Search Kendall Property Tax Records

Kendall is an unincorporated community in southwestern Miami-Dade County, so all property tax records for Kendall parcels are maintained by Miami-Dade County. The county Property Appraiser and Tax Collector offices in Miami handle assessment, billing, and collection for every parcel in Kendall. This page explains how to find those records and what you can do with them.

Kendall Quick Facts

Miami-Dade County Property Appraiser

Kendall has no city government. All property tax functions for Kendall parcels fall to Miami-Dade County. The Miami-Dade County Property Appraiser's office is at 111 NW 1st Street, Suite 710, Miami, FL 33128. The main phone number is 305-375-4712. The appraiser values all real and personal property in the county as of January 1 each year. With millions of parcels across Miami-Dade, this is one of the largest appraisal operations in Florida.

The appraiser is an elected official and operates independently from the county mayor and commission. They do not collect taxes and do not set millage rates. Their job is to determine each property's just value under Florida law. For Kendall, which is a large residential community in the southwest part of the county, the appraiser analyzes sales of similar homes to set values that reflect current market conditions.

The Miami-Dade Property Appraiser website has a full online search tool. You can search for any Kendall parcel at the Miami-Dade property search page. Enter the property address, owner name, or folio number (Miami-Dade's term for parcel ID). The result shows assessed value, taxable value, exemptions, building data, land data, and sale history. No registration or login is needed.

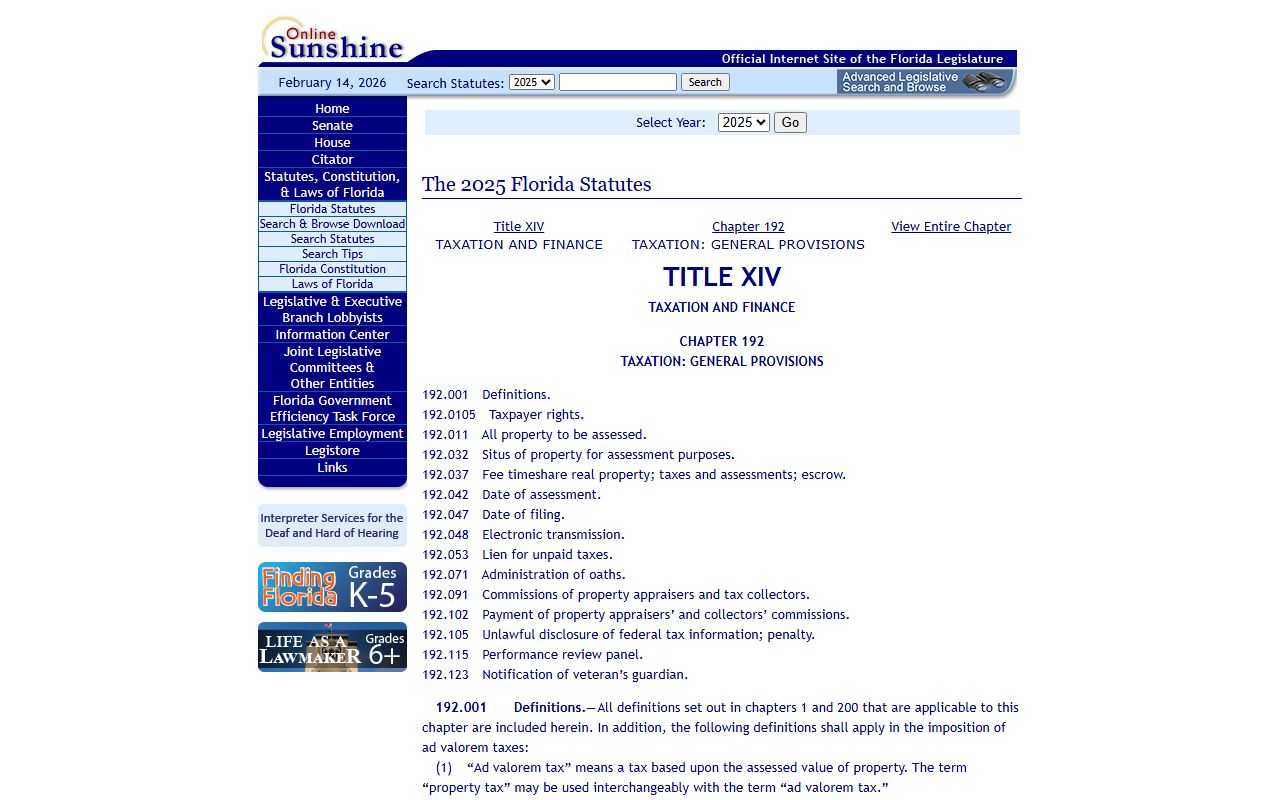

Assessment standards come from state law. Chapter 192, Florida Statutes defines just value. The Florida DOR reviews Miami-Dade County's assessments each year through its Property Tax Oversight program. The DOR can require corrections if county assessments fall out of line with state standards.

