Look Up Calhoun County Property Tax Records

Calhoun County property tax records are maintained by the Property Appraiser and Tax Collector offices at 20859 Central Avenue E in Blountstown, Florida. These records document every assessed parcel in this small Panhandle county and include valuation data, ownership information, exemption status, and tax payment history. If you own or are researching property in Calhoun County, this page explains how to access the records and what they contain.

Calhoun County Quick Facts

Calhoun County Property Appraiser

The Calhoun County Property Appraiser's office is at 20859 Central Avenue E, Room 107, Blountstown, FL 32424. Phone is (850) 674-8242 and fax is (850) 674-5116. The appraiser is responsible for assessing all real property and tangible personal property in Calhoun County as of January 1 each year. This assessment becomes the basis for the tax bills property owners receive in the fall.

Calhoun County is one of Florida's smallest counties by population. Located in the Florida Panhandle along the Apalachicola River, the county is primarily rural with a mix of residential, agricultural, timberland, and recreational properties. The appraiser's office handles all property types and maintains a complete record for each parcel. Agricultural and forest land are significant categories in Calhoun County, and qualifying parcels may receive classified-use assessment that reduces taxable value below market value.

The appraiser uses mass appraisal methods required by the Florida Department of Revenue. Sales data from within the county and comparable surrounding markets helps set values. State guidelines under Chapter 192, Florida Statutes require that all property be assessed at just value, the price a willing buyer would pay a willing seller without any pressure on either side. The appraiser certifies the tax roll each fall after the state review is complete.

Calhoun County is a small office. There may not be an online parcel search portal. Contacting the office directly at (850) 674-8242 is the most reliable way to access specific parcel records. Staff can look up any property by address, owner name, or parcel ID and provide the information over the phone or in person. The office is in Room 107 at the address above during normal business hours.

The Florida DOR maintains the Local Officials directory, which lists current contact information for all 67 county appraisers and tax collectors, including Calhoun County. For general information on how Florida property assessment works, the DOR Property Tax Oversight site is a good starting point.

The Florida DOR Local Officials directory lists contact information for all county property appraisers, including Calhoun County.

Use the DOR directory to confirm current phone numbers and addresses for the Calhoun County Property Appraiser.

Note: Agricultural land classification in Calhoun County can significantly lower your taxable value. Apply with the Property Appraiser by March 1 if your land qualifies for agricultural use.

Calhoun County Tax Collector

The Calhoun County Tax Collector operates at 20859 Central Avenue E, Room 107, Blountstown, FL 32424. The phone is (850) 674-8242 and fax is (850) 674-5116. Like the Property Appraiser, the Tax Collector is an elected official. The two offices share a location in Blountstown, which makes it convenient for residents who need to visit both. The tax collector sends out property tax bills each November after receiving the certified tax roll from the appraiser.

Property tax bills in Calhoun County reflect the taxable value on each parcel multiplied by the applicable millage rates. Taxing authorities may include the county commission, the school board, and any applicable special districts. The total millage on your bill is the sum of all applicable rates. The tax collector collects the combined amount and distributes it to each taxing authority.

Florida's statewide discount schedule applies in Calhoun County. Pay in November and get 4% off. December earns 3%, January 2%, and February 1%. If taxes are not paid by March 31, they become delinquent. At that point, the tax collector begins the tax certificate process. A certificate sale is held, typically in late May or June, where investors pay delinquent taxes in exchange for a certificate that earns interest. If the owner doesn't redeem the certificate within two years, the holder may pursue a tax deed under Chapter 197, Florida Statutes.

In-person payment at the Blountstown office is likely the primary option for Calhoun County residents. Call (850) 674-8242 to confirm whether online or mail payment options are available. The Florida Tax Collectors Association provides general information on tax collection across the state.

How to Find Calhoun County Property Tax Records

Because Calhoun County is a small, rural county, most record access happens through direct contact with the office rather than through an online portal. Call the Property Appraiser at (850) 674-8242 or visit in person at Room 107, 20859 Central Avenue E, Blountstown. Staff can search by owner name, property address, or parcel identification number and give you the information directly or print out a record report.

