Search Madison County Property Tax Records

Madison County property tax records are public documents held by the Property Appraiser and Tax Collector offices in Madison, Florida. Records cover all parcels in this North Florida county and include assessed values, ownership history, exemption status, and tax billing data. This guide explains how to look up those records, who maintains them, and what each office does.

Madison County Quick Facts

Madison County Property Appraiser

The Madison County Property Appraiser office is at 229 SW Pinckney Street, Room 101, Madison, FL 32340. Phone is (850) 973-3698 and fax is (850) 973-3116. This office values all real and personal property in Madison County as of January 1 each year. The assessed value produced by this office forms the base for all local property taxes. The appraiser does not set millage rates and does not collect taxes.

Madison County is a rural North Florida county with significant agricultural land, timberland, and forested areas. Property types range from small rural residential lots and farmsteads to larger timber tracts and commercial operations along US-90. The appraiser values each parcel using mass appraisal methods that follow Florida Department of Revenue guidelines, with adjustments based on local sales data and property characteristics.

The Madison County Property Appraiser website allows online parcel searches by owner name, address, or parcel ID. Search results show assessed value, prior-year comparisons, exemption status, and sales history. The site also includes GIS mapping tools with aerial imagery and parcel boundaries.

The Madison County Property Appraiser site provides online access to all parcel records in the county.

Parcel searches on the appraiser's site are free and return ownership, value, and exemption data for any property in Madison County.

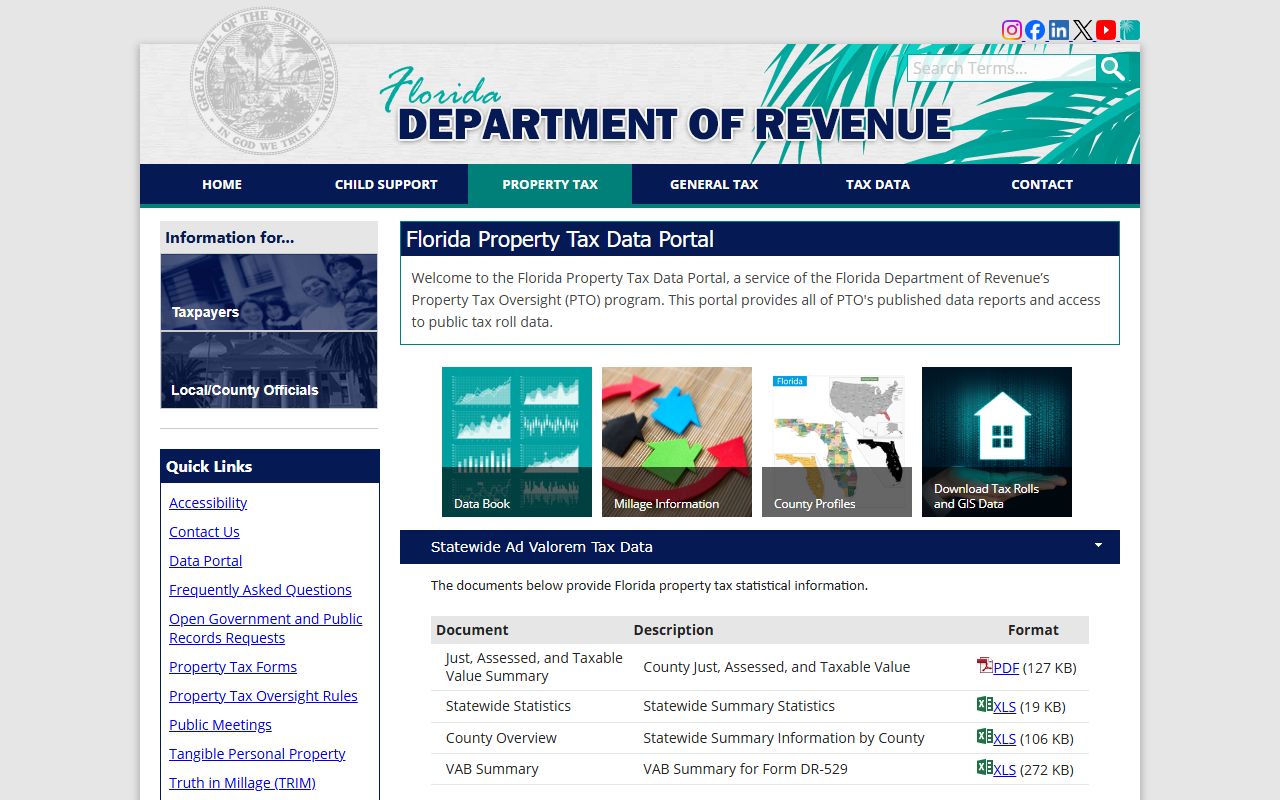

State oversight for all county appraisers comes from the Florida Department of Revenue. The DOR Property Tax Oversight page explains how assessment standards are set and monitored. The legal basis for assessment is in Chapter 193, Florida Statutes, which requires that all property be assessed at just value each year.

Agricultural and Timber Classification

Agricultural and timber classification is common in Madison County. A large share of private land is used for cattle, row crops, timber production, or some mix of the three. Under Florida law, land that qualifies for agricultural classification is assessed based on its agricultural use value rather than its market value. This can reduce the taxable value significantly, especially on land that has appreciated due to location or development pressure.

