Pine Hills Property Tax Records Lookup

Pine Hills is an unincorporated community in western Orange County, and its property tax records are maintained entirely by Orange County. The county Property Appraiser and Tax Collector offices in Orlando handle all assessment, billing, and collection for Pine Hills parcels. This page explains how to find those records and use them.

Pine Hills Quick Facts

Orange County Property Appraiser

Because Pine Hills has no city government of its own, Orange County handles everything property tax related for this community. The Orange County Property Appraiser's office is at 200 S. Orange Avenue, Suite 1700, Orlando, FL 32801. The main phone number is (407) 836-5044. This office values every parcel in the county, including the many thousands in Pine Hills, as of January 1 each year.

The appraiser is an elected official and is independent from the county commission. The office does not set tax rates and does not collect money. It determines what each property is worth under Florida law. That value is the starting point for your annual tax bill. For Pine Hills, which has a mix of residential, commercial, and multifamily properties, the appraiser uses sales data from similar nearby parcels to set values each year.

The Orange County Property Appraiser website has a full parcel search tool. You can enter a Pine Hills address, owner name, or parcel identification number. The result shows the current assessed value, taxable value after exemptions, land data, building details, and all recorded sales. The tool is free and available to anyone without login or registration.

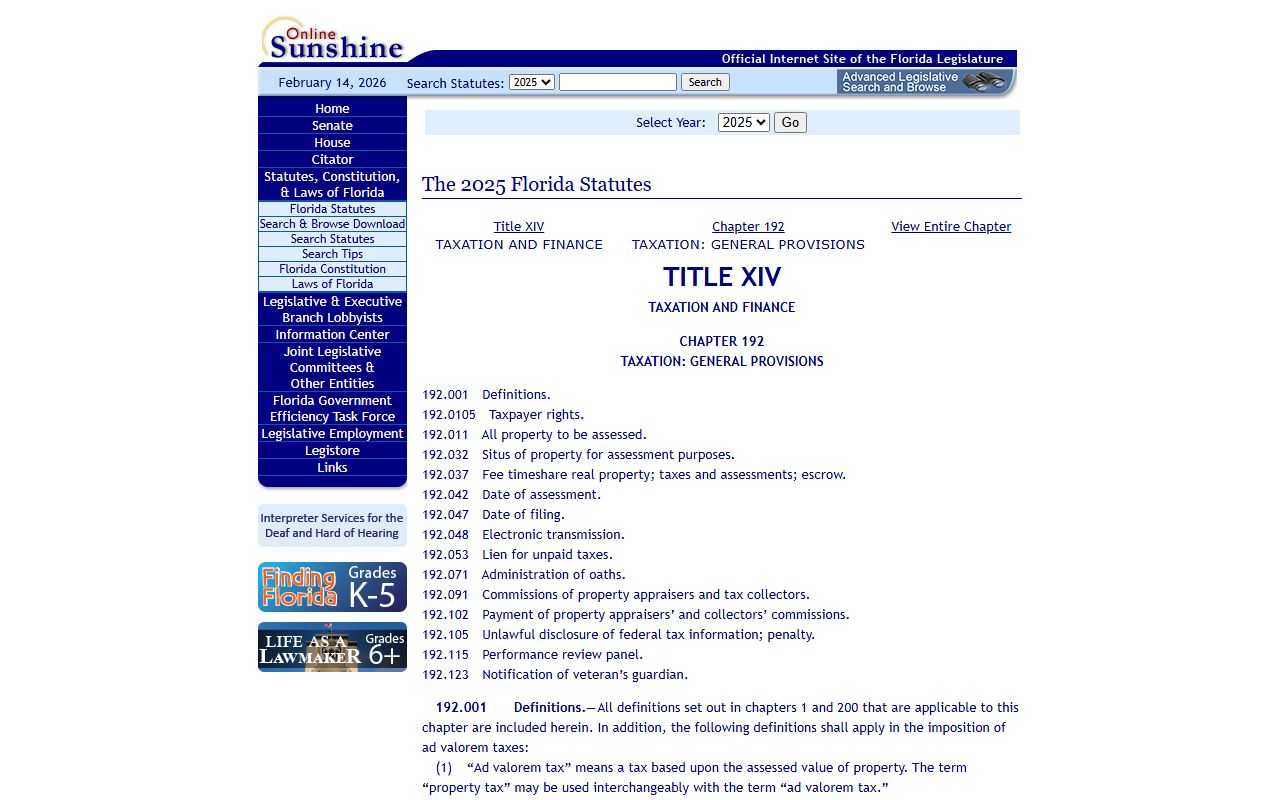

Florida law requires assessed values to reflect just value under Chapter 192, Florida Statutes. The Florida Department of Revenue supervises all county appraisers and reviews their work through the Property Tax Oversight program. If you ever have a question about how Orange County arrived at your value, the appraiser's office can walk you through the methodology.

There are no Pine Hills-specific offices. All in-person services are at the main Orange County office in downtown Orlando or at service branches across the county. The appraiser's office is open normal business hours on weekdays.

