Okaloosa County Property Tax Records

Okaloosa County property tax records are public documents maintained by the Property Appraiser and Tax Collector for all parcels in this northwest Florida county. The county spans from Crestview in the north to the Emerald Coast beaches near Destin and Fort Walton Beach in the south. This page covers how to access those records, how assessments work in Okaloosa County, and what property owners need to know about exemptions, tax bills, and the appeals process.

Okaloosa County Quick Facts

Okaloosa County Property Appraiser

The Okaloosa County Property Appraiser's office is located at 701 E. John Sims Parkway, Suite 202, Niceville, FL 32578. The phone number is (850) 651-7300, and the fax is (850) 678-5790. The office values all real property and tangible personal property in Okaloosa County as of January 1 each year. That assessed value is the starting point for every tax bill in the county. The appraiser does not set millage rates and does not collect taxes, those are handled separately by local governing bodies and the tax collector.

The official property roll for Okaloosa County lists every parcel with its legal description, owner of record, assessed value, taxable value, and any exemptions applied. Okaloosa County covers a diverse mix of property types: residential neighborhoods in Crestview, commercial corridors along Highway 98 near Fort Walton Beach, vacation rentals and condominiums near Destin, and military-adjacent housing near Eglin Air Force Base and Hurlburt Field. The appraiser tracks sales across all these market segments to set values consistent with Chapter 193, Florida Statutes.

You can access Okaloosa County parcel data at the Okaloosa County Property Appraiser website. The online search tool lets you look up parcels by owner name, address, or parcel ID. Results show assessed values, prior-year data, exemption status, and sales history.

The Okaloosa County Property Appraiser's website is the main source for parcel lookups and assessment data in the county.

The appraiser's site covers all parcel types across Okaloosa County, from beachfront condos near Destin to rural parcels in the county's northern areas.

The Florida Department of Revenue oversees all county appraisers and reviews tax rolls each year. You can find statewide guidance on the DOR Property Tax Oversight page.

Homestead and Other Exemptions

Florida's homestead exemption is available to Okaloosa County property owners who use their home as their primary residence. The exemption removes up to $50,000 from the assessed value used for tax purposes. The first $25,000 applies to all taxing authorities, and the second $25,000 applies only to non-school millage. File by March 1 with the Okaloosa County Property Appraiser. You can apply in person at the Niceville office, by mail, or online through the appraiser's website. New homeowners should file as soon as possible after closing to avoid missing the deadline for the following tax year.

Once you have homestead status, the Save Our Homes cap protects you from large assessment increases. Florida limits the annual rise in assessed value to the lesser of 3% or the Consumer Price Index change. Okaloosa County has seen significant property value growth in recent years, particularly in the coastal areas near Destin and Fort Walton Beach. The SOH cap can mean your taxable value is well below market. That accumulated benefit is portable, you can move it to a new Florida home when you buy one. Apply for portability when you file for homestead on the new property.

Other exemptions in Okaloosa County include reductions for widows, widowers, persons with disabilities, and qualifying veterans. Senior citizens meeting income thresholds may qualify for additional relief on county and city levies. Military personnel and veterans may be eligible for specific exemptions tied to service-connected disabilities. Contact the appraiser's office at (850) 651-7300 for details on any exemption. The full list of available exemptions is in Chapter 196, Florida Statutes.

Okaloosa County has a significant military community tied to Eglin Air Force Base and Hurlburt Field. Active-duty military members and veterans may have access to additional exemptions or filing accommodations. The appraiser's office can clarify what is available based on your specific situation.

Tax Collection and Payment

The Okaloosa County Tax Collector handles billing and payment. The office address is 701 E. John Sims Parkway, Suite 202, Niceville, FL 32578, and the phone number is (850) 651-7300. Tax bills are mailed in November and reflect the taxable value set by the appraiser multiplied by millage rates from the county commission, school board, and special districts. Okaloosa County has multiple taxing authorities, so the total bill on any parcel reflects the combined effect of several different rates.

Pay early to take advantage of Florida's discount schedule: 4% in November, 3% in December, 2% in January, 1% in February. Taxes not paid by March 31 become delinquent as of April 1. Once delinquent, the tax collector can proceed with a tax certificate sale. Investors bid on the right to collect unpaid taxes plus interest. If the certificate is not redeemed within two years, a tax deed application can be filed. The full delinquency process is governed by Chapter 197, Florida Statutes.

Okaloosa County taxes can be paid online, by mail, or in person. The tax collector has service locations in Niceville and other parts of the county. An installment payment plan is available for qualifying taxpayers who apply before April 30 of the prior year, splitting the annual bill into four quarterly payments.

Tangible Personal Property in Okaloosa County

Every business in Okaloosa County must file a Tangible Personal Property return with the Property Appraiser by April 1 each year. TPP covers non-real-estate business assets: furniture, fixtures, equipment, computers, and similar items. The first $25,000 in assessed value is exempt, but only if you file a return. File late and you lose that exemption, plus you may face a penalty.

