Liberty County Property Tax Records

Liberty County property tax records are public documents maintained by the Property Appraiser and Tax Collector offices in Bristol, Florida. This small panhandle county borders the Apalachicola National Forest, and its property records include assessed values, ownership data, exemption status, and tax payment history for every parcel in the county. This guide explains how to access those records and what you can find in them.

Liberty County Quick Facts

Liberty County Property Appraiser

The Liberty County Property Appraiser office is located at P.O. Box 536, Bristol, FL 32321, and can be reached by phone at (850) 643-5401. This office values all real and personal property in Liberty County as of January 1 each year. That value forms the basis for the annual tax bill. The appraiser does not set tax rates and does not collect taxes, those are separate duties handled by local government boards and the tax collector.

Liberty County is Florida's smallest county by population. The land area is dominated by the Apalachicola National Forest, which is federally owned and not subject to local property taxes. The taxable land base is small relative to the total county area. That means the appraiser works with a relatively modest parcel roll compared to larger counties, but the work still requires the same legal standards for valuation as any other county in Florida.

Property types in Liberty County include rural residential lots, timber tracts, hunting land, and a small number of commercial properties in and around Bristol. Agricultural and silvicultural classifications are common given the nature of land use here. The appraiser's office in Bristol can answer questions about your specific parcel and what records are on file.

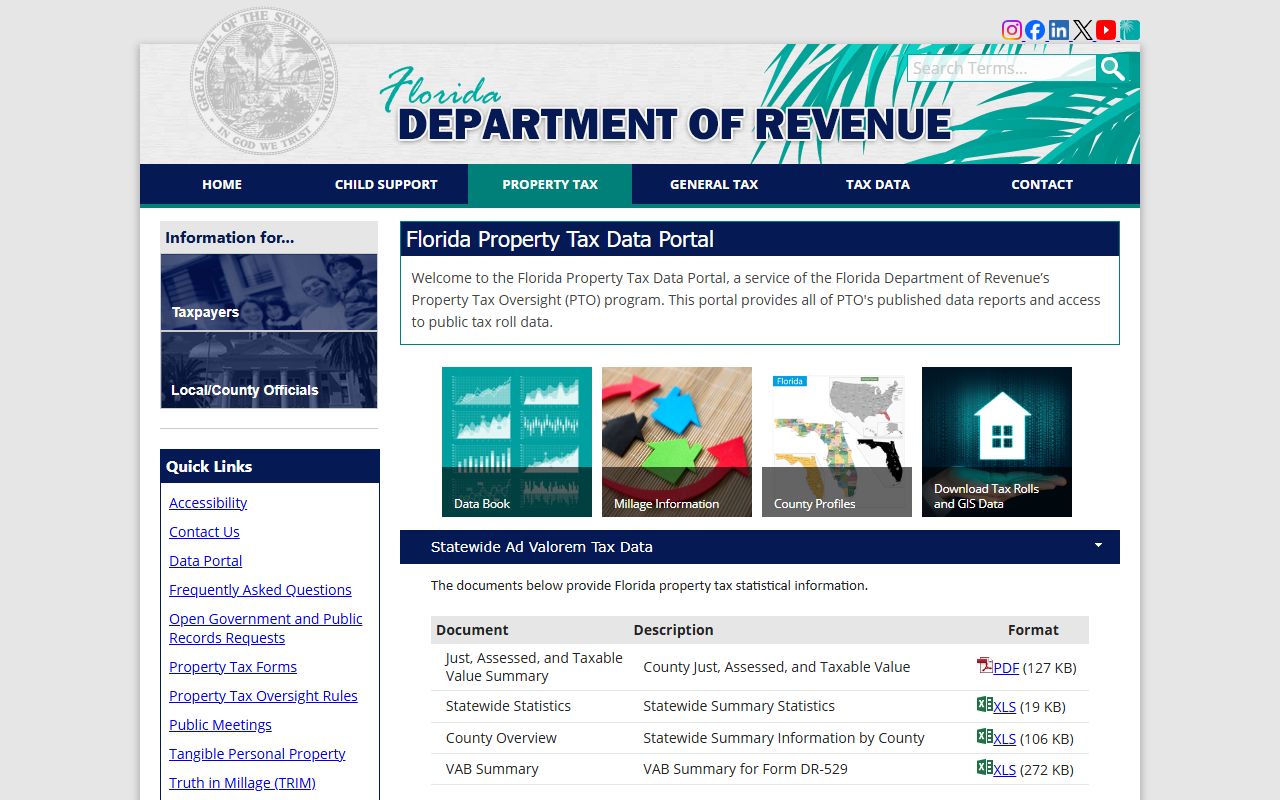

The Florida Department of Revenue oversees all 67 county appraisers through its Property Tax Oversight program. Assessment standards, timelines, and procedures must follow state law. You can find guidance at the DOR Property Tax Oversight page. The legal framework for assessment in Florida is set out in Chapter 193, Florida Statutes.

The Florida DOR's local officials directory lists contact information for the Liberty County Property Appraiser.

The DOR directory is useful when you need verified contact information for the Liberty County appraiser or tax collector.