Because Kendall is unincorporated, residents do not pay a city millage rate. Your tax bill reflects only county, school board, and special district millage, which often makes it slightly lower than what incorporated city residents pay. That said, Miami-Dade is a large county with many services, and the county millage rate is significant on its own.

The Miami-Dade property search tool is the fastest way to find any Kendall parcel record.

DOR oversight ensures Miami-Dade County's Kendall assessments meet state standards.

Tax Collection for Kendall Properties

Miami-Dade County Tax Collector handles billing and collection for all Kendall parcels. The main office is at 200 NW 2nd Avenue, Miami, FL 33128, and the phone is (305) 375-5570. Tax bills go out in November. You can view and pay your bill online at the Miami-Dade tax payment portal.

Your bill reflects the taxable value, just value minus any exemptions, multiplied by the applicable millage rates. Miami-Dade has many taxing authorities, including the county, the school board, and special districts. For Kendall parcels, the exact mix depends on which special districts cover your area. The bill breaks this down line by line so you can see where each dollar goes.

Florida's early payment discount runs each year from November through February. Pay in November for 4% off. December saves 3%, January 2%, and February 1%. After March 31, taxes are delinquent. The delinquency process, including certificate sales, is governed by Chapter 197, Florida Statutes. Non-payment can lead to a tax certificate being sold against your property, with interest running until you redeem it.

Miami-Dade has multiple tax collector service centers across the county. Residents in the Kendall area have access to branch locations in the southwest part of the county that are closer than the main Miami office. Check the Miami-Dade Tax Collector website for the branch closest to your address.

How to Search Kendall Property Tax Records

The main tool is the Miami-Dade property search page. Enter any Kendall address and it returns the matching parcels. Click on your folio number to see the full record. The record shows current just value, assessed value, taxable value, all exemptions, every recorded sale, and building characteristics like square footage and year built. This data is free and publicly available.

For billing history and payment status, use the Miami-Dade Tax Collector portal. Enter the folio number to see current bill status, whether taxes are paid, and prior-year payment history. The two systems work together to give you a complete picture of any parcel in Kendall.

All records are public under Chapter 119, Florida Statutes. You do not need to explain your purpose or provide identification. Bulk requests or certified copies may involve a fee, but individual parcel lookups online are free.

Note: Miami-Dade uses the term "folio number" instead of parcel ID. The folio is a 13-digit number. Use it when searching across both the appraiser and collector systems to ensure you are pulling records for the same property.

Exemptions for Kendall Property Owners

Kendall homeowners can claim all the same exemptions available across Florida. The homestead exemption reduces assessed value by up to $50,000 for a primary residence. The first $25,000 cuts value for all taxing authorities. The second $25,000 reduces value between $50,000 and $75,000 but does not apply to school taxes. For a home assessed at $300,000, the savings can be substantial. Exemptions are set out in Chapter 196, Florida Statutes.

Once homestead is on file, the Save Our Homes cap takes effect under Chapter 193, Florida Statutes. Your assessed value can only increase 3% per year, or the inflation rate if lower. In Miami-Dade, where real estate values have risen sharply in recent years, long-term homestead owners often see assessed values well below just value. This generates meaningful savings year after year.

Miami-Dade County also has local exemption programs in addition to state ones. These include additional relief for seniors with limited income, disability exemptions, veteran exemptions, and exemptions for surviving spouses of first responders killed in the line of duty. Each has its own rules and deadlines. The March 1 deadline applies to most exemptions. File with the Miami-Dade Property Appraiser's office before that date.

Florida Statutes Chapter 196 details all exemptions available to Kendall property owners.

Chapter 196 covers homestead, senior, veteran, and disability exemptions that apply to Kendall parcels.

Appealing a Kendall Property Assessment

If you believe your assessment is too high, Florida gives you a formal appeal path. Each August, the Miami-Dade Property Appraiser mails TRIM notices. That notice shows your proposed value and estimated taxes. You have 25 days from the mailing date to file a petition with the Miami-Dade County Value Adjustment Board (VAB).

The VAB process is set out in Chapter 194, Florida Statutes. You file a petition, pay a fee, and receive a hearing date. A special magistrate hears your case. You present comparable sales, photos, and any appraisal report you have. The appraiser presents their evidence. The magistrate recommends a value. The VAB votes on it.

Miami-Dade VAB hearings process a large volume of cases each year. Scheduling can take months, so plan ahead. For residential properties in Kendall, comparable sales from nearby neighborhoods are the most common and effective evidence. Commercial owners often hire a certified appraiser or tax attorney to handle the case.

Pay the non-disputed portion of your tax bill while the appeal is pending to avoid penalties that are separate from the disputed amount. A successful appeal results in a refund of any overpayment.

County Resources for Kendall

All Kendall property tax matters are handled by Miami-Dade County. For a full overview of the county system, see the Miami-Dade County property tax records page. That page covers office locations, all service center branches, millage breakdowns, and full guidance on how to use the county's online tools. It is the most complete resource for Kendall residents who need more than what this page covers.

Miami-Dade County is the most populous county in Florida and runs a large, well-staffed property tax administration. The online tools are robust and regularly updated. Most Kendall residents can handle all their property tax needs without visiting an office in person.