Search Escambia County Property Tax Records

Escambia County property tax records are maintained by the Property Appraiser and Tax Collector in Pensacola. The Property Appraiser assesses all real and tangible personal property as of January 1 each year, while the Tax Collector sends out bills and processes payments. Whether you own land, a home, or a business in Escambia County, this page shows you exactly how to find your records, apply for exemptions, and handle any concerns about your assessment.

Escambia County Quick Facts

Escambia County Property Appraiser

The Escambia County Property Appraiser's office is at 221 Palafox Place, Suite 300, Pensacola, FL 32502. Call them at (850) 438-6500 or fax at (850) 434-2733. The full website is at escpa.org. This office is an independent constitutional office, not part of county commission or any other local government body. The property appraiser answers directly to voters.

Every January 1, the appraiser places a value on every parcel in Escambia County. That value should reflect what the property would sell for in a fair, open market, what Florida law calls "just value." The appraiser doesn't set tax rates. That's done by local taxing authorities like the county commission, school board, and city councils. The appraiser just sets the base number that those rates are applied to.

The office handles a wide range of services. Real property records, land and buildings, are updated when properties sell, when new construction is completed, and when owners make changes. The appraiser also processes homestead exemption applications, tracks ownership changes, and manages the tangible personal property tax roll for businesses. Their online search portal lets you look up any parcel in Escambia County by owner name, address, or parcel ID.

