Search Bay County Property Tax Records

Bay County property tax records are public documents managed by the Property Appraiser and Tax Collector offices in Panama City. The records cover all parcels in the county, from beachfront condos in Panama City Beach to rural tracts in the inland areas. They include assessed values, ownership history, exemption data, and tax payment status. This guide walks you through how to find and use Bay County property tax records.

Bay County Quick Facts

Bay County Property Appraiser

The Bay County Property Appraiser's mailing address is P.O. Box 2285, Panama City, FL 32402. The office phone is (850) 248-8501 and fax is (850) 248-8541. The appraiser is an elected official whose job is to value all real property and tangible personal property in Bay County as of January 1 each year. These valuations feed directly into the tax bills that property owners receive in the fall.

Bay County has a wide mix of property types. The Gulf Coast beaches drive high values for waterfront and near-beach residential properties. Inland areas have a very different market. The appraiser's office must account for all of this variation using mass appraisal methods approved by the Florida Department of Revenue. The office does field inspections, reviews permits, and analyzes sales data throughout the year to keep the tax roll accurate.

The property roll maintained by the Bay County Appraiser lists every parcel with its legal description, owner of record, land value, building value, total just value, assessed value, taxable value, and exemption status. After Hurricane Michael struck the county in October 2018, the appraiser's office worked through major reassessment work on damaged parcels. Those reassessments are now reflected in current records, but the storm is still relevant context for anyone researching older Bay County assessment data.

Under Chapter 192, Florida Statutes, all Florida property must be assessed at just value as of January 1. For Bay County, that covers everything from single-family homes to hotels, commercial strips, and vacant lots. The appraiser certifies the tax roll to the state and the tax collector each fall.

The Florida DOR reviews each county's assessment work annually. You can find statewide oversight resources at the DOR Property Tax Oversight page. For a list of all Bay County taxing authorities and their millage rates, contact the appraiser's office directly.

Note: Property values in Bay County can shift significantly based on coastal proximity, zoning changes, and storm damage. Check the appraiser's records for the most current figures before making any real estate decision.

Bay County Tax Collector and Tax Payments

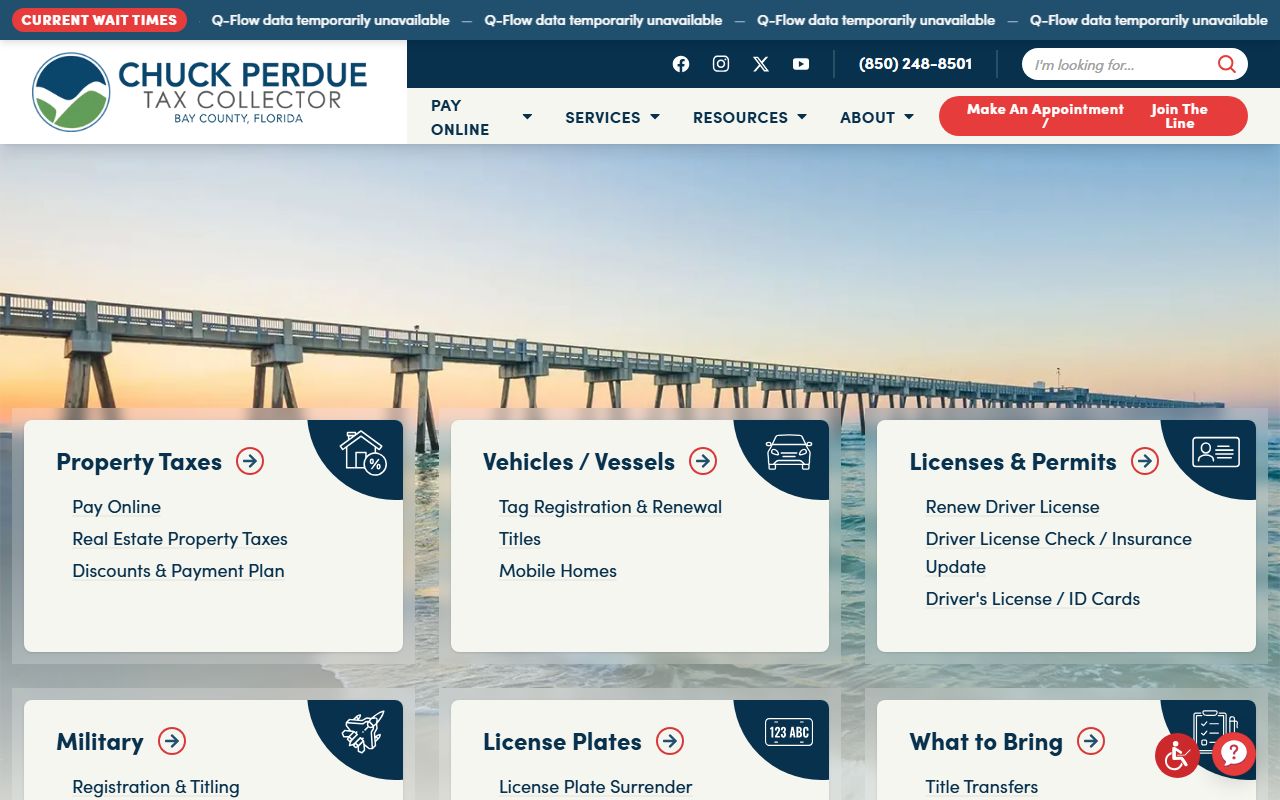

The Bay County Tax Collector uses the same mailing address as the appraiser: P.O. Box 2285, Panama City, FL 32402. The phone number is (850) 248-8501. The Bay County Tax Collector's website is where you go to pay your tax bill online, check a current balance, look up past payment history, and find office locations around the county.