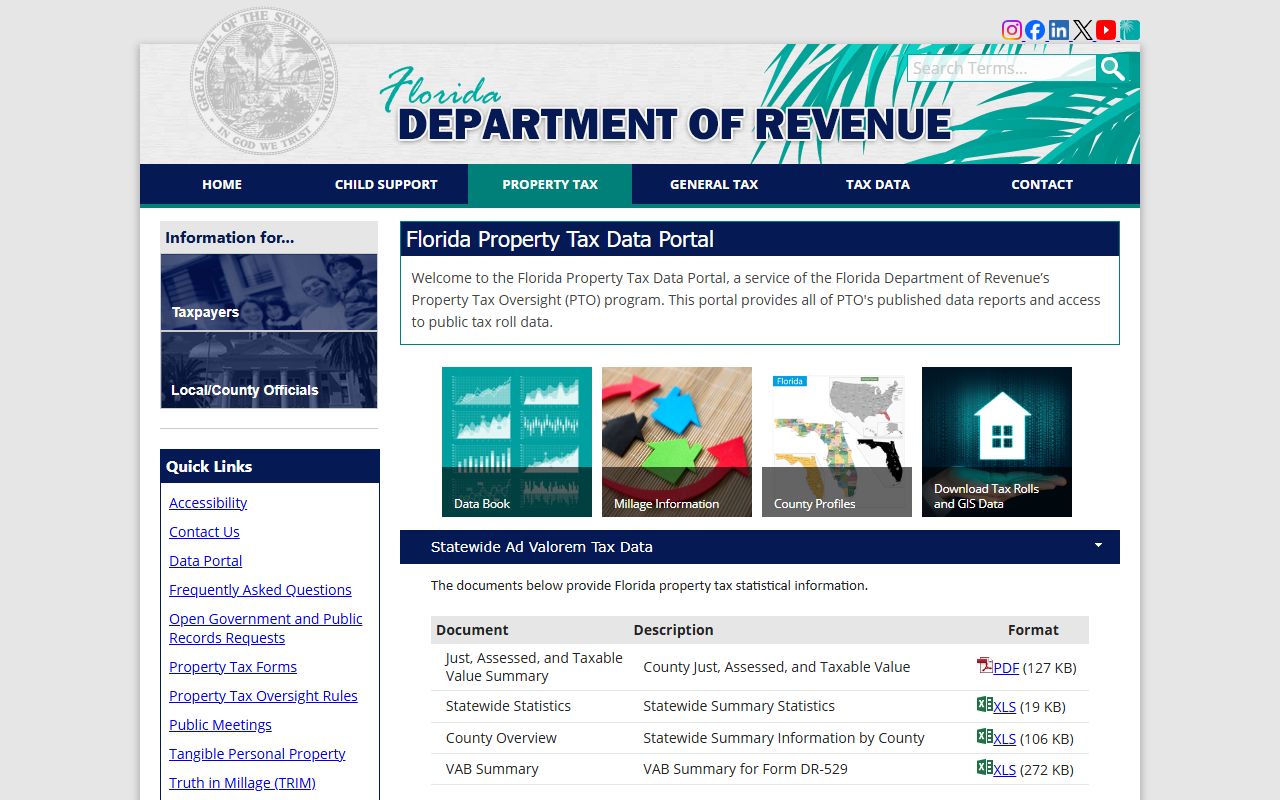

For statewide and aggregate data, the Florida Department of Revenue's Property Tax Data Portal includes Calhoun County in its downloadable files. The data portal has county-level assessment rolls, tax roll summaries, and exemption breakdowns available for download. This is more useful for researchers who need Calhoun County totals than for someone looking up a single parcel.

All Calhoun County property tax records are public under Chapter 119, Florida Statutes. No identification is required to access them, and no reason must be given. The office must respond to records requests in a reasonable time. Written requests submitted to the Calhoun County offices will be processed, though small county offices have limited staff and may take a bit longer than larger counties.

The Florida DOR Property Tax Data Portal includes county-level data for Calhoun County available for download.

The DOR data portal is a good resource for researchers who need Calhoun County property assessment totals and tax roll summaries.

Property Tax Exemptions for Calhoun County Property Owners

All Florida property tax exemptions are available to qualifying Calhoun County property owners. The homestead exemption is the most important. It reduces the assessed value of a primary residence by up to $50,000, $25,000 against all taxing authorities and another $25,000 against all except schools. You apply with the Calhoun County Property Appraiser by March 1. The deadline is firm.

