Find Lafayette County Property Tax Records

Lafayette County property tax records are public documents covering assessed values, ownership data, tax bills, and payment history for every parcel in Florida's smallest county by population. The Property Appraiser and Tax Collector, both based in Mayo, manage the county's tax roll. This page explains how to access those records, apply for exemptions, and navigate the assessment and payment system in Lafayette County.

Lafayette County Quick Facts

Lafayette County Property Appraiser

The Lafayette County Property Appraiser's mailing address is P.O. Box 6, Mayo, FL 32066. The phone number is (386) 294-1993 and fax is (386) 294-1994. The office's website is at lafayettepa.com. The appraiser is an elected official responsible for valuing all real and tangible personal property in the county as of January 1 each year. That date, fixed by state law, applies regardless of when property changes hands or when improvements are made.

Lafayette County is one of Florida's most rural counties. It sits along the Suwannee River basin and has a small, stable property base made up largely of agricultural land, timberland, and a limited number of residential parcels. The appraiser works through that mix using Florida's mass appraisal system, drawing on sales data, cost estimates, and income analysis as appropriate for each property type.

TRIM notices go out in August. Every property owner in Lafayette County receives one showing the proposed assessed value and the tax rates being set by the county, school board, and any other applicable taxing districts. That notice is not a tax bill. It is a notification giving you time to review and, if needed, challenge the figures before they become final in the certified tax roll.

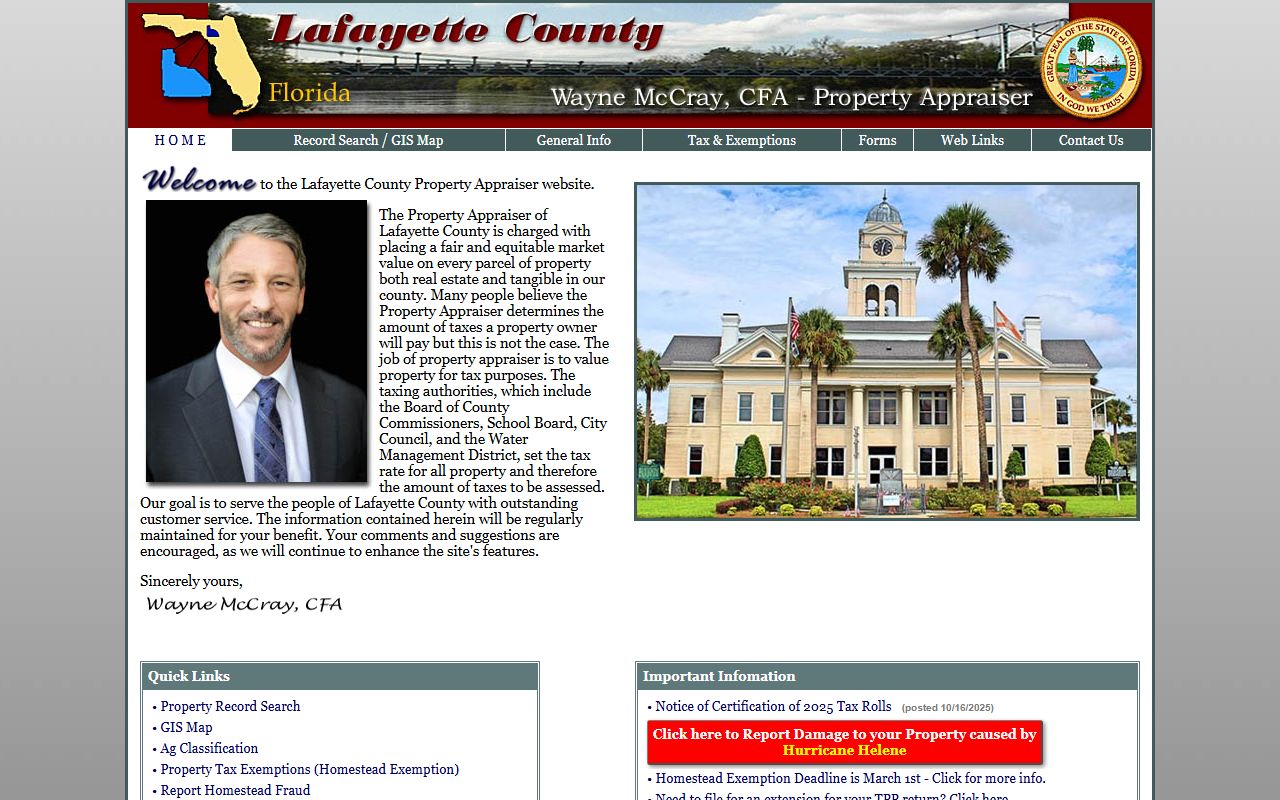

The Lafayette County Property Appraiser website provides online parcel search access and public assessment data.

Use the online portal to search parcels by owner name, address, or parcel ID and view current assessments and property details.

Tax Collector Office and Payment Options

The Lafayette County Tax Collector shares the same mailing address: P.O. Box 6, Mayo, FL 32066, phone (386) 294-1993. In a small county like Lafayette, both offices are often housed together and share staff resources. But they are legally separate. The Tax Collector is an elected official who takes over after the appraiser certifies the tax roll in October. From that point, the collector sends out bills and collects payments.

Tax bills are mailed by November 1. Florida law rewards early payment. Pay in November and save 4%. The discount is 3% in December, 2% in January, and 1% in February. After March 31, the bill is delinquent. There is no grace period. On April 1, interest and costs start adding up, and the collector moves toward the tax certificate sale process.