The coastal tourism sector in Okaloosa County means many businesses operate with substantial physical assets. Vacation rental companies, boat rental operations, restaurants, and retail shops near Destin and Fort Walton Beach all have TPP filing obligations. New businesses must file in their first year of operation. The appraiser's office can provide forms and filing guidance at (850) 651-7300. You can also download TPP forms from the Florida DOR forms page.

Assessment Appeals in Okaloosa County

If your assessed value seems too high, you can appeal to the Okaloosa County Value Adjustment Board. The deadline to file a petition is 25 days from the mailing date shown on your TRIM notice. That notice arrives each August. Missing the deadline closes the appeal window for that tax year, so act quickly after receiving your TRIM notice.

The VAB process uses special magistrates to hear evidence from property owners and the appraiser's office. You can represent yourself or hire an attorney or licensed appraiser. Bring solid evidence, comparable sales data for similar Okaloosa County properties is the most effective argument, since the appraiser's value should reflect what similar homes or commercial properties are selling for. A private appraisal, photos, or records showing factual errors in the appraiser's database also help. The VAB process is governed by Chapter 194, Florida Statutes.

After the VAB issues its decision, you can still appeal to circuit court if you disagree. That step involves additional costs, so most property owners weigh the potential savings against the effort before going that route.

Public Records Access

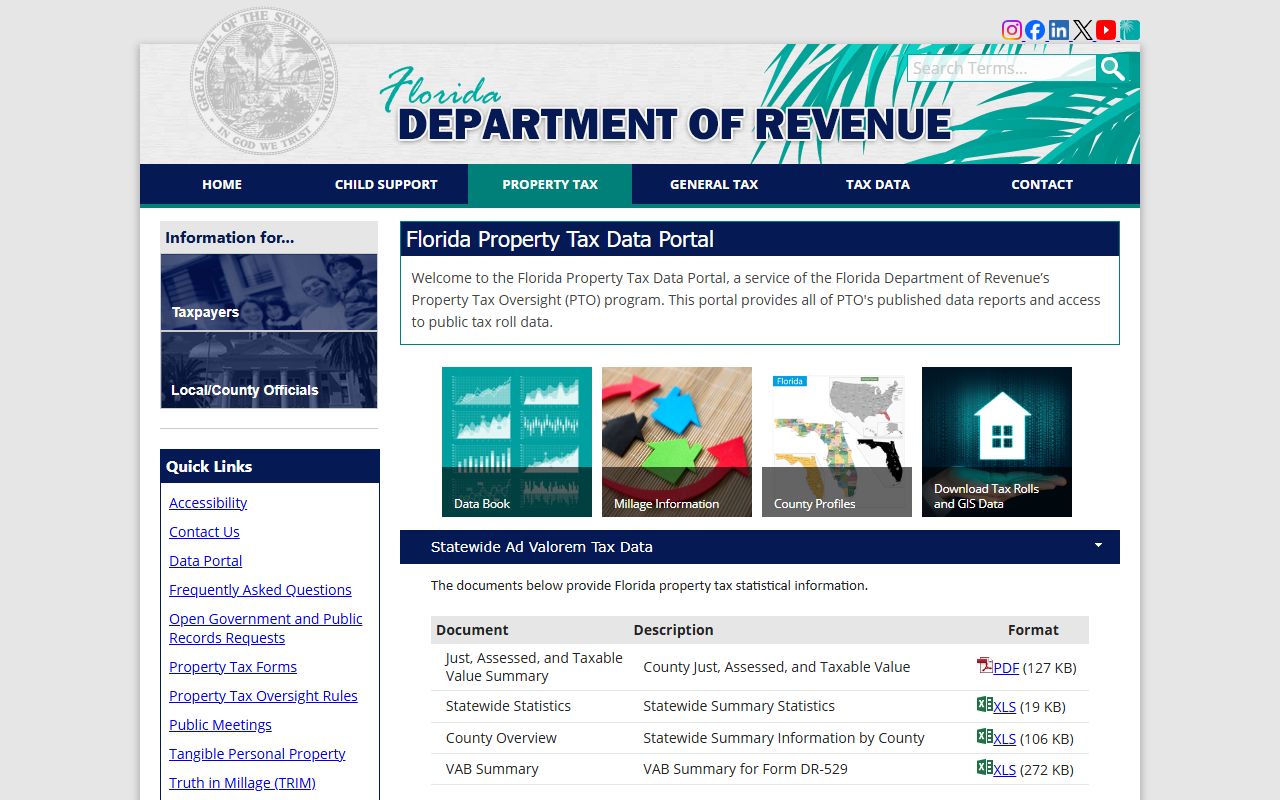

Okaloosa County property records are public under Chapter 119, Florida Statutes. The appraiser's website provides free online access to parcel data, including ownership, assessed values, exemptions, and sales history. For bulk data needs, the Florida DOR's data portal lets you download full county assessment rolls for any Florida county, including Okaloosa.