The Orange County Property Appraiser website handles all Pine Hills parcel lookups.

DOR oversight ensures that Orange County's assessments of Pine Hills parcels meet statewide standards.

Tax Collection for Pine Hills Properties

The Orange County Tax Collector handles all billing and collection for Pine Hills property taxes. The mailing address is P.O. Box 545100, Orlando, FL 32854, and the main phone is (407) 845-6200. Bills are sent in November each year. Because Pine Hills is unincorporated, Pine Hills residents do not pay a city millage rate. The bill covers Orange County, Orange County Public Schools, and any applicable special districts.

That distinction matters. Residents of Pine Hills often pay less in total millage than people inside an incorporated city, because no city millage layer is added. The difference varies year to year based on how each taxing authority sets its rate. The exact breakdown is shown on your annual tax bill.

Florida's discount schedule applies in Orange County just as everywhere else in the state. Pay in November for a 4% discount. December is 3%, January 2%, and February 1%. Taxes must be paid by March 31 to avoid delinquency. The rules governing delinquent taxes are in Chapter 197, Florida Statutes. Once taxes are past due, the collector holds a certificate sale where investors pay the delinquent amount and earn interest on their certificate.

You can pay Orange County property taxes online through the tax collector's portal, by mail, or in person at any county service center. There are several locations across the county, so you can find one convenient to Pine Hills without driving to downtown Orlando.

Searching Pine Hills Property Tax Records

The Orange County Property Appraiser site is the best starting point for any Pine Hills parcel search. Type the street address into the search bar. The system returns matching parcels. Click on the one you want to see the full record. The record includes current value, prior-year values, exemptions, building square footage, year built, and every sale recorded on that parcel.

For tax bill history and payment status, the Orange County Tax Collector site has a separate lookup. Use the parcel ID from the appraiser's record to pull up billing and payment history. These two databases together cover everything that is public record for any Pine Hills parcel.

All records are public under Chapter 119, Florida Statutes. Florida's public records law is broad and requires agencies to make records available promptly. You do not need an account, ID, or reason to access this data. Certified copies and large bulk requests may carry fees, but basic parcel lookups are free.

If you are researching multiple parcels in Pine Hills, you can often find clusters of them by searching by subdivision name on the appraiser's site. This is useful for investors or researchers looking at a whole area rather than a single property.

Property Tax Exemptions in Pine Hills

Pine Hills homeowners can claim the same exemptions as every other Orange County resident. The homestead exemption cuts up to $50,000 from the assessed value of a primary residence. The first $25,000 applies to all taxing authorities. The second $25,000 applies to value between $50,000 and $75,000 and does not reduce school taxes. Most homeowners who qualify get hundreds of dollars in savings each year. Exemption rules are in Chapter 196, Florida Statutes.

Homestead also triggers the Save Our Homes cap. Once you have homestead, the appraiser can only raise your assessed value by 3% or inflation per year, whichever is lower. This cap can become significant over time in a rising market. Pine Hills has seen real estate values climb in recent years, so long-time homestead owners often have assessed values well below current market prices.

Other exemptions available through Orange County include the senior low-income exemption, disability exemptions, veteran exemptions, and a first responder exemption. Each has eligibility rules. All applications go to the Orange County Property Appraiser's office. The deadline to apply is March 1. Missing that deadline means waiting until the following year.

Portability is available when you move from one Florida homesteaded property to another. You can carry some of your SOH savings forward, which reduces your taxable value at the new property. The appraiser handles portability applications along with the homestead filing.

Florida Statutes Chapter 196 details every exemption available to Pine Hills property owners.

Review Chapter 196 to understand which exemptions apply to your Pine Hills property.

Appealing a Pine Hills Property Assessment

If your assessment seems too high, you have a right to appeal. Each August, the appraiser sends a TRIM notice showing your proposed value. You have 25 days from the TRIM notice mailing date to file a petition with the Orange County Value Adjustment Board (VAB). Filing the petition does not stop you from owing taxes, you must still pay by the deadline to avoid penalties.

At the VAB hearing, a special magistrate reviews the appraiser's evidence and yours. Bring comparable sales of similar homes or properties in the area, photos if there are condition issues, and any appraisal report you have. The magistrate makes a recommendation. The VAB votes to accept or reject it. This process is governed by Chapter 194, Florida Statutes.

Most homeowners handle residential VAB appeals on their own. For commercial or larger properties, a real estate attorney or certified appraiser can help build a stronger case. If the VAB ruling is still unsatisfactory, you can appeal further in circuit court, though most cases settle at the VAB stage.

Pine Hills and Orange County

Pine Hills is one of the largest unincorporated communities in Florida. Its size means the Orange County property appraiser deals with a large volume of parcels here. For a broader look at how property taxes work across the entire county, see the Orange County property tax records page. That page covers all county offices, the full millage breakdown, and details on how to use the appraiser's and tax collector's tools.

Because Pine Hills has no mayor or city council, residents go directly to Orange County for all government services, including property tax matters. The county offices in Orlando are the sole point of contact for assessments, exemptions, appeals, and payments.