Installment payment plans are available. Apply by April 30 to enroll for the upcoming tax year. If you have a mortgage, your lender's escrow account typically covers the tax bill, but confirm each year that the payment was made. Errors happen, and the legal responsibility for the tax stays with the property owner. The Florida Tax Collectors Association at floridataxcollectors.com provides guidance on payment options across all Florida counties.

How to Search Lafayette County Property Records

The Property Appraiser's portal at lafayettepa.com is your primary tool. No account is needed. You can search by parcel ID number, owner name, or street address. In a small county like Lafayette, the number of results for any given search is manageable. The parcel ID is still the most reliable input when you have it, since it ties directly to one specific piece of land.

Each parcel record typically shows the current assessed value, the breakdown between land and any improvements, the legal description, sales history, and any exemptions on file. Agricultural land classifications and timberland designations are common in Lafayette County and affect how the property is valued. If you see an agricultural or greenbelt classification, that value reflects use-based assessment under Chapter 193, Florida Statutes, not speculative market value.

For tax payment history and outstanding balances, contact the Tax Collector's office in Mayo. A small county office can often answer questions directly over the phone. If you are buying property in Lafayette County, verify the tax status before closing. Any unpaid certificates follow the property, not the prior owner.

All Lafayette County property tax records are public under Chapter 119, Florida Statutes. Assessed values, ownership data, and payment records are open. Social Security numbers and income data from exemption applications are confidential.

Property Tax Exemptions in Lafayette County

The homestead exemption is available to Lafayette County residents who own and occupy their home as a primary residence. It removes up to $50,000 from the taxable assessed value. The first $25,000 applies to all taxing authorities. The second $25,000 applies to non-school levies on the value between $50,000 and $75,000. File with the Property Appraiser by March 1. Applications after that date are generally not accepted without a documented exception.

Homestead brings with it the Save Our Homes assessment cap. Your assessed value can increase by no more than 3% per year, or by the Consumer Price Index change, whichever is smaller. In a county where property values do not move as dramatically as coastal markets, the cap may be less impactful than in Sarasota or Broward, but it still provides protection when the market does rise. Chapter 193, Florida Statutes governs the cap and the portability rules if you move to a new homestead within Florida.

Other exemptions available in Lafayette County include widow and widower exemptions, permanent disability exemptions, veterans exemptions, and a low-income senior exemption. Agricultural land classification is particularly relevant here. If you farm or manage timberland, talk to the Property Appraiser's office about applying for agricultural classification before the applicable deadline. Full exemption rules are listed in Chapter 196, Florida Statutes.

Assessment Appeals and the Value Adjustment Board

If your Lafayette County assessment looks wrong, call the Property Appraiser's office first. In a small county, informal review moves quickly. Bring evidence: a recent sale price for your property, comparable sales in the area, or documentation of problems that affect value. Most errors get corrected at this stage without any need for a formal petition.

If informal review does not fix the problem, file a petition with the Value Adjustment Board. The deadline is 25 days after the TRIM notice is mailed in August. Late petitions are not accepted. The VAB in Lafayette County follows the same process as every other Florida county. A special magistrate reviews the evidence at a hearing. Both you and the appraiser get to present. You need to show the value is not supported by the data.

Chapter 194, Florida Statutes covers the full VAB petition process, hearing standards, and your rights as a taxpayer at each stage. Keep paying taxes during the appeal. Winning a VAB case results in a refund. If the VAB outcome is still unsatisfactory, you can take the dispute to circuit court, though that is a more demanding step.

Paying Lafayette County Taxes and Delinquency

Tax bills are out by November 1. Pay in November and cut your bill by 4%. After that the discount steps down: 3% in December, 2% in January, 1% in February. After March 31, no discount. The account is delinquent. Interest and fees begin. The Tax Collector schedules a certificate sale for May or June.

At the certificate sale, investors pay the overdue taxes in exchange for a lien on the property. The property owner can redeem the certificate by repaying the investor the face amount plus interest. If two years pass without redemption, the certificate holder can apply for a tax deed. That application starts a process that can result in forced sale of the property at public auction. Chapter 197, Florida Statutes covers this process in full, from the initial certificate sale to the tax deed hearing and beyond.

If you fall behind, contact the Tax Collector's office as soon as possible. Options may exist before the certificate sale. Once a certificate is issued, the cost to redeem only grows. Acting early is always better.

The Florida Department of Revenue's Property Tax Oversight page connects property owners with statewide resources and guidelines.

That page is a useful reference for understanding how state rules apply to your Lafayette County property taxes.

Accessing Public Tax Data and Records

Lafayette County property tax records are public under Chapter 119, Florida Statutes. You can view assessed values, ownership names and mailing addresses, sales data, legal descriptions, and exemption types through the Property Appraiser's online portal at no charge. You do not need to be a resident, an attorney, or a title company to access these records.

If you need certified copies or a bulk data set, contact the appraiser's office in Mayo. Production costs may apply for large requests. The Florida Department of Revenue's data portal at floridarevenue.com/property/Pages/DataPortal.aspx provides downloadable assessment roll data for the entire state. Lafayette County data is included in those downloads.

The Professional Association of Appraisers of Florida at paaf.us represents county property appraisers statewide and publishes educational resources on how appraisal works under Florida law. That is a useful reference if you are trying to understand the methodology behind your assessment or want to know how to approach an appeal more effectively.

Cities in Lafayette County

Lafayette County's only incorporated municipality is Mayo, the county seat. It has a small population of around 1,000 people. No communities in Lafayette County come close to 75,000 residents, so no city-level property tax pages are available for this county at this time.