To apply for agricultural classification, contact the Madison County Property Appraiser before the March 1 deadline. You will need to show that the land is used in good faith for commercial agricultural purposes. Evidence might include lease agreements, sales receipts for crops or livestock, a forest management plan, or records of agricultural income. Hobby farms or personal use gardens typically do not qualify.

Timber and silvicultural classification follows similar rules but focuses on commercial timber production. Land under an active forest management plan and harvested on a commercial schedule is a strong candidate. Once classification is approved, it stays in place year to year as long as the qualifying use continues. If the land is sold or the use changes, rollback taxes may apply for up to three prior years. Appeals go to the Value Adjustment Board under Chapter 194, Florida Statutes.

Tax Billing and Collection

The Madison County Tax Collector office is at 229 SW Pinckney Street, Room 101, Madison, FL 32340, and can be reached at (850) 973-3698. Tax bills go out each November. The amount due reflects the taxable value on your parcel multiplied by the combined millage rates from all local taxing bodies, including the county commission, the school board, and any special taxing districts that cover your parcel.

Florida's early-payment discount schedule applies in Madison County. Pay in November for 4% off, December for 3%, January for 2%, and February for 1%. After March 31, taxes become delinquent. The collector then holds a tax certificate sale in June. Bidders compete to pay the unpaid taxes and earn interest. The process is governed by Chapter 197, Florida Statutes. If a certificate sits unpaid for two years, the holder may apply for a tax deed, which can ultimately result in the property being sold at a public sale.

Call the collector's office in advance to confirm current payment options. For a full list of county collector offices and contact details, the Florida Tax Collectors Association maintains an updated directory. Online payment availability can vary for smaller counties like Madison, so confirming by phone first is a good idea.

Homestead and Other Exemptions

Madison County homeowners who use their property as a primary residence can apply for the homestead exemption. Worth up to $50,000 in assessed value reduction, the exemption also triggers Save Our Homes protection. SOH caps annual assessment increases at 3% or the rate of inflation, whichever is lower. The cap stays active as long as you maintain homestead on the property.

The deadline to file for homestead is March 1. Applications go to the Property Appraiser at 229 SW Pinckney Street. You can also download the application form from the DOR forms page. Filing late means you will not get the exemption for that tax year, you would have to wait until the following year.

Other available exemptions include the senior exemption for qualifying low-income homeowners age 65 and older, disability exemptions, and veteran exemptions. Each has specific income thresholds or eligibility criteria. Chapter 196, Florida Statutes governs all property tax exemptions in Florida. The appraiser's office can walk you through which programs you might qualify for based on your specific situation.

Accessing Property Records Online and In Person

Madison County property tax records are open to the public under Chapter 119, Florida Statutes. Assessment data, ownership information, and tax payment history are all available without charge. You do not need to give a reason to access these records.

Online access is available through the appraiser's website at madisonpa.com. The Florida Department of Revenue also provides bulk data downloads at floridarevenue.com/property/Pages/DataPortal.aspx. From there you can pull county-wide data for Madison in a downloadable format. This is useful for researchers and professionals who need more than single-parcel lookups.

In-person records requests are handled at the appraiser's Pinckney Street office during regular business hours. Staff can search by owner name, address, or parcel ID. For formal public records requests, contact the office in writing. Certified copies may carry a small fee.

The Florida DOR data portal offers bulk downloads of Madison County property records.

The data portal is free and covers all 67 Florida counties, with updates each tax year.

TRIM Notices and Value Disputes

Madison County property owners receive Truth in Millage (TRIM) notices each August. The notice shows your proposed assessed value, exemptions, and the proposed millage rates from local taxing authorities. It also lists upcoming public hearings where residents can speak before rates are set. The TRIM notice is a preview, not the actual tax bill.

If you disagree with your assessed value, you have 25 days from the TRIM notice mailing date to file a petition with the Value Adjustment Board. The Madison County VAB is an independent panel that hears appeals of assessments, exemption denials, and classification decisions. You can first try an informal review with the appraiser at (850) 973-3698, many issues get resolved that way. If not, file a formal VAB petition. The fee is typically $15 per parcel.

The VAB hearing is a formal process where you present evidence and the appraiser presents the basis for the assessed value. After hearing both sides, the board issues a decision. If you still disagree, you can appeal to circuit court. The full appeals framework is covered by Chapter 194. The DOR property tax FAQ has a plain-language explanation of each step.

Statewide Context and Additional Resources

Madison County's property tax system works exactly like all other Florida counties, same statutes, same deadlines, same appeal rights. The county just happens to be small and rural, which affects the range of property types the appraiser deals with and the online tools available. For general guidance on Florida property taxes, the DOR FAQ page is a solid resource.

The Property Appraisers Association of Florida represents all county appraisers and can help you verify current contact information if what is listed here has changed. Their directory covers all 67 counties. The Florida Tax Collectors Association provides the same for collector offices.

The Florida DOR Property Tax Oversight program sets the standards all counties must follow.

DOR oversight ensures Madison County follows the same assessment rules as every other county in Florida.

Nearby Counties

Madison County is bordered by five other North Florida counties, each with its own property appraiser and tax records.