Access The Villages Property Tax Records

Property tax records for The Villages are split across three counties, Sumter, Lake, and Marion. Most of the community falls in Sumter County. Which county handles your records depends entirely on where your parcel sits. This page explains the three-county structure and how to find the right office for your property.

The Villages Quick Facts

Which County Handles Your Parcel

The Villages is one of the few communities in Florida that spans multiple county lines. The bulk of the development, including much of the town square area and many of the older sections, lies in Sumter County. Parts of the community extend south into Lake County and north into Marion County. Your specific parcel determines which county government assesses and collects your taxes.

If you are not sure which county your home is in, there is an easy way to find out. Look at your property deed or your tax bill. Both will show the county. You can also search by address on the Sumter County Property Appraiser website, if your parcel comes up there, you are in Sumter County. If it does not, try Lake County or Marion County.

For most residents, the answer is Sumter County. The Sumter County Property Appraiser handles the largest share of parcels in The Villages. Their office is at 218 E. McCollum Ave., Bushnell, FL 33513, and the phone is (352) 569-6800. The website is sumterpa.com. The Sumter County Tax Collector is at 220 E. McCollum Avenue, Bushnell, FL 33513, phone (352) 569-6740.

If your parcel is in Lake County, contact the Lake County Property Appraiser in Tavares. If your parcel is in Marion County, contact the Marion County Property Appraiser in Ocala. In all three cases, the parcel search tools on each county's website let you confirm which office covers your address.

The Sumter County Property Appraiser covers most parcels in The Villages.

The Florida DOR sets assessment standards that all three counties serving The Villages must follow.

Sumter County Property Appraiser

The Sumter County Property Appraiser values every parcel in their county as of January 1 each year. For The Villages parcels in Sumter County, this means annual assessment of single-family homes, condos, commercial parcels, and vacant land. The appraiser uses comparable sales within The Villages and surrounding Sumter County to set just values.

The appraiser is an elected official who operates independently from the county commission. They do not set tax rates. That is done by the county commission, the school board, and any special districts with authority over your parcel. The appraiser's job is to determine the value. Everything else flows from there.

The Sumter County appraiser website has a full parcel search tool. You can search by address, owner name, or parcel number. The record shows current assessed value, taxable value, exemptions on file, and sale history. For The Villages, where many properties trade frequently as retirees move in and out, the sale history can be especially informative.

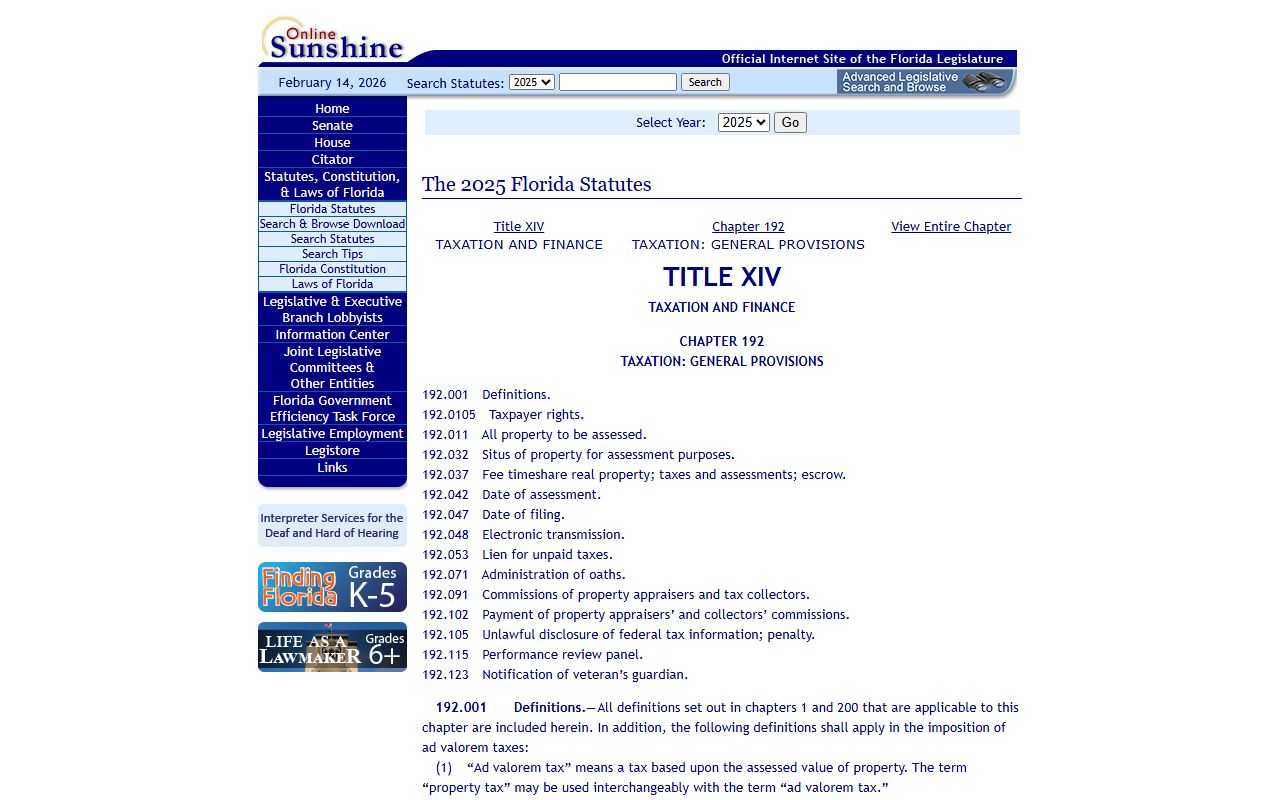

Florida law sets the standard for how assessments work under Chapter 192, Florida Statutes. The Florida Department of Revenue reviews Sumter County's work each year through its Property Tax Oversight program.