Tax bills mail in November. The bill reflects the taxable value certified by the appraiser, multiplied by millage rates set by the county commission, school board, and other local taxing authorities. Bay County has multiple special districts and dependent taxing areas that may apply to specific parcels, so two properties just a few miles apart can carry very different millage rates. The total millage rate on your bill is the sum of all applicable rates.

The discount schedule encourages early payment. Pay in November for 4% off the face amount, December for 3%, January for 2%, and February for 1%. After March 31, taxes go delinquent. The tax collector then holds a certificate sale, typically in late May or June, where investors bid on delinquent parcels. The winning bidder pays the outstanding taxes and receives a certificate that earns interest. If the owner doesn't redeem the certificate within two years, the holder can seek a tax deed under Chapter 197, Florida Statutes.

The Bay County Tax Collector's website provides online payment options and tax bill information.

The Bay County Tax Collector site lets you look up balances and pay online for any parcel in the county.

How to Access Bay County Property Tax Records

Bay County property tax records are public under Chapter 119, Florida Statutes. Anyone can request them, no ID required, no reason needed. The most efficient way to access them is through the appraiser's online parcel search tool. Enter an address, owner name, or parcel number to pull up the full record for any Bay County property. You'll see the current assessed value, just value, taxable value, land data, building data, and sales history.

For tax bill and payment information, the Bay County Tax Collector's site has a separate search function. Search by address or parcel ID to see the current amount due, payment history, and whether any certificates have been issued against the parcel. These two portals together give a complete picture of any property in Bay County.

The Florida Department of Revenue also maintains a statewide property tax data portal with downloadable county-level files. This is the right tool if you need aggregate Bay County data, countywide totals, tax roll summaries, or exemption breakdowns, rather than individual parcel records. You can also find Bay County in the DOR Local Officials directory with current office contacts.

For records not available online, you can submit a written public records request to either the Property Appraiser or Tax Collector office. State law requires a response within a reasonable time. The office may charge a fee for copies but cannot charge for time spent searching unless the request is extensive.

Property Tax Exemptions in Bay County

Bay County property owners qualify for the full range of Florida property tax exemptions. The homestead exemption is the most widely used. It reduces assessed value by up to $50,000 on a primary residence, $25,000 against all taxing authorities and another $25,000 against all except schools. You apply with the Property Appraiser and the deadline is March 1.

Once you receive homestead status, the Save Our Homes cap limits how much your assessed value can increase from year to year. The cap is 3% or the rate of inflation, whichever is lower. This means longtime Bay County homeowners can see a big gap between their just value and their assessed value over time, which helps hold the tax bill down even as market values climb. The Save Our Homes cap is grounded in Chapter 193, Florida Statutes.

Bay County has many vacation homes and short-term rental properties that do not qualify for homestead because the owners don't live there year-round. Those properties get assessed at full just value each year without the SOH cap. Owners of non-homesteaded property do benefit from a 10% cap on year-to-year assessed value increases for non-homestead parcels, but that is less protective than the SOH cap on homestead properties.

Additional exemptions available in Bay County include veteran disability exemptions, widower and widow exemptions, disability exemptions, and senior low-income exemptions. Business owners must file a tangible personal property return by April 1 to claim the $25,000 TPP exemption. All exemption applications and returns go to the Property Appraiser's office. Chapter 196 of Florida Statutes governs exemption eligibility, Chapter 196 is where you'll find the full list.

Appealing a Bay County Property Assessment

Every summer, Bay County property owners receive a TRIM (Truth in Millage) notice in the mail. This notice shows the proposed assessed value for the coming tax year and an estimate of the tax bill at that value. If you disagree with the value, you have 25 days from the TRIM mailing date to file a petition with the Bay County Value Adjustment Board.

The VAB is a separate body from the Property Appraiser. It consists of elected officials and citizen members who hear appeals through special magistrates. When you file a petition, you get a formal hearing. Bring your best evidence, comparable sales from nearby properties, a licensed appraisal, or documentation of condition problems that affect value. The magistrate reviews both sides and makes a recommendation to the VAB, which then votes on it. The appeal process follows Chapter 194, Florida Statutes.

Bay County parcels affected by Hurricane Michael may still have assessment issues worth reviewing. If your property sustained damage that wasn't fully reflected in a reduction, the VAB process is one way to address that. An independent appraisal of post-storm value would be the strongest evidence to bring. If the VAB doesn't resolve the dispute, circuit court is the next step, though most cases settle before reaching that point.

Note: Pay the undisputed portion of your tax bill during an appeal. Failing to pay can result in added penalties even while a VAB case is pending.

Bay County Tax Records and Public Access

Florida's public records law gives everyone equal access to Bay County property tax records. Under Chapter 119, the tax roll, assessment data, payment history, and exemption records are all open to the public. You don't need to be a Bay County resident. You don't need to explain what you plan to do with the information.

Some data is confidential. Social Security numbers on exemption applications, income information, and certain personal details are protected. But the core record, owner name, parcel address, assessed value, taxable value, and tax payment status, is public information that anyone can access without restriction.

In-person requests can be made at the Bay County offices at the address listed above. Written requests are also accepted. Online access through the appraiser's parcel search and the tax collector's payment portal covers most common lookups. For questions about what records are available or how to submit a public records request, call the Bay County Property Appraiser's office at (850) 248-8501.

Cities in Bay County

Panama City is the county seat of Bay County and the main urban center in the area. Panama City Beach, Lynn Haven, Callaway, and Parker are other significant communities within Bay County. All property within Bay County, in any city or unincorporated area, is assessed by the same Property Appraiser and taxed by the same Tax Collector. No communities in Bay County currently meet the population threshold for a dedicated city page on this site, but all Bay County parcel records are accessible through the county-level resources described above.