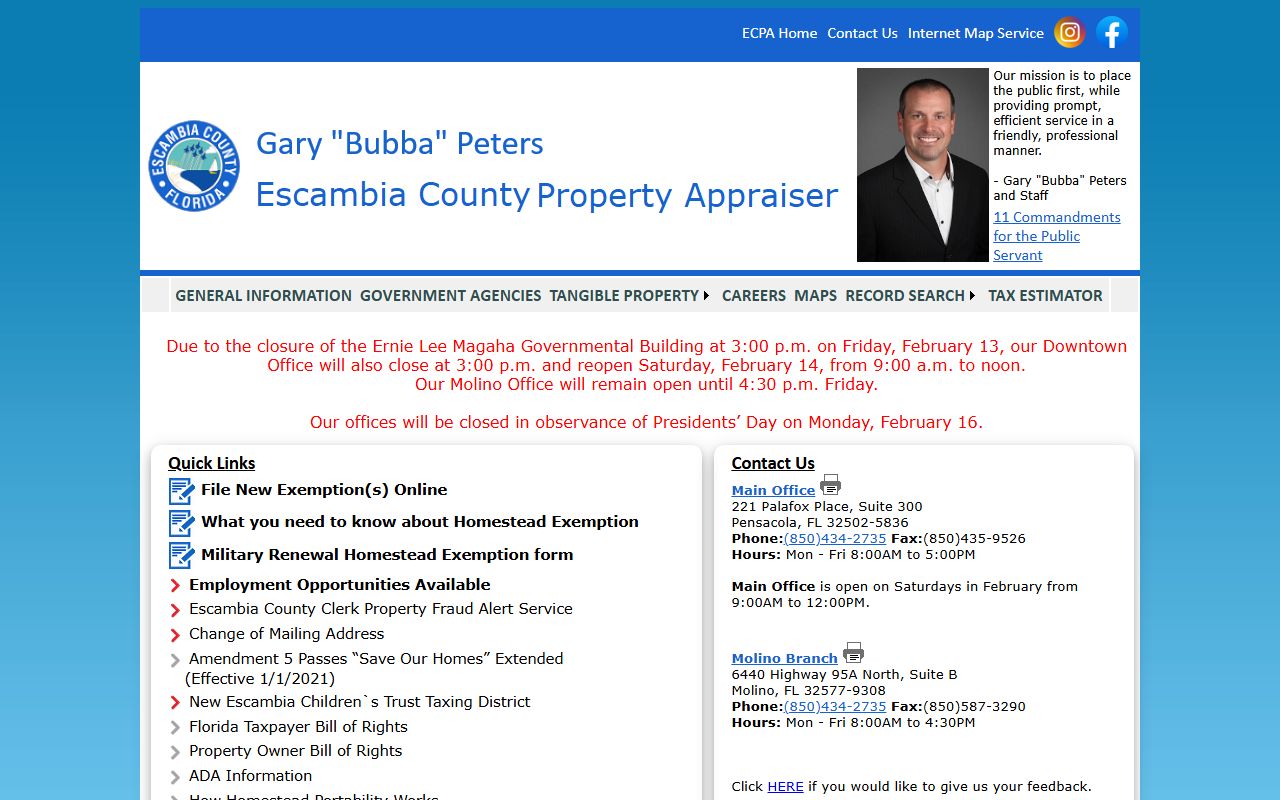

The screenshot below shows the Escambia County Property Appraiser's main website, which serves as the primary source for property tax records in the county.

The Escambia County Property Appraiser's website gives you access to the property search tool and exemption filing resources.

The ESCPA site lets you search property records by address, owner name, or parcel number and view assessed values, ownership history, and exemption status for Escambia County parcels.

Escambia County Tax Collector

The Escambia County Tax Collector mails property tax bills and handles all payment processing. Mailing address is P.O. Box 1312, Pensacola, FL 32591. The phone is (850) 438-6500, extension 3252, and fax is (850) 434-2733. Like the Property Appraiser, the Tax Collector is a separately elected constitutional officer.

Bills go out in November after the Property Appraiser certifies the tax rolls. Payment is due by March 31. Florida offers a discount schedule for early payment under Chapter 197, Florida Statutes. Pay in November and save 4%. December saves you 3%, January 2%, and February 1%. After March 31, the account becomes delinquent and late charges apply.

The Tax Collector also runs the tax certificate sale for delinquent properties. At this annual sale, investors pay the overdue taxes and receive a certificate that earns interest. Property owners can redeem their property by paying the full amount owed plus interest. If a certificate stays unpaid long enough, the certificate holder can apply for a tax deed, which can lead to loss of the property.

Escambia County also participates in the Florida Tax Collectors Association. That statewide group provides resources at floridataxcollectors.com if you need general guidance on how the system works.

Find Escambia County Property Tax Records Online

The Escambia County Property Appraiser's portal at escpa.org is the fastest way to search property tax records. You can look up parcels by owner name, street address, or parcel ID number. Each parcel record shows assessed value, taxable value, land details, building info, exemption status, and sale history. The search is free and open to the public, no registration needed.

Florida's public records law makes property tax information available to anyone who asks. Under Chapter 119, Florida Statutes, assessment data, ownership records, exemption status, and payment history are all public records. The appraiser's office must provide them without requiring you to explain why you want them. Some personal data on exemption applications, like Social Security numbers, is kept confidential, but the property record itself is always public.

For bulk data downloads, useful for researchers, appraisers, or analysts, the Florida Department of Revenue maintains a statewide data portal at floridarevenue.com/property/Pages/DataPortal.aspx. This includes Escambia County parcel data in machine-readable format.

If you need older records not available online, contact the Property Appraiser's office directly. Staff can pull historical assessment records and provide copies. There may be a fee for large or complex requests.

Property Tax Exemptions in Escambia County

Florida's exemption system can cut a significant amount off your taxable value. The homestead exemption is the biggest one, up to $50,000 off the assessed value of your main home. You must own the property and live there as your primary residence on January 1. Apply by March 1 through the Escambia County Property Appraiser's website. You only need to apply once, the exemption renews automatically each year as long as you remain eligible.

The Save Our Homes cap, established under Chapter 193, Florida Statutes, limits how much your homestead's assessed value can increase each year. The cap is 3% or the CPI, whichever is lower. If you move within Florida, you can transfer this benefit to your new home, a process called portability. You apply for portability when you file for homestead at your new address.