Tax Collection in The Villages

Whichever county your parcel is in, the tax collection process works the same way. Bills go out in November. They show the taxable value set by the appraiser, multiplied by the millage rates set by each local authority. The total is what you owe. Sumter County bills are handled by the Sumter County Tax Collector at 220 E. McCollum Avenue in Bushnell.

The Villages has its own special districts that provide many community services. Some of these districts have their own millage that appears on your tax bill. The exact millage depends on which Village you live in and which district covers your area. Check your TRIM notice or tax bill to see all the authorities contributing to your total.

Florida's early payment discount applies in all three counties. November gets you 4% off the full amount. December earns 3%, January 2%, and February 1%. Taxes are due by March 31. After that date, delinquency rules under Chapter 197, Florida Statutes apply. A late-paid bill leads to penalty interest and eventually a tax certificate sale if left unpaid long enough.

Online payment is available through each county's tax collector website. Residents in the Sumter County portion can pay through the Sumter County Tax Collector's online portal. Lake County and Marion County residents use their respective collector portals.

How to Search The Villages Property Tax Records

Start by confirming your county. Then go to that county's property appraiser website. For Sumter County, that is sumterpa.com. Enter your address or parcel ID. The search returns your record with full assessment and exemption details.

For billing history and payment status, go to the corresponding county tax collector's website and search by parcel ID. The two systems, appraiser and collector, together give you a complete picture of any parcel in The Villages.

All these records are public under Chapter 119, Florida Statutes. You do not need to register or explain your reason for looking. Anyone can access these records online at no cost. Certified copies or large bulk requests may carry a fee when handled by county staff.

Note: Property parcel IDs in Sumter County have a different format than those in Lake and Marion counties. If you are cross-referencing records, make sure you are using the right county's parcel ID format for each search.

Exemptions for The Villages Residents

Florida's homestead exemption is available to any resident who uses their Villages home as their primary residence. It cuts up to $50,000 from the assessed value. The first $25,000 reduces value for all taxing authorities. The second $25,000 covers value between $50,000 and $75,000 and excludes school taxes. Exemptions are detailed in Chapter 196, Florida Statutes.

Given that The Villages is a retirement community, many residents may also qualify for the senior low-income exemption. This additional exemption is available to homestead owners age 65 or older whose household income falls below a threshold set each year by the state. It can provide additional relief on top of the standard homestead exemption. You must apply separately with your county property appraiser by March 1.

Other exemptions include those for disabled residents, veterans, surviving spouses, and first responders. Each county has the same exemption types, because they all follow state law. But you must apply with the correct county for your parcel. Applying in the wrong county will not get your exemption applied correctly.

Homestead also triggers the Save Our Homes cap under Chapter 193, Florida Statutes. Each year your assessed value can only rise 3% or the inflation rate, whichever is lower. For long-time residents in The Villages, this cap often produces significant savings compared to the property's full just value.

Chapter 196 of Florida Statutes governs all exemptions available to The Villages property owners across all three counties.

This statute page covers all exemption types, including the senior low-income exemption that many Villages residents qualify for.

Appealing Your Assessment in The Villages

Each summer, your county property appraiser sends a TRIM notice. It shows your proposed value and estimated taxes. You have 25 days from the mailing date to file a petition with your county's Value Adjustment Board (VAB). The VAB for Sumter County is in Bushnell. Lake County residents file in Tavares. Marion County residents file in Ocala. You must file in the county that issued your TRIM notice.

At the VAB hearing, a special magistrate reviews both sides. You bring your evidence, sales of comparable homes in The Villages or surrounding areas, photos of any defects, or an independent appraisal. The magistrate makes a recommendation. The VAB votes to accept or reject it. Appeals are governed by Chapter 194, Florida Statutes.

Residential appeals in The Villages are often straightforward because comparable sales within the community are plentiful. If your home was assessed higher than recent sales of similar models nearby, that data alone can support a reduction. Pay the non-disputed portion of your bill while the appeal is pending to avoid penalties.

County Resources for The Villages

The Sumter County property tax records page has the most detail for residents of the majority portion of The Villages. It covers the county offices, all millage information, and full guidance on the Sumter County system. Residents in the Lake or Marion County portions of The Villages should contact those county offices directly for specific guidance on their parcels.

The Florida Tax Collectors Association at floridataxcollectors.com provides general information on tax collection and links to each county's collector office statewide.