Wakulla County Property Tax Records

Wakulla County property tax records are public documents maintained by the Property Appraiser and Tax Collector offices in Crawfordville, covering all parcels in the county with assessment data, exemption status, ownership information, and payment history.

Wakulla County Quick Facts

Wakulla County Property Appraiser

The Wakulla County Property Appraiser mailing address is P.O. Box 280, Crawfordville, FL 32326-0280. The phone is (850) 926-3371 and fax is (850) 926-2035. This office is responsible for valuing all real and personal property in Wakulla County as of January 1 each year. That value is used to calculate annual property taxes. The appraiser is an elected official and does not collect taxes or set tax rates.

Wakulla County is a largely rural county in the Florida Panhandle, situated just south of Tallahassee. It includes coastal areas along Apalachee Bay, wetlands, and forested land. The property roll covers all parcel types in the county, including residential, agricultural, commercial, and waterfront properties. Each parcel is assigned a legal description, owner name, assessed value, just value, taxable value, and a record of any exemptions on file.

The office uses mass appraisal methods in accordance with Florida Department of Revenue standards. Values are based on comparable sales and property data rather than individual inspections of each parcel every year. For questions about your assessment or to file an exemption, contact the office at (850) 926-3371 or visit in person in Crawfordville.

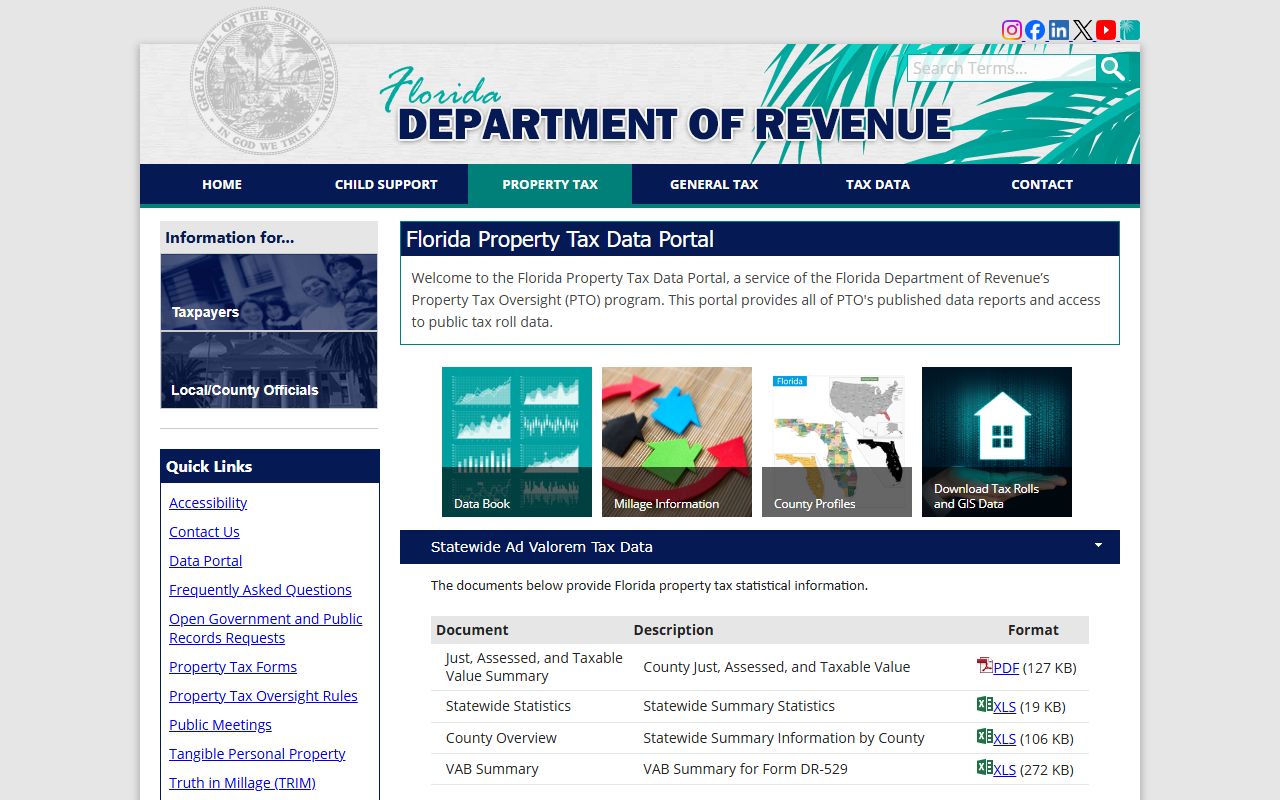

Florida's assessment standards are set out in Chapter 192, Florida Statutes. The Florida Department of Revenue Property Tax Oversight page provides statewide guidance on how assessment works and how all 67 county appraisers are monitored for compliance.

The Florida DOR site explains state assessment standards and provides resources that apply to all county appraisers, including Wakulla County.