Other exemptions available in Escambia County include veterans' exemptions for those with service-connected disabilities, additional exemptions for totally disabled veterans, widow and widower exemptions, senior exemptions for qualifying low-income households over age 65, and exemptions for blind or permanently disabled persons. Each has its own eligibility rules and application deadlines. The appraiser's office can walk you through which ones you qualify for.

Business owners with tangible personal property must file a TPP return by April 1. If the total value of your equipment, fixtures, and business furniture is under $25,000, you qualify for an exemption, but you still have to file the return to claim it. Miss the deadline and you may face a penalty assessment.

Escambia County Property Assessment Appeals

You have the right to appeal your property's assessed value if you think it's wrong. The process starts with your TRIM notice, which arrives in August. TRIM stands for Truth in Millage, and it shows the proposed assessed value along with an estimate of what your taxes will be. Read it carefully. You have 25 days from the date on that notice to file a petition with the Value Adjustment Board.

The Escambia County Value Adjustment Board hears petitions from property owners who disagree with the appraiser's assessment, denied exemptions, or classification decisions. You file a petition with the VAB, pay the filing fee, and get scheduled for a hearing. Hearings are held before a special magistrate, usually an attorney or a certified real estate appraiser. The magistrate reviews both sides and issues a recommendation. The full VAB then votes.

Appeals are governed by Chapter 194, Florida Statutes. If you lose at the VAB and still believe the assessment is wrong, you can file a lawsuit in Escambia County circuit court. That's a longer and more expensive process, but it's available.

Before going to the VAB, try calling the Property Appraiser's office first. Many issues, a wrong measurement, a missed exemption, an incorrect property classification, can be fixed informally without a formal hearing. The appraiser's staff can review your file and make corrections if there's a clear error.

Property Tax Payment in Escambia County

Escambia County tax bills come out each November. You can pay online through the Tax Collector's website, by mail to P.O. Box 1312, Pensacola, FL 32591, or in person at the tax collector's office. Early payment earns a discount, 4% in November, 3% in December, 2% in January, 1% in February. Pay by March 31 to avoid delinquency.

If you have a mortgage, check your escrow account. Most lenders pay property taxes from escrow automatically, but it's worth verifying each year that the payment was made and posted correctly. Errors happen, and you're the one who suffers the consequences if the bill goes unpaid.

Delinquent taxes in Escambia County are sold as tax certificates at the annual sale held in late May or early June. Investors bid on these certificates at an interest rate auction. The lower the interest rate they'll accept, the more likely they win the certificate. Property owners can redeem their property at any time by paying the taxes owed plus the accrued interest. Waiting too long can lead to a tax deed application and potential loss of the property.

Requesting Escambia County Property Tax Records

Property records in Escambia County are public under Florida's broad open records law. The Property Appraiser's website gives you free access to the core record, assessed value, ownership, exemption status, and sale history. The Tax Collector's site shows billing and payment status. For most purposes, those two portals cover everything you need.

If you need copies of specific documents, older records, or data not available online, submit a public records request to the relevant office. Under Chapter 119, they must respond promptly and provide access within a reasonable time. They can charge for the cost of copying and staff time on large requests, but they can't deny you access to public records without a legal exemption.

The Florida Department of Revenue also publishes general guidance and forms for property taxpayers statewide. Their property tax page at floridarevenue.com/property covers the full framework that applies in Escambia County and every other county in Florida. Their forms page at floridarevenue.com/property/Pages/Forms.aspx has state-level forms used across the property tax system.

The Professional Association of Property Appraisers of Florida also maintains resources for property owners at paaf.us. This group represents county property appraisers across the state, including Escambia County.

Cities in Escambia County

Pensacola is the county seat of Escambia County. Its population is approximately 55,000, which is below the threshold for a dedicated city page. No cities in Escambia County currently meet the population minimum for a separate listing.

Nearby Counties

Santa Rosa County shares a border with Escambia County and handles its own property tax records through a separate Property Appraiser and Tax Collector.