county appraisers operate under state law.

The DOR site covers assessment standards that apply to all Miami-Dade County parcels, including those in Miami Gardens.

Miami-Dade Tax Collector

The Miami-Dade Tax Collector is located at 200 NW 2nd Avenue, Miami, FL 33128. The phone number is (305) 375-5570. This office handles billing and collection for all property taxes in the county. Bills go out in November. The collector uses the certified tax roll from the appraiser to generate and send those bills. Payment options include online, mail, and in-person at county service centers throughout Miami-Dade.

You can pay online at mdctaxcollector.gov/property-tax. The portal accepts credit cards and e-checks. Miami-Dade has multiple service centers spread across the county, including locations in north Dade that serve Miami Gardens residents without a long drive downtown.

The standard Florida discount schedule applies. Pay in November for 4% off. December earns 3%, January 2%, February 1%. After March 31, taxes are delinquent. The collector adds interest and fees, and the account moves toward a tax certificate sale. That process is governed by Chapter 197, Florida Statutes. Delinquent certificates can eventually lead to a tax deed action, which puts ownership of the property at risk.

The installment plan is available for taxpayers who prefer quarterly payments. Sign up by April 30 for the following tax year. The plan divides the estimated bill into four payments. This is useful for residents on fixed incomes or those who want to avoid a large payment at year-end.

How to Search Miami Gardens Property Tax Records

The main tool is the Miami-Dade Property Appraiser's search at miamidade.gov/pa/property-search.asp. Search by address or folio number. The record page shows all key assessment data: just value, assessed value, taxable value, exemptions, and the sales history. You can also see the property's characteristics - year built, square footage, building type - and view aerial maps.

For billing and payment data, go to the Tax Collector's site and enter the folio number or address. This shows the current bill amount, any discount if paid early, and whether prior years have outstanding balances. The two databases together give a complete view of any Miami Gardens parcel.

These records are public under Chapter 119, Florida Statutes. No ID is required. No reason is needed. Some exemption application fields - like Social Security numbers - are confidential under state law, but ownership data, values, and tax history are fully open. The Florida DOR public records page explains what is and is not exempt from disclosure at the state level.

Property Tax Exemptions for Miami Gardens Residents

Florida exemptions apply to all qualifying Miami Gardens properties. The homestead exemption is the largest. It removes up to $50,000 from assessed value for a primary residence. The first $25,000 applies against all taxing authorities. The second $25,000 covers value between $50,000 and $75,000, applied to all but school taxes. File with the Miami-Dade Property Appraiser by March 1 of the tax year you want the exemption to start.

Homestead also triggers the Save Our Homes cap. After the first year of homestead, annual increases in assessed value are capped at 3% or inflation - whichever is lower. This is in Chapter 193, Florida Statutes. In a market like Miami Gardens, where values have moved sharply in recent years, the SOH cap can produce a big gap between just value and assessed value. That gap can save hundreds or even thousands of dollars each year in taxes.

Other exemptions include: senior low-income exemption for residents 65 and older with income below the county-set threshold, total disability exemptions, veteran exemptions including a complete exemption for certain service-connected disabilities, and widower exemptions. All require an application with the appraiser. Full details are in Chapter 196, Florida Statutes.

Business owners with tangible personal property should file an annual TPP return with the appraiser by April 1. The first $25,000 of TPP value is exempt. File on time to claim it. Late filers lose the exemption and face a penalty on the assessed amount.

Value Adjustment Board Appeals

If you believe the Miami-Dade Property Appraiser set your value too high, you can file a petition with the Value Adjustment Board. The window to file is 25 days from the mailing of your TRIM notice, which goes out in late summer. The TRIM shows your proposed value and what your taxes will be if no change is made.

The Miami-Dade VAB operates independently of the appraiser. It includes county commissioners, school board members, and citizen members. Petitions are heard by special magistrates. You present evidence. The appraiser presents evidence. The magistrate issues a recommendation, and the board votes. Appeals are governed by Chapter 194, Florida Statutes.

Strong evidence includes recent comparable sales of similar properties in Miami Gardens, photos showing condition issues, and an independent fee appraisal if you have one. You carry the burden of proving the appraiser is wrong. If the VAB does not rule in your favor, you can still appeal in circuit court, though many cases settle through informal negotiation with the appraiser's office before the hearing.

Payment and Delinquency

Bills go out in November. Pay by March 31. The discount schedule saves money for early payers. Taxes that go past March 31 are delinquent. The collector adds interest and a 3% collection fee. In May or June, a tax certificate sale takes place. Investors buy the certificates and earn interest at a rate set at auction. Property owners can redeem the certificate by paying the back taxes plus interest and fees.

If a certificate is not redeemed within two years, the holder can apply for a tax deed. That starts a process that can result in a forced sale of the property. This is the ultimate consequence of non-payment. If you are buying property in Miami Gardens, check the Tax Collector's database for any outstanding tax certificates before closing.

The Florida DOR contact page lists state-level resources for property tax questions.

The DOR contact page can connect you to state-level help when county offices are not enough.