Timber and Forest Land Classifications

A significant portion of privately held land in Liberty County qualifies for timber or silvicultural classification under Florida law. This classification allows land used for commercial timber production to be assessed based on its productivity for timber rather than its market value. In areas where land values have risen due to proximity to Tallahassee or recreational demand, this classification can result in much lower assessed values and substantially lower tax bills.

To qualify, the land must be used in good faith for the production of timber or forest products for commercial purposes. The property owner must apply with the Property Appraiser by March 1. The appraiser will evaluate the management plan, any current timber contracts, and the general use of the land. A certified forest management plan can strengthen your application.

Agricultural classification for farming and cattle operations is also available. The rules are similar, you must apply by March 1 and demonstrate active commercial use. If your application is denied, you can appeal to the Value Adjustment Board under Chapter 194, Florida Statutes. Contact the appraiser's office in Bristol for the specific forms and criteria used in Liberty County.

Homestead Exemption in Liberty County

Liberty County homeowners who use their property as a primary residence can apply for the homestead exemption. The exemption reduces your assessed value by up to $50,000. The first $25,000 applies to all taxing authorities. The second $25,000 applies to non-school levies only. The deadline to file is March 1 each year. Applications go to the Property Appraiser's office in Bristol.

Homestead protection also triggers Save Our Homes, which caps annual increases in assessed value at 3% or the rate of inflation, whichever is lower. That cap can be meaningful in Liberty County, where rural land values have generally increased as demand for hunting, recreational, and residential land has grown in the Florida panhandle. The cap resets when you sell or change how the property is used.

Other exemptions you may qualify for include the senior exemption for low-income homeowners age 65 and older, disability exemptions, and veteran exemptions. All of these are governed by Chapter 196, Florida Statutes. Application forms are available through the DOR forms library or directly from the appraiser's office.

Tax Bills and Collection

The Liberty County Tax Collector office shares the same address as the appraiser at P.O. Box 536, Bristol, FL 32321, with the same phone number: (850) 643-5401. The collector mails tax bills each November. The amount reflects the taxable value set by the appraiser multiplied by the combined millage rates from all local taxing authorities, including the county commission and the school board.

Early payment earns discounts. Pay in November for 4% off, December for 3%, January for 2%, and February for 1%. After March 31, taxes become delinquent. The collector then conducts a tax certificate sale, governed by Chapter 197, Florida Statutes. Investors bid on certificates to cover unpaid taxes, and the property owner must redeem the certificate with interest to clear the lien.

Given Liberty County's small size, it is best to contact the collector's office directly to confirm current payment options. The Florida Tax Collectors Association maintains a directory of all county collector offices and can help you find current contact and payment details. Online payment options may be limited compared to larger counties, so calling ahead is a good idea.

Accessing Property Records Publicly

Liberty County property tax records are public under Chapter 119, Florida Statutes. Anyone can view assessment data, ownership history, and tax payment records. No reason is required to request or view these records.

For online access, the Florida Department of Revenue data portal at floridarevenue.com/property/Pages/DataPortal.aspx provides bulk property data downloads for Liberty County. This is the most convenient way to search multiple parcels or download county-wide data. Individual parcel queries can also be submitted to the appraiser's office in Bristol by phone or in person.

The Florida DOR data portal provides downloadable Liberty County property data at no charge.

The data portal is updated each year and covers all 67 Florida counties, including Liberty.

For in-person records requests, visit the appraiser's office in Bristol during normal business hours. Staff can help locate records by parcel ID, address, or owner name. Certified copies of records may require a written request and may carry a small fee.

TRIM Notices and Disputes

Liberty County property owners receive Truth in Millage (TRIM) notices each August. The notice shows your proposed assessed value, any exemptions applied, and the proposed millage rates from each local taxing authority. It also shows public hearing dates where citizens can speak before rates are finalized. Think of the TRIM notice as a preview of your November bill.

If you disagree with your assessed value, you have 25 days from the TRIM notice mailing date to file a petition with the Value Adjustment Board. The Liberty County VAB reviews assessment disputes, exemption denials, and classification decisions. You can also contact the appraiser directly for an informal review before going to the VAB. Many disputes are resolved informally. Filing fees for VAB petitions are generally $15 per parcel.

If the VAB decision still doesn't satisfy you, you can appeal to circuit court under Chapter 194. That step involves more formal legal proceedings. Most property owners do not need to go that far, but the right to appeal exists. The DOR property tax FAQ has useful background on how the VAB and appeal process works.

Statewide Resources for Liberty County Research

The Property Appraisers Association of Florida tracks all county appraisers and legislative developments that affect assessment law. Their directory can help you verify current information for Liberty County's appraiser. The DOR also publishes guidance on how rural and forested counties like Liberty handle unique assessment challenges.

The Florida Tax Collectors Association connects residents with county tax collector offices statewide.

The association's directory links to Liberty County and every other county tax collector in Florida.

Liberty County's property tax system is governed by the same Florida statutes as every other county. That gives residents and property owners a clear set of rules to rely on, regardless of how small the county is. The appraiser and collector in Bristol follow the same deadlines, procedures, and appeal rights as their counterparts in Miami-Dade or Duval.

Nearby Counties

Liberty County is bordered by several other Florida panhandle counties. Each maintains its own property tax records and offices.