Download full Okaloosa County assessment rolls from the Florida DOR data portal at no cost.

The DOR data portal is the fastest way to get bulk parcel data for Okaloosa County or any other Florida county.

The Florida Tax Collectors Association and the Property Appraisers Association of Florida both provide directories and resources for property owners across the state.

Resources for Okaloosa County Property Owners

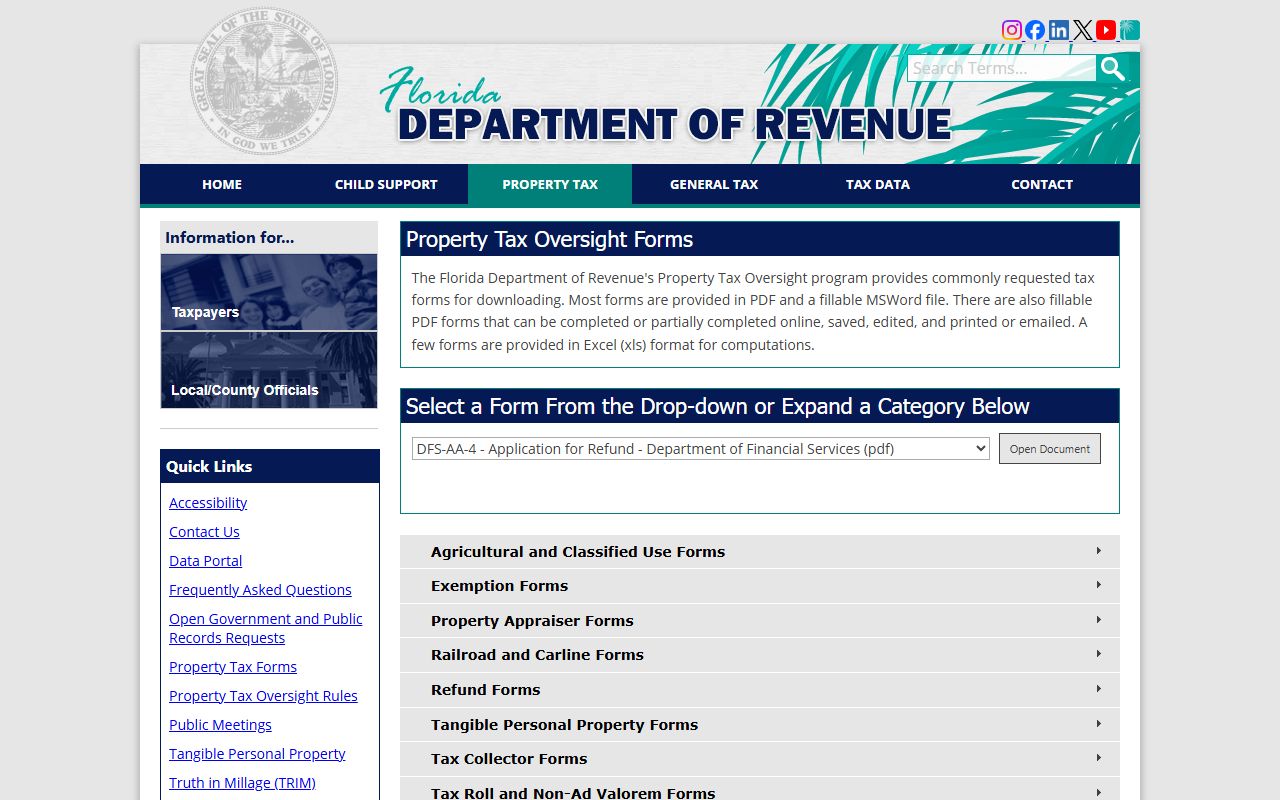

The Florida DOR property tax FAQ answers common questions about assessment, exemptions, portability, and appeals. The DOR forms page has downloadable exemption applications, TPP forms, and other documents used in the property tax process. These resources apply statewide but are consistent with what the Okaloosa County appraiser's office uses.

For questions specific to your Okaloosa County parcel, how to request a review, how to file an exemption, or how to read your TRIM notice, contact the Property Appraiser at (850) 651-7300 or visit the office at 701 E. John Sims Pkwy., Suite 202, Niceville. Staff can help with most property tax questions without the need to file a formal records request.

Download property tax forms from the Florida DOR, including exemption applications and TPP returns used in Okaloosa County.

Most Florida property tax forms are standardized statewide, so the DOR forms page is a reliable source for Okaloosa County filers.

Cities in Okaloosa County

Okaloosa County has no cities above the population threshold for individual city pages. Crestview is the county seat, and Fort Walton Beach and Niceville are the other larger communities, but all fall below the qualifying threshold. Property tax records for all Okaloosa County parcels are accessible through the county appraiser's office in Niceville.