Homestead status also activates the Save Our Homes cap. Once your Calhoun County home is homesteaded, the assessed value can only rise by 3% per year or the rate of inflation, whichever is lower. In a rural market where values move slowly, this cap may not create as dramatic a difference as it does in fast-growing urban areas, but it still provides meaningful protection for long-term homeowners. The cap is detailed in Chapter 193, Florida Statutes.

Agricultural classification is especially relevant in Calhoun County. If your land is actively used for farming, livestock, timber, or other agricultural purposes, it may qualify for classified-use assessment. This is not an exemption, it's a separate method of valuing the land based on its agricultural productivity rather than its market value. The result can be a substantially lower assessed value. You must apply with the Property Appraiser before March 1 to receive the classification for the current year.

Other available exemptions in Calhoun County include those for veterans with service-connected disabilities, surviving spouses of veterans or first responders, residents with total and permanent disabilities, and widows or widowers. Senior low-income exemptions may also be available if the county commission has adopted the local option. Check with the appraiser's office to confirm which exemptions apply in Calhoun County. The full list of Florida exemptions appears in Chapter 196, Florida Statutes.

Note: If you sell your Calhoun County homestead property and buy another home in Florida, you may be able to transfer your accumulated SOH savings using portability. File Form DR-501T when applying for homestead at the new property.

Appealing a Calhoun County Property Assessment

Florida law gives every Calhoun County property owner the right to challenge their assessed value. The process starts with the TRIM notice. This notice arrives in August and shows what the appraiser proposes to assess your property for the coming year. If you think the value is wrong, you have 25 days from that mailing to file a petition with the Calhoun County Value Adjustment Board.

The VAB is independent of the Property Appraiser. In small counties like Calhoun, the VAB may have limited hearing dates and a smaller administrative staff. File your petition as early in the 25-day window as possible to ensure you get a hearing date. Bring evidence that supports a lower value, comparable sales from nearby properties, a licensed appraisal, or photos and documentation of any conditions that hurt your property's value.

The hearing takes place before a special magistrate. The magistrate reviews evidence from both you and the appraiser's office, then makes a recommendation to the VAB. The board votes on it. If the VAB ruling doesn't go your way, you can still file a lawsuit in circuit court. Most VAB cases settle without reaching that point. The VAB process follows Chapter 194, Florida Statutes. Pay the undisputed portion of your tax bill while the appeal is active.

Property Tax Payments in Calhoun County

Calhoun County tax bills go out in November. The discount schedule encourages early payment: 4% off in November, 3% in December, 2% in January, and 1% in February. After March 31, taxes are delinquent and the collection process begins. The Tax Collector adds interest and schedules a certificate sale where investors can bid on delinquent parcels.

Pay in person at 20859 Central Avenue E, Room 107, Blountstown. Call (850) 674-8242 to confirm hours and any available mail or online payment options. Keep your payment receipt. In a small county office, getting a confirmation that your payment has been recorded is especially important.

If you let a Calhoun County tax bill go delinquent, investors can acquire a tax certificate on your parcel. You then have two years to redeem it by paying the amount the investor paid plus interest. If you don't redeem within two years, the investor may apply for a tax deed, starting a process that can end in the forced sale of your property at public auction. This outcome is serious for any property owner and should be avoided by keeping taxes current.

The Florida Tax Collectors Association has resources on the tax certificate and tax deed process that apply to all Florida counties, including Calhoun.

Public Records Access in Calhoun County

Calhoun County property tax records are public under Florida's open records law. Chapter 119, Florida Statutes requires that government records, including the assessment roll and tax roll, be open to any person who requests them. No ID is required. No reason must be given.

The most practical way to access Calhoun County records is by contacting the office directly at (850) 674-8242. For aggregate or downloadable data, the Florida DOR's Property Tax Data Portal includes Calhoun County files. For statewide FAQ and general guidance on property tax records in Florida, the DOR property tax FAQ page covers common questions about access, exemptions, and the assessment process.

The Florida DOR property tax FAQ page answers common questions about accessing and understanding property tax records.

The DOR FAQ page is a good resource for Calhoun County residents with general questions about property tax records and procedures.

Cities in Calhoun County

Blountstown is the county seat and the largest community in Calhoun County. Other communities in the county include Altha and Clarksville. None of these meet the population threshold for a dedicated city page on this site. All property within Calhoun County, whether in Blountstown, Altha, or any other community, is assessed and taxed by the same county offices. Residents throughout Calhoun County use the Property Appraiser and Tax Collector contacts listed on this page for all property tax matters.