Tax Collection in Wakulla County

The Wakulla County Tax Collector is at P.O. Box 280, Crawfordville, FL 32326-0280, phone (850) 926-3371, fax (850) 926-2035. This office sends out property tax bills each November and processes payments from all property owners in the county. The Tax Collector is an elected official, separate from the Property Appraiser.

Bills reflect the taxable value certified by the appraiser, minus any applicable exemptions, multiplied by the combined millage rates from the county commission, school board, and any special taxing districts. Pay early for a discount. November brings 4% off. December earns 3%, January 2%, and February 1%. After March 31, taxes become delinquent.

Once taxes are delinquent, the Tax Collector holds a certificate sale in June. Investors pay delinquent balances and receive interest-bearing certificates. Property owners who do not redeem those certificates within two years risk a tax deed action under Chapter 197, Florida Statutes. Contact the Tax Collector at (850) 926-3371 for current office hours, payment methods, and installment plan information.

How to Search Wakulla County Property Tax Records

Contact the Wakulla County Property Appraiser at (850) 926-3371 or visit the office at Crawfordville for parcel search assistance and assessment data. The appraiser's office can look up any parcel by owner name, address, or parcel ID. Records include assessed values, land and building data, exemption status, and sales history.

For billing and payment data, the Tax Collector's office at the same address maintains records of bills sent, payments received, and any certificate history on a parcel. Call (850) 926-3371 for assistance. Online resources may also be available through the county or state portals.

The Florida DOR maintains a statewide property tax data portal with downloadable bulk data for all counties, including Wakulla. This resource is useful for broader research beyond single parcel lookups.

All property tax records are public under Chapter 119, Florida Statutes. No reason is needed to request them. No residency requirement applies. Personal data on exemption applications is confidential, but core assessment and tax data is fully open.

Exemptions Available in Wakulla County

Florida's property tax exemptions apply to qualifying Wakulla County properties. The homestead exemption reduces assessed value by up to $50,000 on a primary residence. The first $25,000 covers all taxing authorities. The second $25,000 applies to assessed value between $50,000 and $75,000 and excludes school board millage.

Homestead also brings the Save Our Homes cap, which limits annual assessed value increases to 3% or the rate of inflation, whichever is less. This protection is written into Chapter 193, Florida Statutes. For property owners who have held their home for many years, the SOH cap can create a significant gap between just value and taxable value, lowering the tax bill meaningfully.

Other available exemptions include those for seniors with limited income, disabled persons, veterans, and widows and widowers. Each has specific eligibility rules. Apply with the Property Appraiser by March 1. Full details on all Florida exemptions are in Chapter 196, Florida Statutes.

Business owners can claim the $25,000 tangible personal property exemption by filing a TPP return with the appraiser by April 1 each year. This applies to all business personal property used in Wakulla County.

Appealing a Wakulla County Property Assessment

TRIM notices go out each summer showing the proposed assessed value and estimated taxes. If you disagree with your value, file a petition with the Wakulla County Value Adjustment Board within 25 days of the TRIM notice mailing date.

VAB hearings use special magistrates. You present evidence that the appraiser's value is too high. Comparable sales from the same area are the best evidence. Photos of damage, condition issues, or functional problems help too. An independent appraisal adds weight to your argument. The magistrate reviews both sides and recommends a result. The board votes on it. All VAB proceedings follow Chapter 194, Florida Statutes.

If the VAB does not resolve the issue, circuit court is available. Most disputes settle before that step. Pay at least the non-disputed portion of your tax bill while the appeal is pending to avoid penalties on the undisputed balance.

Payment Options in Wakulla County

Bills arrive in November. Pay in November for a 4% discount. December earns 3%, January 2%, and February 1%. March 31 is the deadline before delinquency. After that, penalties and interest apply under Chapter 197.

Contact the Tax Collector at (850) 926-3371 for current payment methods and office hours. Mail checks to P.O. Box 280, Crawfordville, FL 32326-0280. In-person payment is available at the Crawfordville office.

Florida's quarterly installment plan is available to all property owners who prefer to spread out their tax payments. Enrollment takes place in the spring before the tax year. Payments come due in June, September, December, and March. It is a practical option for residents who find the annual November bill difficult to budget for.

The Florida Tax Collectors Association has general information on the certificate sale and tax deed process for delinquent accounts across all Florida counties.

The Florida DOR data portal provides bulk property tax data and statewide resources that complement Wakulla County's local records.

Public Records Access in Wakulla County

Under Chapter 119, Florida Statutes, Wakulla County property tax records are open to the public. Anyone can access them without giving a reason. The Property Appraiser and Tax Collector offices can assist with record lookups by phone or in person. For certified copies or bulk data requests, contact the offices directly at (850) 926-3371. Large requests may carry a fee for staff time or copies, but the underlying data is not restricted. The Florida DOR local officials directory has current contact information for the Wakulla County offices.

Cities in Wakulla County

Crawfordville is the county seat of Wakulla County and serves as the main hub for county government. Sopchoppy is another community in the county. St. Marks, a small coastal town, is also within Wakulla County. All parcels in the county are assessed by the Wakulla County Property Appraiser in Crawfordville. No cities in Wakulla County currently meet the population threshold for a separate city page.